Algeria is at an exciting crossroads in its energy story. With abundant sunshine and ambitious goals for renewable energy, there’s a genuine buzz around the potential for local solar module manufacturing. A venture like this could kickstart economic growth, create a wealth of new jobs, and help the nation take significant strides toward energy independence. But for any entrepreneur or investor eyeing this opportunity, the crucial question is: “How do I know if this kind of project will actually succeed?” The answer, as you might have guessed, lies in a robust feasibility study for a solar energy venture.

In this article, we’ll walk you through a practical example of a feasibility analysis for setting up a solar module production line in Algeria. Drawing on our team’s years of experience at PVknowhow.com guiding solar ventures worldwide, we’ll offer a helpful framework for anyone seriously considering this promising market. While this example provides valuable food for thought, remember that a truly bankable feasibility study for your specific project requires a much deeper, tailor-made dive into the details. And that’s exactly the kind of nitty-gritty work we love to do.

Table of Contents

Understanding the Algerian Solar Landscape – Market Potential

So, what’s the solar scene like in Algeria? The country is actively broadening its energy horizons, with solar power as a cornerstone of that vision. The government has laid out impressive targets, like the “Solar 1,000 MW” program, which aims to install 1 GW of solar capacity. This is naturally fueling a strong homegrown demand for solar modules. Currently, a significant portion of this demand is met by imports, which clearly spells opportunity for local manufacturers.

Estimates place local manufacturing capacity at around 500 MW per year, with strong optimism that this could climb to 600-700 MW by the end of 2025 (according to PV Magazine). Even with this growth, demand is expected to keep rising, leaving plenty of room at the table for new players. Government incentives, which can be a moving target, have historically nurtured local production, so gaining a firm grip on them is vital. And while a few established competitors exist, the market is by no means sewn up, especially for high-quality, technologically advanced modules.

A PVKnowhow Perspective: When we get our teeth into a market analysis—a cornerstone of any solid feasibility study—we don’t just skim the surface. We go deep. We examine what truly drives demand (is it large utility-scale projects, commercial setups, or residential installations?), carefully size up the competition, scrutinize import/export patterns, and work to pinpoint those sweet spots in the market where a new venture can shine.

Example Project Scope: A 100 MW Solar Module Plant in Algeria

To help get our heads around this, let’s outline a hypothetical solar module manufacturing plant with an annual production capacity of 100 MW. This scale often hits a sweet spot: it’s significant enough to make an impact yet manageable as a starting point for many entrepreneurs and investors.

- Proposed Capacity: 100 MW per year. That’s our target output.

- Technology Focus: We’d likely focus on Monocrystalline PERC (Passivated Emitter and Rear Cell) modules. It’s a widely adopted technology known for its efficiency. We might also build in bifacial capabilities—where panels can capture sunlight from both sides—for an extra boost in energy yield.

- Target Market: Our primary focus would be domestic utility-scale projects awarded through government tenders, followed by commercial and industrial (C&I) rooftop installations, and potentially the residential sector via distributors.

This scope allows us to envision a modern, efficient production line turning out high-demand modules. It’s large enough to benefit from economies of scale in procurement and production but not so large that it would instantly flood a still-growing local market.

Technical Feasibility – What’s Needed on the Ground?

So, you have the concept. What does it actually take to build a solar module plant? This requires careful planning of all the physical assets and technical expertise.

Location and Infrastructure

Choosing the right location is absolutely critical. Here’s what you’d need to consider:

- You’ll need easy access to transport links—like ports and highways—for receiving raw materials and shipping finished modules.

- A reliable supply of utilities such as electricity and water is non-negotiable.

- You’ll need a suitable plot of land. For a 100 MW plant, you’re likely looking at around 4,000-5,000 m², including space for warehousing and offices.

- And, of course, you’ll need access to a pool of skilled and semi-skilled workers.

Industrial zones can often offer favorable conditions and may already have some of this essential infrastructure in place.

Production Line & Equipment

A typical 100 MW module production line consists of several key stages:

- Cell Tabbing and Stringing: This is where individual solar cells are connected to form strings.

- Layup/Bussing: These cell strings are then carefully arranged and interconnected.

