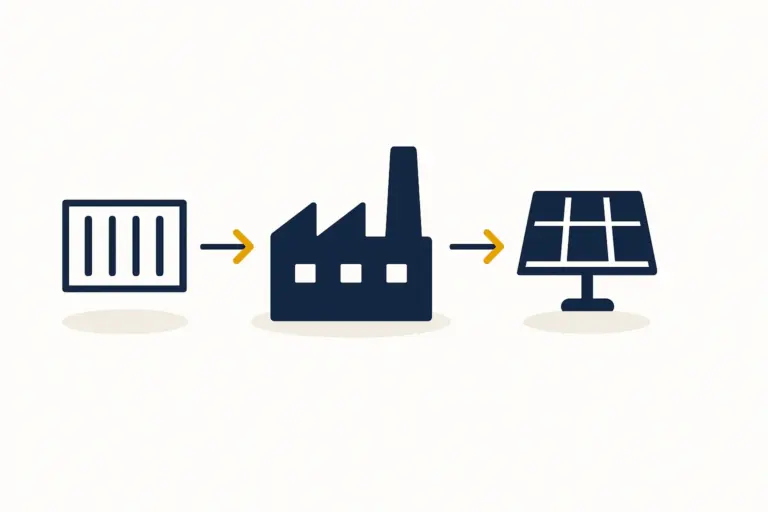

An entrepreneur planning to build a solar module manufacturing facility and contribute to the growing Bhutan manufacturing industry faces a critical question early on: where will the raw materials come from?

The vision for local, clean energy production may be clear, but the operation’s success hinges on a resilient and cost-effective supply chain. For a Bhutanese enterprise, the answer often lies just across the southern border.

This guide offers a strategic analysis of sourcing key solar components from India, exploring the opportunities this proximity creates and detailing the steps for navigating supplier selection, quality control, and logistics to build a robust manufacturing operation.

Table of Contents

The Strategic Advantage of Sourcing from India

Sourcing from India offers Bhutanese enterprises several distinct advantages. The most apparent is geographical proximity, which translates directly into lower transportation costs and shorter lead times compared to sourcing from East Asia or Europe.

The India-Bhutan trade relationship is also one of the strongest in the region. Governed by the South Asian Free Trade Area (SAFTA) agreement, trade between the nations benefits from significantly reduced tariffs, which substantially lowers the final cost of raw materials. With over 85% of Bhutan’s total imports already coming from India, logistics channels are well-established for handling cross-border freight.

India’s domestic solar manufacturing sector is expanding rapidly, driven by government incentives. Projections indicate that the country’s cell manufacturing capacity will exceed 30 GW by 2025, fostering a competitive and diverse supplier market for new entrants.

