It’s no secret that the world is shifting toward renewable energy, and solar power is leading the charge. For nations looking to bolster energy independence, stimulate economic growth, and embrace sustainability, developing local solar manufacturing offers a compelling path forward.

With its abundant sunshine and a growing commitment to green energy, Armenia is emerging as a country of particular interest. But what does it actually take to establish a thriving solar panel production line in this promising landscape?

Armenia has set ambitious renewable energy goals. The government aims for solar power to contribute significantly to its energy mix, targeting 1,000 MW of installed solar capacity by 2040—a big jump from around 402 MW in 2024—and for solar to comprise 15% of its total energy mix by 2030. This ambition is already taking shape, with pioneering local manufacturers like Solaron and LA Solar Factory paving the way.

This analysis explores the critical operational factors for solar production in Armenia, from the availability and cost of labor to the maturity of its supply chain for raw materials and components. For any entrepreneur, investor, or public-sector stakeholder considering this sector, understanding these elements isn’t just helpful—it’s essential.

Table of Contents

The Armenian Labor Force: A Key Asset for Manufacturing?

A skilled, cost-effective workforce is the backbone of any successful manufacturing venture. For potential solar module producers, Armenia’s labor market offers a mix of distinct advantages and challenges.

Overall Labor Market Dynamics

Armenia’s total labor force stood at approximately 1.47 million people in early 2024, with a labor force participation rate of around 57.2% in late 2023. With an unemployment rate of 13.9% in 2024, these numbers suggest a ready pool of available workers.

Crucially, there is a general availability of unskilled and semi-skilled labor, which is essential for the various assembly and operational roles within a solar factory.

Skilled Labor for Solar Manufacturing

Here’s where things get more nuanced. The availability of engineers, technicians, and experienced manufacturing operatives is a more complex factor.

While Armenia has a strong tradition in technical education and its booming IT sector has fostered a pool of tech-savvy individuals, specific experience in solar module manufacturing is, not surprisingly, less widespread.

Competition for skilled technical talent from other growing sectors, like IT, could also influence availability and push up wage expectations. However, the country’s existing manufacturing base and vocational training programs provide a solid foundation.

The good news is that companies like Solaron and LA Solar Factory have already demonstrated that it’s entirely possible to train and develop a skilled workforce locally.

Wage Structures in the Manufacturing Sector

Understanding local wage structures is crucial for any realistic financial planning.

- Minimum Wage: As of January 1, 2025, the national minimum wage in Armenia is set at 75,000 AMD per month (approximately $193 USD, though this is subject to exchange rate fluctuations).

- Manufacturing Wages: The average wage in the manufacturing sector was around 237,373 AMD per month as of April 2024.

- Daily Rates: For general semi-skilled workers, daily rates can range from 6,000 to 8,000 AMD (approx. $15-20 USD), while skilled workers might earn between 9,000 and 15,000 AMD per day (approx. $23-38 USD).

- Specialized Roles: As a benchmark for technically skilled positions, the average salary for a Solar Photovoltaic Installer in Yerevan is approximately $18,214 USD per year.

These figures show that labor costs in Armenia can be highly competitive, particularly when compared to Western European or North American standards. That said, businesses must factor in the necessary costs for training and development, especially for the more specialized roles.

