For many entrepreneurs in emerging markets, the vision of establishing a solar module factory is clear, but the path to securing stable, international financing is often opaque. Local capital markets may be underdeveloped, and traditional international lenders can be hesitant to fund large industrial projects in new sectors, which presents a significant hurdle.

Yet a highly specialized European financial center, Liechtenstein, offers a robust and often overlooked solution for structuring and funding such ventures.

While known for its private banking, Liechtenstein has evolved into a sophisticated hub for asset management and sustainable investments. For entrepreneurs planning a multi-million-dollar solar manufacturing facility, understanding how to leverage this ecosystem is the key to transforming a business plan into an operational reality.

Why Consider Liechtenstein for Solar Manufacturing Capital?

At first glance, a small principality in the Alps may seem an unlikely partner for an industrial project in Africa or the Middle East. Yet, Liechtenstein’s unique characteristics make it an exceptionally stable and reliable financial base.

The country holds a AAA rating from Standard & Poor’s, reflecting its zero-government-debt policy and deep economic integration with Switzerland through a customs and currency union. This provides a financing environment based on the Swiss Franc (CHF), one of the world’s most stable currencies. For an investor operating in a region with currency volatility, this stability is a critical de-risking factor.

Experience from J.v.G. Technology’s turnkey projects shows that securing robust financing is often the most critical non-technical hurdle. Accessing a stable jurisdiction like Liechtenstein mitigates political and economic risks that can deter other international investors.

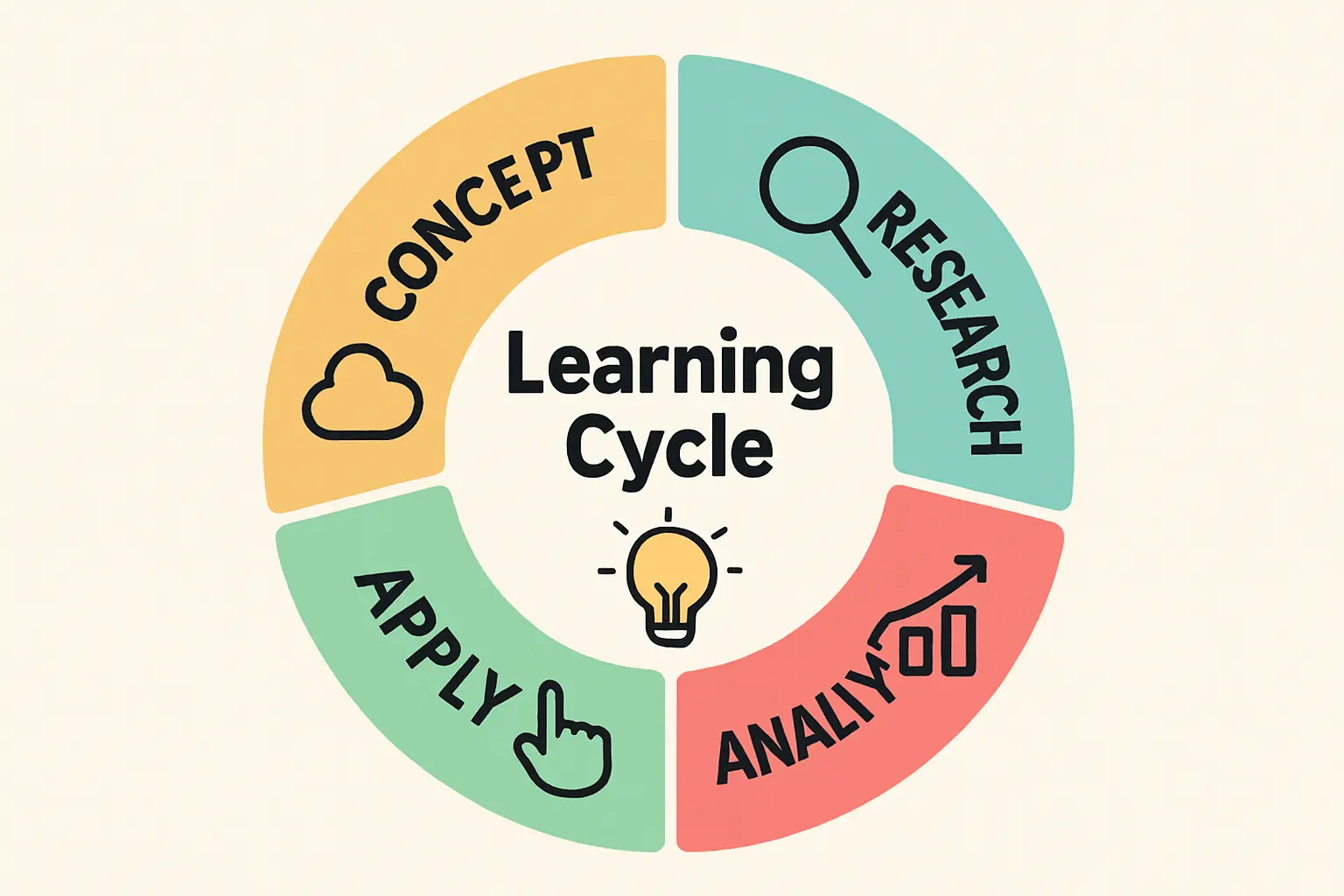

Understanding Liechtenstein’s Financial Ecosystem

Accessing capital in Liechtenstein requires understanding its key pillars. The financial industry here is not a monolith; it is a network of specialized services, each offering different opportunities for a solar project.

