Entrepreneurs entering the solar manufacturing industry often assume a factory’s supply chain must originate from a handful of dominant global producers. While this holds true for certain high-tech components, it overlooks a significant strategic opportunity for new ventures in emerging markets: the regional manufacturing hub.

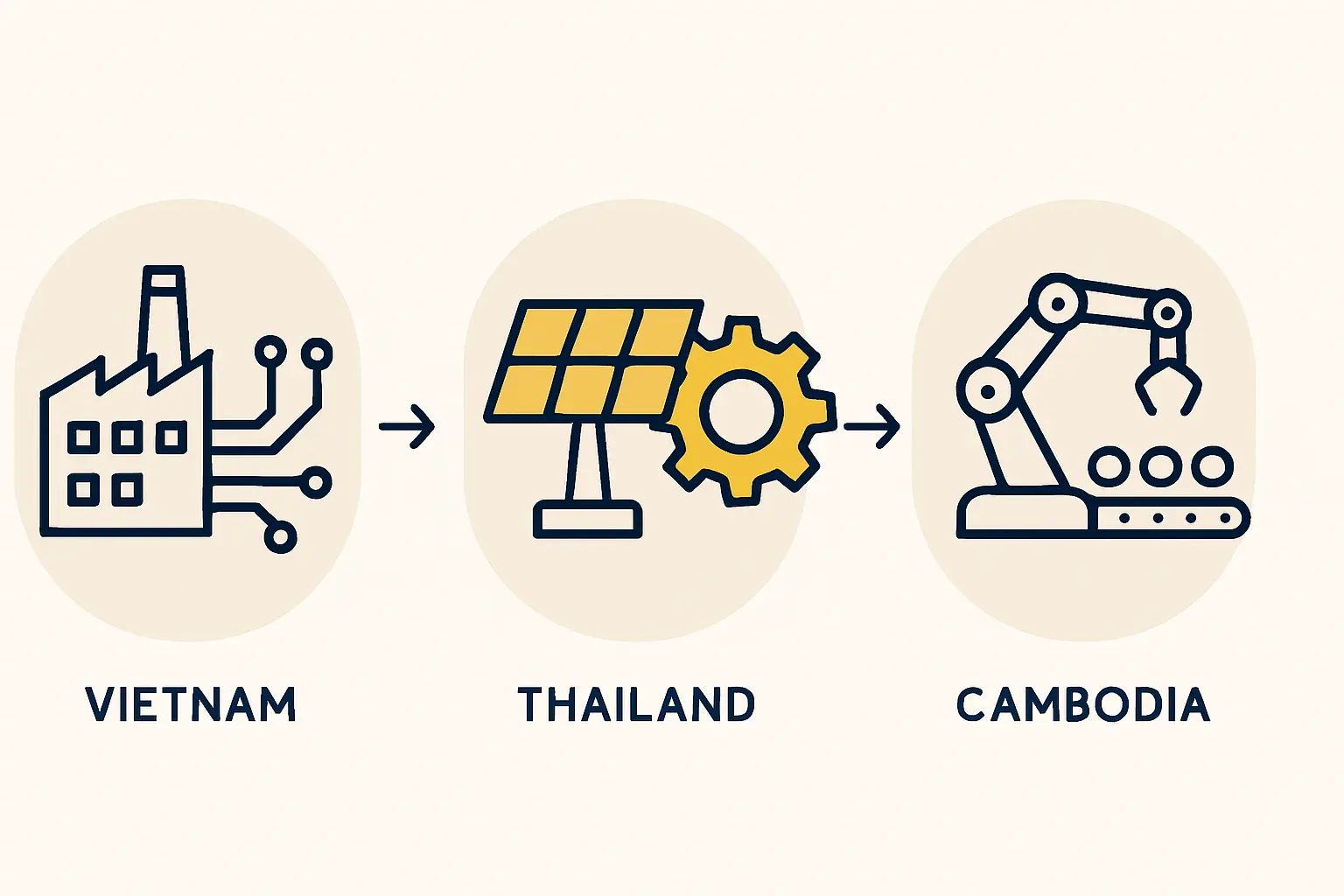

For a new solar module factory in Cambodia, for example, the prospect of sourcing every component from distant suppliers can seem daunting. Looking to established industrial neighbors like Thailand and Vietnam, however, reveals a more agile, resilient, and cost-effective supply chain model. This regional approach can give new market entrants a critical advantage.

Table of Contents

The Challenge: Building a Resilient Supply Chain from Scratch

Establishing a reliable flow of raw materials is a fundamental challenge for any new manufacturing venture. The solar industry is no exception, requiring dozens of specialized items—from solar cells and EVA encapsulant to backsheets and junction boxes.

Relying exclusively on traditional, long-distance supply lines creates several common obstacles:

- Extended Lead Times: Ocean freight from major East Asian ports can take several weeks, tying up capital and complicating production planning.

- High Shipping Costs: For smaller, initial order quantities, Less-than-Container Load (LCL) shipping can be disproportionately expensive.

- Logistical Complexity: Managing customs, quality control, and supplier relationships across vast distances requires significant resources and expertise.

These challenges can be particularly acute for entrepreneurs new to the photovoltaic sector. The solution often lies not in looking further afield, but closer to home.

Leveraging Regional Powerhouses: Why Thailand and Vietnam?