- Lamination: In this crucial step, the cells are encapsulated between layers of glass, EVA (Ethylene Vinyl Acetate) adhesive film, and a backsheet, then sealed together using heat and a vacuum.

- Framing: Aluminum frames are attached to give the module its structural integrity.

- Junction Box Installation: The junction box, which houses the electrical connections, is fitted.

- Testing & Quality Control: This vital stage includes IV (or flash) testing to measure electrical performance, electroluminescence (EL) testing to spot microcracks in cells, and thorough visual checks.

The primary machinery required includes automatic cell stringers, layup stations, laminators, framing machines, and IV and EL testers. The level of automation is a key decision; more automation can lower labor costs and improve consistency but requires a higher upfront investment. Equipment is typically sourced from established European or Asian suppliers. At PVKnowhow, for instance, we often help clients set up turnkey production lines by connecting them with reputable machinery providers.

Raw Materials & Supply Chain

What actually goes into a solar module? The main Bill of Materials (BOM) includes:

- Solar cells (usually the most significant cost and typically imported, often from major global producers in China)

- Tempered solar glass

- EVA encapsulant films

- Backsheets (materials like TPT or KPK)

- Aluminum frames

- Junction boxes, diodes, and cables

- Ribbon and busbars (for electrical connections)

- Sealants and adhesives

A robust supply chain strategy isn’t just important; it’s non-negotiable. While some materials might be sourced locally (like frames or packaging), key components such as solar cells are almost always imported.

Labor & Expertise

A 100 MW plant could directly employ approximately 70-90 people. This would include:

- Skilled technicians to operate and maintain machinery.

- Engineers to oversee process control and quality assurance.

- Production line workers.

- Staff for logistics, sales, and administration.

- A dedicated management team to lead the operation.

Effective training programs are essential to ensure the production of high-quality modules and maintain smooth, efficient operations.

A PVKnowhow Perspective: When we dive into technical feasibility, we get into the nitty-gritty. We’re talking about optimizing the plant layout, helping you select the right machinery for your goals and budget (from semi-automated to fully automated lines), ensuring an efficient material flow, and even planning workforce training. We also tap into our extensive network to assist with supplier qualification, making sure you source high-quality materials from reliable partners.

Financial Viability – The Numbers Game

Now for the part everyone wants to know about: the financials. A detailed financial model is the beating heart of any feasibility study worth its salt.

Let’s look at some sample figures for a 100 MW plant in Algeria, conceptually scaled from projects like the 180 MW Zergoun Green Energy plant (which reportedly involved an investment of around $11.6–$12 million). Keep in mind these are ballpark figures to give you an idea.

Estimated Capital Investment (CAPEX)

For a 100 MW annual capacity plant, the total upfront investment might land in the $5.5–$7 million range. This would typically break down into:

- Land & Building: (Varies significantly depending on a lease or buy decision) Let’s say $1–$1.5 million.

- Machinery & Equipment: (Often the largest expense) Perhaps $3.5–$4.5 million.

- Installation & Commissioning: Getting everything set up and running, say $0.3–$0.5 million.

- Licenses & Permits: Around $0.05–$0.1 million.

- Initial Working Capital: (Needed for the first batch of raw materials and to cover initial operating costs before revenue flows) Maybe $0.5–$1 million.

This works out to an investment cost per Watt of installed annual capacity of roughly $0.055–$0.07/W.

Projected Operating Costs (OPEX – Annual)

Your annual operating costs—what it takes to keep the lights on and the machines running—are heavily influenced by raw material prices and production volume.

- Raw Materials: This is the largest component, potentially making up 70-80% of your module production cost. For a 100 MW output, this could be in the ballpark of $30–$40 million annually, depending heavily on current cell prices and other material costs.

- Labor: (For 70-90 employees) Let’s estimate $0.5–$0.8 million.

- Utilities (Energy, Water): Maybe $0.2–$0.4 million.

- Maintenance & Spares: Keeping the equipment in good working order, say $0.1–$0.2 million.

- Logistics & Shipping: (For inbound materials and outbound modules) Around $0.3–$0.5 million.

- Sales, Marketing, & Administrative Overheads: Office costs, marketing efforts, etc., perhaps $0.2–$0.4 million.

- Depreciation: This is an accounting figure based on the expected lifespan of your assets.

Revenue Projections

What about the money coming in?