A Breakdown of Key Raw Materials and Indian Suppliers

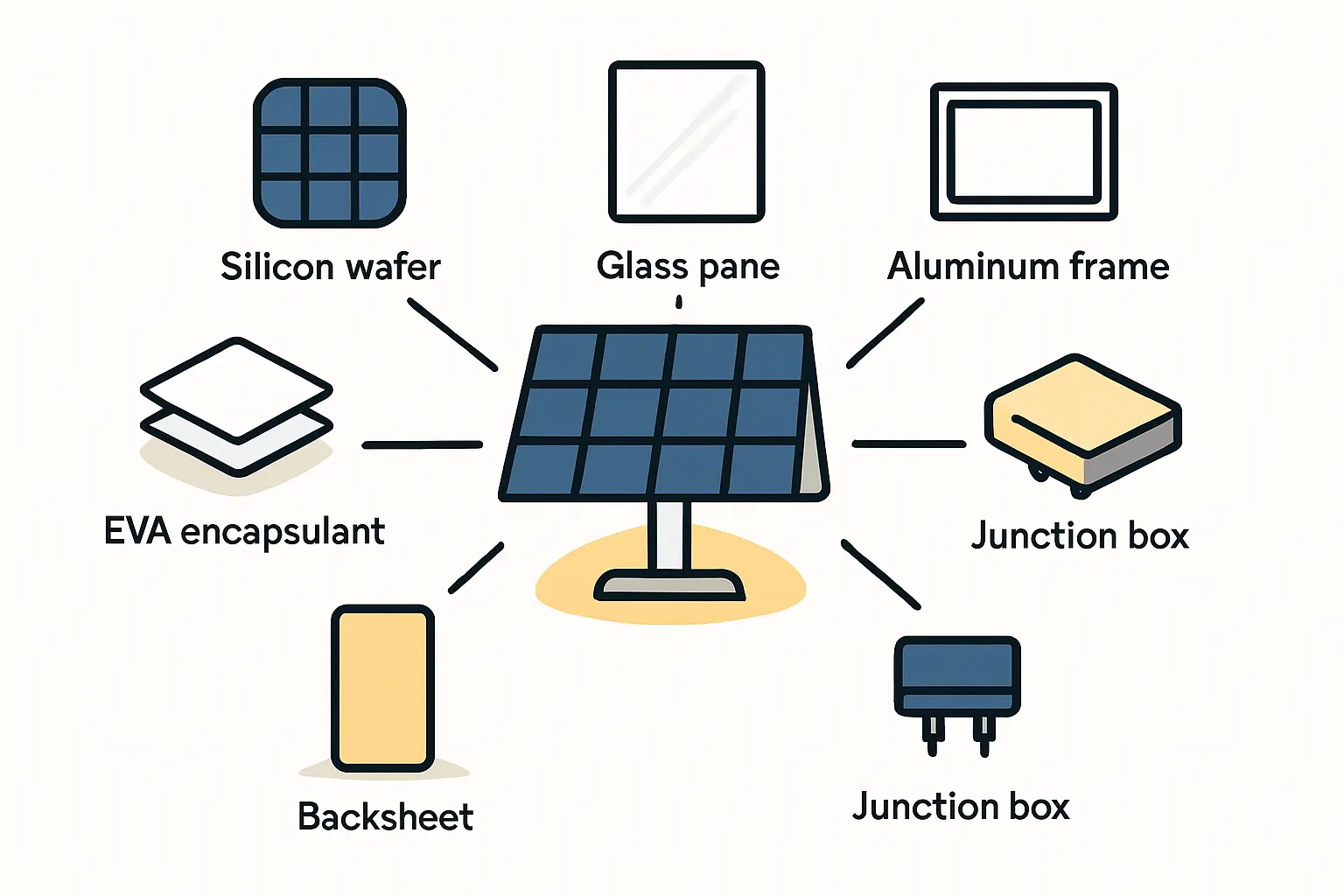

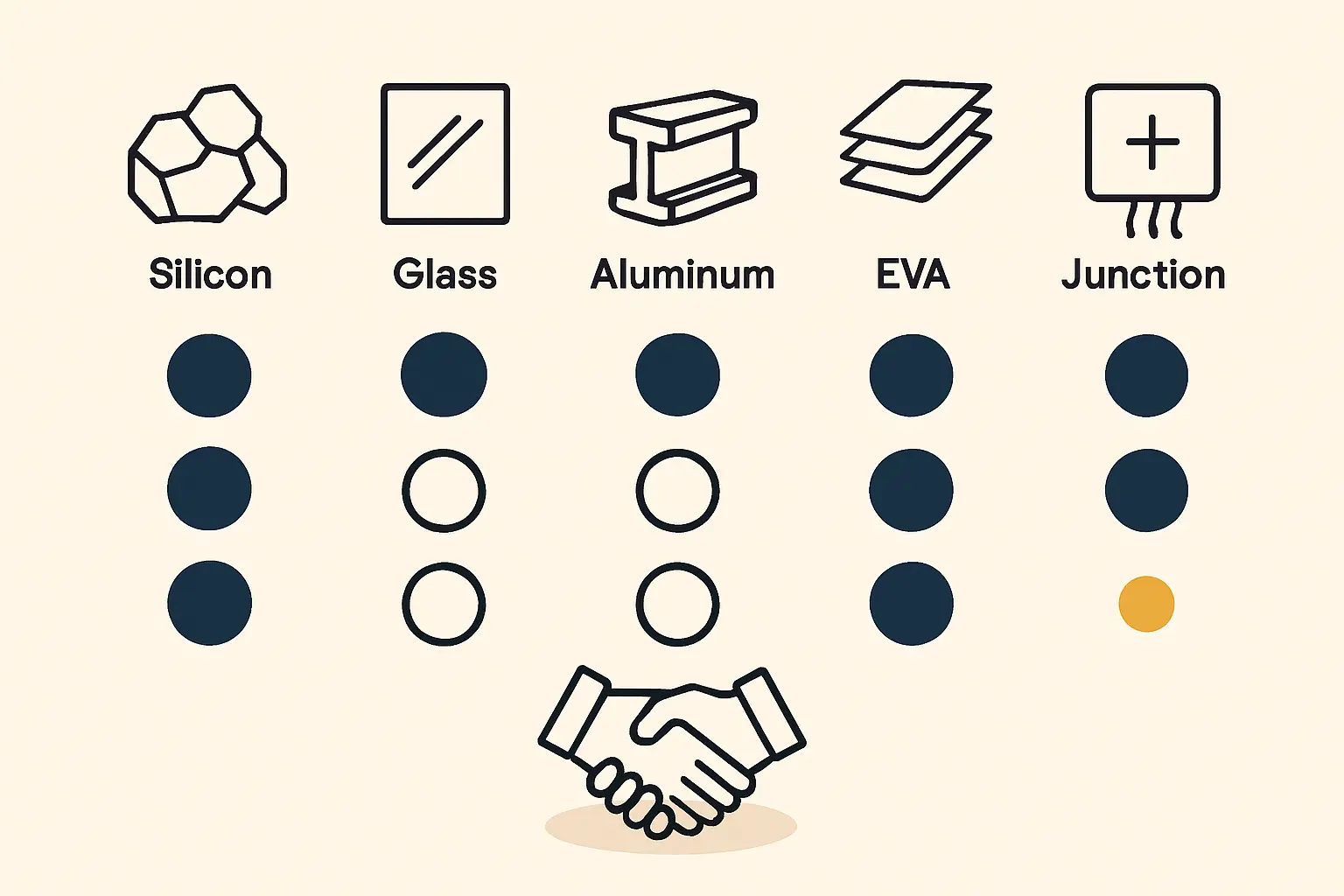

A solar module is assembled from several critical components. Building a successful sourcing strategy requires a clear understanding of each material and the landscape of Indian suppliers.

Solar Cells

The solar cell is the heart of the module, converting sunlight into electricity. The Indian market is home to several established cell manufacturers, including major players like Adani Solar, Waaree Energies, and Tata Power Solar.

When evaluating suppliers, focus on cell technology and efficiency. Most new production lines today use Mono-PERC or the more advanced TOPCon technologies. Understanding the differences between these solar cell technologies is critical to defining a product strategy. Request flash test data for sample cell batches to verify that their efficiency and electrical characteristics meet your planned module’s specifications.

Solar Glass

The front of a module is protected by high-transmission, low-iron tempered glass, typically 3.2 mm thick. This specialized glass is designed to maximize sunlight capture while withstanding harsh environmental conditions. Leading Indian suppliers like Borosil Renewables and Gujarat Guardian have dedicated production lines for solar glass.

Key quality parameters include the presence of an anti-reflective (AR) coating, light transmittance percentage, and compliance with IEC 61215 standards for impact resistance.

Aluminum Frames

The aluminum frame provides structural integrity and protects the laminate’s edges. These are typically sourced as pre-cut, anodized profiles ready for assembly, and numerous extrusion companies across India can supply them.

When sourcing frames, focus on the precision of the mitre cuts, the consistency of the anodization layer (typically 15 microns or more), and the correct placement of mounting and grounding holes. The design of the aluminum frame and junction box directly impacts module durability and ease of installation.

Encapsulants (EVA/POE) and Backsheets

Encapsulant films (EVA or POE) and a protective backsheet laminate the solar cells, providing electrical insulation and shielding them from moisture and UV radiation.

While Indian manufacturers produce these components, quality in this segment can vary significantly, requiring extra diligence during sourcing. Review third-party certifications (e.g., from TÜV Rheinland) and understand the material’s long-term degradation properties. Poor quality here can lead to module failure after just a few years in the field.

Navigating Logistics and Quality Control

A sourcing strategy is only as strong as its logistical execution and quality assurance framework.

