Australia’s rapidly growing solar energy market is fueling interest in establishing local solar panel manufacturing. This ambition, however, hinges on one critical factor: developing robust and resilient supply chains for essential components.

For entrepreneurs and investors venturing into this space, understanding the complexities of component sourcing is paramount for success.

Table of Contents

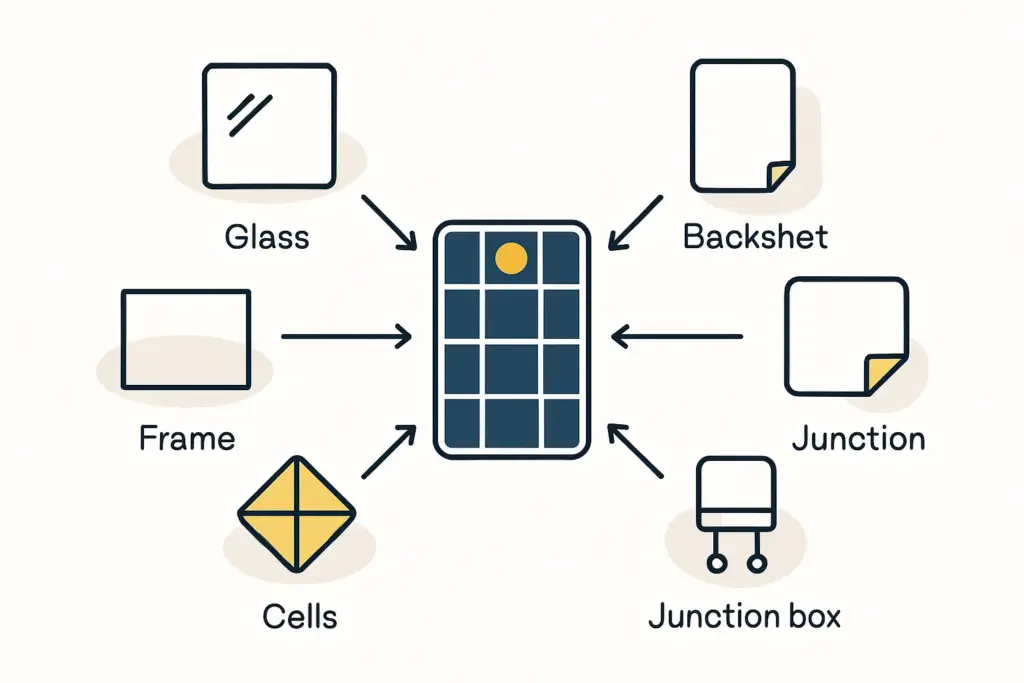

Understanding the Building Blocks: Key Components for Australian Solar Factories

At its core, a solar photovoltaic (PV) panel is a sophisticated assembly of parts, each playing a vital role in converting sunlight into electricity. For an Australian manufacturing facility, a clear understanding of these components isn’t just academic—it’s the foundation of strategic sourcing.

The Heart of the Panel: Solar Cells

Solar cells are the active elements responsible for energy conversion. Their creation involves several distinct stages:

- Polysilicon: It all starts with high-purity silicon, the primary raw material.

- Ingots and Wafers: This polysilicon is melted and formed into cylindrical ingots, which are then meticulously sliced into ultra-thin wafers.

- Cell Fabrication: The wafers then undergo a series of chemical and physical processes to create the p-n junction that enables the photovoltaic effect.

Protective Layers

To protect the delicate solar cells and ensure a long, productive life, several protective layers are crucial:

- Tempered Glass (Front Cover): This specially treated glass offers essential impact resistance while allowing maximum sunlight to pass through.

- EVA (Ethylene Vinyl Acetate) Encapsulant: These polymer sheets laminate the cells, glass, and backsheet together. Think of them as the ‘glue’ that provides adhesion, cushioning, and electrical insulation.

- Backsheet: This is a durable, polymer-based material (or sometimes glass, in the case of bifacial modules) that protects the rear of the panel from moisture, UV radiation, and mechanical damage.

Structural and Electrical Integrity

Finally, several components provide physical support and allow for the extraction of generated power:

- Aluminum Frame: This provides structural rigidity, protects the vulnerable edges of the laminate, and enables mounting.

- Junction Box: This is a weatherproof enclosure on the back of the panel. It houses bypass diodes, which help mitigate the effects of shading, and provides the connection points for linking panels into an array.

The quality and compatibility of each component are critical. Sourcing decisions must balance cost against performance, durability, and unwavering reliability.

The Sourcing Dilemma: Local Champions vs. Global Giants

Australian solar manufacturers face a fundamental strategic choice for each component: source locally or from international markets. Each path comes with its own distinct set of advantages and challenges.