Private Banking and Wealth Management

Private banking and wealth management form the historical foundation of Liechtenstein’s financial sector. The country’s private banks and wealth managers oversee hundreds of billions in assets for an international clientele. Increasingly, these high-net-worth individuals and family offices are directing capital toward ESG (Environmental, Social, and Governance) and impact investments.

A well-structured solar manufacturing project, promising both financial returns and a positive environmental impact, aligns perfectly with this trend. It represents a source of ‘patient capital’ from investors focused on long-term, sustainable value creation.

Asset Management and Investment Funds

Liechtenstein is a globally recognized domicile for investment funds, thanks to its flexible legal framework and access to the European Union market. A solar manufacturing venture can be structured to attract capital from specialized funds focused on renewable energy, infrastructure, or sustainable technology.

A credible project requires a detailed and realistic solar factory business plan, which serves as the core document for engaging with these fund managers.

Venture Capital and Private Equity

While smaller than hubs like London or Frankfurt, Liechtenstein has a dynamic venture capital and private equity community. These firms often focus on innovative, high-growth sectors. A solar project featuring advanced technology or a particularly compelling business model for a high-growth region could attract this type of investment, where financiers take an equity stake in exchange for capital and strategic guidance.

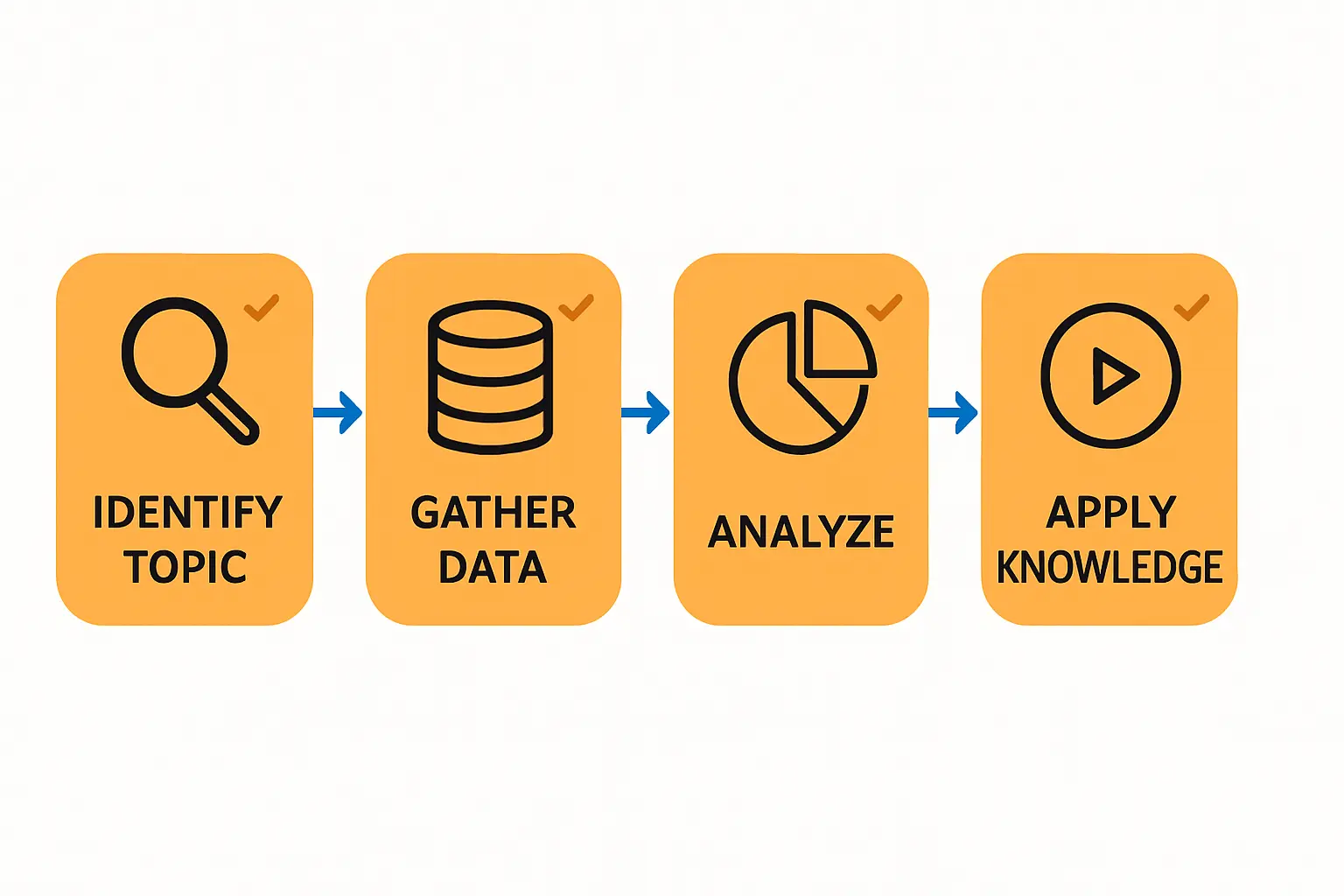

Pathways to Securing Financing for Your Solar Venture

Navigating the Liechtenstein financial market requires a clear strategy. Depending on the project’s scale and the investor’s equity position, several pathways are available.

1. Traditional Bank Loans

Established banks in Liechtenstein, such as LGT Bank and Liechtensteinische Landesbank (LLB), provide corporate financing, though they are typically conservative. A loan application for a solar factory would require:

- A substantial equity contribution: Lenders will expect the project sponsor to finance a significant portion of the project (typically 30-40%) with their own capital.

- A bankable business plan: This must include exhaustive financial projections, technical specifications, market analysis, and off-take agreements.

- Collateral: Assets are usually required to secure the loan.

A common challenge for applicants is demonstrating sufficient operational expertise. Partnerships with technical advisors become invaluable here, helping to build lender confidence.

2. Attracting Private Equity or Venture Capital

This route involves offering an equity stake in the company to investors. In these negotiations, the project’s valuation and the investment requirements for the machinery are key data points. Investors will conduct extensive due diligence on the management team, the chosen technology, and the market opportunity before committing capital. In addition to funding, they typically provide strategic oversight.

3. Structuring an Investment Fund or Bond

For larger projects, typically with capital needs exceeding €20 million, creating a dedicated investment vehicle can be an effective strategy. This could be a specialized fund or a corporate bond domiciled in Liechtenstein, designed to pool capital from multiple qualified investors. Such structures are regulated by the Financial Market Authority (FMA), ensuring a high degree of transparency and security that attracts international investors.

Key Requirements and Preparation

