An entrepreneur planning to enter Thailand’s booming solar market often focuses on machinery and the factory floor. However, the operation’s long-term success hinges on a challenge that’s less visible but far more complex: establishing a reliable and cost-effective supply chain for raw materials.

The choice between sourcing locally and importing involves navigating tariffs, quality control, and logistical hurdles that can define a project’s profitability. This guide breaks down the supply chain logistics for solar module production in Thailand. It examines the practical considerations for sourcing key materials like solar cells, glass, and frames, offering a framework for making strategic decisions that align with your business objectives and the realities of the Southeast Asian market.

The Strategic Context: Thailand’s Growing Solar Industry

Thailand’s government has created a favorable environment for investment in renewable energy. With a national goal to source 30% of its energy from renewables by 2037, the demand for locally produced solar modules is strong.

To encourage this growth, the Thai Board of Investment (BOI) offers significant incentives, including corporate income tax exemptions and import duty waivers on machinery and raw materials. These can substantially improve the financial viability of a new manufacturing plant.

This opportunity, however, is tied to a critical dependency. While Thailand has excellent infrastructure, its domestic capacity for producing high-grade raw materials—particularly solar cells—is limited. This dynamic makes Thailand a key importer, primarily from manufacturing hubs like China, creating a distinct set of challenges and opportunities for new producers. Understanding this is the first step toward building a resilient business.

The Core Sourcing Dilemma: Local Suppliers vs. International Imports

For any new solar module manufacturer in Thailand, the central question is where to procure essential components. The answer requires a careful analysis of each material, weighing the benefits of proximity against the advantages of scale and specialization offered by international suppliers.

Solar Cells: The Heart of the Module

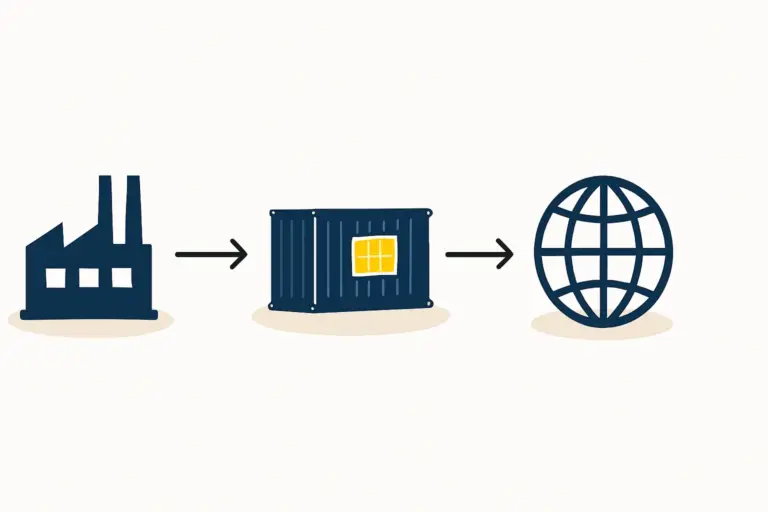

Solar cells are the most technologically sensitive and highest-value component in a solar panel. In Thailand, high-efficiency monocrystalline and polycrystalline cells are almost exclusively imported. China is the dominant supplier, offering advanced technology and economies of scale that are currently unmatched by local producers.

While import tariffs exist, free trade agreements like the ASEAN-China Free Trade Area (ACFTA) can mitigate these costs. The primary challenge isn’t the tariff itself, but managing supplier relationships, ensuring consistent quality across batches, and navigating the logistics of international shipping.

Glass, EVA, and Backsheets: The Protective Layers

Similar to solar cells, specialized materials like low-iron tempered solar glass, EVA (ethylene vinyl acetate) encapsulant, and durable backsheets are predominantly sourced from international suppliers. Producing these materials requires significant capital investment and specialized expertise, which is not yet widespread in Thailand.

A new manufacturer must factor in international lead times for these components. A typical sea freight shipment from China to a major Thai port like Laem Chabang takes approximately two to four weeks—a timeline that doesn’t account for potential customs clearance delays.