- Estimated Production Output: If your 100 MW plant runs at 85% utilization (a reasonable target), it will produce about 85 MW of modules. With an average module power of 340Wp, that’s roughly 250,000 modules a year.

- Average Selling Price (ASP): In the Algerian market, module prices have been reported around €0.625/W (about $0.67/W) for specific projects, according to PV Magazine. However, for planning purposes, it’s always smart to be conservative. Let’s assume an ex-factory price in the $0.35–$0.45/W range. This will depend on your technology and prevailing market conditions.

- Annual Revenue Forecast: At an ASP of $0.40/W and selling 85 MW of modules, your annual revenue would be around $34 million.

Profitability Analysis (Example)

Let’s touch on how you determine profitability:

- Gross Profit Margin: This is your (Revenue minus Cost of Goods Sold) divided by Revenue. Your COGS is dominated by raw materials. For instance, if materials cost you $0.30/W and you sell for $0.40/W, your material gross margin is $0.10/W, or 25%.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This key metric indicates the profitability of your core operations before financing and accounting decisions.

- Net Profit Margin: In solar module manufacturing, this typically hovers in the 5-15% range, but it’s highly sensitive to operational efficiency, scale, and market prices.

Return on Investment (ROI) & Payback Period (Example)

The big questions: when do you get your money back, and what’s the overall return?

- Simple Payback Period: This is simply your Total Investment divided by your Annual Net Profit. With favorable conditions and efficient operation, payback periods of 3-5 years are certainly achievable. Some reports even suggest that Algerian plants might achieve this in a faster 2-4 years.

- A full-blown feasibility study would also include detailed Net Present Value (NPV) and Internal Rate of Return (IRR) calculations. These are crucial for making your case to investors and securing financing.

A PVKnowhow Perspective: Building comprehensive, bankable financial models is something we really get a kick out of. Our premium business plan e-course, which includes personal mentoring, is designed to walk people just like you through creating these models step-by-step. We help you factor in local nuances, consider different financing structures, and run sensitivity analyses to ensure your financial projections are as robust and realistic as possible.

Regulatory Path and Environmental Considerations

Successfully navigating Algeria’s regulatory landscape is a critical step on your journey. Here are some key items to have on your radar:

- Business Registration and Licensing: First, you’ll need to secure all the necessary permits to operate a manufacturing facility.

- Investment Codes and Incentives: It’s crucial to understand Algeria’s investment laws. Are there specific incentives for renewable energy manufacturing or for projects located in designated industrial zones?

- Environmental Regulations: You must comply with national standards for emissions, waste disposal, and chemical handling. An Environmental Impact Assessment (EIA) is often required to identify and mitigate potential environmental effects.

- Labor Laws and Standards: Adhering to local employment regulations is, of course, a must.

- Customs and Import/Export Regulations: These will affect how you source raw materials and, potentially, if you plan to export finished modules.

Let’s be honest, manufacturing solar panels involves chemicals and creates some waste products (like broken cells, EVA trimmings, and lamination byproducts). A responsible manufacturer—the only kind you want to be—will implement programs to minimize waste and recycle wherever possible. For instance, partnering with specialized waste management services to handle manufacturing byproducts is essential. Proactively addressing any concerns about solar panel manufacturing pollution helps build trust and credibility from the start.

A PVKnowhow Perspective: Our consulting services often involve helping clients navigate the sometimes-complex regulatory maze in various countries. We draw on our global experience to help clients anticipate requirements and streamline the approval process, making it as smooth as possible.

Risk Assessment – What Could Go Wrong?