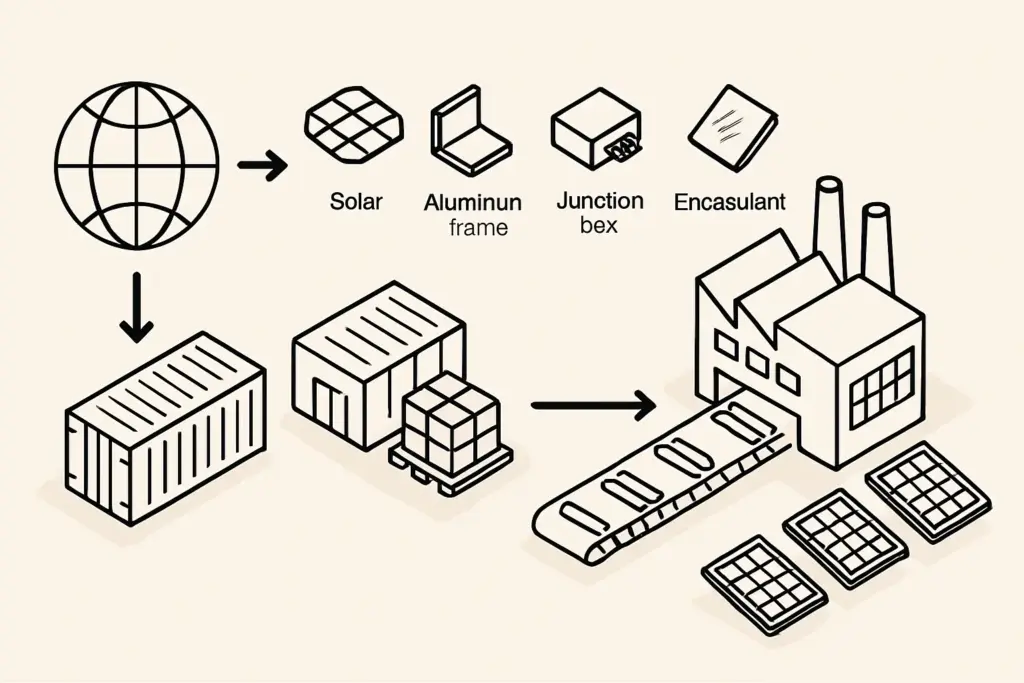

Deconstructing the Supply Chain for Solar Module Production in Armenia

No manufacturing operation is viable without a reliable, cost-effective supply chain. For solar, this involves sourcing everything from raw materials and components to specialized manufacturing equipment.

Raw Material Availability

Right now, this is one of the biggest hurdles: Armenia relies heavily on imports for most of the critical raw materials used in solar module production.

- Silicon & Wafers: These foundational materials are primarily imported. While Armenia has historical capacity in chemical production (e.g., “Nairit” CJSC, “Prometey Khimprom” JSC) that could theoretically be adapted for metallurgical silicon or polysilicon processing, this potential is not yet realized for solar-grade materials.

- Solar Glass: Specialized, low-iron, tempered glass for solar modules is typically imported.

- Aluminum Frames: While local aluminum extrusion capabilities may exist for general purposes, the specific profiles and quality required for solar module frames are often sourced internationally.

- Encapsulants (EVA/POE), Backsheets, Junction Boxes, Connectors: These specialized components are also predominantly imported from abroad.

Local Component Manufacturing & Assembly

The current landscape in Armenia is focused on module assembly rather than the more complex upstream manufacturing of cells or wafers.

- Solaron: Established in 2016, Solaron was the first solar panel manufacturer in Armenia, with an annual production capacity of 60 MW. It uses an Italian Ecoprogetti production line to produce monocrystalline, polycrystalline, bifacial, and PERC modules.

- LA Solar Factory: Founded in 2019 and located in the “Alliance” free economic zone, LA Solar Factory boasts an impressive 350 MW production capacity using Swiss Meyer Burger technology. What’s particularly noteworthy is that it exports approximately 70% of its products, showcasing the clear potential for Armenian-made modules in international markets.

The presence of these manufacturers demonstrates that the logistical and operational know-how for module assembly already exists. However, the broader ecosystem for locally sourced sub-components or specialized manufacturing equipment is still in its early stages.

Logistics and Import Infrastructure

As a landlocked country, Armenia faces a logistical reality that businesses must plan for. Imports typically arrive via ports in neighboring countries like Georgia and are then transported overland. This makes efficient customs procedures and well-maintained road networks all the more crucial.

Businesses must factor in the transportation costs and lead times associated with importing materials and equipment. On a positive note, the government has been actively working on improving trade facilitation.

