Entrepreneurs considering a new manufacturing venture face a critical decision: where to establish their operations. This choice influences everything from initial capital outlay to long-term profitability.

For those looking to enter the renewable energy sector in Southern Africa, the Kingdom of Lesotho offers a compelling, often overlooked opportunity backed by a powerful suite of financial incentives.

This guide breaks down the tax benefits and rebates offered by the Lesotho National Development Corporation (LNDC) and explains how these programs support new industrial enterprises—particularly in export-focused sectors like solar module production. Understanding these incentives is the first step in evaluating Lesotho as a strategic base for a new solar factory.

Understanding the Role of the LNDC

The Lesotho National Development Corporation (LNDC) is the primary development finance institution of the Government of Lesotho. Established to promote industrial development, its core mission is to attract both domestic and foreign investment. The LNDC acts as a strategic partner for investors, facilitating market entry and providing a support framework that fosters the long-term success of new ventures.

For business professionals new to the region, the LNDC is the main point of contact, offering guidance and access to a portfolio of incentives that directly impact a company’s bottom line.

Key Financial Incentives for Renewable Energy Manufacturers

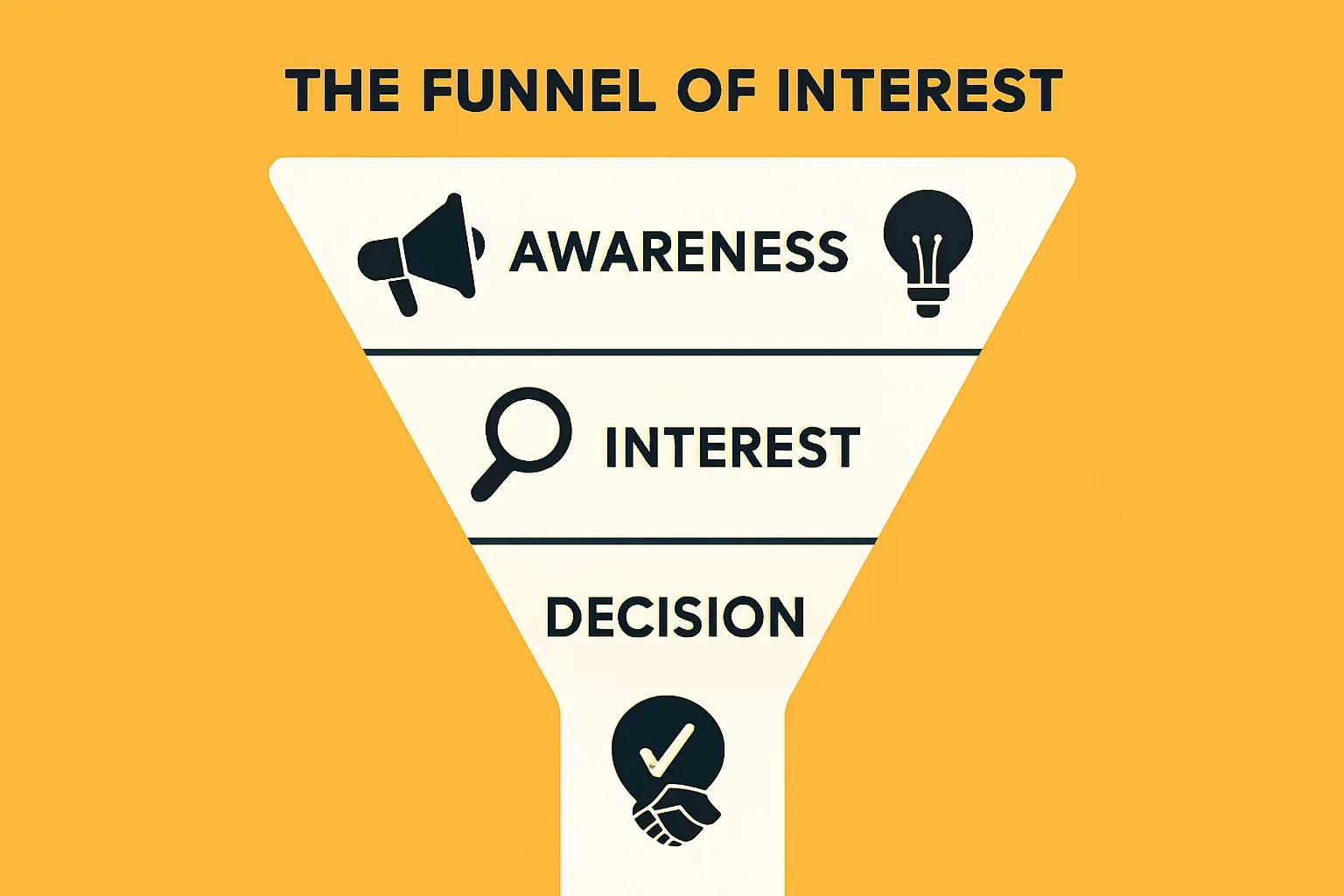

The LNDC offers a series of financial incentives that are particularly advantageous for manufacturers focused on exports. For a solar module factory, which typically serves regional or international markets, these benefits can fundamentally alter the project’s financial viability.

The Corporate Tax Advantage: 0% and 10% Rates

The most significant incentive is Lesotho’s corporate income tax structure for manufacturing companies. The rates are tied directly to the destination of the final products:

-

0% Corporate Income Tax: This rate applies to all profits generated from exporting manufactured goods to markets outside the Southern African Customs Union (SACU). For a solar manufacturer shipping modules to Europe, North America, or other parts of Africa, this effectively means no tax on corporate profits.

-

10% Corporate Income Tax: A highly competitive flat rate of 10% is applied to profits earned from sales within the SACU region, which includes Botswana, Eswatini, Namibia, and South Africa.