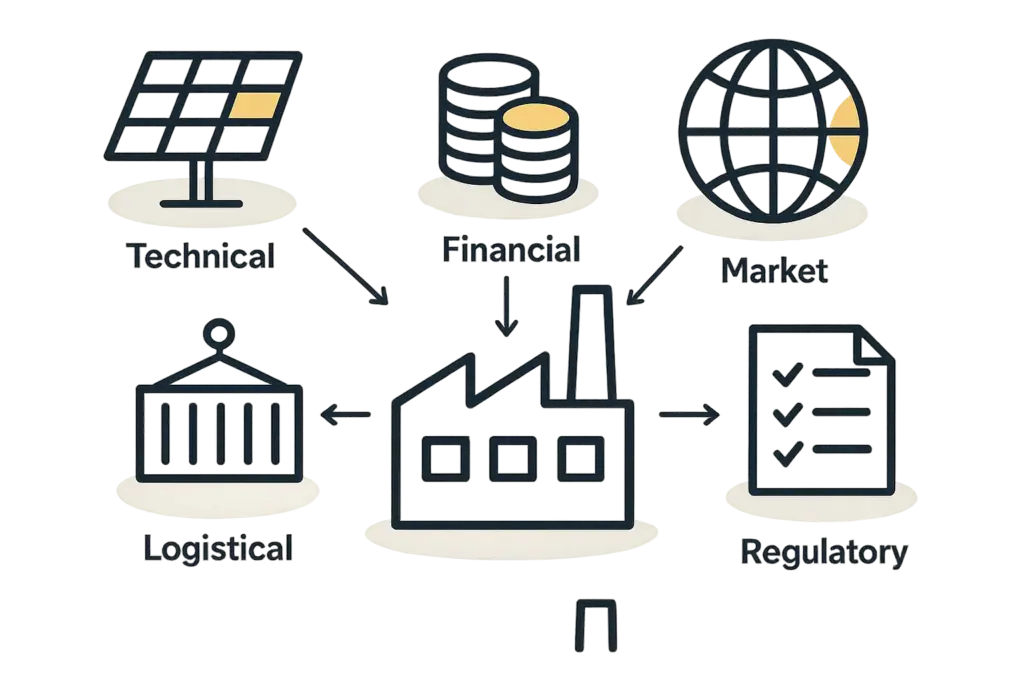

Every business venture, no matter how exciting, comes with risks. A good feasibility study doesn’t just identify these; it also suggests smart ways to manage or mitigate them:

Market Risks:

- Module prices can fluctuate, often influenced by global supply and demand.

- You might face competition from low-cost imports.

- Government policies or incentive programs could change.

- How to Mitigate: Consider locking in long-term supply agreements, focus on delivering superior quality and local service, and try to diversify your customer base.

Operational Risks:

- Supply chain disruptions could occur (e.g., raw material shortages or sudden price hikes).

- You might encounter equipment breakdowns or technical issues.

- Finding sufficient skilled labor could be a challenge.

- How to Mitigate: It’s wise to diversify your suppliers, adhere to robust maintenance schedules, and implement comprehensive training programs for your team.

Financial Risks:

- Costs could run higher than expected during construction or operation.

- You might find it difficult to secure financing, or the loan terms may be unfavorable.

- Currency exchange rate volatility can impact your financials.

- How to Mitigate: Implement detailed budgeting and tight cost controls, have strong financial planning in place from day one, and consider financial hedging strategies for currency risks.

Regulatory & Political Risks:

- Laws could change, or approval processes could be delayed.

- Political instability could affect the investment climate (a factor in many emerging markets).

- How to Mitigate: Conduct thorough due diligence, consider partnering with local experts or businesses, and always stay informed about potential policy changes.

Why This Feasibility Study Matters for Algerian Solar Growth

Ultimately, establishing local solar module manufacturing, guided by a robust feasibility study, offers numerous benefits for Algeria:

- Job Creation: This includes direct jobs in the factory (a 100 MW plant could mean 70-90 jobs, and a larger 200 MW plant like Zergoun Green Energy, potentially 150 jobs) and indirect jobs in supporting industries.

- Economic Diversification: A key benefit, this helps Algeria reduce its reliance on hydrocarbon exports and build a new industrial sector.

- Reduced Import Dependency: Local manufacturing makes the country’s energy supply more secure and keeps more economic value within Algeria’s borders.

- Technology Transfer and Skill Development: It helps build local expertise in advanced manufacturing—skills that are valuable far beyond the solar industry.

- Supporting Renewable Energy Goals: And, of course, it ensures a stable, local supply of modules to help Algeria meet its ambitious solar deployment targets.