Maturity of the Local/Regional Supply Network

The network of local distributors for industrial consumables, spare parts, and MRO (Maintenance, Repair, Operations) supplies is still maturing. As the industrial base grows, this network is expected to strengthen.

Operational Considerations: Costs and Infrastructure

Beyond labor and supply chains, several other operational costs and infrastructure factors come into play.

Overhead Costs

- Industrial Real Estate: Warehouse rental costs in regions like Kotayk or near Yerevan typically range between $3.75 and $7.50 USD per square meter per month.

- Electricity Prices: As of December 2023, the business electricity price was approximately $0.109 USD per kWh. Given that solar panel manufacturing can be energy-intensive, this is a significant operational cost to watch.

- Office Space: Rent for office space in Yerevan ranges widely, from roughly $11.73 to $46.91 USD per square meter per month, depending on location and quality.

Energy Infrastructure Reliability

A stable and reliable electricity supply is critical for continuous manufacturing operations—it’s simply non-negotiable. Armenia has been working to modernize its energy infrastructure, which is a vital step for attracting serious industrial investment.

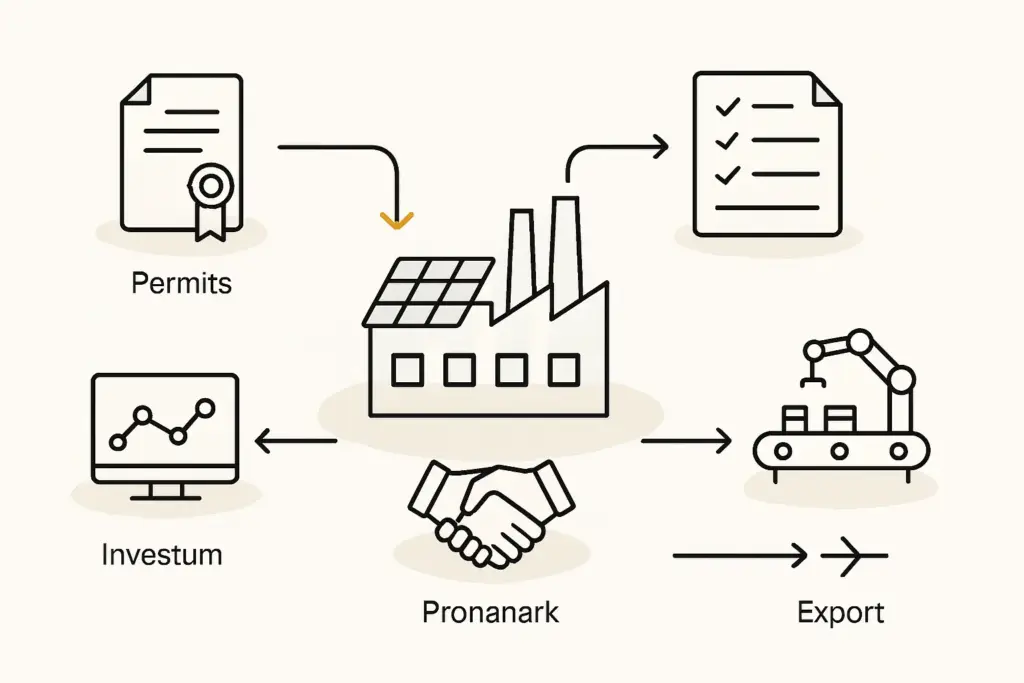

Government Support & Regulatory Environment

This is a major plus for potential investors: the Armenian government has shown strong support for renewable energy.

- Policy & Tariffs: The Law on Energy Efficiency and Renewable Energy mandates the purchase of all renewable energy. The Public Services Regulatory Commission (PSRC) sets tariffs, with projects like the Masrik-1 solar plant securing a very competitive tariff of $0.0419 per kWh.

- Net Metering: The net metering limit has been increased to 500 kWh for legal entities, which further encourages solar adoption.