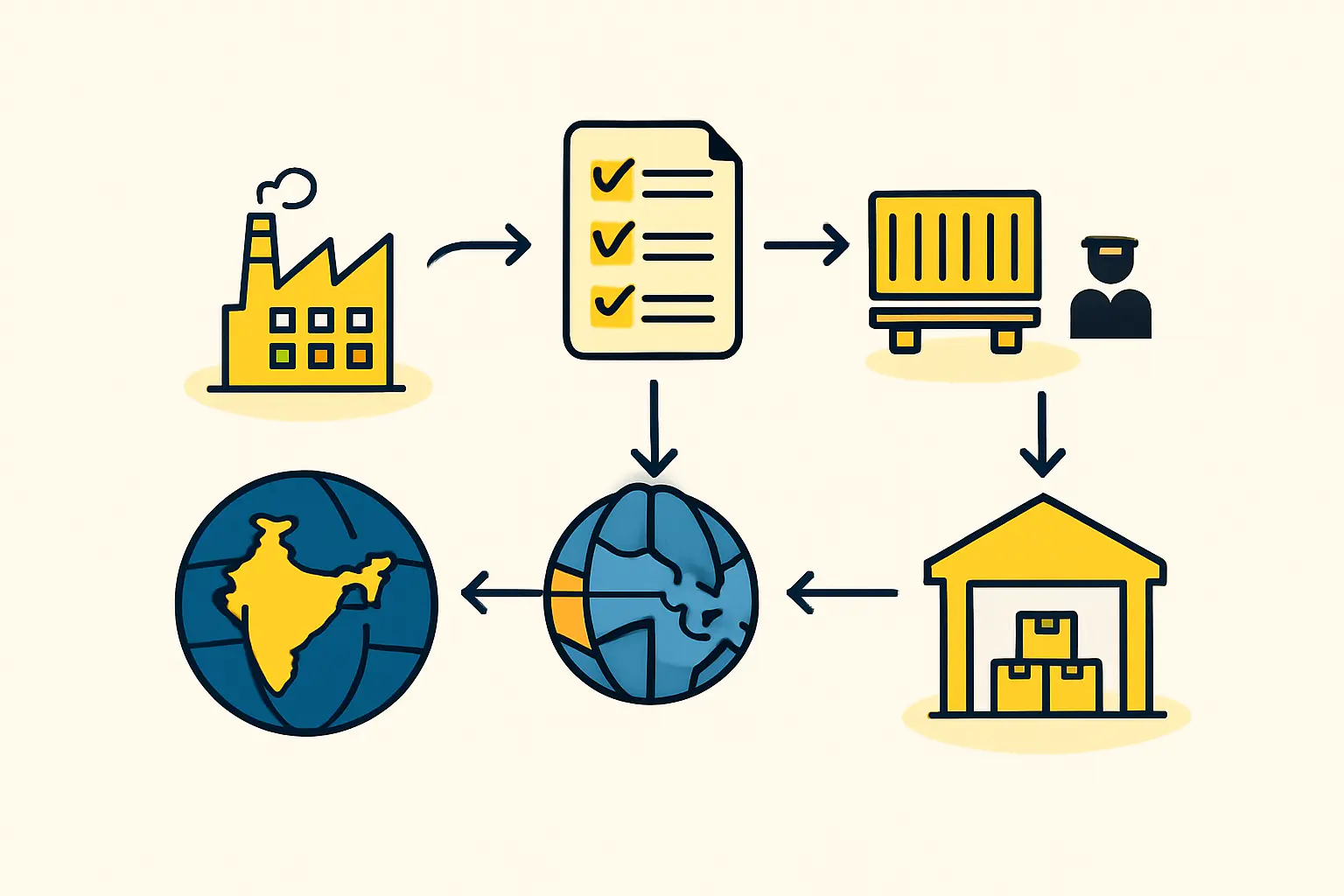

Logistics from India to Bhutan

The primary land route for goods entering Bhutan from India runs through the commercial hub of Phuentsholing. Most materials travel by road from manufacturing clusters in states like Gujarat, Maharashtra, and Telangana to logistics hubs in West Bengal, such as Siliguri or Jaigaon, before making the final leg of the journey.

Potential challenges include delays at the border crossing during peak times and transportation disruptions during the monsoon season (typically June to September). Partnering with a reliable freight forwarding company that has specific expertise in India-Bhutan customs clearance is crucial.

Quality Assurance: A Non-Negotiable Step

The quality of raw materials directly determines the final product’s performance, reliability, and bankability. A single substandard batch of cells or encapsulant can compromise an entire week of production. A robust quality control process is an investment, not an expense.

This process should include three key stages:

- Supplier Vetting: Before signing a contract, request and verify all relevant material certifications (IEC, UL) and, if possible, arrange a third-party factory audit.

