Investing in Austria’s Solar Future: A Comprehensive Guide for Solar Manufacturing Ventures

Austria’s ambitious push toward a green energy future opens up a significant opportunity for investors in the solar manufacturing sector. With clear national targets for renewable energy and a supportive policy framework, the nation is actively cultivating an environment ripe for growth. For entrepreneurs and investors considering this dynamic market, a clear understanding of Austria’s business climate is essential. This guide offers an in-depth look at what makes Austria a prime location for solar manufacturing investments.

Table of Contents

Your solar success, simplified. Need expert assistance?

Our services deliver. Crave deep industry knowledge? Our Premium Course provides it. We’re committed to making your solar journey profitable and straightforward.

Understanding Austria’s Appeal for Solar Investment

Austria’s commitment to achieving 100% renewable electricity by 2030 and climate neutrality by 2040 is the driving force behind its solar energy expansion. This national strategy extends beyond environmental goals to encompass economic growth, energy independence, and technological innovation.

Investors looking to establish solar module production lines will find a market defined by:

- Strong governmental support

- Rising demand

- A robust economic framework

Austria’s Macro-Economic Landscape & Business Environment

Austria’s stable and prosperous economy creates a secure environment for long-term investments. The country consistently ranks well in global business climate surveys, reflecting its political stability and reliable legal framework.

While **administrative processes** like permitting require diligence, the overall environment is favorable for business development. A notable advantage for energy-intensive manufacturing is the high power grid availability, which stands at 99.99%.

The U.S. Department of State’s investment climate statements also affirm Austria’s openness to foreign investment, highlighting its central European location and skilled workforce.

The Austrian Solar Market: Demand & Growth Trajectory

Demand for solar photovoltaic (PV) systems in Austria is rising sharply. By the end of 2023, Austria had an installed solar PV capacity of approximately 6.4 gigawatts (GW). Projections indicate this figure could reach nearly 10 GW by 2029, with an ambitious target of over 11 GW by 2030. This growth is fueled by several factors:

- National Renewable Energy Targets: The government’s clear goals drive consistent demand.

- Residential Sector Boost: A VAT exemption for small PV systems (up to 35 kWp) introduced in 2024 has significantly stimulated residential installations.

- Commercial and Industrial Demand: Businesses are increasingly adopting solar to manage energy costs and meet sustainability targets.

- Utility-Scale Projects: The development of large solar parks is gaining momentum, supported by policies allowing investment subsidies to be combined with Power Purchase Agreements (PPAs) for projects over 1 MW.

This burgeoning demand creates a substantial domestic market for locally manufactured solar panels and components.

Government Support & Regulatory Framework for Solar Manufacturing

The Austrian government has put several measures in place to encourage investment in renewable energy, particularly in local manufacturing.

The Renewable Energy Expansion Act (EAG)

This cornerstone legislation simplifies administrative procedures and sets clear expansion targets for renewables, providing a predictable framework for investors.

The “Made in Europe” Bonus

A key initiative is the “Made in Europe” bonus, effective from June 2025, which offers a 20% uplift to government funding for PV and storage projects that use European components. An initial €60 million has been allocated for this bonus in 2025, an amount designed to directly strengthen the European and Austrian solar manufacturing sectors.

Other Financial Incentives

- Various investment subsidies, grants, and potentially tax incentives for manufacturing enterprises.

- The European Investment Bank (EIB) as a key source of co-financing for renewable energy projects and related infrastructure.

Permitting and Licensing

While Austria is business-friendly, securing permits and licenses for manufacturing facilities involves a detailed process. Investors will need to budget sufficient time and resources to navigate these requirements. Environmental regulations are aligned with EU standards, ensuring a high level of environmental protection.

Austria’s Solar Manufacturing Ecosystem & Supply Chain

Austria already has a solid solar manufacturing ecosystem. Companies active in module production include:

- Kioto Photovoltaics

- Energetica Industries

- DAS Energy

- Ertex-Solartechnik

Additionally, Austria is home to Fronius International, a major global inverter manufacturer that produced 4.15 GW of inverters in 2022.

In 2022, domestic module production stood at 208.3 MW, with over half of this output being exported—highlighting its existing capacity and internationally recognized quality.

While a comprehensive local supply chain for all raw materials and sub-components is still developing, the presence of established manufacturers and a strong industrial base offers a solid foundation.

The country’s excellent logistics and transport infrastructure, centrally located in Europe, ensures the smooth flow of goods and materials. Austria also hosts reputable R&D institutions and innovation hubs that support advancements in solar technology and drive continuous improvement.

Operational Considerations for Solar Manufacturing Investors

Several operational factors make Austria an attractive location for solar manufacturing:

Labor Market

Austria offers a highly skilled and educated workforce, with engineers and technicians vital to advanced manufacturing.

