Tax Incentives and Customs Duty Exemptions for Solar Manufacturing in Turkmenistan

When planning a new industrial venture, the initial capital outlay for equipment and construction is a significant financial hurdle. For entrepreneurs entering the solar panel manufacturing sector, the cost of importing specialized machinery can be further inflated by customs duties and taxes, impacting a project’s overall viability.

Recognizing this, many governments actively create favorable conditions to attract such investment. Turkmenistan, for instance, has established a robust framework of financial incentives designed to significantly lower the barrier to entry for renewable energy projects.

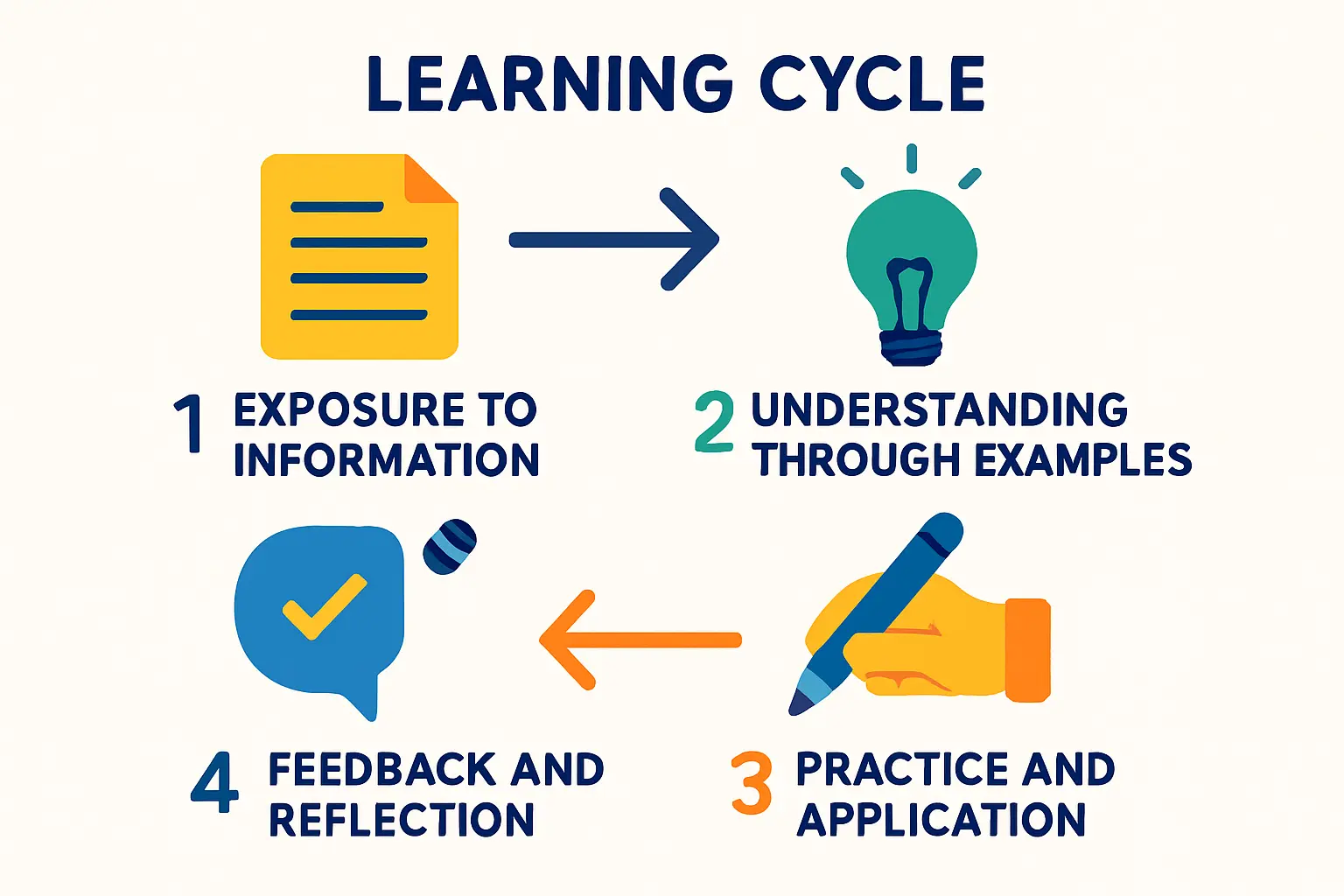

This guide details the specific tax incentives and customs duty exemptions available to investors planning to establish solar module production facilities in Turkmenistan. Understanding these benefits is a critical first step toward evaluating the financial landscape and developing a sound investment strategy.

Understanding the Financial Landscape for New Projects

Any large-scale manufacturing project comes with several key cost centers that must be managed. Beyond the direct purchase price of equipment, investors face:

- Customs Duties: Taxes levied on imported goods, which can add a substantial percentage to the cost of essential machinery not produced locally.

- Corporate Profit Tax: A tax on the net income of the business, which affects long-term profitability.

- Property and Land Taxes: Ongoing operational costs tied to the value of the physical factory and the land it occupies.

