Imagine finding the perfect location for a new solar module factory. It offers political stability, a favorable business environment, and excellent logistics. The catch? Its local population is small, and the specialized technicians you need live in two neighboring countries, each with its own laws. This isn’t a hypothetical puzzle; it’s the practical reality for an entrepreneur establishing a manufacturing base in Liechtenstein.

While this scenario is specific, it offers a powerful case study for any business professional considering a location near a national border. The principles of managing a cross-border workforce—from navigating work permits to coordinating payroll and aligning social security systems—are universally relevant.

This article explores the key considerations for structuring employment agreements for workers from Austria and Switzerland who commute to a factory in Liechtenstein, offering a framework for managing this complex but rewarding operational model.

The Strategic Context: Liechtenstein’s Unique Labor Market

Liechtenstein’s appeal as a high-tech manufacturing hub is clear. As a member of the European Economic Area (EEA), it provides access to the EU single market. Yet, with a population of just under 40,000, its domestic labor pool cannot support the country’s industrial ambitions alone.

Consequently, over half of the country’s workforce is made up of cross-border commuters, known as Grenzgänger, the majority of whom travel daily from neighboring Switzerland and Austria. For a solar module manufacturer, this arrangement opens up access to a deep pool of skilled labor from the strong engineering and manufacturing sectors of these countries. Tapping into this talent, however, depends on a clear understanding of three distinct legal and administrative systems.

A Tale of Two Borders: Austria (EEA) vs. Switzerland (EFTA)

While both neighbors provide skilled talent, the administrative pathways for employing their citizens differ significantly—a critical distinction for any business plan.

Austrian Workers (EEA Members)

Since Austria is part of the EEA, its citizens benefit from freedom of movement, which simplifies the hiring process significantly. They generally do not need a specific work permit for employment in Liechtenstein; the primary focus is on proper registration for tax and social security.

Swiss Workers (EFTA, but with Bilateral Agreements)

Although Switzerland is not in the EEA, its relationship with Liechtenstein is governed by a long-standing customs and currency union, along with various bilateral agreements. Swiss citizens require a cross-border commuter permit (Grenzgängerbewilligung). While typically a straightforward process for qualified individuals, this adds an administrative step that must be factored into recruitment timelines.

Based on experience from J.v.G. turnkey projects, a new factory’s administrative setup should account for approximately 15% more processing time for permits and registrations for non-EEA staff, even from a closely aligned country like Switzerland.

Ready to make big Profits?

The solar Industry is Booming

WE HELP NEWCOMERS to the solar industry start their own solar module production line. Customers can make BIG PROFITS by selling modules and finding investors, without wasting money and time on things they don't need!

