While an entrepreneur’s initial focus is often on production technology and market demand, a solar module factory’s long-term profitability hinges on a decision made long before the first machine is ordered: its physical location.

With the US solar manufacturing sector projected to grow tenfold by 2026, driven by initiatives like the Inflation Reduction Act (IRA), selecting the right site is now a critical strategic challenge. The difference between a location with efficient logistics and one without can translate into millions of dollars in operational costs over the life of the facility.

This guide offers a framework for evaluating potential US factory locations based on the three pillars of industrial logistics: port access, rail connectivity, and interstate trucking. Understanding how these systems interact is essential for building a resilient and cost-effective supply chain.

The Strategic Importance of Logistics in Solar Manufacturing

A solar factory is not an island but a central node in a complex flow of materials. Its supply chain runs in two directions: inbound logistics for receiving raw materials like glass, solar cells, and aluminum frames, as well as the initial delivery of heavy solar manufacturing equipment. Outbound logistics handle the distribution of finished solar modules to project sites nationwide.

The choice of transportation mode directly and significantly impacts cost. Analysis from logistics industry data reveals a stark contrast:

- Ocean/Barge: $0.01 – $0.02 per ton-mile

- Rail: $0.03 – $0.05 per ton-mile

- Trucking: $0.25 – $0.50 per ton-mile

While trucking is often unavoidable for final-mile delivery, relying on it for long-haul transport can erode profit margins. The goal of a strategic site selection process is to minimize dependence on the most expensive transport modes by maximizing the efficiency of ports and railways.

Mapping the US Solar Manufacturing Landscape

Recent analysis from institutions like the Brookings Institution reveals the emergence of a ‘solar belt’ across the American Southeast and Midwest. This region is becoming a hub for new manufacturing facilities due to a combination of factors, including favorable state-level incentives, established industrial infrastructure from the automotive sector, and the logistical advantages offered by its geography.

This map illustrates the convergence of critical infrastructure. Major ports like Savannah, Charleston, and Houston serve as gateways for international materials. An extensive network of Class I railroads and interstate highways connects these ports to inland manufacturing sites and, ultimately, to the end markets for finished solar panels.

Evaluating Key Transportation Infrastructure

A comprehensive site evaluation must analyze how each mode of transport supports a potential location. The ideal site optimizes the interplay between ports, rail, and trucking to create a cost-effective and resilient supply chain.

Port Proximity: The Gateway for Global Materials

Because most solar manufacturing relies on a global supply chain for raw materials and components, proximity to a deep-water container port is a primary consideration.

Key evaluation factors include:

- Container Handling Capacity: Ports like Savannah and Houston are investing heavily in expanding their capacity to handle the large container ships that are standard in global trade. A high-capacity port is less prone to the kind of congestion that can delay production schedules.

- Drayage Costs: ‘Drayage’ is the short-haul transport of goods from the port to a nearby warehouse, rail yard, or factory. These costs can be substantial, making a location within a 50-100 mile radius of the port significantly more economical.

- Customs and Tariffs: Understanding the specific customs procedures and any applicable tariffs at a given port is crucial for accurate financial modeling.

The Power of Rail: Cost-Effective Long-Haul Transport

For moving large quantities of materials over land, rail is significantly more efficient than trucking. Once raw materials are unloaded at a port, transitioning them to rail for the journey to an inland factory can yield substantial cost savings.

Locating a factory near one of these terminals offers a powerful degree of flexibility. It allows a business to leverage the low cost of long-haul rail from the port while retaining the flexibility of trucking for the final leg of the journey to the factory. This strategy often strikes the optimal balance of cost, speed, and reliability.

How Logistics Choices Impact Overall Project Costs

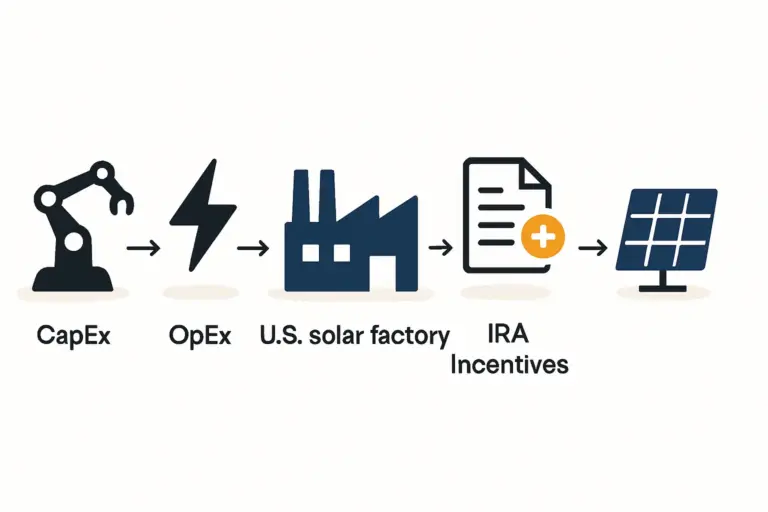

The financial implications of site selection extend beyond shipping rates. These decisions shape both capital and operational expenditures.

- Capital Expenditures (CAPEX): A site with poor road access may require significant investment to build new access roads. The cost of land itself also depends heavily on its proximity to key infrastructure. These factors are a core component of the initial investment requirements.

- Operational Expenditures (OPEX): Inefficient logistics lead to higher recurring costs for fuel, driver hours, and carrier fees. Over a decade, these seemingly small daily differences accumulate into a major competitive disadvantage.

- Facility Design: The choice of site can also constrain factory layout planning. A site with excellent rail and road access allows for more efficient designs for receiving and shipping docks, improving internal workflow and reducing handling time.

Frequently Asked Questions (FAQ)

How far from a major port is considered ‘too far’?

There is no absolute number, but generally, locations within 100-150 miles of a port are considered optimal for minimizing drayage costs. Beyond 200-250 miles, the cost and complexity of trucking from the port increase significantly, making rail access almost essential for a cost-competitive operation.

Is a direct rail spur essential for a new factory?

While a direct rail spur is the ideal solution for high-volume factories, it is not always essential for smaller or medium-sized operations (e.g., 50-200 MW). A location within a few miles of a public intermodal rail terminal can provide many of the same cost benefits without the capital expense of building a private spur.

Should I choose a site based on inbound or outbound logistics?

The decision should be a balanced one. For solar manufacturing, however, inbound logistics often carry more weight. Raw materials are typically heavier and more voluminous than the finished product. Optimizing the transport of incoming goods from the port, therefore, often yields the greatest cost savings. The extensive US highway system generally provides sufficient flexibility for outbound distribution.

How does the Inflation Reduction Act (IRA) influence logistics decisions?

The IRA’s tax credits and incentives are designed to encourage domestic manufacturing. This means that while many raw materials may still be imported, a domestic ecosystem of suppliers for components like glass, frames, and backsheets is likely to emerge. When selecting a site, it is wise to consider its proximity not only to ports but also to these emerging domestic supply chain hubs, many of which are clustering in the ‘solar belt.’

Conclusion: From Site Selection to Operational Success

Choosing a location for a new solar module factory is one of the most consequential decisions an entrepreneur will make. While the appeal of tax incentives and low land prices is strong, these benefits can be quickly negated by inefficient and costly logistics.

A thorough evaluation of port access, rail connectivity, and the interstate highway system is not an administrative detail—it is a cornerstone of a successful business strategy. By viewing a potential site through the lens of its supply chain, you can build a foundation for an operation that is not only productive but also profitable and resilient for years to come. The next logical step in this process is a detailed feasibility study that models transportation costs from specific sites.