A market with over 300 days of sunshine per year, a government actively seeking 37% renewable energy generation by 2030, and a clear demand for energy independence—this defines the opportunity for solar investment in Cuba.

Unlocking this potential, however, requires navigating a uniquely complex financial and regulatory environment. For the international investor, success hinges not just on technical execution but on mastering the nuances of Cuba’s economic landscape.

This guide explores the critical financial considerations for establishing a solar manufacturing or power generation project in Cuba. It focuses on the primary challenges for any viable business plan: currency management, the banking system, and the legal framework for repatriating profits.

Understanding Cuba’s Economic Framework for Foreign Investors

Before building a financial model, an investor must grasp the core elements of the Cuban economy that directly impact foreign-led projects. The country has undergone significant monetary reforms, with a legal structure for investment designed to attract capital while maintaining state oversight.

The Cuban Peso (CUP) and Exchange Rate Dynamics

Until early 2021, Cuba operated a dual-currency system with the Cuban Peso (CUP) and the Convertible Peso (CUC). This system has since been unified, and the CUP is now the sole official national currency.

For a foreign investor, the most critical factor is the exchange rate. The Cuban state sets an official exchange rate for the CUP against foreign currencies like the Euro or US Dollar. However, a wide gap often exists between this official rate and the rate available on the informal market. This discrepancy presents a significant risk:

- Revenue in CUP, Expenses in EUR/USD: Your solar plant will likely generate revenue in CUP through a Power Purchase Agreement (PPA) with the state utility, Unión Eléctrica (UNE). However, essential machinery, raw materials, and potentially a portion of management salaries must be paid in foreign currency.

- Valuation Risk: Converting CUP-based profits back to your home currency at the official rate can drastically impact your projected returns if that rate doesn’t reflect the currency’s true market value. A robust financial model must include sensitivity analysis based on different exchange rate scenarios.

The Legal Foundation: Law 118 on Foreign Investment

Enacted in 2014, Law 118 is the cornerstone of foreign investment in Cuba, offering a legal framework with protections and incentives for foreign capital. Key provisions include:

- Protection Against Expropriation: The law guarantees investments against expropriation, except for reasons of public or social interest, and with due compensation.

- Profit Repatriation: It explicitly grants foreign investors the right to freely transfer abroad—in a convertible currency—the net profits or dividends they earn.

- Investment Modalities: The most common structures for a solar project are an International Economic Association Contract or a Joint Venture (empresa mixta) with a Cuban state entity. Wholly foreign-owned operations are possible but typically restricted to the Mariel Special Development Zone.

While Law 118 provides a solid legal basis, the practical application of these rights depends heavily on the country’s foreign currency reserves and administrative processes.

Structuring Your Financial Model: Key Variables and Risks

A financial model for a Cuban solar project must be more than a simple spreadsheet of costs and revenues. It must function as a risk management tool, stress-testing the venture against the country’s specific economic variables.

Revenue Projections in a State-Controlled Market

Your primary revenue stream will come from a long-term PPA with the Cuban state, and negotiating its terms is a critical step. While the tariff will likely be denominated in CUP, it is sometimes possible to negotiate clauses that peg the rate to a basket of foreign currencies. This can provide a partial hedge against the devaluation of the CUP. A comprehensive business plan needs to model future revenue streams based on both the negotiated tariff and potential currency fluctuations.

Managing Operational Costs (OPEX)

