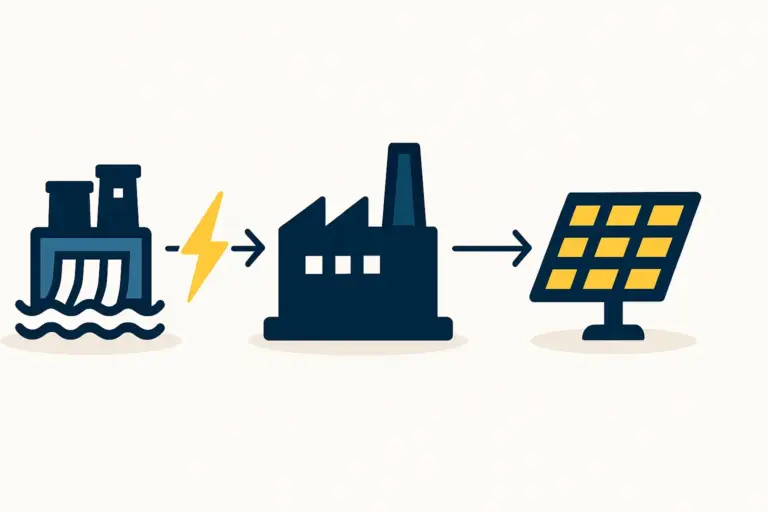

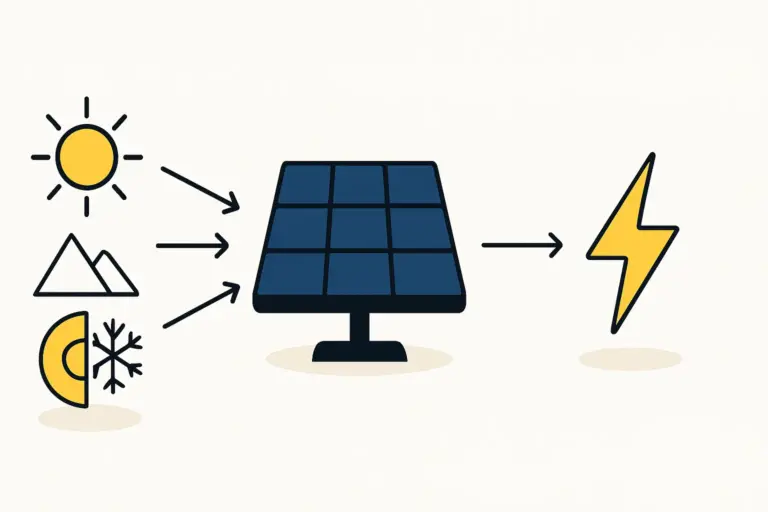

Renowned for its immense hydropower resources, Tajikistan is making a significant strategic shift. The government is actively promoting solar energy to diversify its energy mix and bolster security, particularly during the winter months.

This creates a unique opportunity for international entrepreneurs and investors to enter a nascent market backed by a government keen to attract foreign capital. Success, however, hinges on understanding the local legal and administrative landscape.

This article provides a structured overview of establishing a foreign-owned solar manufacturing enterprise in Tajikistan. It outlines the key institutions, legal requirements, and investment incentives that shape the business environment, offering a clear path for those considering this promising frontier.

The Strategic Opportunity: Why Consider Tajikistan for Solar Manufacturing?

Tajikistan’s commitment to renewable energy is more than aspirational; it’s codified in national strategy. The government aims to install over 800 MW of new renewable energy capacity, primarily solar, by 2030. This ambition is supported by a robust legal framework designed to attract and protect foreign direct investment (FDI).

Investors are drawn to the country’s high solar irradiation levels, its strategic location bordering China, Afghanistan, Uzbekistan, and Kyrgyzstan, and a proactive government stance. The State Committee on Investments and State Property Management (SCISPM) is the primary agency facilitating FDI, working to streamline the process for foreign entities.

A Step-by-Step Guide to Establishing Your Solar Enterprise

A methodical approach is essential when navigating a new regulatory environment. While investor-friendly policies are in place, the path from registration to full operation in Tajikistan involves several distinct stages.

Step 1: Choosing the Right Legal Structure

For most foreign investors, a Limited Liability Company (LLC) is the most common and practical legal structure. An LLC provides a clear separation between the personal assets of the owners and the company’s liabilities—a crucial consideration for any new venture. This structure allows for 100% foreign ownership, providing full control over the enterprise’s operations and strategic direction.

Step 2: The ‘Single Window’ Registration Process

Tajikistan has simplified company registration with a ‘single window’ system managed by the Tax Committee. This centralized approach reduces administrative burdens and shortens timelines.

To register an LLC, founding investors must prepare and submit a package of documents, including:

- Application for State Registration: A formal request to establish the legal entity.

- Company Charter: The foundational document outlining the company’s governance, objectives, and operational rules. Developing a robust charter is a critical step, often informed by a comprehensive solar panel manufacturing business plan.

