An entrepreneur spots a compelling opportunity: establishing a solar module factory in a nation committed to renewable energy and strategically positioned between continents. The government actively encourages foreign investment, promising significant benefits.

Yet, a critical question remains: how does one navigate the official channels to transform these promises into tangible, legally binding incentives? For investors exploring Cape Verde investments, this is a familiar scenario. While the potential is clear, the process can seem opaque from the outside.

This guide provides a structured overview of the process for securing investment incentives through Cabo Verde TradeInvest, the national Investment and Export Promotion Agency. It outlines the necessary steps, clarifies the agency’s role, and details the types of benefits available for a solar manufacturing project. The goal is to demystify the procedure, helping investors engage with confidence and clarity.

Table of Contents

Understanding Cabo Verde’s Investment Framework

Cabo Verde’s economic strategy centers on attracting foreign direct investment (FDI) to drive sustainable development. To ensure security and transparency for foreign investors, the government has established a clear legal framework, primarily through its Investment Code.

For a solar manufacturing enterprise, this creates a dual opportunity. The project aligns with the national goal of increasing renewable energy generation while also supporting the diversification of the economy—a key government priority. Cabo Verde TradeInvest serves as the central point of contact, guiding investors through the legal and administrative requirements.

The Role of Cabo Verde TradeInvest

It’s a common misconception to view an investment agency as merely a regulatory body. Cabo Verde TradeInvest functions more as a strategic partner for investors. Its mandate includes:

- Information Hub: Providing detailed information on the legal framework, tax system, and specific sector opportunities.

- Process Facilitator: Assisting investors in preparing and submitting their investment project applications.

- Inter-Agency Coordinator: Liaising with other governmental bodies (e.g., customs, land registry, licensing authorities) on behalf of the investor.

- After-Care Support: Offering ongoing assistance after the investment has been approved and implemented.

Experience from J.v.G. turnkey projects in emerging markets shows that early and transparent communication with the investment agency is a critical factor for a smooth project launch.

A Step-by-Step Guide to the Application Process

Securing incentives is a formal process that requires meticulous preparation. While each project is unique, engagement with Cabo Verde TradeInvest generally follows a structured path.

Step 1: Initial Project Design and Due Diligence

Before submitting a formal application, investors must develop a comprehensive project proposal. This document is more than a business plan—it is a detailed blueprint of the intended investment. It must include:

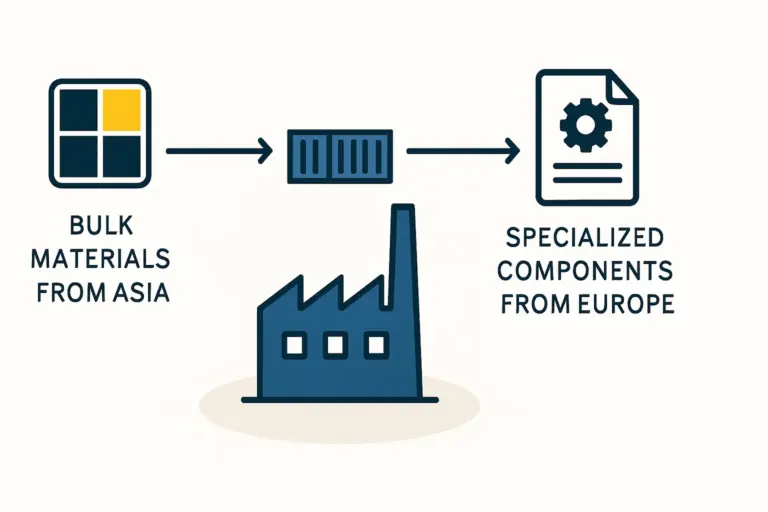

- Technical Specifications: A clear outline of the factory’s proposed capacity, the technology to be used, and the types of solar modules to be produced.

- Financial Projections: Detailed financial models, including the total investment amount, funding sources, and projected revenue. Understanding the typical investment requirements for a 20-50 MW setup is crucial at this stage.

- Market Analysis: Evidence of demand, target markets (local and export), and competitive positioning.

- Socio-Economic Impact: An assessment of job creation, knowledge transfer, and contribution to the local economy.

