For entrepreneurs and investors in the solar manufacturing sector, the choice of location is a foundational decision with lasting consequences. Beyond proximity to markets, the regulatory and fiscal environment can either accelerate growth or create unforeseen barriers. In South America, a compelling model is taking shape as entrepreneurs establish export-focused manufacturing operations within Uruguay’s highly advantageous Free Trade Zones (Zonas Francas).

Uruguay’s free trade framework provides a stable and remarkably efficient platform for solar module manufacturing, especially for businesses targeting the Mercosur trade bloc and other global markets.

Understanding Uruguay’s Free Trade Zone Framework

Uruguay’s Free Trade Zones are designated areas that operate under a special legal and fiscal regime designed to attract foreign investment and promote export-oriented activities. Governed by the robust Free Zone Law (No. 15.921), this framework offers exceptional long-term stability and security for international investors.

The core principle is simple: companies operating within these zones are, for most practical purposes, treated as if they are offshore. This allows them to engage in industrial, commercial, and service activities with a minimal tax burden and administrative complexity, making it an ideal model for assembling products for export from globally sourced components.

The Financial Advantages for Solar Module Manufacturing

For a solar module assembly business, where profit margins depend on efficient supply chain management and cost control, the financial benefits of operating within a Uruguayan Zona Franca are substantial.

The Power of 100% Tax Exemption

The most significant advantage is a complete exemption from all current and future national taxes. For a solar manufacturer, this translates into direct, significant cost savings. Key exemptions include:

- Corporate Income Tax (IRAE): Profits generated from operations within the zone are not subject to corporate income tax.

- Net Wealth Tax (IP): Company assets located within the FTZ are exempt from this tax.

- Value Added Tax (VAT): The procurement of goods and services within the zone is not subject to VAT.

This comprehensive tax holiday allows manufacturers to reinvest capital into technology, expand production capacity, or maintain more competitive pricing in the global market.

Streamlined Customs and Logistics

A typical solar module assembly line relies on importing various components: photovoltaic cells, specialized glass, EVA encapsulant, backsheets, and aluminum frames. Under the FTZ regime, these goods can be imported into the zone free of any customs duties or import taxes.

Similarly, when the finished solar modules are exported to international markets, they are exempt from all Uruguayan export taxes and duties. This creates a frictionless flow of goods, turning the manufacturing facility into an efficient, bonded assembly hub. The modern port infrastructure in Montevideo strengthens this logistical advantage, providing reliable access to global shipping lanes.

Unrestricted Capital and Profit Flow

A critical concern for any international investor is the ability to manage capital effectively. Uruguay’s framework guarantees the free repatriation of profits and capital without restrictions or special permits, giving investors complete control over their financial returns.

Strategic Market Access: Serving Mercosur and Beyond

While the financial benefits are compelling, Uruguay’s strategic location is a distinct geographical advantage, particularly for accessing the growing South American solar market.

Gateway to Mercosur

Mercosur, the South American trade bloc comprising Brazil, Argentina, Paraguay, and Uruguay, represents a substantial market for renewable energy. While goods produced in FTZs are generally considered ‘non-Mercosur,’ they can still be exported to member countries by paying the Common External Tariff (AEC). This provides a predictable, regulated pathway to access one of the world’s most promising solar markets from a stable, tax-neutral operating base.

A Global Export Platform

The benefits extend far beyond the immediate region. A facility in a Uruguayan FTZ serves as an ideal platform for reaching markets in North America, Europe, Africa, and the Middle East. This combination of tax exemptions, logistical efficiency, and a stable legal environment creates a highly competitive base for any export-oriented manufacturing business.

Operational Considerations for Setting Up in a Zona Franca

Based on experience from J.v.G. turnkey projects, establishing a production line requires careful planning of several practical details.

Building and Infrastructure

Uruguay’s Free Trade Zones, such as Zonamerica or Parque de las Ciencias, offer modern infrastructure and facilities ready for industrial use. This can significantly shorten the time required to set up and commission a new factory.

Workforce Requirements

The Free Zone Law stipulates that at least 75% of a company’s workforce must be Uruguayan nationals, a key planning factor for any solar factory. Fortunately, Uruguay has a skilled and educated labor pool, making it feasible to meet this requirement while maintaining high production standards.

Typical Project Scale

The FTZ model is exceptionally well-suited for entrepreneurs establishing a small to medium-scale solar module production line. A typical entry-level facility with a capacity of 50–200 MW can be established efficiently, allowing for a phased approach to market entry and expansion.

Frequently Asked Questions (FAQ)

What exactly is a Free Trade Zone?

A Free Trade Zone (Zona Franca) is a fenced-off, geographically delimited area within a country where goods can be landed, handled, manufactured, or reconfigured, and re-exported without the intervention of customs authorities. Activities within the zone are subject to a special tax and regulatory regime.

Are all national taxes really exempt?

Yes, for activities conducted within the zone and for export, users are exempt from all national taxes, including Corporate Income Tax, VAT, and Net Wealth Tax. The only applicable costs are social security contributions for Uruguayan employees and a small annual fee paid to the FTZ operator.

Can I sell modules from the FTZ into Uruguay’s domestic market?