- Decision of the Founder(s): A formal resolution confirming the decision to create the company.

- Proof of Identity: Notarized copies of passports for individual founders or corporate registration documents for legal entities.

- Confirmation of Legal Address: Evidence of the company’s official place of business in Tajikistan.

The registration process is typically completed within a few business days. The company is then officially entered into the State Register and assigned a taxpayer identification number.

Step 3: Securing Essential Licenses and Permits

Once registered, the solar manufacturing facility must obtain the necessary operational licenses. The Ministry of Energy and Water Resources is the primary authority overseeing activities in the energy sector. Specific permits may be required for:

- Manufacturing Activities: A general license to produce goods.

- Construction Permits: For the development and construction of the factory.

- Environmental Clearances: An assessment to ensure the facility complies with national environmental standards.

Engaging local legal and technical consultants is highly advisable to ensure all sector-specific requirements are met efficiently.

Step 4: Leveraging Investment Guarantees and Incentives

The Tajik government offers significant incentives to attract foreign capital into priority sectors like renewable energy. These incentives are legally guaranteed under the Law ‘On Investments’ and other relevant legislation.

Key benefits for a solar manufacturing project include:

- Tax Exemptions: Imported technological equipment, components, and raw materials for manufacturing are often exempt from Value Added Tax (VAT) and customs duties. This can substantially lower the initial investment for a solar panel factory.

- Protection of Capital: The law guarantees the right of foreign investors to repatriate profits, dividends, and other income in foreign currency after paying taxes.

- Guarantees Against Nationalization: Investments are protected from expropriation or nationalization, except in specific cases of public interest defined by law, where prompt, adequate, and effective compensation is guaranteed.

- Dispute Resolution: The legal framework allows for investment disputes to be settled through national courts or, by mutual agreement, through international arbitration centers.

Experience from turnkey projects shows these incentives are a critical factor in the financial viability and risk assessment of new manufacturing ventures in emerging markets.

Frequently Asked Questions (FAQ)

What is the role of the State Committee on Investments and State Property Management (SCISPM)?

The SCISPM is the central government body responsible for implementing state policy on investment. It acts as a primary point of contact for foreign investors, providing information, facilitating administrative processes, and helping resolve issues that may arise.

Can a foreign company own 100% of a business in Tajikistan?

Yes, Tajik law permits 100% foreign ownership of a legal entity, such as a Limited Liability Company (LLC). There is no legal requirement to have a local partner.

What are the primary tax benefits for a new solar factory?

The most significant benefits are typically exemptions from VAT and customs duties on imported manufacturing equipment and components. Depending on the scale and location of the investment, additional tax holidays or reduced rates on corporate profit tax may also be available under specific government programs.

Is it necessary to hire a local director?

While it is not legally mandatory to have a Tajik citizen as a director, it is often a practical necessity. A local manager can navigate administrative procedures, language barriers, and cultural nuances more effectively, particularly during the initial setup phase.

The Path Forward

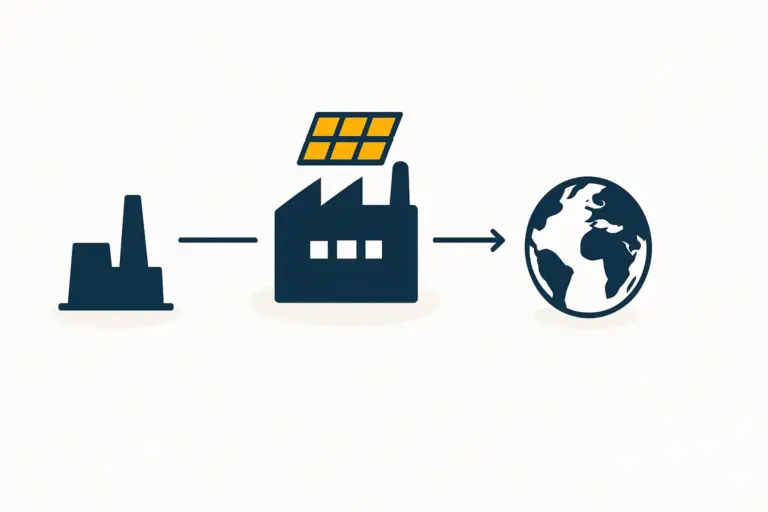

Entering Tajikistan’s solar manufacturing sector offers a considerable opportunity for entrepreneurs looking to expand into Central Asia. The government has established a clear legal framework and compelling incentives to attract foreign investment. However, a successful venture depends on meticulous planning and a thorough understanding of the regulatory requirements.

The process, while structured, has nuances that benefit from expert guidance. For investors, a methodical approach to market entry, technology selection, and factory planning is fundamental for mitigating risk. By leveraging local expertise and the available incentives, entrepreneurs can confidently tap into this promising market and play a role in Tajikistan’s clean energy future.