Current Australian Landscape

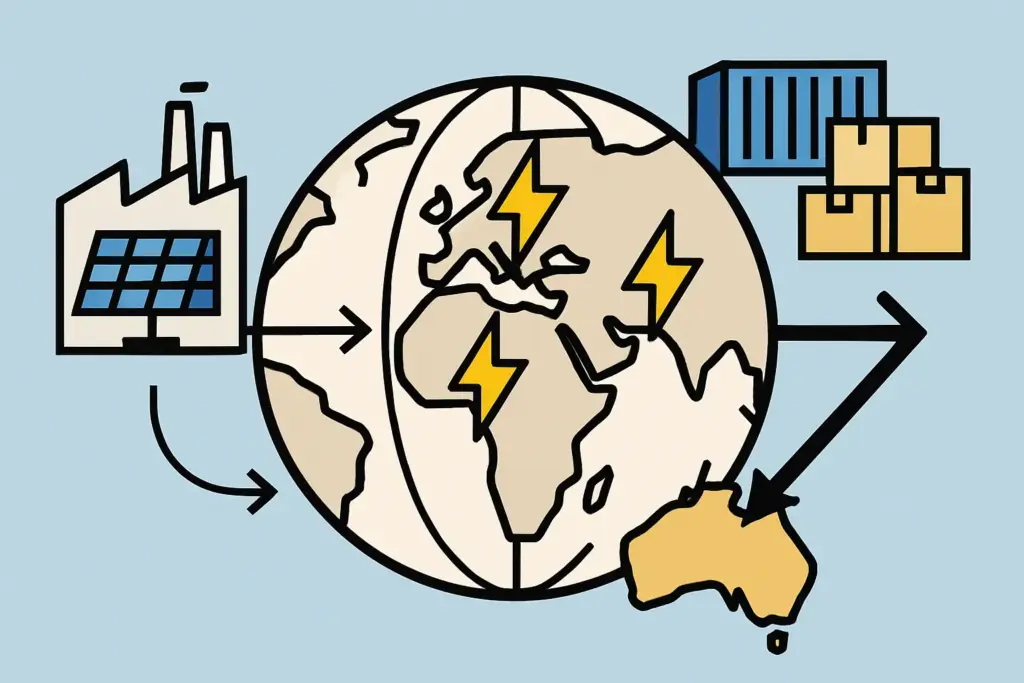

Currently, Australia’s solar module manufacturing capacity is limited, with Tindo Solar being the primary established producer. The nation relies heavily on imports—over 90% of solar modules, particularly from China—to meet soaring local demand. As research from institutions like the United States Studies Centre (USSC) has highlighted, this high import dependency underscores a significant vulnerability in the nation’s current supply chain.

Component-by-Component Sourcing Analysis

Solar Cells

- International Sourcing: China overwhelmingly dominates global solar cell production (around 88%), including upstream polysilicon and wafer segments. This path offers lower costs due to economies of scale and established supply chains. The downside, however, is significant geopolitical risk, shipping disruptions, and long lead times. Other regions like Southeast Asia and India are emerging as potential alternative suppliers.

- Local Sourcing: Developing local cell manufacturing in Australia is a significant undertaking. Initiatives like the Australian Government’s $1 billion ‘Solar Sunshot’ program and ARENA’s ‘Silicon to Solar’ roadmap aim to bolster the country’s domestic capabilities. This approach promises enhanced supply security, innovation potential, and local job creation, but it requires high initial capital investment and specialized expertise to be cost-competitive.

Solar Grade Glass

- International Sourcing: Well-established global suppliers offer specialized solar glass, making this a straightforward option.

- Local Sourcing: Australia has the raw materials for glass production. Significant potential exists for Australian glass manufacturers to adapt or expand to meet the specific requirements of the solar industry, such as low-iron, high-transmittance tempered glass.

EVA and Backsheets

- International Sourcing: These are specialized chemical products manufactured by a relatively small number of global companies.

- Local Sourcing: While competing on commodity-scale production would be tough, niche opportunities may exist for local manufacturing, perhaps focusing on innovative materials developed through Australian R&D.

Aluminum Frames

- International Sourcing: Aluminum frames are mass-produced globally, often in regions with integrated aluminum industries, which makes them very cost-effective.

- Local Sourcing: This is an area of significant potential. Australia is a major producer of bauxite and aluminum. Leveraging this for local frame manufacturing could offer benefits like customization, reduced shipping costs, and improved supply chain responsiveness.

Junction Boxes and Connectors

- International Sourcing: These components are highly standardized and produced in enormous volumes by international specialists.