This dual-rate system allows a business to optimize its tax strategy based on market focus, significantly enhancing its return on investment compared to jurisdictions with standard corporate tax rates of 25% or higher.

Financial Support: Loans, Equity, and Guarantees

The LNDC offers direct financial assistance to qualifying projects. This support is not a simple grant but a partnership model intended to de-risk the initial investment. Options include:

-

Long-Term Loans: Financing is available for acquiring fixed assets, such as the machinery required for a turnkey solar manufacturing line.

-

Equity Participation: In certain cases, the LNDC may take an equity stake in a project, providing valuable capital and demonstrating state-level commitment to the venture’s success.

-

Loan Guarantees: The LNDC can provide guarantees to commercial banks, making it easier for new enterprises to secure private-sector financing.

This financial support reduces the initial capital burden and lowers the barrier to entry, a critical factor when considering the overall investment requirements for a solar factory.

Value-Added Tax (VAT) Exemptions and Refunds

Lesotho’s VAT system is built to encourage exports. Goods exported from Lesotho are zero-rated for VAT, meaning no VAT is charged on the final sale. In addition, any VAT paid on raw materials and other inputs during manufacturing is fully refundable. This ensures that cash flow is not tied up in tax payments, a common challenge for manufacturing businesses in other regions.

Unrestricted Repatriation of Profits

For foreign investors, the ability to move capital is paramount. Lesotho guarantees the free repatriation of profits and dividends. This policy assures investors that they can access and transfer their returns without restrictive foreign exchange controls, fostering a stable and predictable investment climate.

Operational and Infrastructure Support

Beyond direct financial incentives, the LNDC provides practical, on-the-ground support to reduce operational costs and streamline the setup process.

Subsidized Industrial Land and Factory Shells

One of the most immediate challenges for any new factory is securing a suitable location. The LNDC addresses this by offering serviced industrial land at highly competitive lease rates. These sites are already equipped with connections to essential utilities.

Additionally, the LNDC offers ready-built factory shells for rent. These buildings are constructed to international standards and can be adapted to various manufacturing processes. This option dramatically reduces the initial construction timeline and capital expenditure, allowing a business to become operational much faster.

