An investor sees a clear opportunity: the United Kingdom has committed to reaching Net Zero by 2050 and plans to increase its solar capacity nearly fivefold to 70GW by 2035, creating a substantial domestic market for solar module manufacturing. He arranges his first shipment of high-efficiency solar cells from a trusted supplier in Germany, expecting a routine delivery.

Instead, the container is held at the Port of Dover for weeks, stalled by unfamiliar paperwork demands concerning ‘rules of origin’. This scenario is no longer a hypothetical risk but the new reality for businesses importing into the UK.

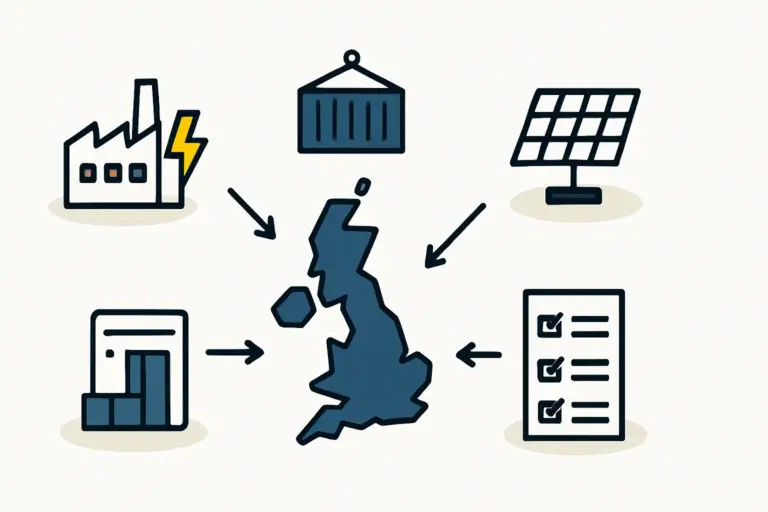

The UK’s departure from the EU Single Market and Customs Union has fundamentally reshaped the flow of goods. For entrepreneurs considering setting up a solar module production facility in the UK, understanding this new landscape isn’t just an administrative task—it’s a strategic consideration critical to the viability of the entire business model. This article breaks down the customs, tariffs, and logistical frameworks for importing solar components into the UK from both EU and non-EU markets.

The New Trading Landscape: Key Changes for Importers

Before Brexit, moving goods from the European Union to the United Kingdom was almost as simple as transporting them between two adjacent cities. That frictionless environment is gone. Today, Great Britain operates as a ‘third country’ to the EU, introducing three core changes that every importer must address:

-

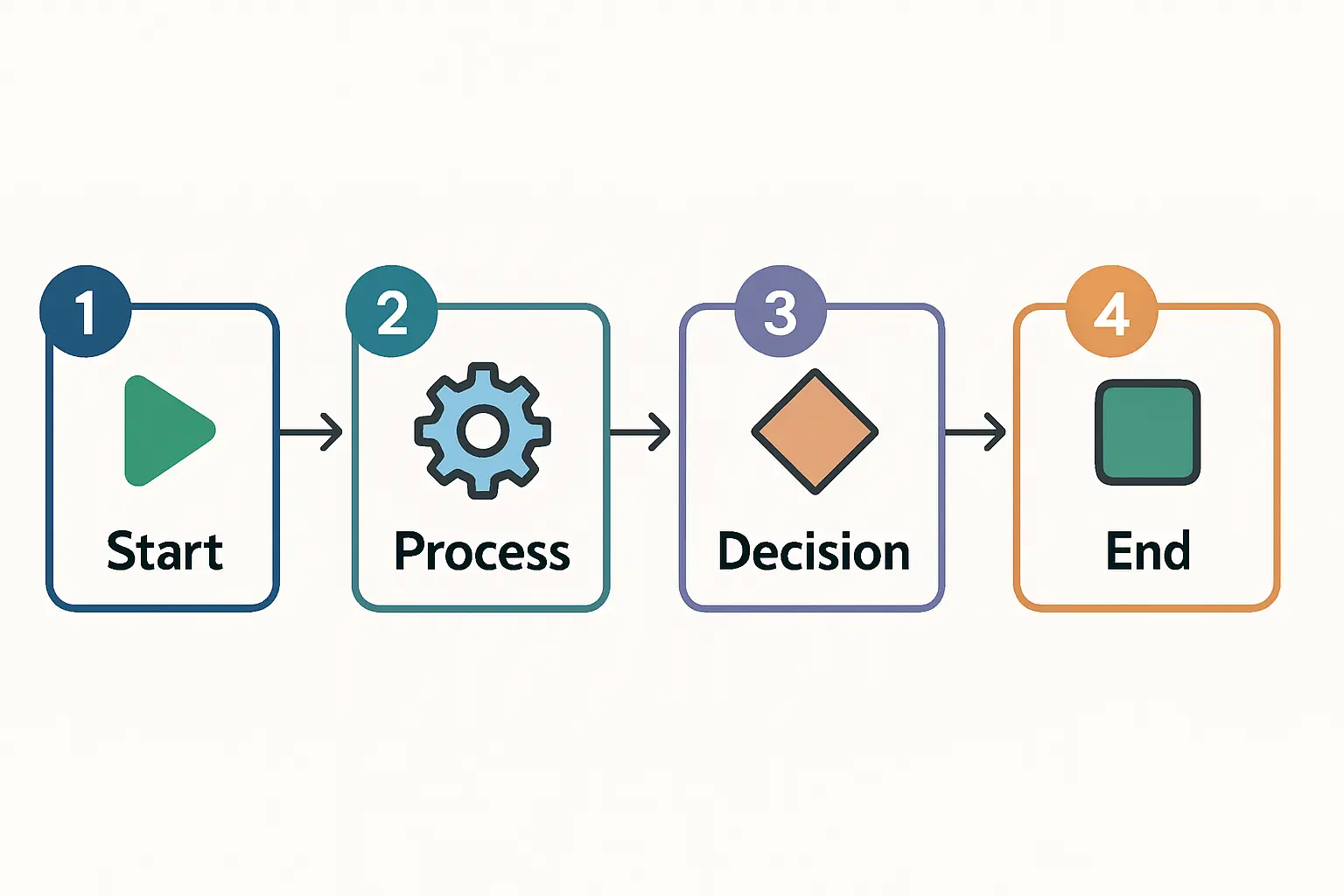

Customs Declarations: Every shipment crossing the EU-UK border now requires a formal customs declaration. This involves classifying goods with specific commodity codes, declaring their value, and providing detailed documentation.

-

Rules of Origin (RoO): The EU-UK Trade and Cooperation Agreement (TCA) allows for trade without tariffs or quotas, but this benefit only applies if the goods ‘originate’ in either the UK or the EU. Proving origin is a complex but essential step to avoid unnecessary costs.

-

Potential Tariffs and VAT: Goods that don’t meet the rules of origin, or are imported from countries without a free trade agreement, are subject to the UK Global Tariff (UKGT). Import VAT is also now payable at the point of entry.

These changes mean that what was once a simple logistical step now demands careful planning, precise documentation, and a deeper understanding of international trade regulations.

Understanding ‘Rules of Origin’ in Solar Manufacturing

The concept of ‘Rules of Origin’ is perhaps the most significant new hurdle for solar manufacturers. In essence, these rules determine the ‘economic nationality’ of a product. For a solar module assembled in the UK to be exported to the EU tariff-free, a sufficient percentage of its value must come from UK or EU content.

Consider an analogy: a chef bakes a cake in London. While the flour and sugar are from the UK, the most valuable ingredient—the high-grade chocolate—is imported from Switzerland, a non-EU country. Under trade rules, that cake may not qualify as ‘originating’ in the UK and could face tariffs if sold in France.

For a solar module manufacturer, the ‘high-grade chocolate’ is often the solar cells. Since most of the world’s solar cells are produced in Asia, a module assembled in the UK using Chinese cells may not meet the origin requirements for tariff-free export to the EU. This has profound implications for a factory’s sourcing strategy and target market.

Sourcing Components: A Global Puzzle with UK-Specific Pieces

A solar module assembly line relies on a global supply chain. While primary components like solar glass, EVA encapsulant, backsheets, aluminium frames, and junction boxes can be sourced from various regions, the solar cells themselves predominantly come from Asia. This creates two distinct import pathways, each with its own challenges.