- Incentives & FEZs: Free Economic Zones (FEZs), such as the “Alliance” FEZ where LA Solar Factory operates, can offer significant tax and customs duty advantages for manufacturers. It’s well worth exploring the specific incentives for establishing new solar manufacturing operations.

SWOT Analysis: Armenia for Solar Module Manufacturing

Strengths

- Abundant solar irradiation (1,720 kWh/m² avg.)

- Strong government support for renewable energy

- Growing domestic & regional solar market

- Existing manufacturing base (Solaron, LA Solar)

- Competitive labor costs for certain roles

- Established Free Economic Zones

Weaknesses

- High import reliance on raw materials & key components

- Potential skilled labor gaps in specialized solar manufacturing

- Developing local supply chain for specialized inputs

- Landlocked geography impacting logistics costs

Opportunities

- Development of local upstream industries (e.g., components)

- Export potential to regional markets

- Job creation & economic diversification

- Contribution to national energy independence

- Leveraging “Made in Armenia” brand for quality

Threats

- Global supply chain disruptions & price volatility

- Regional competition from established manufacturing hubs

- Economic instability or shifts in policy

- Brain drain of skilled technical labor

Future Development and Building a Robust Ecosystem

So, what’s next? For Armenia to truly capitalize on its solar manufacturing potential, a few key areas warrant focus:

- Localizing Supply Chains: Strategic investments and initiatives are needed to encourage the local production of key components (like junction boxes and encapsulants) and raw materials (such as solar-grade silicon, glass, and aluminum frames). This would reduce import dependency and create more value within the country.

- Research & Development: Fostering R&D in solar technologies can help Armenian manufacturers stay competitive and develop innovative products for a global market.

- Vocational Training: Expanding and tailoring vocational training programs to the specific needs of the solar manufacturing industry will be crucial for building a highly skilled workforce. This includes dedicated training for technicians, engineers, and quality control specialists.

Conclusion: Is Armenia Ripe for Solar Manufacturing Expansion?

So, what’s the verdict? Armenia presents a compelling—if still developing—landscape for solar module manufacturing. The nation clearly benefits from high solar irradiation, strong governmental backing for renewables, and a solid precedent set by existing local manufacturers. Labor costs are competitive, and there is a foundational workforce that, with targeted training, can absolutely support industry growth.

However, prospective investors and entrepreneurs must navigate the challenges with eyes wide open. The primary hurdles are the heavy reliance on imports for raw materials and specialized components and the need to cultivate a deeper pool of labor skilled in advanced solar manufacturing. Logistics in a landlocked country also require careful, strategic planning.

Ultimately, the success of ventures like LA Solar Factory, particularly its impressive export achievements, demonstrates that these challenges are surmountable. By focusing on operational efficiency, strategic sourcing, workforce development, and leveraging available government support, establishing a solar module production line in Armenia is a viable and potentially rewarding endeavor. It’s an opportunity not just for business success, but also to contribute meaningfully to Armenia’s sustainable energy future and its continued economic development.

Want to learn more or need expert help? Visit our free e-course or explore our services. Or, if you’re ready to dive deeper, our Premium Business Plan E-Course offers personalized guidance to get your venture off the ground. Let’s make your solar journey smooth and successful.

Frequently Asked Questions (FAQs)

Q1: What is the average wage for a manufacturing worker in Armenia?

A1: As of April 2024, the average wage in Armenia’s manufacturing sector was approximately 237,373 AMD per month. The national minimum wage is 75,000 AMD per month (effective January 2025). Daily rates for semi-skilled workers are around 6,000-8,000 AMD, and for skilled workers, 9,000-15,000 AMD.

Q2: Does Armenia have local sources for solar panel raw materials?

A2: Currently, Armenia heavily relies on imports for most critical raw materials like solar-grade silicon, wafers, specialized glass, aluminum frames, and encapsulants. While there is industrial capacity that could potentially be developed, it is not yet realized for solar-grade applications.

