Reconstructing a nation’s infrastructure is a monumental challenge, but it is also a generational opportunity to build back better, stronger, and more resilient. For Ukraine, rebuilding its energy sector goes beyond replacing what was lost—it’s about establishing a foundation for long-term energy independence.

International development banks and financial institutions have committed billions for this purpose, creating a unique opening for entrepreneurs and investors to build critical manufacturing capacity, particularly in the solar photovoltaic (PV) sector.

This article offers a strategic framework for business professionals seeking to understand and access these international reconstruction funds. It outlines the key players, typical requirements, and the strategic approach for positioning a solar manufacturing project to secure funding.

The Context: Why Solar Manufacturing is a Priority for Ukraine

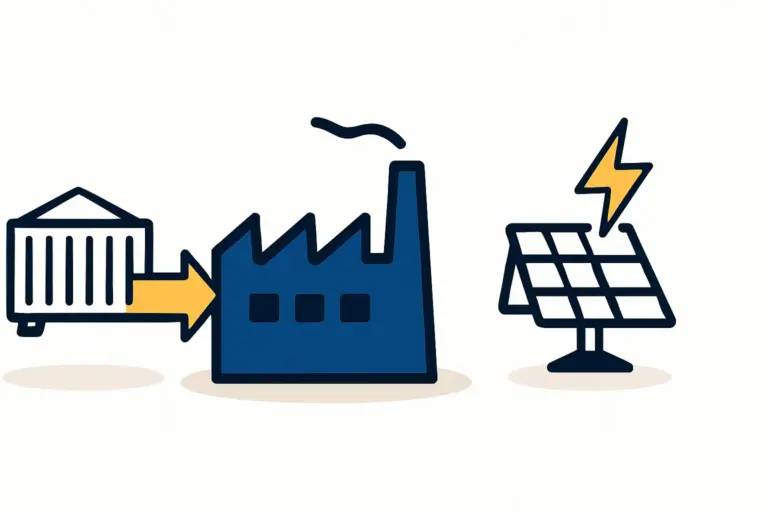

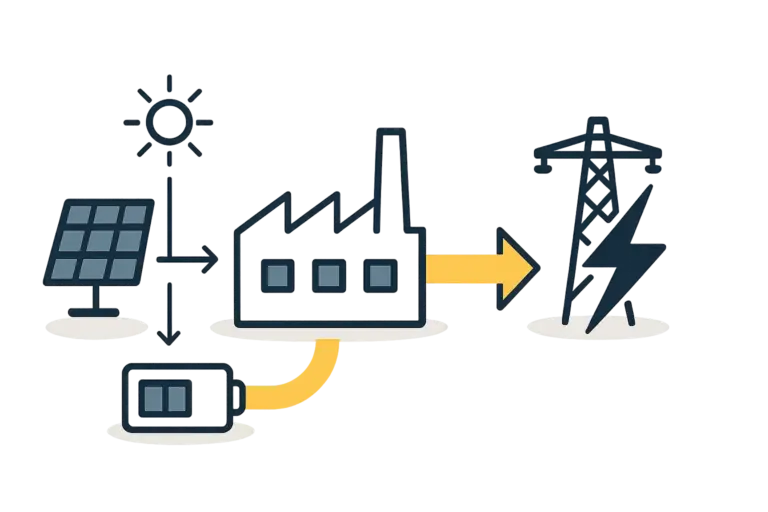

Before exploring the funding mechanisms, it’s essential to understand why solar manufacturing is so central to Ukraine’s recovery strategy. The conflict has damaged or destroyed an estimated 50% of the country’s energy infrastructure, creating an urgent need for a decentralized energy system that is less vulnerable to centralized attacks.

Solar energy is uniquely suited to this objective. Small- and medium-scale solar installations can be deployed rapidly across the country, reducing reliance on large, vulnerable power plants. To support this widespread deployment, a local manufacturing base for solar modules is not just an economic advantage—it is a matter of national security and energy sovereignty.