- Local Sourcing: Opportunities may exist for the local assembly of junction boxes or the manufacturing of specialized connector solutions, particularly if integrated with Australian innovation.

Raw Material Considerations for Local Sourcing

Australia has abundant natural resources, including high-quality quartz (for silicon) and bauxite (for aluminum). However, there are significant gaps in the midstream value chain. For instance, while quartz is plentiful, Australia currently lacks large-scale commercial polysilicon refining, ingot and wafer production, and cell manufacturing capabilities. ARENA’s ‘Silicon to Solar’ roadmap is actively exploring the techno-economic feasibility of developing these crucial upstream segments.

Navigating the Maze: Logistics and Import Realities for Australian Manufacturers

Sourcing components is only half the battle. Whether sourcing internationally or moving them domestically, the realities of logistics and imports are critical operational hurdles.

International Shipping and Freight

Sourcing components from overseas means dealing with substantial shipping costs, which can fluctuate with global demand, fuel prices, and route availability. Long sea voyages impact lead times, inventory planning, and cash flow. Disruptions like port congestion, customs delays, and geopolitical events can severely disrupt supply lines.

Import Duties, Tariffs, and Regulations

Manufacturers must navigate Australia’s complex import regulations. Understanding duties and taxes is crucial for accurate costing. Imported parts must also meet stringent Australian standards—often requiring Clean Energy Council (CEC) approval to be eligible for systems receiving government incentives.

Domestic Logistics

Even after components arrive at Australian ports or are sourced locally, domestic logistics present their own challenges. Australia’s vast geography can lead to significant transportation costs when moving materials to manufacturing facilities. Efficient warehousing and inventory systems are essential to manage component flows and buffer against potential disruptions.

Building a Fortress: Strategies for a Resilient Solar Component Supply Chain in Australia

Given these complexities, how can an Australian solar manufacturer proactively build resilience into their supply chain?

Diversification is Key

Avoid over-reliance on a single supplier for any critical component. Reduce dependence on a single country by exploring alternative international sources in regions like Southeast Asia, India, or North America, a strategy supported by USSC recommendations.

Strengthening Local Capabilities

Actively engage with federal and state initiatives like the ‘Solar Sunshot’ program and ARENA funding opportunities designed to foster domestic manufacturing. Work with other local players, research institutions, and industry bodies to build a supportive ecosystem.

Strategic Partnerships and Joint Ventures

Consider collaborations with established international component manufacturers. This could involve licensing technology, setting up joint ventures for local production, or securing contract manufacturing agreements.

Supply Chain Visibility and Risk Management

Map your supply chain to understand every tier and identify potential bottlenecks. Develop clear contingency plans to mitigate the impact of disruptions, such as pre-qualifying alternative components or having backup suppliers on standby.

Robust Quality Assurance and Supplier Vetting

Implement stringent quality control processes for all incoming components. Thoroughly vet all potential suppliers for their reliability, financial stability, and adherence to quality standards. This upfront due diligence can prevent significant problems down the line.

Considering the Circular Economy

Explore the long-term potential for sourcing recycled materials. As more of Australia’s solar panels reach their end of life, developing local recycling capabilities could provide a future source of materials like glass and aluminum, reducing import reliance.

The Path Forward: A Strategic Approach to Sourcing for Australia’s Solar Future

Developing a thriving solar manufacturing sector in Australia requires a strategic, clear-eyed approach to component sourcing. This involves carefully balancing the pressure of cost-effectiveness with the critical need for supply chain security and resilience. There is no single right answer; the optimal strategy will depend on the specific components, your operational scale, and your enterprise’s appetite for risk.

Manufacturers, government bodies, and investors must collaborate to address the current gaps in the Australian solar value chain. This means supporting R&D, investing in necessary infrastructure, and creating policy settings that encourage both local production and diversified international sourcing.

Conclusion: Securing Australia’s Solar Manufacturing Ambitions

The journey to establish a significant solar panel manufacturing presence in Australia is complex, but it is achievable. Strategic component sourcing isn’t just an operational detail; it’s the very cornerstone of this ambition.

By understanding the components, carefully weighing domestic versus international options, navigating logistical hurdles, and proactively building resilience, Australian enterprises can lay a strong foundation for a competitive and enduring solar manufacturing industry. With intelligent strategies and a concerted effort, Australia can move toward greater energy independence and become a meaningful player in the global clean energy manufacturing landscape.

Ready to build your solar manufacturing business in Australia? Get expert help with our free e-course or explore our services. For a comprehensive roadmap, our Premium Business Plan E-Course provides personalized guidance to launch your venture. Let’s secure your success in Australia’s solar future.