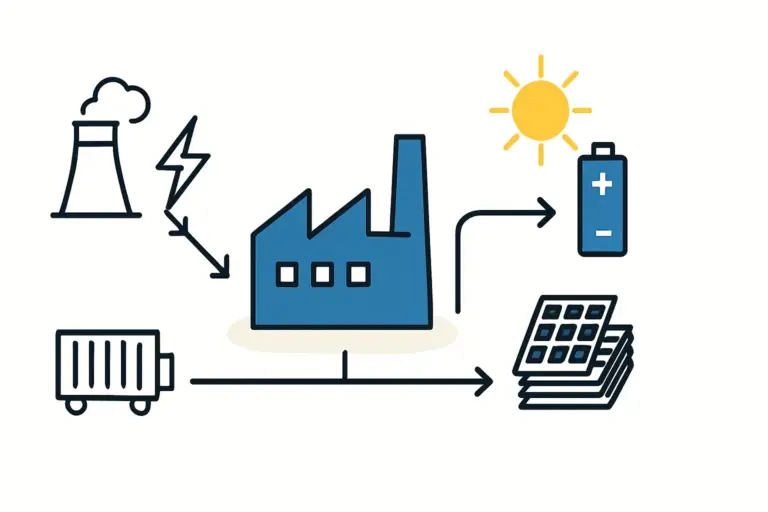

Operational expenditures will be a mix of local and foreign currency.

- Local Costs (CUP): These include local labor, rent, utilities, and some administrative services.

- Foreign Currency Costs (EUR/USD): This portion is significant for a solar manufacturer, as it includes the import of solar cells, EVA film, backsheets, junction boxes, and specialized machinery.

This currency mismatch is a central challenge. The business needs a reliable mechanism to convert its CUP earnings into the hard currency required for essential imports.

The Critical Path: Repatriating Profits from Cuba

The legal right to repatriate profits is clear under Law 118. However, exercising this right is a multi-step process that requires careful navigation.

