When considering a new manufacturing venture, an entrepreneur’s focus naturally turns to the initial capital outlay: the cost of land, buildings, and machinery. While this is a logical starting point, in Tunisia, that calculation tells only half the story.

The country has established a robust legal framework that does more than just permit foreign investment; it actively encourages it with substantial financial incentives, effectively turning the government into a strategic partner in your venture’s success.

This guide provides a clear overview of the financial and tax exemption strategies available for new solar manufacturing investments in Tunisia. It is designed for business professionals exploring opportunities in the renewable energy sector, offering a practical understanding of how government incentives can significantly enhance a project’s financial viability and long-term return on investment.

The Strategic Advantage: Why Tunisia for Solar Manufacturing?

Before examining the specific financial benefits, it helps to understand the broader context of Tunisia’s commitment to renewable energy. The nation’s ‘Plan Solaire Tunisien’ (PST) outlines an ambitious goal of generating 35% of its electricity from renewable sources by 2030. This national strategy creates a stable and growing domestic market for locally produced solar modules.

Beyond its internal market, Tunisia’s geographic location offers a distinct advantage. Positioned as a gateway between Europe and the rest of Africa, it provides preferential access to two significant markets. For European customers, a Tunisian manufacturing base can dramatically shorten supply chains, reducing logistics costs and dependencies on Asian markets.

Moreover, the region’s high solar irradiation levels make it one of the world’s most suitable locations for solar technology. Establishing local production meets a clear and present demand, driven by both economic and environmental logic.

Unlocking Key Financial Benefits: An Overview of Tunisia’s Investment Law

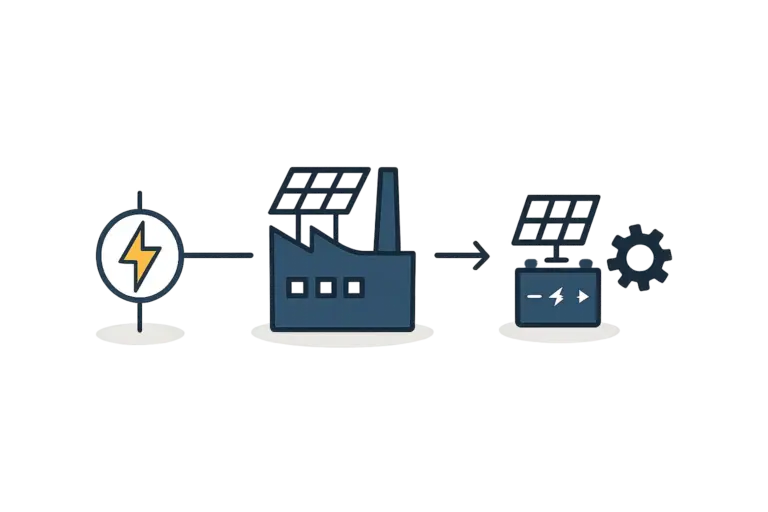

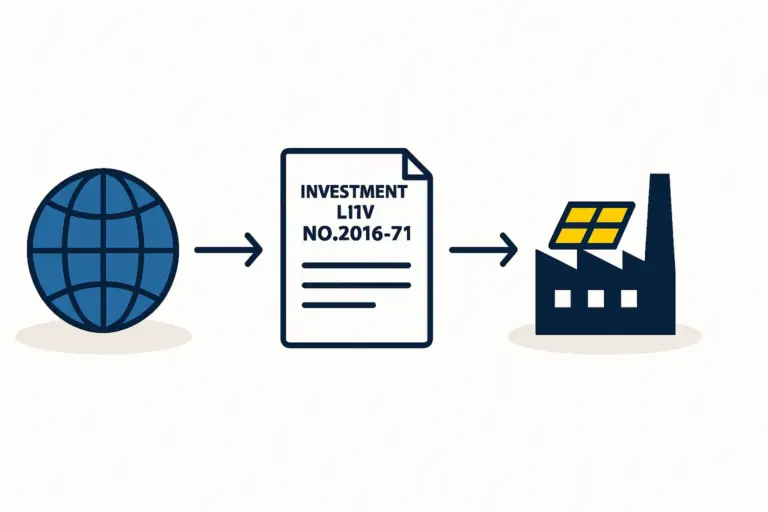

The foundation for these incentives is Tunisia’s Investment Law No. 2016-71. This legislation was designed to create a transparent and attractive environment for local and foreign investors alike. For those planning to establish a solar panel factory, the law offers several powerful mechanisms to reduce initial costs and improve profitability.

Exemption from Customs Duties on Imported Equipment

A solar module production line includes specialized machinery—such as cell stringers, laminators, and testing equipment—which is almost always imported. These capital goods represent a major portion of the initial setup cost.

The Investment Law grants approved projects a full exemption from customs duties on these imported capital goods. This directly lowers the barrier to entry by substantially reducing the upfront investment required to start a solar panel factory. For an investor, this means capital that would otherwise have gone to taxes can be redirected to operations, raw materials, or other growth-critical areas.

Value-Added Tax (VAT) Suspension

In addition to customs exemptions, the law provides for the suspension of Value-Added Tax (VAT) on the same imported equipment. This offers a critical cash-flow advantage.

In many systems, an investor would pay VAT upfront and then go through a lengthy process to reclaim it. The Tunisian framework allows for this payment to be suspended altogether, preserving working capital during the most critical phase of the project: the setup and commissioning of the factory.

