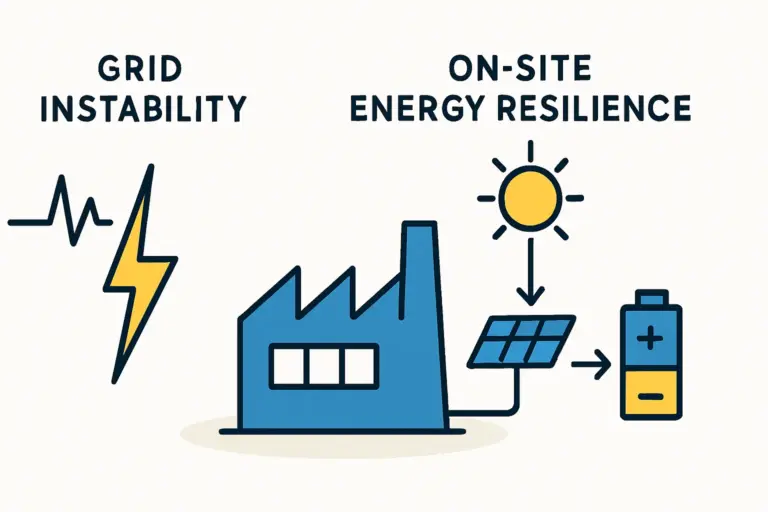

Guyana’s rapid economic development, fueled by its emerging energy sector, has created a surging demand for reliable electricity. For entrepreneurs and investors, this presents a clear opportunity to establish local solar module manufacturing.