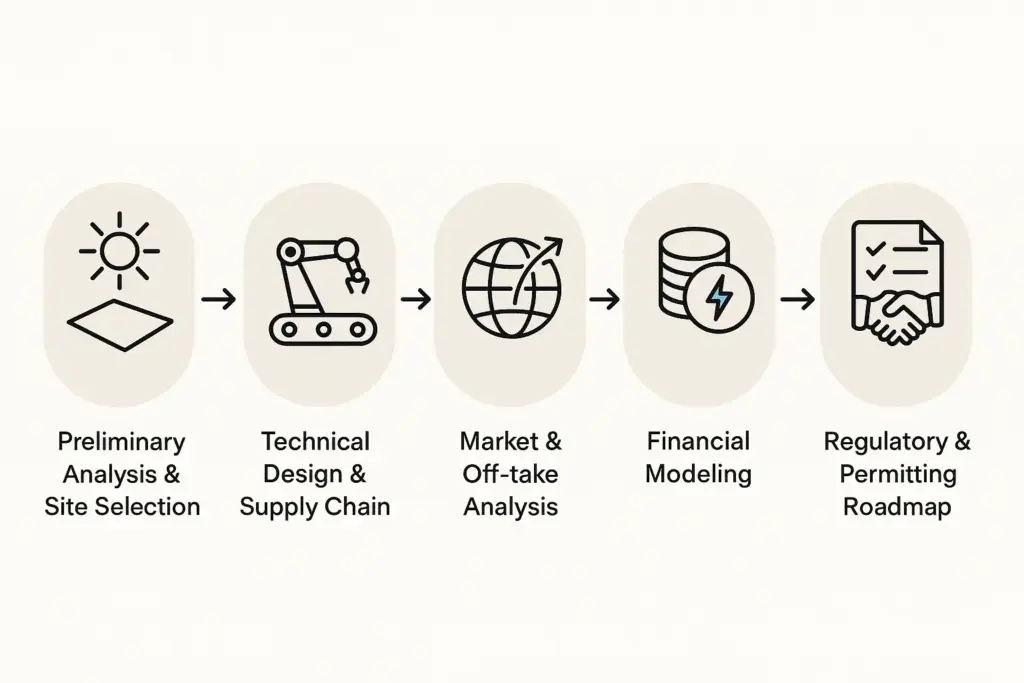

Your Next Step: Partnering with PVknowhow for a Bankable Feasibility Study

Hopefully, this overview has given you a good sense of the complexities involved in planning a solar module manufacturing plant.

While it offers a foundational understanding, let’s be frank: a multi-million-dollar investment decision requires a much deeper, more specific, and truly bankable feasibility study.

Here at PVknowhow.com, this is precisely our bread and butter, drawing on over two decades of hands-on, in-the-trenches experience from our J.v.G. Technology GmbH founders, Johann von Gott Thoma and Patrick Thoma. We offer:

- Turnkey Solar Production Lines: From helping you choose the right machinery to perfecting the process engineering and facilitating technology transfer, we can guide you every step of the way.

- Premium Business Plan E-Course: We’ll take you by the hand, with personal mentoring, to create the robust financial models and strategic plans that investors want to see.

- One-on-One Consulting: We’re ready to roll up our sleeves and help you tackle your specific technical, operational, and financial challenges.

A professional feasibility study from our team at PVKnowhow provides the clarity you need for informed decision-making. It significantly de-risks your investment and is often a prerequisite for securing financing. Ultimately, it’s what transforms an ambitious idea into an actionable, fundable project.

Ready to turn your Algerian solar vision into a bankable project? Contact PVknowhow today for a confidential, no-obligation consultation. Let our experts guide your solar module manufacturing venture in Algeria to success.

Conclusion

The opportunity for solar module manufacturing in Algeria is undeniably real, propelled by strong government support for renewables and growing energy demand. However, success in this arena hinges on meticulous planning and a deep, practical understanding of the local market, technical requirements, financial realities, and regulatory environment. An initial feasibility study for solar energy, like the example we’ve walked through here, is an excellent first step. For entrepreneurs and investors serious about capitalizing on Algeria’s solar boom, the critical next move is to partner with experienced advisors—like our team at PVknowhow.com—to develop a comprehensive, bankable feasibility study. That’s what paves the way for building a successful and impactful local solar manufacturing enterprise.

Want to learn more or need expert help? Visit our free e-course or explore our services. Or, if you’re ready to dive deeper, our Premium Business Plan E-Course offers personalized guidance to get your venture off the ground. Let’s make your solar journey smooth and successful.