For entrepreneurs entering the solar manufacturing sector, choosing a location is one of the most critical decisions. This choice extends far beyond the cost of land or labor; it defines the efficiency of the entire supply chain, from sourcing raw materials to delivering finished solar modules.

A factory’s location can become either a significant competitive advantage or a persistent operational bottleneck. This article examines Bulgaria’s logistical landscape as a potential site for a solar module manufacturing plant. We will analyze how its unique geographical position, modern infrastructure, and EU membership create a compelling case for businesses aiming to serve markets across Europe, the Middle East, and North Africa.

Table of Contents

Bulgaria’s Strategic Geographic Advantage

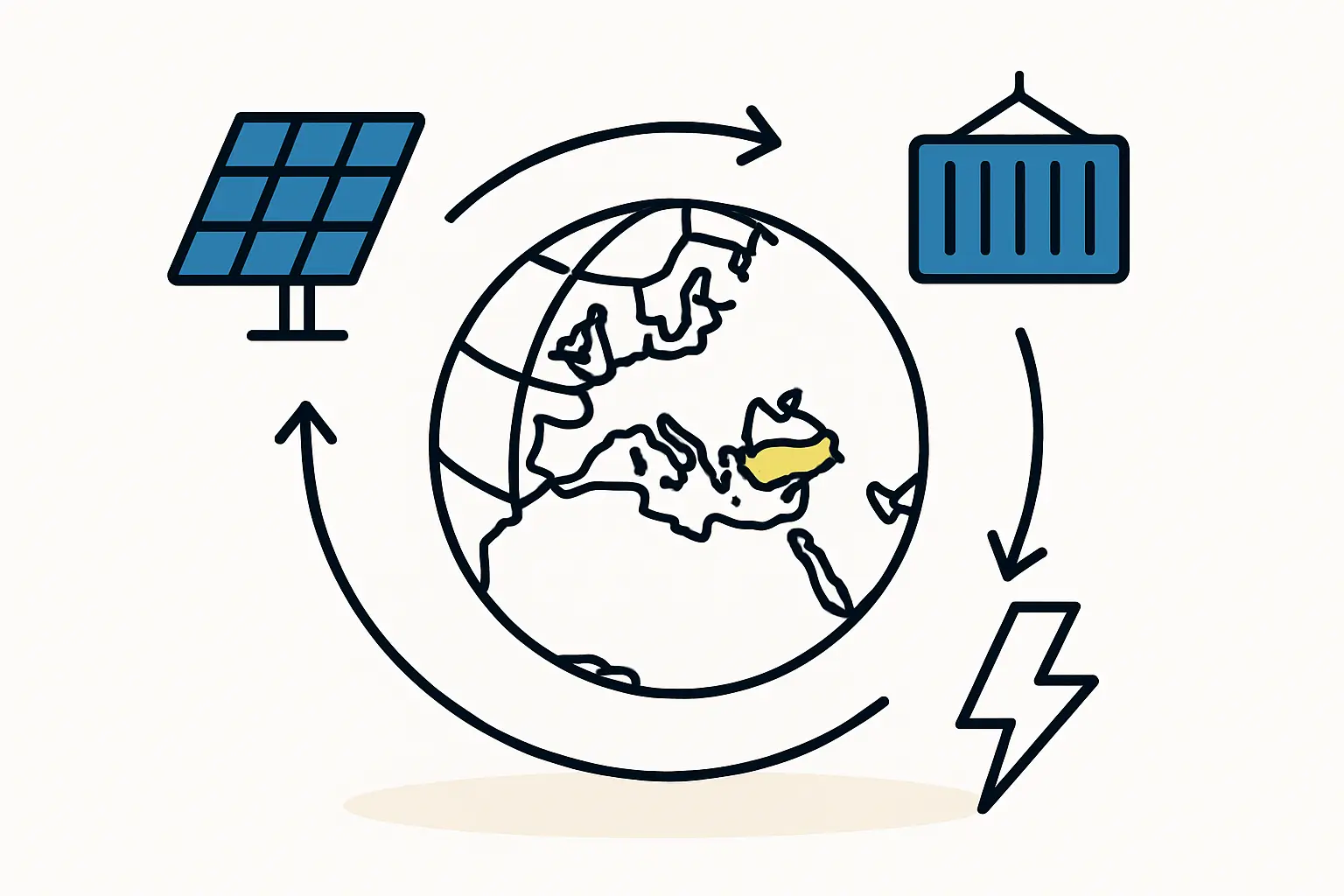

Bulgaria’s primary logistical strength lies in its position as a natural crossroads. As a member of the European Union, it offers stable, tariff-free access to the world’s largest single market. At the same time, its location on the Balkan Peninsula, with a long Black Sea coastline, provides a strategic gateway to Turkey, the Caucasus region, and the Middle East.

This dual access is supported by major infrastructure integrated into the Pan-European Transport Corridors—key routes established by the European Union to facilitate the flow of goods and people. Bulgaria is a hub for several of these corridors:

- Corridor IV: Connects Dresden, Germany, to Istanbul, Turkey.

- Corridor VIII: An east-west route linking the Adriatic Sea in Albania to the Black Sea ports of Varna and Burgas.