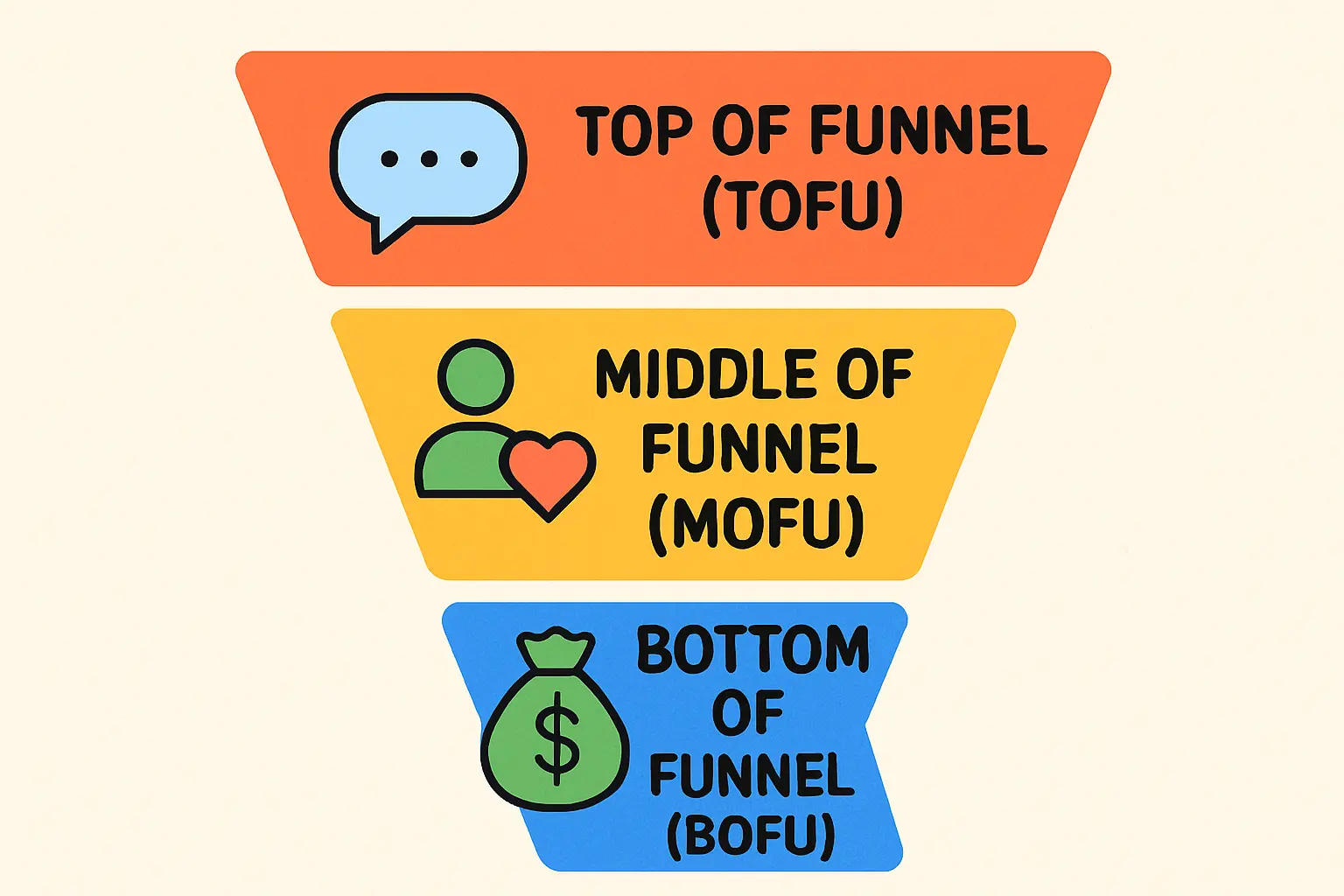

Core Pillars of Cross-Border Employment Management

Successfully managing a workforce from Austria and Switzerland requires a systematic approach to three key areas: work permits, payroll and taxation, and social security contributions.

1. Work and Residence Permits: The Gateway to Employment

The first step is securing the legal right for an employee to work in Liechtenstein.

For a Swiss national, the employer in Liechtenstein initiates the application for the cross-border commuter permit, which is tied to the specific employment contract. The process requires documentation proving the job offer, the candidate’s qualifications, and personal identification.

For an Austrian national, the process is simpler. Although no work permit is needed, the employee must register with the relevant Liechtenstein authorities upon starting employment. This registration is essential for tax and social security purposes.

The overall investment requirements for a solar module factory must also account for the legal and administrative costs associated with establishing these cross-border employment structures.

2. Payroll and Taxation: Navigating Double Taxation Agreements

A primary concern for both employer and employee is ensuring income is taxed correctly and only once. Fortunately, Liechtenstein has comprehensive double taxation agreements with both Austria and Switzerland to prevent this.

The standard procedure for cross-border commuters is taxation at source (Quellensteuer) in Liechtenstein. This means the employer deducts the appropriate income tax from the employee’s salary and remits it directly to the Liechtenstein tax authorities.

-

For Swiss Commuters: The tax paid in Liechtenstein is generally credited against their tax liability in Switzerland. Employees must declare their worldwide income on their Swiss tax return, but the agreement ensures they are not taxed twice on the same earnings.

-

For Austrian Commuters: The agreement with Austria also designates Liechtenstein as the primary place of taxation for income earned there. The system functions similarly, preventing double taxation through established clearing mechanisms between the two countries.

Setting up payroll requires software and expertise capable of handling these specific Quellensteuer calculations and reporting requirements.

3. Social Security: The Principle of the Place of Work

Social security—covering health, unemployment, and pension insurance—is perhaps the most complex area. The governing rule within the EEA and under Swiss-EU agreements is that an employee is subject to the social security system of the country where they perform their work.

This means that regardless of their nationality or place of residence, employees of a Liechtenstein-based solar factory will contribute to Liechtenstein’s social security system (AHV/IV/FAK). The employer is responsible for deducting the correct contributions from the employee’s salary and paying the employer’s share.

To formalize this, an employee residing in Austria or Switzerland but working in Liechtenstein must have an A1 certificate (for EEA) or an equivalent document. This certificate proves they are paying social security contributions in Liechtenstein and are therefore exempt from paying in their country of residence. It is a critical compliance document that prevents dual liability for social security payments.

The management of a turnkey solar production line extends beyond the machines on the factory floor; it requires equally precise systems for human resources and legal compliance.

Frequently Asked Questions (FAQ)

What defines a ‘cross-border commuter’ (Grenzgänger)?

A cross-border commuter is a person who works in one country but resides in another and returns to their place of residence at least once a week. This status has specific legal, tax, and social security implications.

Does a Liechtenstein company need to understand Austrian and Swiss labor law?

The employment contract itself is governed by Liechtenstein labor law. However, a comprehensive understanding of the cross-border implications—especially regarding taxation and social security coordination—is essential for the HR and finance departments.

Is it necessary to have separate HR specialists for Austrian and Swiss employees?

Not necessarily. A single HR team or external advisor with proven expertise in managing cross-border employment for all three countries is more efficient, ensuring both consistency and compliance.

What happens if an employee works from home in Austria or Switzerland part-time?

This can complicate the tax and social security situation. If a substantial part of the work (e.g., more than 25%) is performed in the country of residence, it may shift the primary location for social security contributions back to that country. Such hybrid arrangements require careful legal examination.

Planning for a Cross-Border Workforce

Establishing a solar factory in a location like Liechtenstein offers significant strategic advantages by tapping into the skilled labor pools of multiple countries. Success, however, is not just about technology and production efficiency; it hinges on meticulous administrative planning.

By addressing work permits, payroll, and social security with a clear and compliant strategy from the outset, a company can build a resilient and talented international team. This approach transforms a potential logistical challenge into a significant competitive advantage, allowing the enterprise to draw from the best talent the region has to offer. Understanding these frameworks is therefore foundational to building a solid operational plan.