Turkmenistan’s strategic legislative measures directly address each of these points, creating a uniquely advantageous environment for solar manufacturing investment.

Exemption from Customs Duties: A Core Pillar of Support

A primary concern for any new solar manufacturer is the cost of acquiring the necessary production equipment, most of which is imported. Turkmenistan addresses this directly through government Decree No. 2503, enacted on December 6, 2021.

The decree exempts investors from paying customs duties on a wide range of imported goods intended for renewable energy source (RES) projects. This includes:

- Technological equipment

- Components and spare parts for that equipment

- Raw materials necessary for production

This exemption applies only to goods not produced within Turkmenistan, a condition that virtually all specialized solar manufacturing equipment meets. The list of eligible goods is formally approved by the Cabinet of Ministers, providing a clear and official framework. For an investor, this means the entire cost of a turnkey solar manufacturing line can be brought into the country without incurring import taxes, significantly reducing the initial capital required.

A Decade of Tax Advantages: The ’10-Year Holiday’

Beyond the initial savings on imported equipment, Turkmenistan’s Tax Code provides powerful, long-term operational benefits. These incentives, often called a ‘tax holiday’, are designed to support a new facility’s financial health during its critical first decade of operation.

Exemption from Profit Tax

Article 228 of the Tax Code offers a 10-year exemption from profit tax for legal entities on income from the sale of electricity generated using renewable energy sources. While a solar module factory primarily sells modules, this incentive becomes highly relevant for vertically integrated projects or for the factory’s own power supply. Many modern factories install their own solar power plants on-site to reduce energy costs. Under this provision, any surplus power sold to the grid from such an installation would be free from profit tax for 10 years following its commissioning.

Exemption from Property Tax

Article 203 of the Tax Code offers a more direct and significant benefit: a 10-year exemption from property tax on the renewable energy facilities themselves. This applies directly to the core assets of the business, including the factory building and all the production machinery inside. Such an exemption substantially lowers annual operating expenses, allowing for faster capital recovery and reinvestment.

Exemption from Land Tax

Complementing the property tax exemption, Article 164 of the Tax Code also grants a 10-year exemption from land tax for the plots occupied by renewable energy facilities. This further reduces fixed operational costs and contributes to a more predictable and favorable financial model.

The Legal Framework Supporting Your Investment

These financial incentives are part of a broader, coherent national strategy. The Law ‘On Renewable Energy Sources’ (2021) establishes the government’s commitment to supporting the sector through tax, customs, and other benefits.

For international entrepreneurs, the Law ‘On Foreign Investments’ (2008) provides a crucial layer of security. Article 7 of this law guarantees that foreign investors receive treatment ‘not less favorable’ than that provided to domestic investors. This principle ensures that all incentives available to local entities are equally accessible to international partners, fostering a secure investment climate.

Strategic Considerations for Maximizing Benefits

To fully leverage these opportunities, investors should consider several strategic factors.

Location and Special Economic Zones (SEZs)

Turkmenistan’s Law ‘On Special Economic Zones’ (2017) outlines further customs and tax privileges for businesses operating within these designated areas. Establishing a solar factory within an SEZ could potentially allow an investor to combine RES-specific incentives with additional benefits. A thorough analysis of available SEZs should be a key component of the site selection process in the business plan for a solar panel factory.

Documentation and Process

Accessing these incentives requires adherence to formal procedures. Meticulous documentation is essential to prove that imported equipment qualifies for customs duty exemption. Working with experienced partners who can navigate these administrative processes can prevent costly delays. Based on experience from turnkey projects, having a clear and comprehensive list of all essential machines for module production is a prerequisite for a smooth customs clearance process.

Frequently Asked Questions (FAQ)

Do these incentives apply to any size of factory?

The legislation does not specify a minimum capacity, so the benefits apply to a wide range of projects, from smaller, specialized lines to large-scale factories, covering various investment requirements for a solar factory.

What kind of equipment is covered by the customs duty exemption?

The exemption covers technological equipment, components, and raw materials not produced in Turkmenistan. This would include core machinery such as solar cell stringers, laminators, electroluminescence (EL) testers, and solar simulators.

Is it difficult for a foreign investor to access these benefits?

The Law ‘On Foreign Investments’ provides a strong legal guarantee of equal treatment. However, as with any jurisdiction, understanding and navigating local administrative procedures is key to a successful application.

How long are these incentives likely to be available?

These incentives are integral to Turkmenistan’s national strategy to increase the share of renewable energy by 2030, which suggests a stable policy environment for investors planning projects in the medium term.

Conclusion: A Strategic Entry Point into Central Asia’s Solar Market

The comprehensive suite of customs duty exemptions and 10-year tax holidays in Turkmenistan makes a compelling financial case for establishing a solar module manufacturing facility. These incentives significantly de-risk the investment by lowering both initial capital expenditure and long-term operational costs.

For entrepreneurs looking to enter or expand into the solar manufacturing sector, Turkmenistan offers more than just a geographic location; it provides a strategic financial advantage. By leveraging this supportive legal and fiscal framework, investors can build a competitive enterprise positioned for success in the growing Central Asian market. The next logical step is to translate these benefits into a detailed financial model and a comprehensive business plan.