For entrepreneurs exploring new frontiers in solar manufacturing, the Kingdom of Bhutan offers a unique and compelling proposition. While known globally for its pioneering Gross National Happiness index and pristine environment, Bhutan is also cultivating a welcoming landscape for the high-tech **bhutan manufacturing industry**. The government has established a structured framework of fiscal incentives to attract foreign direct investment, particularly in the renewable energy sector.

This guide outlines the specific financial benefits available to investors planning to establish solar module manufacturing operations in Bhutan, covering the tax holidays, duty exemptions, and support mechanisms that form the foundation of this strategic initiative.

Table of Contents

Understanding Bhutan’s Strategic Vision for Solar Manufacturing

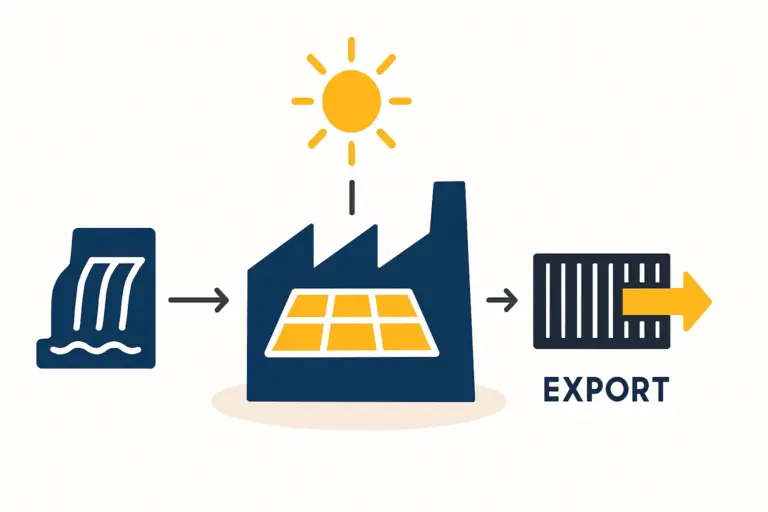

Bhutan’s industrial policy is shaped by a unique set of national priorities. As a carbon-negative country with an economy that has historically relied on hydropower, diversification is a key strategic goal. The push for solar manufacturing is not merely an economic decision; it is a calculated move to enhance energy security, create skilled employment, and build a modern, sustainable industrial base.

For an international investor, understanding this context is crucial. It signals that a solar manufacturing project aligns directly with the nation’s long-term development goals, promising strong government support and a stable regulatory environment.

Core Fiscal Incentives for Solar Manufacturing Investors

The Royal Government of Bhutan offers a clear and attractive set of incentives through its Fiscal Incentives Act. These are not vague promises but legislated benefits within the **bhutan tax system** that significantly de-risk the initial investment and improve the financial viability of a manufacturing enterprise.

Tax Holidays: A Significant Financial Advantage

The most direct and impactful incentive is a complete exemption from Corporate Income Tax (CIT) for a substantial period.

- Duration: New manufacturing businesses in high-priority sectors, including renewable energy technology, are eligible for a 10-year tax holiday.

- Conditions: This incentive applies to new ventures and requires a detailed project proposal that demonstrates alignment with Bhutan’s economic development goals.

- Business Impact: With a standard CIT rate of 25% in Bhutan, this 10-year exemption directly translates into higher retained earnings during the most critical phase of a business—the start-up and scaling years. This capital can then be reinvested into operations, technology upgrades, or market expansion.

Exemption on Import Duties and Sales Tax

Machinery and equipment are a major component of the initial capital expenditure for a solar factory—a cost Bhutan’s incentive package addresses directly.

- Scope: A full exemption from customs duties and sales tax covers the import of plant, machinery, and equipment needed to set up the factory. This also extends to raw materials and components for manufacturing that are not available locally.

- Practical Example: Choosing the right solar panel manufacturing equipment is a critical decision. For a 20-50 MW production line, where machinery can represent over 60% of the initial capital outlay, this exemption can substantially reduce the upfront investment, freeing up capital for other operational needs.