- Pre-Shipment Inspection: For large orders, hiring an inspection service in India to check materials before they are dispatched can prevent costly rejections.

- Incoming Goods Inspection: At your factory in Bhutan, inspect all incoming materials against a checklist to confirm they meet the specifications in the purchase order.

Cost Management and Supplier Negotiation

For a typical 20–50 MW solar factory, raw materials can account for 70–80% of the final module cost per watt. Effective procurement and cost management are central to profitability.

When negotiating with Indian suppliers, the best strategy balances cost with reliability. While spot-buying may occasionally offer lower prices, establishing long-term agreements with two or three vetted suppliers for each key component can secure more stable pricing and guarantee supply.

It’s also important to stay informed about Indian industrial policies, like the Production Linked Incentive (PLI) scheme, as they can influence supplier capacity and pricing. A 5% reduction in sourcing costs through strategic negotiation can significantly impact the business’s bottom line.

Frequently Asked Questions (FAQ)

Q: Can I source all materials from a single supplier in India?

A: It’s highly unlikely. Most Indian manufacturers specialize in one or two components (e.g., cells or glass). A successful strategy is to build relationships with a portfolio of specialized suppliers. This diversification also mitigates the risk of production stoppages due to an issue with a single provider.

Q: What are the main import duties or taxes for sourcing from India to Bhutan?

A: Under the SAFTA agreement, most goods traded between India and Bhutan have zero or very low customs duties. However, there will still be local taxes and administrative fees. Consulting with a Bhutanese customs house agent is essential for a precise calculation based on your specific bill of materials.

Q: How can I verify a supplier’s quality claims from Bhutan?

A: Verification is a multi-step process. Start by requesting all technical datasheets and third-party certification documents. For critical materials like solar cells, order a small sample batch for in-house testing. Finally, for major supply contracts, hiring a reputable third-party inspection agency based in India to audit the factory and inspect goods before shipment is a best practice.

Q: Is it better to source from China or India for a factory in Bhutan?

A: Both options have trade-offs. India offers significant logistical advantages due to its shared land border, lower freight costs, and faster delivery times. Sourcing from China may offer a wider selection or potentially lower ex-factory prices for some components, but these benefits are often offset by higher shipping costs, longer lead times, and more complex customs procedures. For a new enterprise in Bhutan, the simplicity and speed of an Indian supply chain are compelling advantages.

Conclusion and Next Steps

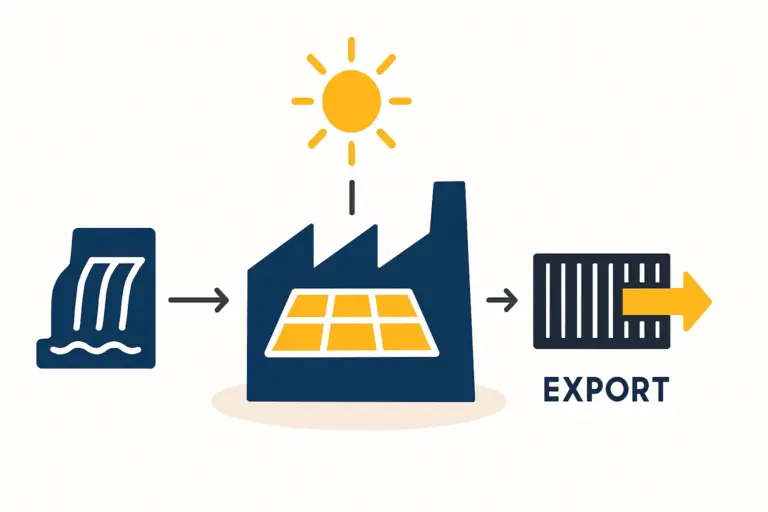

For entrepreneurs in Bhutan, India represents a powerful and strategic sourcing hub for a solar module manufacturing plant. The combination of geographical proximity, a favorable trade agreement, and a growing domestic manufacturing base creates a strong foundation for a resilient supply chain.

Success, however, depends on a diligent, structured approach. Careful supplier vetting, strict quality assurance protocols, and smart logistics planning are the pillars that turn this geographical advantage into a competitive business reality.

Developing a comprehensive supply chain map and bill of materials is a foundational step toward a bankable business plan. To get started, explore the free pvknowhow.com e-learning course, which offers dedicated modules that guide new entrepreneurs through these and other critical planning stages for starting a solar factory.