Aluminum Frames and Junction Boxes: The Local Potential

The outlook for sourcing locally is more promising for structural and electrical components. Thailand has a capable aluminum extrusion industry, meaning custom-designed frames can often be procured from domestic suppliers. Junction boxes and cabling may also be available locally.

The key consideration here is ensuring quality and consistency. While local sourcing can reduce lead times and shipping costs, it demands a rigorous vetting process. A manufacturer must confirm that local suppliers can meet the precise tolerances and international certification standards (like IEC or UL) required for a high-quality finished module. The complete solar module manufacturing process depends on every component meeting these stringent specifications.

Navigating the Practicalities: Logistics, Quality, and Costs

A successful sourcing strategy goes beyond simply choosing suppliers. It requires robust operational processes to manage the flow of goods and mitigate risks.

The Critical Role of Quality Control

When relying on imported materials, a stringent incoming quality control (IQC) process is non-negotiable. It is unwise to assume that all materials from a supplier, even a reputable one, will meet specifications.

Establishing an in-house or third-party inspection protocol to verify cell efficiency, identify microcracks, check glass integrity, and test other material properties is essential before they enter the production line. This step protects the entire initial investment from being compromised by substandard components.

Managing Logistics and Financial Variables

Efficient logistics are vital. Although Thailand’s ports are modern, customs procedures can be unpredictable. Working with an experienced freight forwarder who understands the specific documentation requirements for solar components can prevent costly delays.

Most international material purchases are transacted in US dollars (USD) or Chinese Yuan (CNY), introducing a currency exchange risk for a business operating in Thai Baht (THB). Financial hedging strategies or careful cash flow management should be considered to mitigate the impact of currency fluctuations on material costs.

A Comparative Framework for Decision-Making

Most successful solar manufacturers in Thailand adopt a hybrid sourcing model. The decision for each component should be based on a clear assessment of the trade-offs.

- Import High-Tech Components: For solar cells, glass, and specialized polymers like EVA, importing is generally the only viable option to achieve the quality and performance required for a competitive product. The focus here should be on building strong relationships with top-tier suppliers.

- Develop Local Partnerships: For frames, junction boxes, and packaging materials, developing relationships with reliable local suppliers can provide a significant competitive advantage through greater flexibility, reduced inventory costs, and faster response times.

This balanced approach, a core component of a well-planned factory setup, allows a manufacturer to leverage global efficiencies while building local resilience. Experience from J.v.G. turnkey projects shows this hybrid strategy is consistently the most effective in emerging markets.

Frequently Asked Questions (FAQ)

Is it possible to source all solar module materials locally in Thailand?

Currently, it is not feasible to source all components from within Thailand at the quality and scale needed for modern module production, particularly high-efficiency solar cells and specialized solar glass. A successful operation will need to import these critical items.

What are the biggest risks when importing materials from China?

The primary risks include potential quality inconsistencies between batches, logistical delays from shipping or customs clearance, and financial exposure to currency fluctuations. A robust quality control process and a reliable logistics partner are essential for managing these risks.

How do BOI incentives affect sourcing decisions?

BOI incentives, such as exemptions from import duties on raw materials, make importing high-quality components more financially attractive. They effectively lower the cost of accessing superior technology from global markets, allowing a new manufacturer to produce a more competitive end product.

What is a realistic lead time for a full set of materials for a production run?

Factoring in order processing, production at the supplier, sea freight (2-4 weeks), and a buffer for potential customs delays, a manufacturer should prudently plan for a total lead time of 6-8 weeks from order placement to material arrival at the factory.

Conclusion: Building a Resilient Supply Chain

For an entrepreneur entering Thailand’s solar manufacturing sector, the supply chain is not an administrative afterthought—it is the strategic foundation of the business. The country’s supportive policies and logistical strengths provide a solid platform for success, but this potential can only be realized with a well-designed sourcing strategy.

By carefully blending the global procurement of high-tech components with the development of local supplier relationships for structural parts, a new manufacturer can build a resilient, flexible, and cost-effective operation. This balanced approach mitigates risk, optimizes costs, and positions the company to effectively serve Thailand’s growing demand for clean energy. The next step is translating this strategy into a detailed operational and financial plan.