An entrepreneur sees opportunity where others see complexity. In Zimbabwe, the opportunity is clear: a nation with abundant solar irradiation faces a significant energy deficit, creating immense demand for locally produced renewable energy solutions.

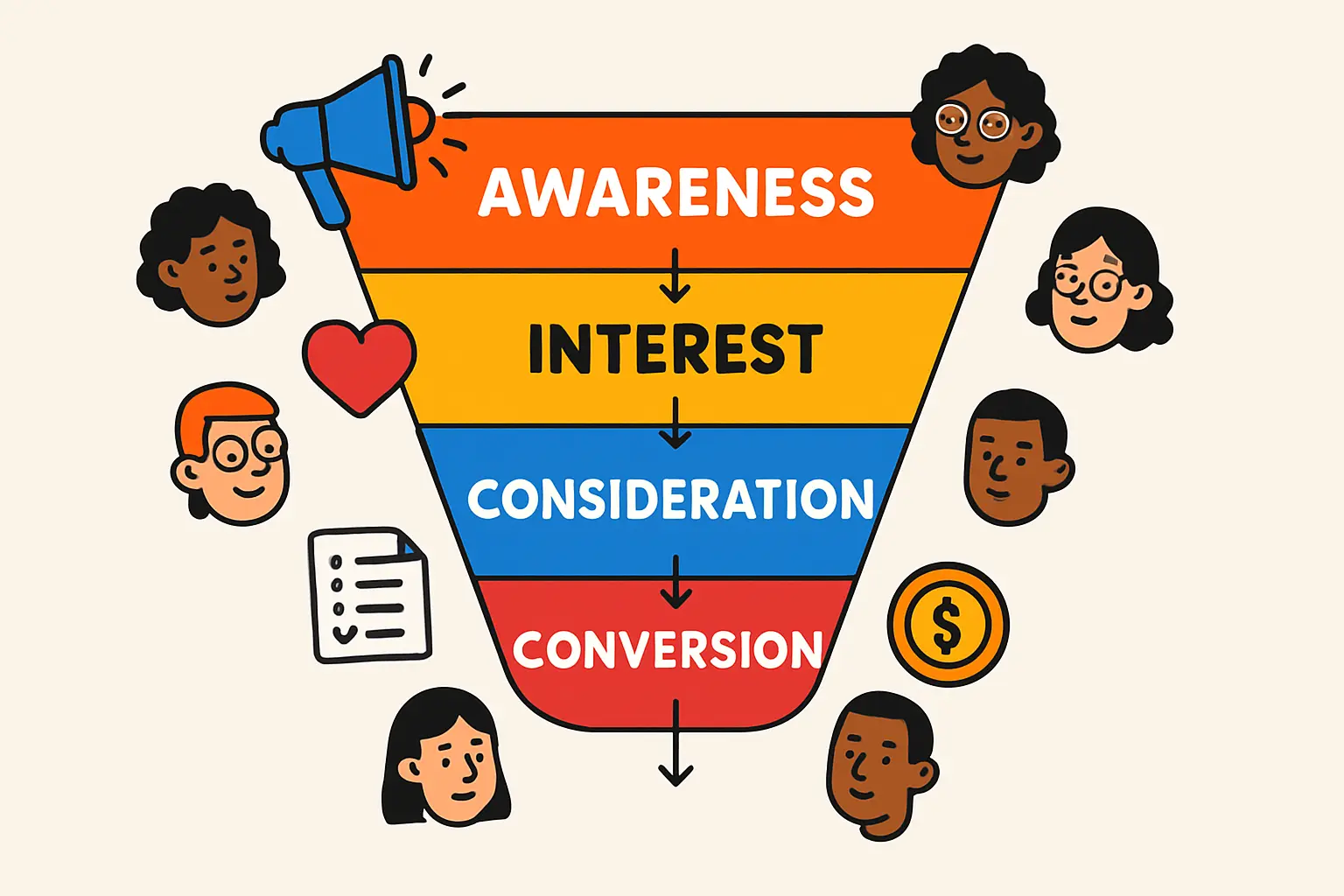

For international investors, however, the country’s unique multi-currency financial system often raises critical questions. How does one manage capital in a dual-currency environment? What are the mechanisms for repatriating profits? This guide provides a foundation for business professionals considering entry into Zimbabwe’s solar manufacturing sector. It outlines key currency considerations, risk mitigation strategies, and the regulatory framework designed to support foreign investment.

With proper planning, the financial landscape is less a barrier and more a manageable variable.

Understanding Zimbabwe’s Multi-Currency System

To operate successfully in Zimbabwe, an investor must first understand its monetary framework. For years, the country has used a multi-currency system, with the US Dollar (USD) circulating alongside a local currency. In 2024, the Zimbabwe Gold (ZiG) was introduced to replace the Zimbabwean Dollar (ZWL), backed by a basket of precious metals and foreign currency reserves to foster greater stability.

For a solar manufacturing enterprise, this has several practical implications:

-

Capital-Intensive Imports: The majority of the solar panel manufacturing plant cost involves procuring machinery from international suppliers. These transactions are conducted almost exclusively in USD.

-

Local Operating Costs: Expenses such as salaries, utilities, and local raw materials may be payable in a combination of ZiG and USD, depending on regulations and supplier preferences.

-

Revenue Streams: The modules you produce will likely be sold to commercial, industrial, and residential customers who transact in both currencies. Pricing strategies must account for this.

The core challenge for any investor is to manage the flow of funds between these currencies while protecting value against potential fluctuations and regulatory shifts.

