For entrepreneurs in the solar manufacturing industry, choosing a location is a critical decision. It goes far beyond simple geography, requiring a careful evaluation of the economic stability, regulatory framework, and strategic incentives that can either accelerate growth or create unforeseen obstacles.

Botswana, with its strategically developed Special Economic Zones (SEZs) designed to attract and support new industrial ventures, presents a compelling option for those looking into African investment opportunities.

This article explores how Botswana’s SEZ framework creates an advantageous environment for establishing a solar module manufacturing facility. We will examine the financial incentives, regulatory support, and infrastructure available to investors, highlighting the opportunity within this stable and forward-looking African nation.

Table of Contents

Understanding Special Economic Zones: A Strategic Overview

A Special Economic Zone is a geographically demarcated area within a country where business and trade laws differ from the rest of the nation. SEZs are primarily designed to increase foreign investment, boost exports, and create jobs by offering a highly attractive operational environment.

In Botswana, the establishment of SEZs is a cornerstone of Vision 2036, a long-term national strategy aimed at transforming the country into a high-income, export-led economy. These zones represent a sustained government commitment—not just a temporary program—to foster industrial growth in targeted sectors, including renewable energy and advanced manufacturing. For a new business owner, this offers a level of predictability and state support that is essential for long-term planning.

Key Advantages of Botswana’s SEZs for Manufacturers

Investors in Botswana’s designated SEZs gain access to a range of benefits designed to reduce initial capital outlay, minimize tax burdens, and streamline administrative processes.

Favorable Tax and Financial Incentives

The financial structure of the SEZs is arguably their most significant draw. The government offers a clear and highly competitive fiscal regime designed to attract serious investment. Key incentives include:

-

Reduced Corporate Tax: Companies operating within an SEZ benefit from a corporate income tax rate of just 5% for the first ten years of operation. Thereafter, the rate is set at a highly competitive 10%.

-

Customs and Duty Exemptions: All raw materials and manufacturing equipment imported for use within the SEZ are exempt from customs duties. This significantly lowers the initial setup cost for a solar module production line.

-

No Capital Gains Tax: The disposal of property acquired for the business is exempt from capital gains tax, providing greater financial flexibility for future growth or restructuring.

These measures directly address the primary financial concerns of any new manufacturing venture, preserving capital and improving the project’s financial viability from day one.

Streamlined Regulatory Environment

Navigating bureaucracy is a common challenge when establishing a business in a new country. Botswana’s SEZs address this directly through One-Stop Service Centres (OSSCs).

These centres serve as a single point of contact for investors, consolidating the processes for securing permits, licenses, and other necessary approvals. This centralized approach dramatically reduces administrative delays, allowing business leaders to focus on core operational matters like factory setup and supply chain development instead of navigating complex bureaucracy.

Developed Infrastructure and Logistics

Botswana’s government has invested significantly in reliable, high-quality infrastructure for its SEZs, including power grids, water supply, and transportation networks that connect the zones to national and regional corridors.

Several SEZs are positioned to support manufacturing and export activities:

-

Selebi Phikwe SEZ: Designated for manufacturing and base metal beneficiation, this zone is well-suited for a solar panel factory.

-

Sir Seretse Khama International Airport (SSKIA) SEZ: Located near the capital, Gaborone, this zone is ideal for logistics, warehousing, and businesses requiring rapid air freight access.

The strategic placement of these zones ensures that a manufacturer can produce goods efficiently and export them seamlessly to regional markets.