International partners recognize this strategic imperative. The focus is not simply on importing finished solar panels but on fostering a domestic industry that can supply the reconstruction effort for years to come. This approach powerfully aligns Ukraine’s national interests with the objectives of international development funds.

Key Figures Driving the Opportunity:

-

Reconstruction Cost: The World Bank estimates the total cost of Ukraine’s recovery and reconstruction at over $486 billion over the next decade.

-

Committed Aid: More than €100 billion has already been mobilized by international partners.

-

Energy Sector Focus: A significant portion of these funds is earmarked for restoring and modernizing the energy grid, with a strong emphasis on renewable and decentralized solutions.

Identifying the Primary Funding Sources

Navigating the landscape of international finance requires a clear understanding of the key institutions. The organizations involved are not traditional venture capitalists; they are development-focused entities with specific mandates. They typically offer a blend of financial instruments, including loans, grants, and risk guarantees.

Major International Financial Institutions (IFIs)

These are the largest and most prominent players in Ukraine’s reconstruction. Their involvement often signals a project’s viability to other investors.

-

The World Bank: Through instruments like the Ukraine Relief, Recovery, Reconstruction and Reform Trust Fund (URTF), the World Bank channels funds from multiple governments into critical projects. It prioritizes initiatives that restore essential services and build long-term economic capacity.

-

European Bank for Reconstruction and Development (EBRD): The EBRD has a strong track record in the region and has pledged to invest billions in Ukraine. It focuses on supporting the private sector, making it a key partner for entrepreneurs aiming to establish manufacturing facilities.

-

European Investment Bank (EIB): As the lending arm of the European Union, the EIB is heavily invested in Ukraine’s recovery. Its EU for Ukraine (EU4U) Initiative supports projects that align with EU integration goals, including green energy and industrial development.

National Development Finance Institutions (DFIs)

Many individual countries have their own development agencies that are active in Ukraine. These often work in concert with the larger IFIs.

-

U.S. International Development Finance Corporation (DFC): The DFC provides financing and political risk insurance for private sector projects in emerging markets. It has identified Ukraine as a priority country and is actively seeking bankable projects, especially in critical infrastructure like energy.

-

Germany’s KfW (Kreditanstalt für Wiederaufbau): KfW is a major contributor to Ukraine’s recovery, often providing long-term loans and grants for infrastructure and energy projects.

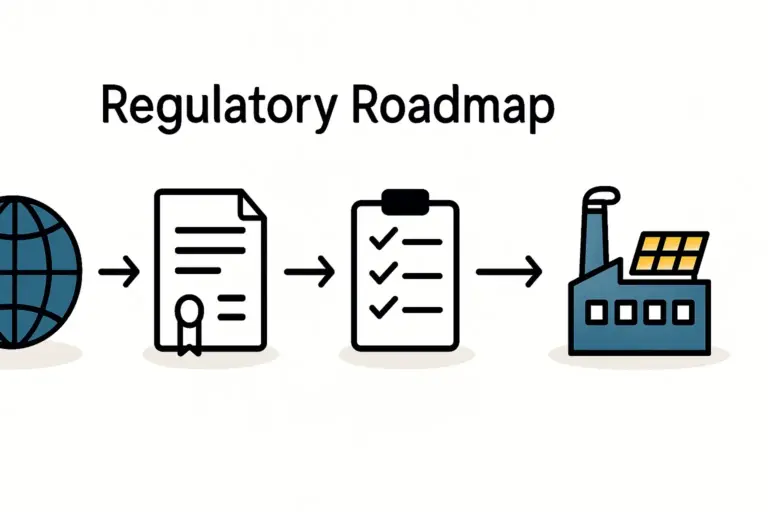

Understanding the specific mandate of each institution is the first step. While the World Bank might focus on large-scale infrastructure, the EBRD and DFC are often more accessible for private sector manufacturing ventures. A successful application hinges on aligning your project’s objectives with the institution’s strategic priorities.