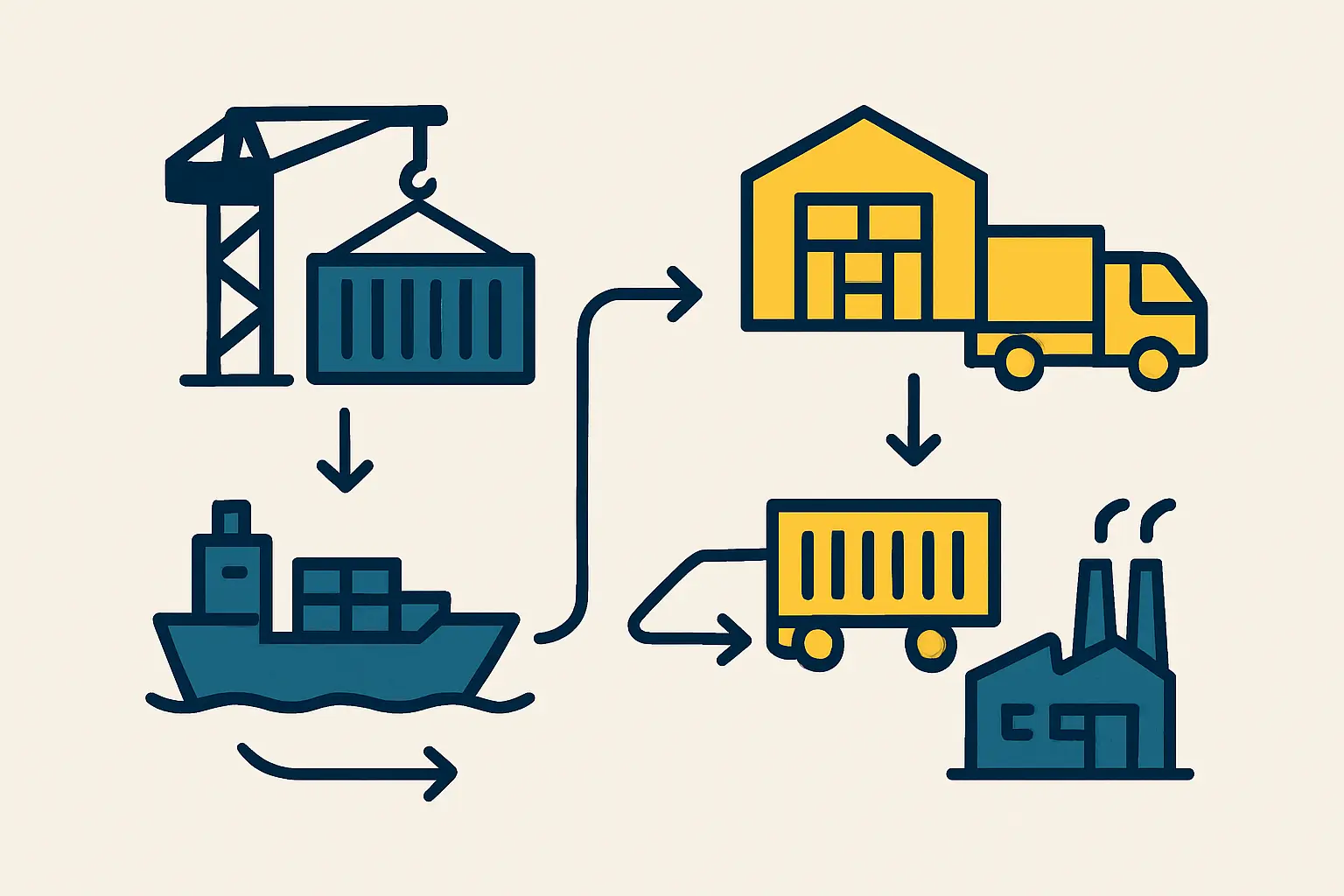

A successful production line, however, involves more than just assembling panels. It depends fundamentally on a well-planned and resilient supply chain. The strategic sourcing of raw materials is a decision that can determine the financial viability and operational efficiency of the entire venture.

A new solar module factory in Guyana has two primary logistical pathways to consider: importing all necessary components internationally through the Port of Georgetown, or developing a regional sourcing strategy that leverages potential suppliers in Brazil and the Caribbean. Any serious business plan must start by weighing the trade-offs between these two approaches.