The Market Opportunity: A Compelling Case for Investment

Despite the financial complexities, the business case for local solar manufacturing in Zimbabwe is exceptionally strong. The country’s power grid is under strain, leading to frequent outages that hamper industrial productivity and daily life. This creates a strong, inherent demand for reliable, off-grid, and supplementary power solutions.

This energy gap represents a significant, long-term market for locally manufactured solar panels. Businesses and households are actively seeking energy independence, and a local manufacturer is uniquely positioned to meet this demand more efficiently and affordably than importers. Capitalizing on this clear market need begins with a thorough understanding of how to start a solar panel manufacturing business.

Strategic Financial Structuring for a Solar Enterprise

A robust financial strategy is essential for mitigating risk and ensuring long-term profitability. This involves carefully structuring capital inflow, operational financing, and profit outflow.

Securing Initial Capital Investment

The initial investment for sourcing a turnkey solar manufacturing line and setting up the facility will be in foreign currency, typically USD or EUR. This capital is brought into the country through official banking channels. Registering these funds as foreign direct investment (FDI) is crucial to facilitate future profit and dividend repatriation.

Structuring Revenue and Managing Foreign Exchange Risk

A key strategy is to denominate sales contracts in USD wherever possible, particularly for commercial and industrial clients who often have access to foreign currency. This creates a natural hedge, as your primary revenue stream will be in the same currency as your major costs (imported materials) and profit expectations.

For sales in the local currency (ZiG), businesses need a clear policy for converting these funds back to USD. This requires working closely with a reputable local bank that has a strong foreign exchange department.

Planning for Profit Repatriation

Foreign investors are naturally concerned with their ability to repatriate profits and dividends. Zimbabwe’s regulations, administered by the Reserve Bank of Zimbabwe (RBZ), permit foreign investors to remit their profits. However, repatriation is subject to procedural requirements and the availability of foreign currency in the market.

Projects designated as priority investments, particularly in the energy sector, may receive preferential treatment. Furthermore, exporters are subject to a foreign currency surrender requirement, where a portion (e.g., 25%) of export earnings must be converted to the local currency at the official rate. While a new manufacturer may initially focus on the domestic market, understanding this rule is vital for future export planning.

The Role of the Zimbabwe Investment and Development Agency (ZIDA)

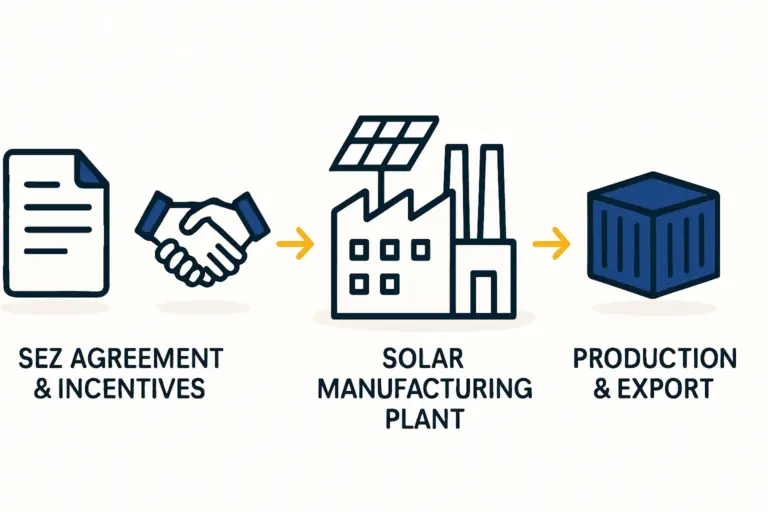

The Zimbabwean government established the Zimbabwe Investment and Development Agency (ZIDA) to streamline and protect foreign investment. ZIDA acts as a ‘One Stop Investment Services Centre,’ designed to assist investors with everything from company registration to securing permits and licenses.

Engaging with ZIDA is a critical step for any serious investor. Registering your project with ZIDA can provide access to specific incentives, such as tax breaks or special dispensations on currency controls, and adds a layer of formal recognition and protection to your investment.

Frequently Asked Questions (FAQ)

Can I wholly own my solar manufacturing business in Zimbabwe as a foreign investor?

Yes, foreign investors are generally permitted to own 100% of their businesses in most sectors, including manufacturing. Registering with ZIDA helps formalize this ownership structure.

How do I manage payroll with the dual-currency system?

Many companies in Zimbabwe offer employees a blended salary, with a portion paid in USD and the remainder in ZiG. This approach, which must comply with current labor laws and regulations, helps protect employees’ purchasing power while managing the company’s foreign currency resources.

What is the primary risk associated with the ZiG currency?

The primary risk for any new currency is stability and public confidence. The ZiG is backed by reserves to mitigate this, but investors should still model for potential exchange rate fluctuations. Structuring the business to maximize USD-denominated revenue is the most effective mitigation strategy.

Is it difficult to get foreign currency out of the country for supplier payments?

While there have been challenges with foreign currency availability in the past, priority is typically given to payments for essential imports, such as raw materials and machinery for productive sectors. Establishing a strong relationship with your bank and maintaining transparent records is crucial for smooth processing.

Conclusion: A Market for the Prepared Investor

Entering the solar manufacturing market in Zimbabwe requires more than just technical and operational planning; it demands a sophisticated financial strategy tailored to the local context. The multi-currency system, while complex, is not an insurmountable obstacle.

By structuring the business to maximize USD revenue, engaging directly with regulatory bodies like ZIDA, and building strong local banking relationships, investors can effectively navigate the financial environment. The profound demand for energy in Zimbabwe offers a compelling reward for the well-prepared entrepreneur ready to build a foundational business in the nation’s renewable energy future.