- Average salaries in the solar industry typically range from approximately €4,290 to €4,687 per month.

- Labor laws are well-defined, providing clarity for employers.

Energy Costs

Electricity prices are a key consideration for industrial consumers:

- Recent estimates place industrial costs at around €0.24 per kilowatt-hour (kWh).

- Renewable energy sourcing options for factory operations are increasingly available.

Land and Real Estate

- Factory rental costs can start from around €6.87 per square meter per month, varying by location and facility specifications.

Other Operational Costs

- In Vienna, industrial water costs approximately €2.33 per cubic meter, plus wastewater fees.

Financial Landscape: Funding and Investment Support

Access to finance is critical for large-scale manufacturing projects. The European Investment Bank (EIB) is a major financial partner, increasing its funding to Austria to nearly €1.7 billion in 2024. A substantial 64% of this amount is dedicated to climate action and green projects, including support for solar initiatives.

National promotional banks and various public funds are also available to support strategic industries and investments in renewable energy. Meanwhile, private equity and venture capital interest in the clean-tech sector continues to grow.

Competitive Analysis: Austria vs. Other European Locations

While several European nations are vying for solar manufacturing investments, Austria offers a compelling package. Its “Made in Europe” bonus offers a direct financial advantage for projects using European content. The combination of a stable economy, a skilled workforce, strong R&D capabilities, high quality of life, and central European location makes it a competitive choice. The focus on quality and innovation within its existing manufacturing sector also bolsters its appeal.

Risk Assessment and Mitigation Strategies

Investors should be aware of potential challenges and plan accordingly:

Economic and Regulatory Shifts: While generally stable, policy adjustments can occur. For instance, overall government funding for renewables in 2025 is anticipated to be lower than in 2024, shifting toward more targeted support like the “Made in Europe” bonus. Staying informed about policy developments is crucial.

Supply Chain Vulnerabilities: Global supply chains for certain raw materials and components can be volatile. The “Made in Europe” initiative aims to mitigate this by fostering regional supply chains, but robust procurement strategies are essential.

Grid Integration and Curtailment: As renewable energy generation increases, grid capacity and stability become crucial. Austria has experienced some curtailment of renewable energy (57.4 GWh reported in early 2024), and securing grid connection permits can sometimes be a lengthy process. However, Austria is actively investing in grid expansion and modernization to address these challenges.

Mitigation Strategies: Thorough due diligence, flexible business planning, diversification of suppliers, and proactive engagement with local authorities and grid operators can help mitigate these risks.