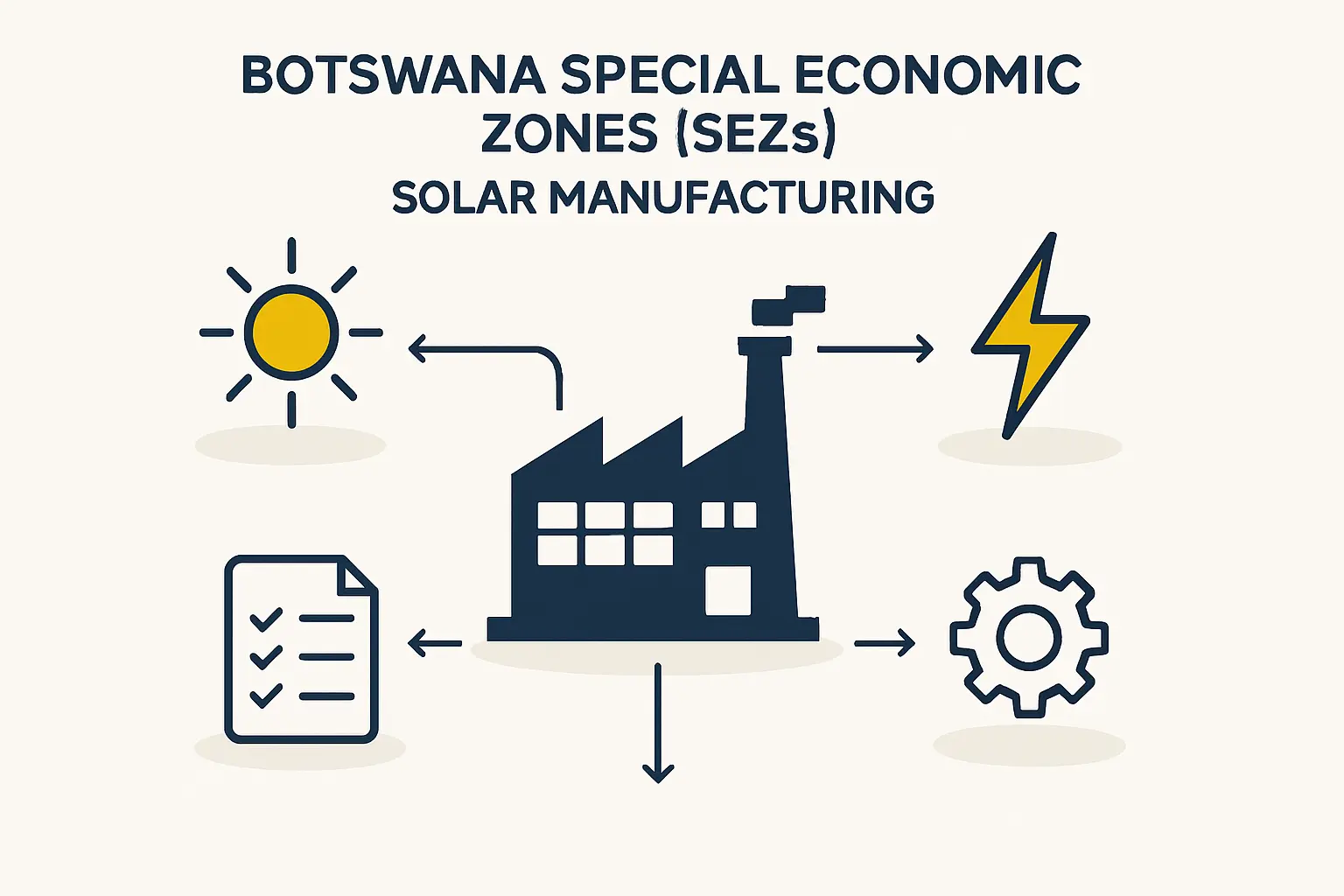

The Specific Opportunity for Solar Module Manufacturing

Beyond the general SEZ framework, Botswana offers distinct advantages for entrepreneurs in the solar energy sector.

Abundant Natural Resources and Growing Demand

Botswana is one of the sunniest countries in the world, with over 3,200 hours of sunshine annually. This high level of solar irradiation creates a strong local and regional appetite for photovoltaic solutions. As Southern Africa increasingly turns to renewables to solve energy deficits and power rural communities, a locally-based manufacturer is perfectly positioned to meet this growing demand.

Strategic Market Access

As a member of the Southern African Development Community (SADC) and the Southern African Customs Union (SACU), Botswana provides manufacturers with duty-free access to a combined market of over 300 million people. This allows a new solar module factory to serve not just the domestic market but to act as an export hub for neighboring countries like South Africa, Namibia, and Zambia.

Considerations for Site Selection within Botswana

Selecting the right location within Botswana requires careful analysis. A business focused on heavy manufacturing might find the incentives and infrastructure at the Selebi Phikwe SEZ most appropriate. In contrast, an operation that relies heavily on imported components and air freight for finished goods might benefit more from the logistical advantages of the SSKIA SEZ.

Navigating Potential Challenges

While the SEZ framework is robust, prospective investors should be aware of potential challenges. Based on experience from J.v.G. turnkey projects in emerging markets, two areas in particular require careful planning:

-

Skills Development: There may be a shortage of personnel with highly specialized technical skills in advanced manufacturing. A successful business plan should include a budget and strategy for employee training and skills transfer.

-

Administrative Diligence: Although the OSSC model is designed to be efficient, successfully navigating any new regulatory system requires diligence and preparation. Working with experienced consultants can help ensure all requirements are met correctly the first time.