Q3: What government incentives are available for solar manufacturing in Armenia?

A3: The Armenian government actively supports renewable energy through policies like feed-in tariffs, net metering schemes, and the Law on Energy Efficiency and Renewable Energy. Furthermore, operating within a Free Economic Zone (FEZ) can offer significant tax breaks and customs duty exemptions. Investors should explore specific incentives with relevant government agencies.

Q4: What is the solar energy potential in Armenia?

A4: Armenia has excellent solar energy potential, with an average annual solar energy flow of 1,720 kWh per square meter—considerably higher than the European average. The country is aiming to have 1,000 MW of installed solar capacity by 2040.

References

All references

- Trading Economics. (n.d.). Armenia Labor Force Total. Retrieved from https://tradingeconomics.com/armenia/labor-force-total-wb-data.html

- Trading Economics. (n.d.). Armenia Labor Force Participation Rate. Retrieved from https://tradingeconomics.com/armenia/labor-force-participation-rate

- CEIC Data. (n.d.). Armenia Labour Force Participation Rate. Retrieved from https://www.ceicdata.com/en/indicator/armenia/labour-force-participation-rate

- Moody’s Analytics. (n.d.). Armenia – Labor Force. Retrieved from https://www.economy.com/armenia/labor-force

- Armenian Lawyer. (n.d.). Armenia Recruitment & Salary Trends 2025. Retrieved from https://armenian-lawyer.com/business-immigration/armenia-recruitment-salary-trends-2025/

- Trading Economics. (n.d.). Armenia Wages in Manufacturing. Retrieved from https://tradingeconomics.com/armenia/wages-in-manufacturing

- PVknowhow.com. (n.d.). Armenia Solar Report. Retrieved from https://www.pvknowhow.com/solar-report/armenia/

- SolarFeeds. (n.d.). Solar Panel Manufacturers in Armenia. Retrieved from https://www.solarfeeds.com/solar-panel/manufacturers/c/armenia

- TÜV Rheinland. (n.d.). PV Supply Chain Services in Armenia. Retrieved from https://www.tuv.com/armenia/en/pv-supply-chain-services.html

- CND Clean Energy. (2022). Armenia Solar Energy Market. Retrieved from https://www.cndcleanenergy.com/20220429-2/

- R2E2 Fund Armenia. (n.d.). Task 3 Solar PV Final Report. Retrieved from https://old.r2e2.am/wp-content/uploads/2017/06/Task-3-Solar-PV-Final_Report_eng.pdf

- Solaron. (n.d.). Homepage. Retrieved from https://www.solaron.am/en/

- LA Solar Factory. (n.d.). Homepage. Retrieved from https://lasolarfactory.com/en

- EBRD. (2024). Armenian LA Solar expands with EBRD support. Retrieved from https://www.ebrd.com/home/news-and-events/news/2024/armenian-la-solar-expands-with-ebrd-support.html

- Wikipedia. (n.d.). Solar power in Armenia. Retrieved from https://en.wikipedia.org/wiki/Solar_power_in_Armenia

- ADB. (n.d.). Promoting Low-Emission Energy Production and Consumption in Armenia. Retrieved from https://www.adb.org/sites/default/files/publication/1046801/adbi-solar-energy-all-promoting-low-emission-energy-production-and-consumption-armenia.pdf

- OECD. (n.d.). Special Report on Solar PV Global Supply Chains. Retrieved from https://www.oecd.org/en/publications/special-report-on-solar-pv-global-supply-chains_9e8b0121-en.html

- Logistics Cluster. (n.d.). Armenia Manual Labor Costs. Retrieved from https://lca.logcluster.org/33-armenia-manual-labor-costs

- WageIndicator.org. (n.d.). Armenia Minimum Wage. Retrieved from https://wageindicator.org/salary/minimum-wage/armenia

- Trading Economics. (n.d.). Armenia Minimum Wages. Retrieved from https://tradingeconomics.com/armenia/minimum-wages