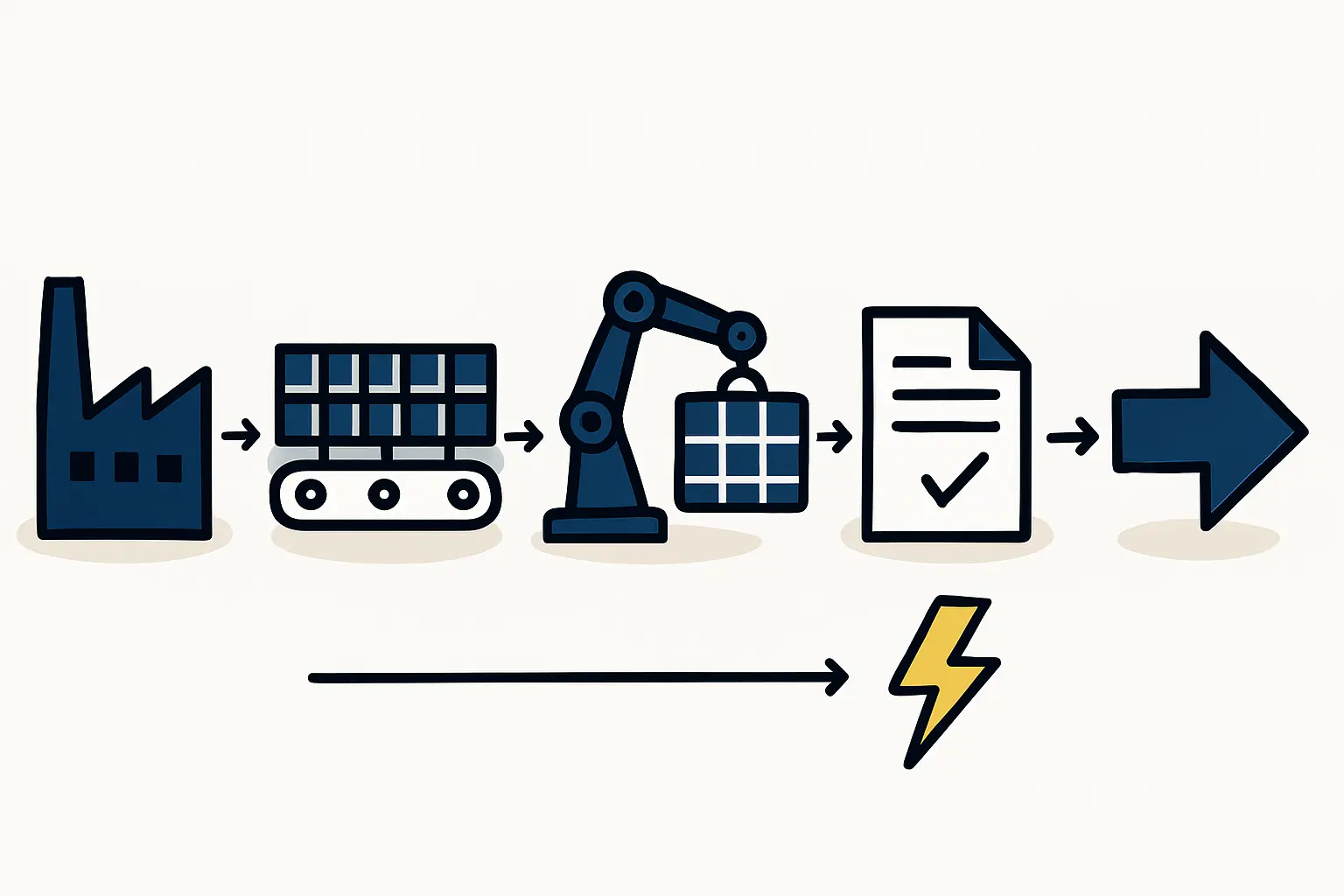

Setting Up Your Solar Manufacturing Plant in Austria: A Roadmap

Embarking on a solar manufacturing venture in Austria involves several key steps:

- Market Research and Due Diligence: Understand the market, competition, regulations, and incentives.

- Business Planning: Create a comprehensive plan with financial projections and a market entry strategy.

- Securing Funding: Explore financing options—EIB, national grants, private investment.

- Site Selection: Consider logistics, infrastructure, labor, and cost.

- Permitting and Licensing: Engage with relevant authorities early to understand and navigate the application processes.

- Building Local Partnerships: Connect with local suppliers, industry associations (like Photovoltaic Austria), and service providers. Government agencies such as ABA – Invest in Austria can provide valuable assistance to foreign investors.

Conclusion: Seizing the Austrian Solar Manufacturing Opportunity

Austria offers a robust and supportive environment for investors looking to establish or expand solar module manufacturing operations. The nation’s strong commitment to renewable energy, coupled with specific incentives like the “Made in Europe” bonus, creates a favorable business climate. While challenges exist, as they do in any market, the proactive approach of the Austrian government, its stable economy, skilled workforce, and growing demand for solar products present a compelling case.

For entrepreneurs ready to contribute to Europe’s clean energy transition while building a successful manufacturing enterprise, Austria stands out as a compelling choice. With careful planning and strategic execution, your venture can thrive in the heart of Europe’s burgeoning solar industry.

Frequently Asked Questions (FAQs)

What are the main challenges for solar manufacturers in Austria?

Key challenges include navigating the permitting process, which can be time-consuming; managing potential grid constraints as renewable capacity grows (though these are being addressed); and ensuring a resilient supply chain for raw materials. Competition from established global manufacturers is also a factor.

How does Austria’s “Made in Europe” bonus work?

The “Made in Europe” bonus offers a 20% financial uplift on government funding for solar PV and energy storage projects that demonstrably use European components. It is designed to incentivize local and European manufacturing, with an initial budget of €60 million allocated for 2025. Specific eligibility criteria and application processes will be defined by the relevant government bodies.

What is the outlook for skilled labor in Austria’s solar sector?

Austria has a well-educated and skilled workforce, including engineers and technicians. The growing renewable energy sector is also driving demand for specialized skills. While competition for talent exists, the country’s strong vocational training system and universities help ensure a steady supply of qualified professionals.

How complex is the permitting process for new factories?

The permitting process for industrial facilities in Austria is thorough and involves multiple authorities to ensure compliance with environmental and safety standards. While it can be complex and require detailed documentation, it is a transparent process. Early engagement with local authorities and potentially seeking expert legal or consulting support is advisable.

What level of financial support is available beyond the “Made in Europe” bonus?

Various financial support mechanisms may be available, including general investment subsidies, R&D grants, and programs from national promotional banks. The European Investment Bank (EIB) is also a significant source of funding for large-scale renewable energy and industrial projects. The specific support available depends on the project’s scope, location, and innovation level.