The Blueprint for a Successful Funding Application

Securing financing from these institutions is a rigorous process. It requires more than a simple business idea; it demands a comprehensive, bankable project proposal that addresses financial, technical, and social criteria. As experience from J.v.G. Technology’s turnkey projects shows, applicants must demonstrate robust planning in several key areas.

1. The Bankable Business Plan

This is the cornerstone of any application. It must go beyond market projections to provide a detailed operational blueprint. For entrepreneurs new to the industry, this is often the most significant hurdle. A complete plan, as detailed in guides like how to start a solar module production business, typically includes:

-

A detailed analysis of the initial investment requirements for a solar factory.

-

Projected production costs, revenue models, and cash flow analysis.

-

A complete technical specification of the proposed production line.

-

A comprehensive human resources plan, including recruitment and training.

2. Adherence to Environmental, Social, and Governance (ESG) Criteria

IFIs and DFIs place a strong emphasis on ESG standards. A solar manufacturing project has an inherent environmental advantage, but the proposal must also detail:

-

Social Impact: How the project will create jobs, foster local skills development, and contribute to community well-being.

-

Governance: A clear corporate governance structure that ensures transparency, accountability, and compliance with international anti-corruption standards.

3. Demonstrating Technical and Managerial Competence

Investors need assurance that the project is viable and will be managed effectively. Since many entrepreneurs entering this field may lack a technical background in photovoltaics, this is a critical point. Success often hinges on:

-

Partnership with Technical Experts: Collaborating with experienced engineering firms or consultants who can validate the technical aspects of the project.

-

A Credible Management Team: Assembling a team with proven business management experience, even if it is from other industries.

-

A Phased Development Plan: Outlining a realistic timeline from factory construction to full-scale production.

4. Local Partnerships and Integration

Projects that demonstrate strong local ties are often viewed more favorably. This can include partnerships with Ukrainian construction companies, logistics providers, or educational institutions for workforce training. A local partner can also help navigate the administrative and regulatory landscape, mitigating some of the challenges when starting a solar factory in a new market.

Frequently Asked Questions (FAQ)

Q1: Do I need a local partner in Ukraine to apply for these funds?

While not always a formal requirement, having a credible local partner is highly advantageous. It demonstrates a commitment to the local economy and provides invaluable on-the-ground operational support. Funding institutions view this as a significant risk mitigation factor.

Q2: What is the typical project size these institutions are willing to finance?

It varies, but for industrial projects like a solar factory, IFIs are often looking for scalable ventures. A project with an initial capacity of 20-50 MW per year is a common starting point. This represents a substantial investment capable of making a meaningful impact on the domestic supply chain.

Q3: Is political risk a barrier to securing funding?

The risk is significant, but many DFIs, such as the DFC, offer political risk insurance to mitigate these concerns for private investors. The very existence of these large-scale reconstruction funds signals that major international bodies are committed to underwriting this risk to encourage private sector participation.

Q4: How long does the funding application process typically take?

The process is thorough and can take anywhere from 6 to 18 months. It involves multiple stages of due diligence, including technical, financial, and legal reviews. This underscores the importance of submitting a comprehensive and meticulously prepared proposal from the outset.

Q5: Can my existing company from another industry apply?

Yes. In fact, many successful applicants are established businesses from other sectors looking to diversify. Funding institutions often view this favorably, as it demonstrates a track record of successful business management. The key is to supplement existing business acumen with specialized technical expertise for the solar manufacturing venture.

Conclusion: Preparing for a Strategic Entry

Establishing a solar manufacturing facility offers a significant opportunity to participate in Ukraine’s reconstruction. It’s a chance to build a profitable business while contributing directly to the country’s energy security and economic recovery.

However, accessing the substantial international funds available requires more than ambition; it demands a strategic, detailed, and professional approach. Success hinges on a deep understanding of the requirements of development finance institutions and the submission of a robust, bankable business plan.

For entrepreneurs and investors, the immediate next step is to focus on developing this foundational document. Resources such as the pvknowhow.com e-course on solar manufacturing can provide the structured knowledge needed to navigate the complexities of factory planning and create a proposal that meets the high standards of international funders.