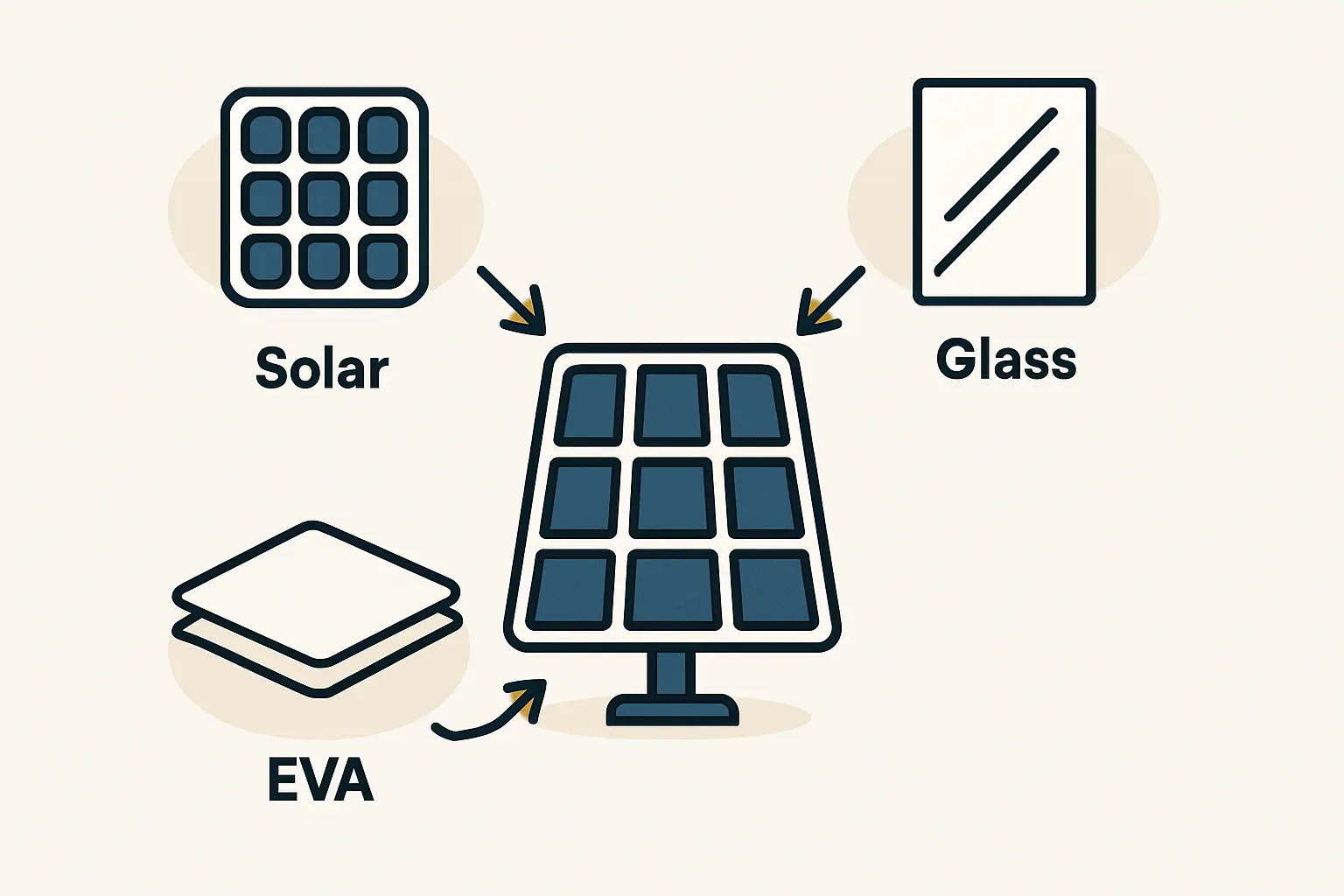

The Core Components: A Brief Overview

Before diving into logistics, it helps to understand the key raw materials required for solar module assembly. A typical factory needs a consistent supply of:

- Solar Cells: The most technologically sensitive and highest-value component, primarily sourced from manufacturers in Asia.

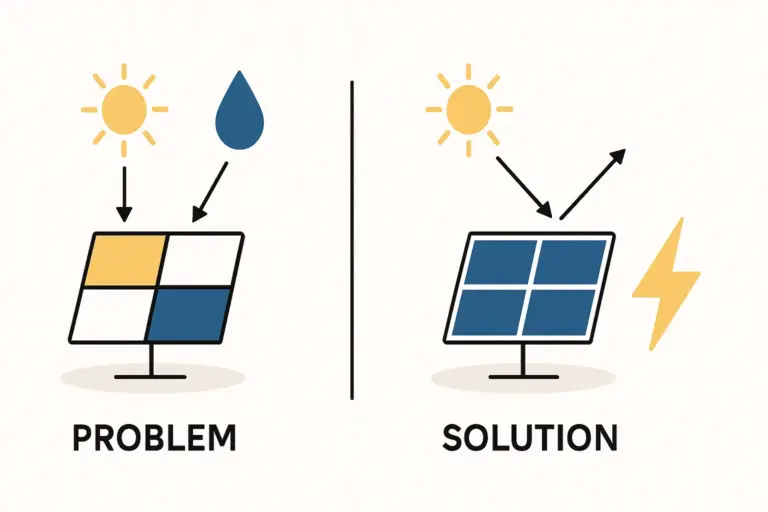

- Solar Glass: A specialized, low-iron, tempered glass for the front of the module. It is heavy and fragile, making logistics a key cost factor.

- Encapsulant (EVA): Ethylene Vinyl Acetate films used to laminate the cells and protect them from moisture and impact.

- Backsheet: A durable polymer-based material that provides mechanical protection and electrical insulation for the rear of the module.

- Aluminum Frames: Extruded aluminum profiles that provide structural integrity to the finished module.

Sourcing each of these materials involves a unique set of logistical and financial considerations.

Option 1: The Global Route via the Port of Georgetown

The most straightforward approach for a new manufacturer is to import all raw materials from established global suppliers, primarily in China and Southeast Asia. This route depends entirely on maritime shipping into the Port of Georgetown.

Drawing from J.v.G. Technology’s experience with turnkey projects in emerging markets, this model offers access to the latest technology, particularly for solar cells. However, it also creates significant dependencies and risks that must be managed.

Advantages of a Global Supply Chain

- Access to High-Quality Components: Global leaders in solar cell and EVA production offer the highest efficiencies and most reliable products.

- Economies of Scale: Large international suppliers can offer competitive pricing on high-volume orders.

- Established Processes: The shipping lanes and customs procedures for importing from Asia are well-established, though not without challenges.

Challenges and Risks

The primary bottleneck is the Port of Georgetown itself. According to the Port Authority of Guyana, the port has a draft limitation of approximately 9.5 meters, which restricts the size of container vessels that can enter. This leads to several business-critical issues:

- Transshipment Requirements: Larger vessels often must unload cargo at a regional hub like Kingston, Jamaica, or Port of Spain, Trinidad. The cargo is then reloaded onto smaller ships bound for Georgetown, adding time, cost, and the risk of damage.

- Port Congestion: As Guyana’s economy grows, port traffic increases. The Guyana Revenue Authority has noted that clearance times can vary, with potential delays impacting production schedules. A two-week delay in a shipment of solar cells can halt an entire production line.