Step 2: Formal Submission via the One-Stop Shop

Cabo Verde TradeInvest operates a One-Stop Shop (Balcão Único de Investimento) to streamline the application. Investors submit the project proposal along with all required legal documentation for the investing entity. The agency then formally registers the project and begins its internal evaluation.

Step 3: Evaluation and Negotiation

During this phase, TradeInvest assesses the project’s eligibility and alignment with national development goals. The agency may request clarifications or additional documentation. This is also the stage where the specific terms of the Investment Agreement are negotiated. The investor, often with legal counsel, discusses the precise tax, customs, and land-use benefits that will apply to the project. The efficiency of this phase hinges on the clarity and detail of the initial proposal.

Step 4: Securing the Certificate of Investment

Upon successful negotiation, the Council of Ministers formally approves the project. Cabo Verde TradeInvest then issues a Certificate of Investment (Certificado de Investidor). This document legally entitles the project to the negotiated benefits and is the cornerstone of the investment’s legal protection.

Step 5: Implementation and Compliance

Once the certificate is issued, the project enters the implementation phase. This involves company incorporation, securing land, and fulfilling the building requirements for a solar module factory. Throughout this period, the investor must submit periodic reports to TradeInvest to demonstrate compliance with the terms of the Investment Agreement, particularly on job creation and investment milestones.

Key Incentives for Solar Manufacturing Projects

The benefits available are substantial, designed to lower both initial capital expenditure and ongoing operational costs. While the final package is negotiated, typical incentives under the Investment Code include:

Tax Incentives:

- Industrial Tax (IRPC) Credit: A tax credit of up to 50% of the eligible investment amount, which can be carried forward for several years.

- Property Tax (IUP) Exemption: Exemption from property tax on land and buildings used for the industrial facility for a specified period.

- Stamp Duty Exemption: Exemption on financing operations and other legal acts required for establishing the business.

Customs Incentives:

- Duty-Free Imports: Full exemption from customs duties on the importation of machinery, equipment, raw materials, and components for the solar module assembly line. This is a significant financial benefit that directly reduces the initial investment cost.

Land and Infrastructure:

- Favorable Land Concessions: Potential for long-term land concessions at favorable rates, especially within designated industrial zones or the Special Economic Zone for Maritime Economy (ZEEM).

Repatriation of Funds:

- Guaranteed Fund Transfers: Guarantees for the transfer of profits, dividends, and proceeds from the sale of the investment abroad, subject to compliance with tax obligations.

Successfully navigating this landscape requires a well-documented and professionally presented project. The pvknowhow.com platform provides resources, including a structured e-course, to help investors prepare a comprehensive solar manufacturing business plan that meets the standards of international investment agencies.

Frequently Asked Questions (FAQ)

Q: Is there a minimum investment amount to qualify for these incentives?

A: While the Investment Code does not always specify a rigid minimum, projects of significant scale (typically over €5 million) that demonstrate substantial economic impact are prioritized. The scale of the incentives is often proportional to the investment size and the number of jobs created.

Q: How long does the entire approval process take?

A: From formal submission to receiving the Certificate of Investment, the process can take three to six months, assuming all documentation is complete and correct. Delays are most often caused by incomplete project proposals.

Q: Is a local partner required for a foreign investor?

A: No, Cabo Verde law permits 100% foreign ownership of investments. However, engaging local legal and business consultants is highly advisable to navigate administrative procedures effectively.

Q: What are the main challenges an investor might face?

A: The primary challenges are typically administrative rather than legal. They include understanding specific documentation requirements, coordinating between different government departments, and managing project timelines. This is precisely where the facilitation role of Cabo Verde TradeInvest becomes invaluable.

Conclusion: A Pathway to a Secure Investment

Securing investment incentives in Cabo Verde is not an insurmountable bureaucratic hurdle but a structured process designed to attract and protect serious investors. By understanding the role of Cabo Verde TradeInvest, preparing a thorough project proposal, and engaging in transparent negotiation, investors can establish a solar manufacturing operation on a solid legal and financial foundation.

The key lies in preparation. A well-defined project that clearly articulates its financial viability and its contribution to Cabo Verde’s development goals is positioned for success. With the right guidance, investors can confidently navigate this path, turning a promising opportunity into a tangible and profitable enterprise.