The Official Repatriation Mechanism

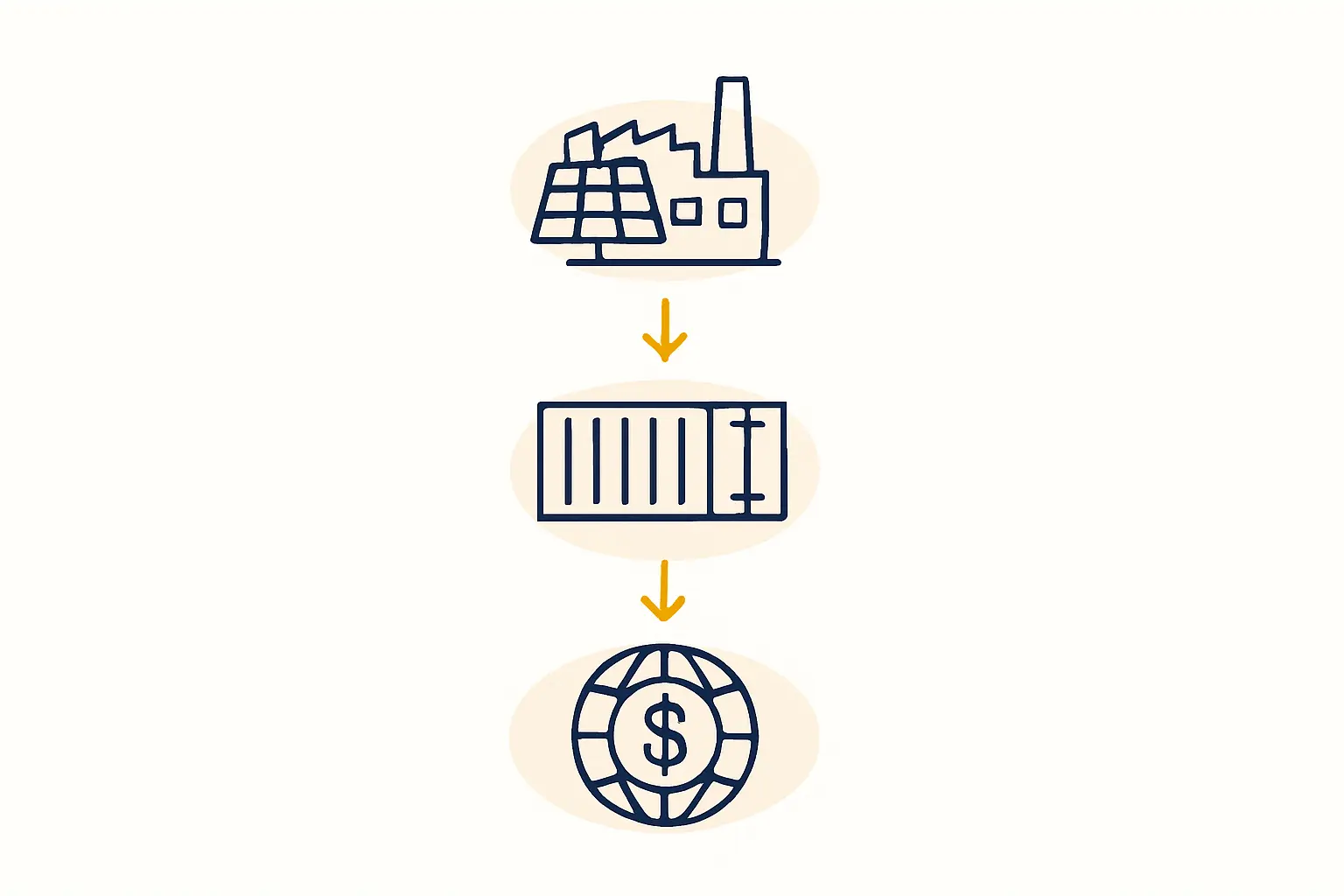

The process generally follows these steps:

- Generate Profits: The joint venture or association earns revenue in CUP.

- Declare Dividends: After paying local taxes and other obligations, profits are declared as dividends.

- Request Currency Conversion: The business formally requests that the Banco Central de Cuba (Central Bank of Cuba) convert the CUP-denominated profits into the investor’s foreign currency (e.g., Euros).

- Transfer Abroad: Once the conversion is approved and executed, the funds can be transferred to an offshore bank account.

The primary bottleneck in this process is the availability of foreign currency within the Cuban central banking system. Delays are a known risk and must be factored into any cash flow projections. Investors embarking on a large-scale project should have frank discussions about this process with their Cuban partners from the outset.

Risk Mitigation Strategies

Experienced investors employ several strategies to manage currency and repatriation risks:

- Reinvestment: A common strategy is to reinvest a portion of profits back into the Cuban operation to fund production expansion or equipment modernization. This approach defers the need for immediate repatriation, can generate greater long-term returns, and demonstrates a long-term commitment to the Cuban partner.

- Structured Finance: Financing can also be structured with development banks or export credit agencies that have established protocols for operating in Cuba. These institutions can often provide specific financial instruments or guarantees that mitigate repatriation risk.

- Negotiating Favorable Terms: During the initial joint venture negotiation, investors should push for maximum clarity on the repatriation process, timelines, and priorities. Agreeing on a transparent process with the Cuban partner is crucial.

Frequently Asked Questions (FAQ)

What is the primary currency for doing business in Cuba?

The official currency is the Cuban Peso (CUP). However, for international trade and investment, foreign currencies like the Euro are essential for imports and for repatriating profits.

Is 100% foreign ownership of a solar plant possible in Cuba?

While legally possible, it is rare outside of the Mariel Special Development Zone. The most common and encouraged structure is a joint venture with a Cuban state-owned entity.

How reliable is the Cuban banking system for international transfers?

The system is functional but often faces significant delays due to foreign currency liquidity shortages and the complexities imposed by international sanctions, particularly the US embargo.

Are my profits guaranteed to be convertible to foreign currency?

Law 118 guarantees the right to convert and repatriate profits. In practice, however, the ability to do so depends on the availability of foreign currency at the central bank when the request is made.

How does the US embargo affect a non-US investor?

The embargo has an extraterritorial reach that can complicate international banking. Transactions involving Cuba, even for European or Canadian companies, can be flagged or blocked by intermediary banks with a US presence. Working with financial institutions experienced in handling such transactions is vital.

Conclusion and Next Steps

Cuba presents a compelling case for investment in solar energy, driven by abundant natural resources and clear government objectives. The financial environment, however, is complex and carries risks that differ significantly from most other markets.

A successful venture hinges on a meticulously prepared financial model that accounts for currency volatility, potential repatriation delays, and the unique structure of the state-controlled economy. Building a relationship of trust and transparency with a Cuban partner is just as important as the technical specifications of the solar plant.

For entrepreneurs and companies serious about this opportunity, the next step is a deeper dive into creating a viable financial projection. Understanding the complete process, from initial investment to operational management, is fundamental for turning initial interest into a developed project plan.