When exploring new industrial ventures, entrepreneurs naturally focus on market demand and technology. But a critical success factor is often overlooked: the local regulatory and fiscal landscape.

For solar manufacturing, a supportive government framework can fundamentally alter a project’s financial viability, particularly in the crucial early years. While many nations offer incentives, the Republic of Suriname offers a compelling opportunity through its Investment Law, specifically designed to attract new industries like solar panel production.

This guide examines the incentives available under Suriname’s legislation, offering business professionals a clear understanding of the financial benefits and application procedures for establishing a solar module factory in the country.

Understanding Suriname’s Strategic Investment Framework

Suriname is increasingly focused on diversifying its economy beyond traditional mining and oil. To drive this transition, the government established the Investment Law (known locally as ‘Wet Investeringen’) to create a predictable and attractive environment for both foreign and domestic investors. The central body facilitating this process is InvestSur, the national investment and promotion agency, which serves as the primary contact for new industrial projects.

The law’s core principle is to offer tangible fiscal benefits in exchange for investments that create local jobs, introduce new technologies, and boost the country’s export capacity. For entrepreneurs planning to [start a solar panel factory], this framework provides a direct path to reducing initial capital expenditure and improving profitability in the early stages.

Key Fiscal Incentives for Solar Manufacturers

The Investment Law outlines several powerful incentives. For a capital-intensive project like a solar module assembly line, these benefits can transform the business case.

Tax Holidays: A Period of Profit Maximization

One of the most significant advantages is the potential for a complete income tax exemption for a defined period.

Duration: Tax holidays typically range from five to ten years. The final duration depends on the scale of the investment and the number of sustainable jobs created. A 20–50 MW solar production facility, for example, represents a substantial investment likely to qualify for the upper end of this range.

Business Impact: This exemption allows a new enterprise to reinvest its profits directly in the business—scaling production, training staff, or building a robust distribution network. It creates a critical financial buffer during the market entry phase.

Import Duty Exemptions on Machinery and Raw Materials

This incentive is paramount for solar manufacturing, where most specialized equipment and many raw materials are imported. The law provides exemptions from customs duties and other import-related taxes on:

-

Capital Goods: All machinery required for the production line, including cell stringers, laminators, and module testers. A full exemption on these high-value items dramatically lowers the initial [investment requirements for solar manufacturing].

-

Raw Materials: Essential components like photovoltaic cells, EVA film, backsheets, and junction boxes can also qualify for exemptions, at least for an initial period. Based on experience from J.v.G. turnkey projects in other regions, accurately forecasting material needs for the first one to two years is crucial for maximizing this benefit.

Value-Added Tax (VAT) Considerations

The framework also includes favorable treatment for VAT (or BTW, in Dutch). New investment projects can often benefit from a zero-rating on specific goods and services procured locally during the construction and setup phase. This improves cash flow by eliminating the need to pay and later reclaim VAT on significant initial expenses.

Access to Land and Infrastructure

While not a direct fiscal incentive, the Investment Law facilitates access to state-owned land for industrial purposes. Approved projects may be granted long-term leases at concessionary rates, particularly in designated industrial zones. This reduces the uncertainty and cost associated with site acquisition, a key step when [choosing the right location for your factory].

