An investor secures funding, identifies a market, and drafts a comprehensive business plan for a new solar module factory—a project that seems sound on paper. Yet, operations are unexpectedly halted for hours each month, damaging sensitive equipment and wasting significant material. The overlooked factor isn’t market demand or financing; it’s the fundamental reliability of the local power grid—a detail that can make or break a manufacturing venture.

This scenario highlights a critical due diligence step for any entrepreneur considering Bolivia’s solar production industry. While the nation offers considerable opportunity, a thorough assessment of its core infrastructure—specifically its power and water supply—is essential. This guide provides a technical overview of Bolivia’s industrial infrastructure, helping potential investors grasp the operational realities and plan accordingly.

Table of Contents

The Critical Role of Power Grid Stability in Manufacturing

Continuous, high-quality electrical power is the lifeblood of a solar module production line. Any interruption can halt automated processes, compromise quality, and lead to costly downtime. That makes understanding the structure and performance of Bolivia’s national grid a top priority.

Understanding Bolivia’s National Interconnected System (SIN)

Bolivia’s electricity is managed by the state-owned Ende (Empresa Nacional de Electricidad) Corporación, which operates the National Interconnected System (SIN). The SIN supplies power to the majority of the country’s industrial and residential centers.

According to recent national data, Bolivia’s energy matrix relies heavily on thermal generation, which accounts for approximately 56% of its power. While the government has ambitious goals to shift towards renewables by 2025, investors must plan based on the current infrastructure. This reliance on fossil fuels can expose a business to fluctuating energy costs, a key variable in any financial projection.

Key Metrics for Assessing Grid Reliability

To move from a general overview to a specific risk assessment, investors rely on two key performance indicators used globally to measure grid stability:

- SAIDI (System Average Interruption Duration Index): This measures the total duration of power outages per customer over a year. For Bolivia, the national average SAIDI is approximately 15.68 hours.

- SAIFI (System Average Interruption Frequency Index): This measures the average number of interruptions a customer experiences. The national average SAIFI is around 17.38 interruptions per year.

For a manufacturing business, these are not just statistics; they represent tangible risk. A SAIDI of over 15 hours means that, on average, a facility could be without power for nearly two full business days each year. In processes like lamination, where a sudden power loss can destroy all modules currently in the machine, the financial impact of a single interruption is significant. There is also a notable disparity between urban centers, which tend to have a more stable supply, and rural areas, where interruptions are more frequent and prolonged.

A comprehensive solar panel manufacturing business plan must address these realities. The initial investment should include provisions for a robust backup power system, such as an Uninterruptible Power Supply (UPS) for sensitive electronics and diesel generators capable of running the entire production line for extended periods.

Securing a Reliable Water Supply for Production

While power is a primary concern, water is an equally critical resource for solar module manufacturing. It is used extensively for cleaning solar glass—a crucial step for ensuring module quality and efficiency—and for cooling machinery.

Bolivia’s Hydrological Challenges and Opportunities

Bolivia’s geography creates a complex water landscape. The high-altitude Altiplano region, which includes major cities like La Paz and El Alto, is semi-arid and heavily dependent on glacial melt for its water supply. Climate change is accelerating the retreat of these glaciers, posing a long-term risk to water security in the region. The 2016 water crisis in La Paz serves as a stark reminder of this vulnerability.

In contrast, the Amazonian lowlands in the east experience high rainfall and have abundant water resources. This geographical variance makes site selection a deeply strategic decision. Building a factory near a seemingly convenient urban center in the Altiplano could introduce long-term water scarcity risks that would not exist in a region like Santa Cruz.