Both Thailand and Vietnam have evolved into sophisticated manufacturing and logistics centers within the Association of Southeast Asian Nations (ASEAN). Their proximity and industrial maturity offer a powerful alternative for sourcing many components needed for solar module assembly.

Thailand as a Logistics and Component Hub

Thailand’s Eastern Economic Corridor (EEC) is a hub of industrial activity with a strong base in automotive, electronics, and polymer manufacturing. This ecosystem provides a ready source for essential solar module components like junction boxes, aluminum frames, and certain specialized plastics. Thailand also boasts world-class infrastructure, including the deep-sea port of Laem Chabang and extensive road networks connecting directly to its neighbors.

Vietnam’s Rise in High-Tech Manufacturing

Vietnam has attracted significant foreign investment in high-tech manufacturing, including the production of solar components. A growing number of suppliers for materials like backsheets and EVA encapsulant are now based there. The country’s major ports, such as Cai Mep, solidify its role as a key node in regional and global supply chains.

Experience from J.v.G. turnkey projects shows that sourcing regionally can reduce shipping times from 3–4 weeks by sea to just 2–5 days by truck, dramatically improving operational agility.

The Strategic Advantage: Trade Agreements and Logistics

The strategic advantage of a regional sourcing strategy lies in the economic and logistical frameworks that govern trade in Southeast Asia.

The ASEAN Free Trade Area (AFTA)

The most significant advantage is the ASEAN Trade in Goods Agreement (ATIGA). Under this agreement, goods originating from and traded between ASEAN member states—including Thailand, Vietnam, and Cambodia—benefit from zero or very low import tariffs.

To benefit, a supplier must provide a Certificate of Origin (known as Form D), proving the goods were produced within the region. This can lead to substantial cost savings compared to importing the same materials from non-ASEAN countries, which are typically subject to standard tariffs.

Cross-Border Logistics in Practice

For a factory in Cambodia, this framework transforms supply chain dynamics. Instead of a complex international sea shipment, the process becomes a straightforward overland freight operation.

A typical workflow is quite straightforward:

- An order is placed with a junction box supplier in Rayong, Thailand.

- The goods are loaded onto a truck with the necessary customs documentation, including the Form D certificate.

- The truck travels via established road networks to a land border crossing, such as Poipet/Aranyaprathet.

- After customs clearance, the truck proceeds directly to the factory, often near a major city like Phnom Penh.

This streamlined process not only saves time but also reduces the risk of port congestion and handling damage.

Practical Considerations for Implementation

While powerful, the regional hub model requires careful execution. Success depends on diligent planning and a clear understanding of both the opportunities and the potential pitfalls.

Supplier Vetting and Qualification

Proximity alone doesn’t eliminate the need for stringent due diligence. Every potential regional supplier must be thoroughly audited to ensure their products meet international quality standards and the specific requirements of the factory’s bill of materials.

Establishing a robust quality control process for all incoming raw materials is non-negotiable, regardless of their origin. A project J.v.G. consulted on in Southeast Asia found that while regional suppliers offered logistical benefits, initial quality validation required the same rigor as with any global supplier.

Building a Diversified Bill of Materials (BOM)

Sourcing 100% of solar module components from within the ASEAN region is currently unrealistic. The most critical component—high-efficiency solar cells—is still predominantly manufactured by a small number of global leaders.

The most successful strategy is a hybrid one:

- Source Regionally: Items like aluminum frames, junction boxes, and packaging materials, where logistics costs are a significant portion of the total price.

- Source Globally: High-value, technologically sensitive items like solar cells and specialized encapsulants, where quality and performance are paramount.

Navigating these sourcing complexities is a key area where experienced technical partners prove invaluable during the setup phase of a turnkey solar manufacturing line.

Frequently Asked Questions (FAQ)

Q: Is it always cheaper to source from Thailand or Vietnam than from China?

A: Not necessarily on a per-unit basis. The primary financial advantage comes from the combination of zero tariffs under AFTA, significantly lower transportation costs, and reduced working capital needs due to shorter lead times.

Q: What is the ASEAN Certificate of Origin (Form D)?

A: This is an official document used in ASEAN trade to certify that goods being shipped were produced or manufactured in a specific member country. The certificate is essential for an importer to claim the preferential tariff rates (usually 0%) offered under the ATIGA agreement.

Q: Can a new factory rely 100% on regional suppliers?

A: As of today, this is highly unlikely. A strategic and balanced approach is recommended. The goal is not to replace global suppliers entirely but to augment the supply chain with regional options to build resilience and optimize costs.

Q: How does this strategy impact inventory management?

A: Shorter and more predictable lead times from regional suppliers allow a factory to operate with leaner inventory levels. This “Just-in-Time” approach reduces warehousing costs and frees up working capital that would otherwise be tied up in materials in transit.

Conclusion: Building a Smarter, More Agile Supply Chain

For entrepreneurs establishing solar module manufacturing facilities in growing markets, a regional hub strategy offers a clear path toward greater operational agility and cost efficiency. By integrating suppliers from neighboring industrial powerhouses like Thailand and Vietnam, a new factory can mitigate the risks of long-distance supply chains and leverage powerful regional trade agreements.

This approach isn’t about choosing one source over another but about building a diversified, resilient, and intelligent supply chain tailored to the region’s specific economic and geographic realities. Understanding these dynamics is a critical first step for any professional aiming to successfully enter and compete in the solar manufacturing industry.