Corporate Income Tax Holidays

The potential for a complete exemption from corporate income tax for up to 10 years is one of the most significant long-term benefits. This incentive is typically granted to projects established in designated ‘regional development zones,’ a policy the government uses to encourage economic growth across the country.

A decade-long tax holiday can fundamentally alter a project’s financial projections. It accelerates the timeline to profitability and allows for the rapid reinvestment of earnings back into the business to fund expansion, research, or diversification.

State Contributions to Social Security and Infrastructure

The state may also take on the employer’s contribution to the social security system for a set period. For large-scale projects—defined as those with an investment exceeding 15 million Tunisian Dinars—the government may also contribute to the cost of necessary infrastructure, such as road access or utility connections.

Navigating the Application Process: The Role of the Tunisian Investment Authority (TIA)

These incentives are not granted automatically. Investors must navigate a formal application process through the Tunisian Investment Authority (TIA), which serves as a single point of contact designed to streamline and facilitate the investment process.

The typical procedure involves:

-

Project Declaration: Submitting a formal declaration of the investment project to the TIA.

-

Business Plan Submission: Providing a detailed solar manufacturing business plan that outlines the project’s scope, financial projections, job creation potential, and technical specifications.

-

Review and Approval: The TIA reviews the application to ensure it aligns with national development goals and meets the criteria outlined in the Investment Law.

Experience with J.v.G. turnkey projects in emerging markets shows that working with a partner who understands both the technical requirements of a factory and the nuances of local administrative processes is invaluable.

Case Study Context: Maximizing ROI on a 50 MW Solar Factory

To illustrate the tangible impact of these incentives, consider a hypothetical 50 MW solar module factory.

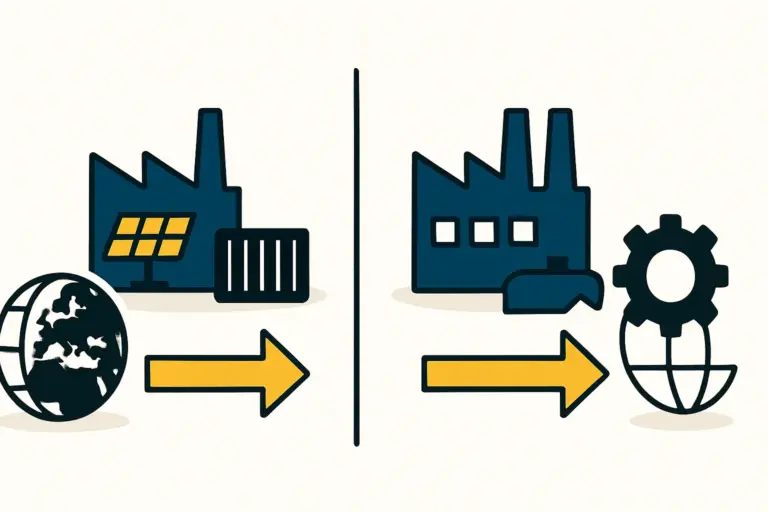

Without Incentives: The investor would face the full cost of importing a full turnkey solar production line, including substantial customs duties and VAT. Once operational, the business would be subject to standard corporate income tax from its first year of profit, slowing the rate at which the initial investment is paid back.

With Tunisian Incentives: The same investor realizes immediate and long-term benefits.

-

Reduced CapEx: The exemption from customs duties could save hundreds of thousands, if not millions, of euros on equipment imports.

-

Improved Cash Flow: VAT suspension frees up vital working capital at the start.

-

Accelerated Profitability: A 10-year tax holiday means that all profits for the first decade can be used to strengthen the company’s financial position, repay loans faster, or fund future growth.

The result is a project that is not only less expensive to start but is also structured for faster, more sustainable long-term success.

Frequently Asked Questions (FAQ)

Are these incentives available to foreign investors?

Yes. The Tunisian Investment Law is founded on the principle of non-discrimination. Foreign investors receive the same treatment and are eligible for the same incentives as domestic investors.

What qualifies as a ‘regional development zone’?

These are specific geographic areas designated by the Tunisian government to encourage investment and job creation. The Tunisian Investment Authority (TIA) provides an official list and maps of these zones, which are often located inland to promote balanced economic growth.

Does the size of the factory matter for these benefits?

The core benefits, such as customs duty and VAT exemptions on equipment, apply to all approved investment projects, regardless of size. However, certain additional benefits, like state contributions to infrastructure costs, are reserved for larger projects that exceed a specified investment threshold.

How does the political environment in the region affect such long-term investments?

While regional political dynamics are a valid consideration for any international investment, Tunisia has established a robust legal framework to protect and encourage foreign capital. The Investment Law itself signals the country’s long-term strategic commitment to creating a stable and predictable environment for businesses.

Conclusion and Next Steps

Tunisia offers a particularly compelling case for investment in solar module manufacturing. The government has moved beyond simply permitting investment to creating a framework of active financial partnership.

This combination of customs duty exemptions, tax holidays, and other contributions significantly de-risks the investment and enhances its potential return. For the discerning entrepreneur, this transforms Tunisia from just another potential location into a strategic financial decision.

Understanding these incentives is the crucial first step. The next is to integrate them into a detailed financial model and operational plan. For any serious investor looking to capitalize on this opportunity, developing a comprehensive business plan is the logical next step.