Water Requirements and Mitigation Strategies

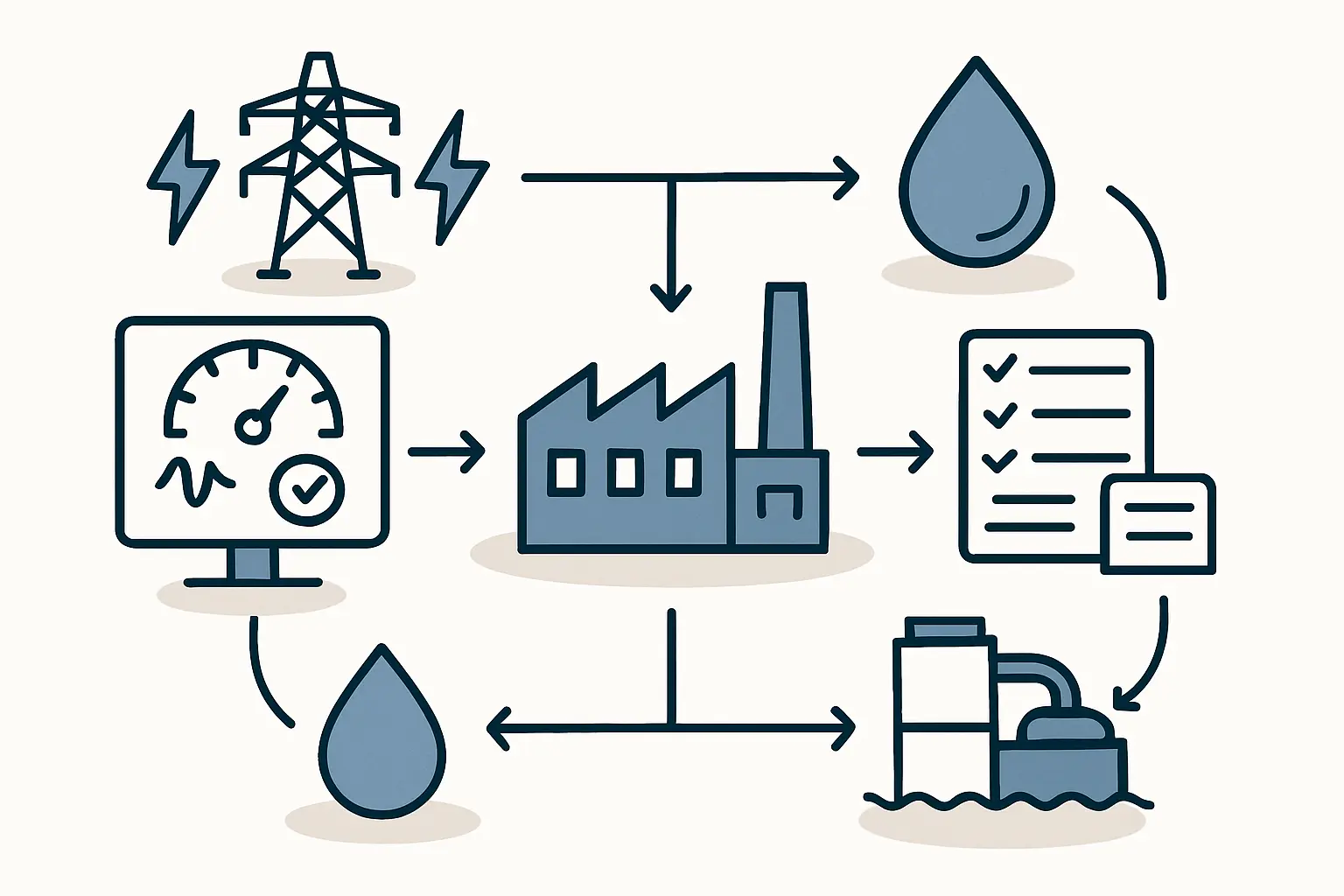

A typical 50 MW solar factory can consume a significant volume of water daily. The purity required for cleaning glass also means that raw municipal or groundwater is often insufficient without treatment.

Investors must investigate not only the availability of water but also its quality and the reliability of the municipal supply. Given the potential for scarcity and rationing, reducing reliance on the local supply by investing in an on-site water treatment and recycling system is a forward-thinking approach. Such a system can capture, purify, and reuse a majority of the water from the production process, drastically lowering consumption and insulating the operation from external water shortages. The initial capital outlay for this equipment is a prudent investment in operational continuity—a key component of the overall solar factory requirements.

Integrating Infrastructure into Your Business Plan

The stability of power and water are not minor operational details; they are foundational pillars of a successful manufacturing enterprise. A feasibility study for a turnkey solar production line in Bolivia must include a detailed, site-specific analysis of this infrastructure. This analysis must go beyond national averages and require direct engagement with local utility providers to understand the performance of the grid and water mains in the precise industrial zone being considered.

The findings from this assessment will directly influence the cost to start solar panel manufacturing, as they will determine the necessary investment in backup generators, water recycling systems, and other essential risk-mitigation equipment. By addressing these factors proactively, an investor can build a resilient operation capable of thriving in Bolivia’s growing market.

Frequently Asked Questions (FAQ)

Q1: How much backup power is needed for a 50 MW solar production line?

A 50 MW production line has significant power requirements. A complete backup system would typically require multiple industrial-grade diesel generators with a combined capacity sufficient to run all critical machinery—including stringers, laminators, and testing equipment—simultaneously. A detailed energy audit during the planning phase is necessary to specify the exact size and configuration.

Q2: What are the first steps in conducting a site-specific infrastructure assessment?

The first step is to identify potential industrial zones for the factory. An investor should then formally contact the regional electricity and water utility providers to request historical performance data for those specific locations. It’s also wise to consult with existing industrial businesses in the area to understand their real-world experience with utility reliability. This process is often managed by a technical consultancy like J.v.G. Technology GmbH as part of a detailed feasibility study.

Q3: Can a solar factory operate on 100% recycled water?

While achieving 100% is challenging due to evaporation and process losses, advanced water recycling systems can recover and reuse over 90% of the water used in production. This dramatically reduces the factory’s dependence on external sources and is a highly recommended strategy, especially in water-scarce regions.

Q4: How do infrastructure costs impact the total investment?

The cost of backup power and water treatment systems can be a considerable part of the initial capital expenditure. However, this investment should be viewed as a form of insurance against the much larger financial losses that would result from production downtime, material waste, and equipment damage. Factoring these costs in from the beginning leads to a more accurate and realistic business plan.