- Lead Times and Inventory Costs: A typical sea freight journey from East Asia to Guyana can take 40-60 days. To mitigate this risk, a factory must hold a larger inventory of raw materials, often two to three months’ worth. This ties up significant working capital and incurs carrying costs.

Option 2: A Regional Sourcing Strategy

An alternative, or complementary, strategy is to source bulkier, less technologically complex materials from nearby countries, such as Brazil or CARICOM member states. This approach can reduce shipping times, lower freight costs for heavy materials, and build a more resilient supply chain.

Sourcing from Brazil

Brazil has a developing industrial base, including glass and aluminum extrusion manufacturing.

- Potential Materials: Solar glass and aluminum frames are the most likely candidates for sourcing from Brazil.

- Logistical Pathway: The primary land route is via the Lethem-Linden road. While this route is undergoing improvements, its current condition can be challenging for transporting fragile goods like large sheets of solar glass, making road infrastructure a critical factor.

- Business Considerations: Sourcing from Brazil could significantly reduce lead times from over a month to just one or two weeks. However, it requires establishing new supplier relationships, ensuring quality control meets international standards (e.g., IEC 61215), and navigating land-based customs procedures at the border.

Sourcing from the Caribbean (CARICOM)

As a member of CARICOM, Guyana can benefit from preferential trade agreements. Trinidad and Tobago, for instance, has a well-established aluminum industry.

- Potential Materials: Aluminum frames are a strong candidate for sourcing from Trinidad.

- Logistical Pathway: Short-sea shipping from Port of Spain to Georgetown is significantly faster and potentially less expensive than transatlantic or transpacific routes for this specific commodity.

- Business Considerations: The Caribbean is not a major producer of solar cells, EVA, or specialized solar glass, so this option would be part of a blended supply chain, not a complete replacement for global sourcing.

A Comparative Analysis for Decision-Makers

| Factor | Global Sourcing (via Georgetown) | Regional Sourcing (Brazil/Caribbean) |

|---|---|---|

| Cost | Lower unit cost for high-tech items (cells, EVA). High freight costs for heavy items (glass, frames). | Potentially higher unit cost. Significantly lower freight costs for heavy and bulky materials. |

| Lead Time | High (40-60 days). Requires larger inventory holding. | Low (7-14 days). Allows for leaner, just-in-time inventory management. |

| Risk | Vulnerable to global shipping disruptions, port congestion, and currency fluctuations. | Dependent on regional infrastructure (e.g., roads), supplier quality, and cross-border trade stability. |

| Scalability | Easily scalable for high-volume production needs from established global players. | May be limited by the production capacity of emerging regional suppliers. |