Accelerated Depreciation on Plant and Machinery

Beyond the initial tax holiday, the framework enhances long-term financial efficiency through favorable depreciation rules.

- Mechanism: Investors can claim an accelerated depreciation allowance on plant and machinery. This allows a larger portion of an asset’s value to be written off against taxable income in the early years of its life.

- Benefit: While this benefit takes effect after the 10-year tax holiday ends, it is a crucial element for long-term financial planning. It effectively reduces taxable income in subsequent years, improving cash flow and the overall return on investment.

Additional Support Mechanisms and Non-Fiscal Benefits

Support for investors in Bhutan extends beyond direct financial incentives; the country’s operational environment itself offers several distinct advantages.

Streamlined Foreign Direct Investment (FDI) Approval Process

The government provides a clear and efficient pathway for foreign investors. The Department of Industry acts as the central agency for facilitating FDI, offering a single window for project approval and licensing.

As experience from global turnkey projects by firms like J.v.G. Technology shows, a predictable and transparent regulatory framework is vital to keeping a project on schedule and within budget.

Access to a Stable and Green Energy Supply

For an energy-intensive business like solar module manufacturing, the cost and reliability of electricity are significant operational factors.

- Localization Advantage: Bhutan offers one of the world’s most stable and greenest electricity grids, powered almost entirely by hydropower. Electricity tariffs are competitive, providing a sustainable operational advantage over regions reliant on fossil fuels or with unstable grid infrastructure.

Land Lease Agreements at Concessional Rates

Securing a suitable location is a foundational step. The government facilitates this process by offering long-term land leases at concessional rates within designated industrial parks and special economic zones. This simplifies factory planning and layout, removing a common and often complex hurdle for new industrial projects.

Navigating the Application Process: A Practical Overview

While the incentives are substantial, accessing them requires a methodical approach. The typical process involves several key stages:

- Project Proposal Submission: A comprehensive business plan and technical feasibility study must be submitted to the Department of Industry.

- Due Diligence: The agency reviews the proposal for its economic viability, technical soundness, and alignment with national priorities.

- FDI Registration: Upon approval, the investor proceeds with company registration and obtains an FDI Registration Certificate.

- Securing Final Approvals: This includes securing the necessary sectoral clearances, trade licenses, and environmental permits.

Developing a robust business plan is the cornerstone of a successful application. For guidance on preparing these essential documents for a solar manufacturing venture, the pvknowhow.com free e-course offers structured modules.

Example Solar Manufacturing Facility Layout

Frequently Asked Questions (FAQ)

Q: What is the minimum investment required to qualify for these incentives?

A: While there is no single fixed minimum, the project must be of a scale that makes a significant contribution to the industrial sector. Projects in the 20-50 MW annual capacity range are typically well-received.

Q: Are there restrictions on the repatriation of profits?

A: Bhutan’s FDI policy permits the repatriation of profits and dividends. The regulations are investor-friendly and in line with international standards.

Q: What is the local labor market like for skilled technicians?

A: Bhutan has a young, educated workforce. While specialized solar manufacturing experience may be limited initially, the government supports vocational training programs. A common strategy for new ventures is to bring in a core team of expatriate experts to train local staff.

Q: Do these incentives apply to expansions of existing facilities?

A: Yes, fiscal incentives are available for projects involving substantial expansion or technology upgrades, subject to approval.

Q: How does Bhutan’s landlocked geography affect logistics?

A: Logistics require careful planning. The most common freight route is through India via the port of Kolkata. While this adds a logistical layer, the duty exemptions on imported goods and raw materials help offset these challenges.

Conclusion: The Strategic Opportunity in Bhutan

Bhutan offers more than just a list of financial incentives; it offers a partnership with a nation committed to sustainable and strategic growth. For the discerning entrepreneur, the combination of a 10-year tax holiday, comprehensive duty exemptions, and a stable, green operational environment creates a uniquely compelling business case.

Understanding these financial incentives is the crucial first step. The next is to develop a comprehensive plan for the technical, logistical, and operational requirements of building a successful solar manufacturing plant.