Engaging with Liechtenstein’s financial institutions is a formal process that requires meticulous preparation.

Due Diligence and Compliance

Liechtenstein adheres to the highest international standards for financial transparency, including strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Entrepreneurs must be prepared to provide comprehensive documentation on the source of their personal and corporate funds. Such rigorous compliance is not a barrier but a feature that ensures the integrity of the financial center.

The Bankable Business Plan

This is the single most important document in the entire process. It must be data-driven, professionally presented, and validated by third-party experts. A comprehensive feasibility study is non-negotiable and forms the backbone of the financial case presented to potential investors and lenders.

Local and International Legal Counsel

Successfully structuring a deal requires a team of experts. This team should include a reputable law firm in Liechtenstein to handle corporate and regulatory matters, as well as legal counsel in the project’s home country to manage local permits and contracts.

Frequently Asked Questions (FAQ)

Do I need to be a resident of Liechtenstein to get financing?

No, the financial center is structured to serve international clients, and the project itself can be located anywhere in the world. However, project sponsors and their business plan will undergo intense scrutiny to ensure viability and compliance.

What is the typical investment size that attracts Liechtenstein-based capital?

While there is no official minimum, projects seeking upwards of €5–10 million in capital are a more suitable fit for private equity or structured fund solutions. Smaller projects may be better served by traditional bank financing or local capital sources.

How long does the financing process take?

Securing major project financing is a marathon, not a sprint. A realistic timeframe is 6 to 18 months from the initial engagement to the final disbursement of funds. The timeline depends heavily on the quality of the project’s preparation and the complexity of the deal structure.

Is Liechtenstein still a ‘tax haven’?

That’s a common misconception based on an outdated image. Liechtenstein has fully embraced international tax transparency standards, including the Automatic Exchange of Information (AEOI). It is now considered a reputable, compliant financial center that offers a competitive low-tax environment, not a haven for undeclared assets.

What role does a technical partner play in securing finance?

For investors unfamiliar with the solar industry, a credible technical partner is essential. Financiers need assurance that the proposed factory is technically sound, the budget is realistic, and the production plan is achievable. A partner like J.v.G. Technology can provide this technical validation, significantly strengthening the investment proposal and building confidence among capital providers.

Conclusion: Your Next Steps in Financial Planning

Liechtenstein offers a stable, sophisticated, and increasingly sustainability-focused capital market for well-structured solar manufacturing projects. For the serious entrepreneur, it provides a powerful alternative to more conventional financing routes, de-risking the project through a secure legal and financial jurisdiction.

The path is rigorous and demands thorough preparation. The first step is not to contact a bank, but to build an unassailable business case. By understanding the operational and technical details that financiers will scrutinize, you can position your project for success. Explore the detailed steps to start a solar module factory to lay the essential groundwork for your financial journey.