Building a Resilient, Hybrid Supply Chain

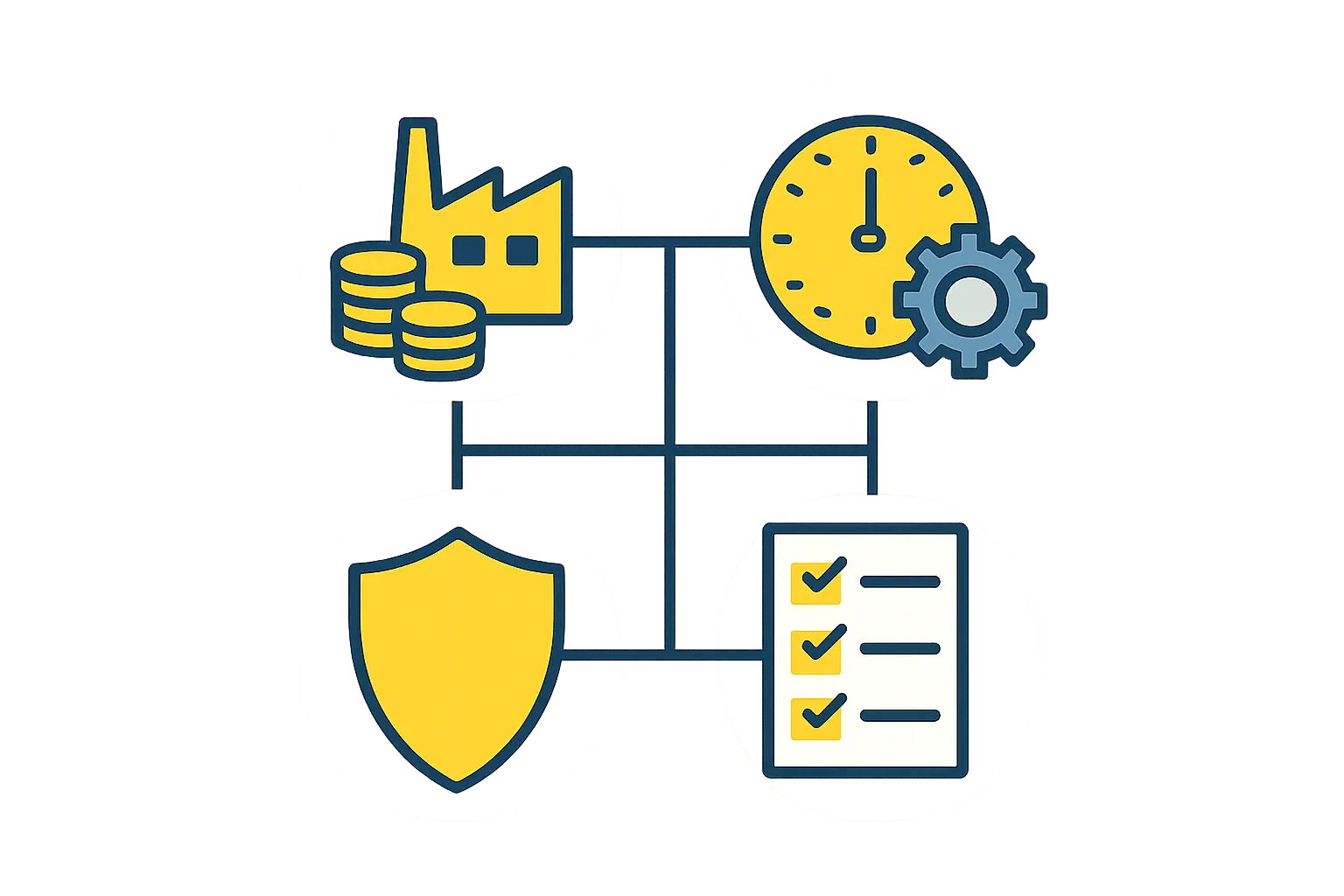

For most new solar manufacturing ventures in Guyana, the optimal solution is not an ‘either/or’ choice but a carefully constructed hybrid model. A robust business plan for solar module manufacturing should segment raw materials based on their characteristics:

-

High-Tech, Low-Weight Components (e.g., Solar Cells, EVA): Continue sourcing these from top-tier global suppliers in Asia. The quality and performance of these components are paramount and justify the longer lead times.

-

Heavy, Bulky, Standardized Components (e.g., Glass, Aluminum Frames): Actively develop relationships with regional suppliers in Brazil and Trinidad. The savings on freight costs and reduction in lead times for these materials can create a significant competitive advantage.

This blended approach diversifies risk. A disruption in global shipping might not halt production if frames and glass are sourced regionally, while a road closure in the interior might be manageable if a buffer of these materials is held while cells continue to arrive by sea. This strategy is central to designing a turnkey solar panel production line that is not just technically efficient but commercially resilient.

Frequently Asked Questions (FAQ)

What are the main materials needed to start a solar module factory?

The primary raw materials are solar cells, tempered solar glass, EVA encapsulant, a polymer backsheet, and extruded aluminum frames. You will also need junction boxes, connectors, and tabbing wire.

How long does a typical shipment from Asia to Guyana take?

Including potential transshipment delays, a business should plan for a lead time of 40 to 60 days from the supplier’s factory to arrival at the Port of Georgetown. Customs clearance can add several more days.

Are there import duties on solar components in Guyana?

As part of its commitment to renewable energy and CARICOM agreements, Guyana often provides duty exemptions for components used in renewable energy manufacturing. However, policies can change, so it’s essential to verify the current customs tariff schedule with the Guyana Revenue Authority.

Can a factory rely solely on regional suppliers?

At present, it is not feasible to source all necessary high-quality components from within the South American or Caribbean region. Specifically, high-efficiency solar cells are almost exclusively manufactured in Asia. A hybrid model is the most practical approach.

What is the biggest logistical challenge for a new factory in Guyana?

The primary challenge is managing the long and potentially unpredictable lead times associated with international shipping and port operations. This requires careful inventory management and significant working capital to avoid production stoppages. A secondary challenge is the underdeveloped land transport infrastructure for sourcing from neighboring countries.