Importing from the EU (e.g., Germany, Netherlands)

Although seemingly simpler, sourcing components like junction boxes or specialized polymers from EU suppliers is no longer seamless. Full customs declarations are required for every shipment, and the supplier must provide evidence that the goods originate in the EU for the importer to claim tariff-free access under the TCA. Even when correctly documented goods enter the UK without tariffs, the administrative burden and potential for delays at ports like Dover remain a challenge to cost competitiveness.

Importing from Global Markets (e.g., China, Taiwan)

For critical components like solar cells, sourcing from Asia is often unavoidable. These goods are subject to the UK Global Tariff unless a specific trade agreement or tariff suspension is in place—a cost that must be factored directly into the production budget. A further regulatory hurdle is the UK Conformity Assessed (UKCA) marking, the UK’s replacement for the EU’s CE mark. Now mandatory for many products sold in Great Britain, the UKCA mark means importers must ensure their suppliers’ components comply with UK standards, adding another layer of due diligence when procuring essential machinery and materials.

Practical Logistics: From Port Delays to Paperwork

Beyond tariffs and regulations, the day-to-day logistics of moving goods into the UK have grown more complex. Major ports like Felixstowe and Southampton have experienced significant delays from the increased volume of customs checks and a shortage of qualified customs agents. A documentation error that might have been easily corrected in the past can now leave a container stranded for weeks, disrupting production schedules.

Accurate documentation is therefore critical. Commercial invoices, packing lists, and transport documents must be flawless, and goods must be classified using the correct Harmonized System (HS) commodity codes. An incorrect code can lead to both delays and improper tariff payments.

Experience from J.v.G. Technology’s turnkey projects shows that underestimating the time and precision required for customs compliance is one of the most common and costly mistakes new manufacturers make.

Strategic Considerations for New Market Entrants

For entrepreneurs entering the UK solar manufacturing sector, supply chain logistics must be a central part of the business plan, not an afterthought.

Factor in Lead Times and Costs

The post-Brexit environment adds significant time and administrative overhead. These new variables, including customs broker fees, inspection charges, and a financial cushion for potential delays, must be built into financial models and production timelines.

The Importance of a Customs Broker

For any business without in-house expertise, partnering with a reliable customs broker or freight forwarder is essential. These professionals are experts in navigating the complexities of customs declarations, tariff classifications, and origin requirements, mitigating the risk of costly errors.

Develop a Resilient Sourcing Strategy

A robust supply chain strategy should evaluate suppliers on more than just price. Consider a supplier’s experience with UK customs, the clarity of their documentation, and the origin of their components. In some cases, sourcing a slightly more expensive component from a UK or EU supplier may prove more cost-effective in the long run by simplifying the process of obtaining the necessary certifications and avoiding cross-border friction.

Frequently Asked Questions (FAQ)

What is the difference between CE and UKCA marking?

The UKCA (UK Conformity Assessed) mark is the new product marking for certain products sold in Great Britain (England, Wales, and Scotland), replacing the CE marking used in the European Economic Area. While the CE mark may be accepted for a transitional period, businesses should plan for full UKCA compliance.

Do I have to pay tariffs on solar cells from China?

Generally, yes. Solar cells imported from China into the UK are subject to duties under the UK Global Tariff (UKGT). The exact rate depends on their specific HS commodity code. It is critical to verify the current tariff rates as part of any financial projection.

Can I still source components from the EU without tariffs?

Yes, under the EU-UK Trade and Cooperation Agreement, but only if the goods meet the specific ‘rules of origin.’ The importer is responsible for holding proof that the goods originate in the EU. Without this proof, tariffs may apply.

How long do customs clearances take now?

This can vary significantly. A well-documented shipment handled by an experienced broker may clear within 24–48 hours. However, shipments with errors or those selected for physical inspection can be delayed for days or even weeks. It is prudent to add a buffer of at least 5–7 working days to pre-Brexit transit times.

Conclusion and Next Steps

The United Kingdom’s commitment to expanding its solar energy capacity offers a compelling opportunity for new manufacturing enterprises. However, the path to success now involves a new layer of logistical and regulatory complexity. A post-Brexit supply chain requires meticulous planning, a deep understanding of trade rules, and strategic sourcing.

For entrepreneurs ready to navigate these complexities, our structured guidance and e-learning courses at pvknowhow.com offer a clear roadmap—from initial planning to a fully commissioned production line.