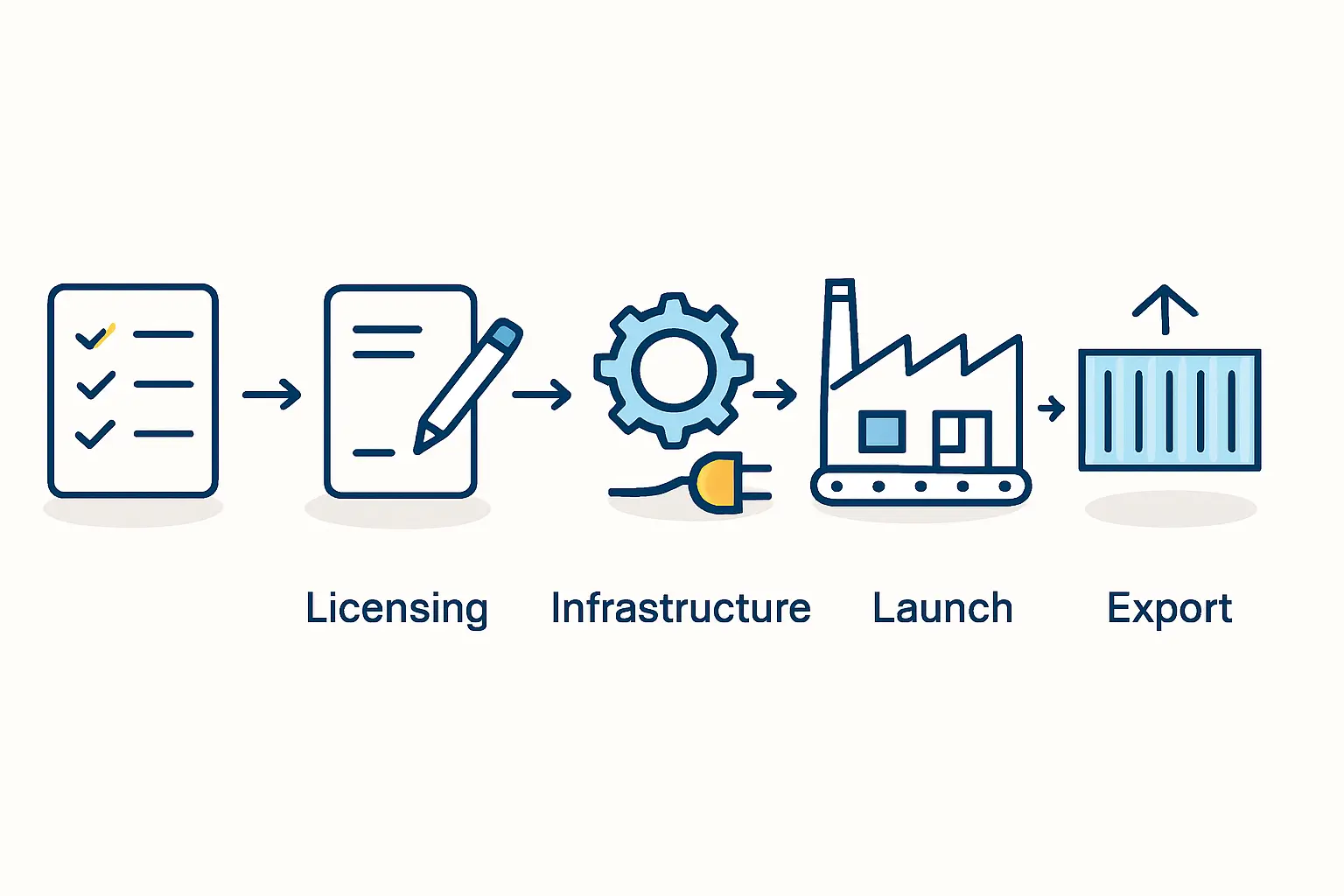

Planning Your Entry: A Structured Approach

Entering any new market requires a comprehensive business plan that accounts for local conditions. Understanding the complete solar module manufacturing process is a critical first step, as this knowledge informs everything from factory layout to financial projections.

A well-structured plan built on reliable data is the foundation for a successful launch. For new entrants, educational resources like the structured e-courses from pvknowhow.com can be invaluable for navigating this complex planning stage and transforming an ambitious idea into a viable operational strategy.

Frequently Asked Questions (FAQ)

What is the primary benefit of an SEZ over a non-SEZ location in Botswana?

The primary benefit is the comprehensive package of incentives. While a non-SEZ location may offer some advantages, only the Botswana Special Economic Zones provide the combined benefits of a significantly reduced tax rate (5%), duty-free importation of materials, and streamlined administrative support through a One-Stop Service Centre.

Is prior experience in the solar industry necessary to start a factory in Botswana?

While direct experience is beneficial, it is not an absolute requirement. Many successful entrepreneurs enter the solar industry from other sectors. The key is to partner with technical experts who can provide guidance on technology, process, and factory setup. This aligns with the pvknowhow.com philosophy: “You don’t need to be an expert – we’ll guide you.”

How does Botswana’s landlocked location impact logistics for exporting solar modules?

Although Botswana is landlocked, it has well-developed road and rail infrastructure connecting it to major Southern African ports, such as Durban in South Africa and Walvis Bay in Namibia. Its central location within the SADC region makes it an excellent hub for ground-based distribution and regional trade.

What is the typical timeline for setting up a manufacturing plant in an SEZ?

The timeline can vary based on the project’s scale and complexity. However, the SEZ framework and the OSSC are specifically designed to shorten the setup period compared to standard processes. With proper planning and expert guidance, a turnkey production line can often become operational in under a year.

Solar Production“/>

Solar Production“/>