Generally, goods produced in an FTZ are intended for export. Selling into the Uruguayan domestic market (outside the zone) is restricted and subject to standard import duties and taxes, treating the goods as if they were coming from a foreign country.

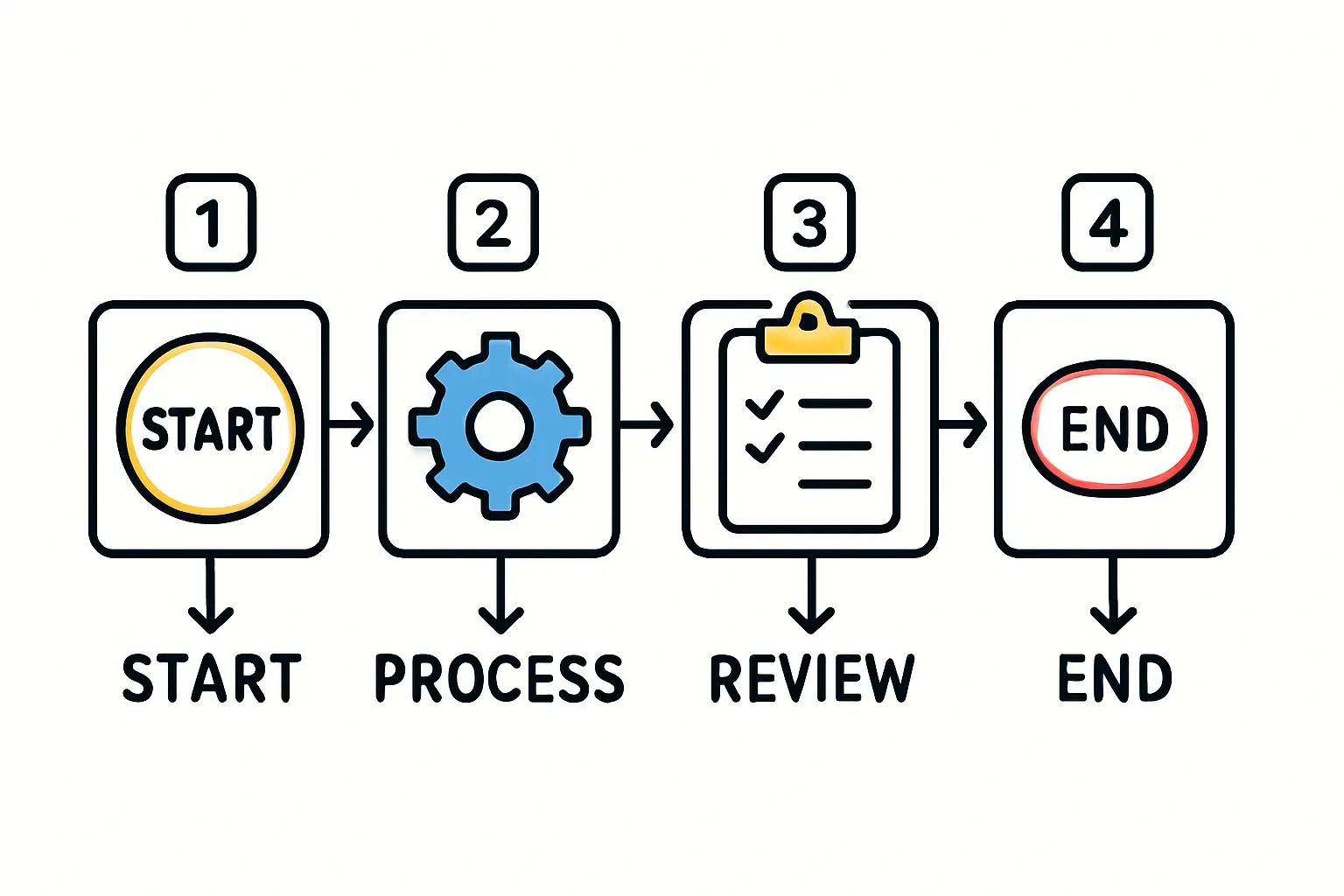

What is the process for getting approval to operate in an FTZ?

An interested party must submit a detailed investment project and business plan to the National Free Zone Directorate. Once approved, the company signs a user agreement with the private developer of the chosen FTZ.

Is this legal framework stable for long-term investment?

The stability of Uruguay’s Free Zone Law (No. 15.921) is a key part of its appeal. The benefits granted to FTZ users are secured by contract with the government, providing a high degree of legal certainty for long-term investments.

Conclusion: A Strategic Foundation for Growth

For entrepreneurs looking to enter the solar module manufacturing industry, Uruguay’s Free Trade Zones offer more than just tax incentives. They provide a comprehensive, stable, and strategically located platform for building a competitive and scalable export business.

With 100% tax exemption, duty-free trade, unrestricted capital flows, and privileged access to South American markets, this framework creates a powerful foundation for success. Understanding how to leverage such frameworks is a critical first step in the planning process. For those new to the industry, structured guidance, such as that provided in the pvknowhow.com’s structured e-course, can help transform this complex opportunity into a viable business plan.