Skills Development: The Training Reimbursement Grant

A skilled workforce is essential for modern manufacturing. The LNDC offers a non-repayable training grant that reimburses a company for up to 50% of the costs of training its local employees. This program supports knowledge transfer and helps equip the local workforce with the specific skills needed to operate sophisticated machinery. This is particularly relevant when considering the labor and staffing for a solar module factory, as it helps offset the cost of developing technical expertise.

Streamlined Access to Utilities and Permits

The LNDC acts as a facilitator, helping investors navigate the administrative processes of setting up a business. This includes securing necessary work permits for key expatriate staff and ensuring reliable access to water and electricity—at no connection cost—within its industrial estates.

Strategic Market Access: Lesotho’s Geographic Advantage

Lesotho’s location, landlocked within South Africa, is a strategic asset. As a member of the Southern African Customs Union (SACU), it enjoys duty-free trade with Botswana, Namibia, South Africa, and Eswatini.

Furthermore, Lesotho benefits from several international trade agreements, including:

-

AGOA (African Growth and Opportunity Act): Provides duty-free access to the United States market.

-

SADC (Southern African Development Community): Offers preferential access to a market of over 300 million people.

-

EU-SADC Economic Partnership Agreement (EPA): Allows duty-free, quota-free access to the European Union.

These agreements transform Lesotho from a small domestic market into a duty-efficient export hub for accessing major global economies.

Eligibility and Application Process

The LNDC’s incentives are aimed at businesses that contribute to Lesotho’s economic development. While specific criteria may vary, the general requirements focus on:

-

Job Creation: The potential to create sustainable employment for local citizens.

-

Export Orientation: A primary focus on selling products to international markets.

-

Technology Transfer: The introduction of modern manufacturing techniques and skills.

-

Use of Local Resources: Incorporating local raw materials where feasible.

The application process begins with a comprehensive business proposal submitted to the LNDC. This document is the cornerstone of the application. As experience from J.v.G. turnkey projects shows, a well-structured and detailed solar factory business plan is critical to demonstrating a project’s viability and securing the full range of available incentives. The LNDC evaluates each proposal on its economic merits and its alignment with national development goals.

The Long-Term Impact on Your Business Plan

When combined, the LNDC’s incentives make a powerful financial case for establishing a solar manufacturing facility in Lesotho. The 0% export tax rate directly increases net profit margins. Reduced upfront costs for land and buildings lower the initial investment, while training grants and utility support decrease ongoing operational expenditures.

These factors significantly improve key financial metrics, such as the internal rate of return (IRR), and shorten the investment’s payback period, making the project more attractive to investors and financial institutions.

Frequently Asked Questions (FAQ)

What is the primary role of the LNDC?

The LNDC is Lesotho’s main development finance institution, responsible for attracting and supporting industrial investment through a package of financial, infrastructural, and administrative incentives.

Is the 0% corporate tax rate applicable to all companies in Lesotho?

No, the 0% rate is specifically for manufacturing companies on profits generated from exports to countries outside the Southern African Customs Union (SACU). Profits from sales within SACU are taxed at 10%.

How does the training grant work?

The LNDC can reimburse a company for up to 50% of wage costs during the initial training period for newly recruited local employees. This is a non-repayable grant intended to promote skills development.

Are these incentives available only to foreign investors?

No, the incentives are available to both foreign and domestic investors who meet the eligibility criteria for establishing a manufacturing enterprise in Lesotho.

Next Steps for Deeper Exploration

The incentives offered by the Lesotho National Development Corporation present a clear strategic advantage for entrepreneurs looking to establish a solar module factory. By significantly reducing the tax burden and initial capital costs, this framework creates one of the most competitive environments for export-oriented manufacturing in the region.

For those considering such a venture, the next logical step is to develop a detailed financial model and business plan that incorporates these powerful benefits. A thorough understanding of the initial investment, operational costs, and market potential is essential to building a successful enterprise.