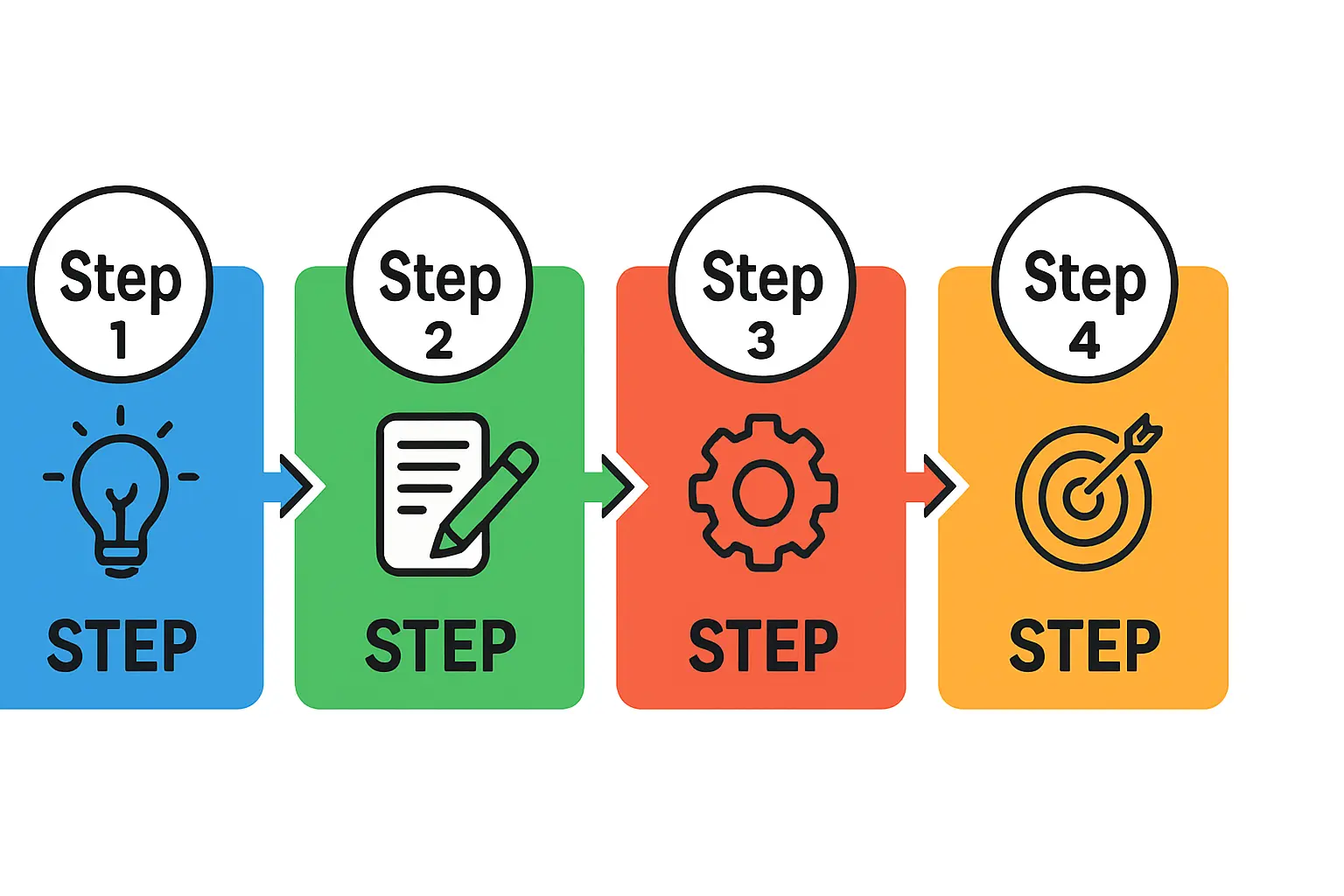

Navigating the Application Process

Securing these incentives requires a formal, structured application process through InvestSur. While specifics may vary, the typical path involves several key stages:

-

Submission of a Comprehensive Business Plan: The foundation of the application is a detailed business plan that goes beyond financials. It must outline the project’s technical specifications, job creation projections, market analysis, and contribution to the local economy.

-

Formal Application to InvestSur: The business plan is submitted alongside a formal application. InvestSur then reviews the project for eligibility and alignment with national development goals.

-

Negotiation and Agreement: Following a successful review, a formal investment agreement is drafted. This legal document specifies the incentives granted to the project and the obligations of the investor.

-

Official Approval and Gazetting: The final agreement requires approval from the Council of Ministers and is often published in the official gazette, giving it the force of law.

This process underscores the importance of meticulous preparation. Entrepreneurs without a technical background often find it challenging to develop a plan with sufficient detail on production processes and machinery specifications. Engaging with technical consultants is vital. For example, a proposal backed by a detailed layout for an available [turnkey solar production line] gives the government concrete, verifiable data, increasing the likelihood of a swift and positive outcome.

Strategic Considerations Beyond the Law

While the Investment Law is highly favorable, success in Suriname—as in any new market—requires looking beyond the legal text.

-

Logistical Landscape: While Suriname’s location offers strategic access to CARICOM and South American markets, a thorough assessment of its port infrastructure, inland transportation, and supply chain reliability is essential.

-

Labor and Training: Because the incentives are tied to job creation, a successful project must include a plan for hiring and training a local workforce, often in collaboration with local technical institutes.

-

Long-Term Stability: Investors should conduct due diligence on the country’s economic and political stability to ensure the long-term integrity of their investment agreement.

Ultimately, Suriname’s framework offers a clear and compelling case for establishing a solar manufacturing presence. For a well-prepared entrepreneur, it represents a significant competitive advantage in a growing global market.

Frequently Asked Questions (FAQ)

What is the typical minimum investment to qualify for these incentives?

While there is no fixed minimum, projects representing a substantial commitment—generally upwards of USD 1 million in capital equipment—are more likely to receive the full suite of benefits. The government’s emphasis is on the project’s economic impact, not just the dollar amount.

How long does the approval process usually take?

Timelines vary, but an investor with a well-prepared, comprehensive business plan can typically expect the process to take six to twelve months from initial submission to final approval.

Are these incentives available for expanding an existing operation?

Yes, the Investment Law also applies to significant expansions of existing businesses, provided the expansion meets the criteria of creating new jobs and increasing production capacity.

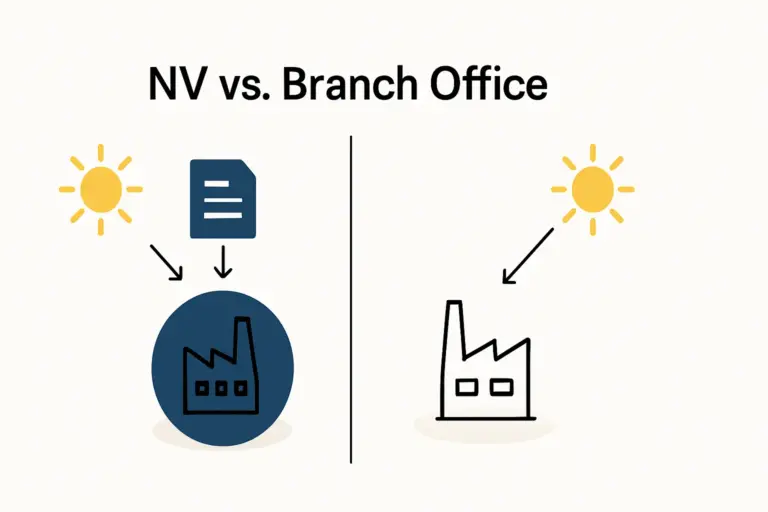

Is a local business partner required to invest in Suriname?

No, foreign investors can own 100% of their enterprise in Suriname. However, partnering with a local entity can be advantageous for navigating administrative processes and understanding the local business environment.