- Corridor IX: Connects Northern Europe (Finland) to the Aegean Sea in Greece.

- Corridor X: Links Salzburg, Austria, to Thessaloniki, Greece.

For a solar manufacturer, this network transforms a Bulgarian factory from an isolated outpost into a highly connected hub. Finished goods can be efficiently transported by road and rail to major European economic centers, while the country’s ports open up maritime trade routes to the east and south.

The Inbound Supply Chain: Importing Raw Materials

A solar module factory relies on a steady flow of raw materials, including solar cells, EVA film, backsheets, aluminum frames, junction boxes, and specialized solar glass. The majority of these components are currently sourced from manufacturers in Asia, primarily China, Taiwan, and South Korea.

This makes an efficient and reliable maritime import route essential. The primary pathway for these goods into Bulgaria is via sea freight:

- Goods are loaded into 40-foot High Cube (HC) containers at major Asian ports.

- Vessels travel through the Suez Canal into the Mediterranean Sea.

- They then transit the Bosphorus Strait in Turkey to enter the Black Sea.

- Finally, they arrive at one of Bulgaria’s two major deep-water ports: Varna or Burgas.

Upon arrival, the containers undergo EU customs clearance. While rigorous, this process is standardized and predictable—a key advantage of operating within the EU framework. Once cleared, the materials can be transported inland to the factory by truck or rail. Mastering these logistical details from the outset is a critical step in learning how to start a solar module factory.

Entrepreneurs must account for a typical sea transit time of 30-45 days from Asia to Bulgaria. This lead time is a crucial variable for inventory management and production planning.

The Outbound Supply Chain: Exporting Finished Modules

Once solar modules are manufactured and certified, a factory in Bulgaria offers distinct advantages for distribution.

- Access to the European Union Market: Finished modules can be loaded onto trucks and shipped directly to any country within the EU without tariffs or complex customs borders. This allows for just-in-time delivery to distributors and large-scale solar projects in Germany, Italy, France, and neighboring countries like Romania and Greece. This frictionless trade is a powerful incentive, especially compared to the tariffs and administrative hurdles faced by modules imported into the EU from Asia.

- Access to Emerging Markets: Using the same ports of Varna and Burgas, finished modules can be containerized and exported to high-growth markets in the Middle East and North Africa (MENA). This proximity creates a significant cost and time advantage over competitors based farther away. An effective export strategy is a cornerstone of any robust solar panel manufacturing business plan.

Operational Considerations and Cost Factors

Beyond geography, Bulgaria offers a business environment conducive to manufacturing. Corporate income tax rates are among the most competitive in the EU, and the cost of skilled technical labor is favorable compared to Western European countries.

However, success requires meticulous planning around the ‘total landed cost’ of raw materials. This figure includes not only the purchase price and shipping freight but also insurance, customs duties, port handling fees, and inland transportation. Based on experience from J.v.G. turnkey projects, underestimating these ancillary costs is a common pitfall for new entrants. Proper financial modeling must account for every step of the logistical chain.

The stability of operating within the EU legal and economic framework is another vital asset. It provides a level of predictability in regulations, currency, and market access that international investors highly value.

Frequently Asked Questions (FAQ)

Q: Why not manufacture closer to the raw material sources in Asia?

A: While that seems logical, manufacturing in Asia for the European market incurs significant tariffs on finished solar modules imported into the EU. Establishing a factory within the EU, such as in Bulgaria, circumvents these tariffs.

Furthermore, it provides greater quality control, faster delivery times to European customers, and the valuable ‘Made in EU’ branding, which is increasingly important for public and private tenders.

Q: What are the main logistical challenges to consider in this region?

A: The primary challenges involve managing the long sea-freight lead times from Asia and navigating potential chokepoints like the Suez Canal and the Bosphorus Strait. Global shipping disruptions can affect this route, making buffer stock management crucial. On the administrative side, ensuring all import documentation complies perfectly with EU standards is essential to avoid clearance delays.

Q: Is rail a viable option for transport to and from Bulgaria?

A: Yes, rail is a highly viable and growing option. The ports of Varna and Burgas connect to the national and pan-European rail networks. Rail can be very efficient for moving heavy, bulk raw materials inland from the port to the factory and for exporting large volumes of finished modules to Central and Western Europe.

Q: How does Bulgaria’s infrastructure compare to other European locations?

A: Through significant investment, partly funded by the EU, Bulgaria has modernized its key ports, highways, and rail connections. While some rural infrastructure may still be developing, the main commercial arteries are well-maintained and capable of supporting industrial-scale logistics.

Conclusion: The Next Steps in Your Planning

Bulgaria offers a unique and strategic proposition for solar module manufacturing. It combines the economic and regulatory stability of the European Union with a geographic position that serves as a logistical bridge to multiple high-growth regions. Its modern port infrastructure, integration into pan-European transport corridors, and favorable business environment create a solid foundation for a successful enterprise.

However, a prime location is only part of the puzzle. Understanding these logistical advantages is the first step. The next is to align this knowledge with the selection of the right solar panel manufacturing machines and the development of a comprehensive operational plan. For entrepreneurs new to the industry, structured guidance is invaluable for navigating these complex early-stage decisions.