Any entrepreneur eyeing a new venture in an emerging market weighs opportunity against risk. While Burundi’s energy sector offers significant growth potential, challenges like high initial costs and complex regulations can seem daunting.

For those looking to establish a solar module factory, the critical question isn’t just if the market is ready, but how to navigate the local framework to build a financially viable enterprise. This is where Burundi’s Investment Code (Law N°1/14 of August 20, 2008) becomes a strategic asset.

Far more than a legal document, it is a clear invitation from the government, designed to attract and protect foreign direct investment in priority sectors like manufacturing and energy. Understanding its provisions is the first step toward a successful company setup in Burundi.

This guide breaks down the key articles of the Investment Code relevant to a solar factory investor, detailing the process for securing significant tax and customs advantages that can fundamentally improve a project’s financial outlook.

Table of Contents

Understanding the Purpose of Burundi’s Investment Code

The Investment Code’s primary objective is to create a transparent, secure, and favorable environment for private investment, aiming to reduce the initial financial burden on investors and provide long-term stability. Administered by the Investment Promotion Agency (API), the code serves as the central point of contact for investors, simplifying procedures and offering guidance.

For a capital-intensive project like a solar module factory, which requires importing specialized machinery and materials, the benefits offered under this code are not marginal—they are foundational to the business case. This framework recognizes that attracting manufacturing requires competitive incentives that directly address the largest upfront expenditures.

Key Advantages for Solar Module Manufacturing

To qualify for incentives, an enterprise must first obtain a Certificate of Eligibility from the API. Once approved, a solar manufacturing project gains access to a range of benefits designed to accelerate its path to profitability.

Experience from various turnkey solar module manufacturing line setups shows that leveraging these advantages is a critical factor for success in new markets.

Exemption from Customs Duties and Import Taxes

Arguably the most impactful benefit for a solar factory is the exemption from all customs duties and taxes on imported capital goods, equipment, and construction materials needed for the project, as provided by Article 26 of the Investment Code.

-

What this means in practice: All machinery—from the cell stringer and laminator to the final testing equipment—can be imported without incurring duties, delivering a direct and substantial reduction in the initial investment. For a 20-50 MW facility, these savings can easily amount to hundreds of thousands of dollars.

-

Raw Materials: The code also extends these exemptions to raw materials and semi-finished products unavailable locally—a crucial provision for the ongoing production of solar modules.

Value Added Tax (VAT) Exemptions

Under the standard regime, an 18% VAT applies to most goods and services. The Investment Code, however, provides significant relief. Article 26 also grants an exemption from VAT on imported eligible equipment. This measure prevents capital from being tied up in tax payments and improves the project’s cash flow during the critical setup phase.

Corporate Income Tax Reductions

While full tax holidays are rare, the code offers significant relief from corporate income tax (typically 30%). Article 28 grants a tax credit equal to a percentage of the total investment amount. This credit can be applied against the company’s tax liability for several years, effectively reducing the tax rate during the crucial early stages of operation.

Additionally, enterprises that create a significant number of local jobs may be eligible for further fiscal advantages.

Guarantees and Protections for Investors

Beyond fiscal incentives, the code offers critical legal protections to build investor confidence. These include:

-

Free transfer of capital and profits: Investors are guaranteed the right to repatriate dividends, loan repayments, and proceeds from liquidation.

-

Protection against expropriation: Investments are secured against arbitrary seizure, with provisions for fair and prior compensation if required by the national interest.

-

Equal treatment: Foreign investors receive the same rights and protections as national investors.

How to Qualify for Investment Incentives: A Step-by-Step Process

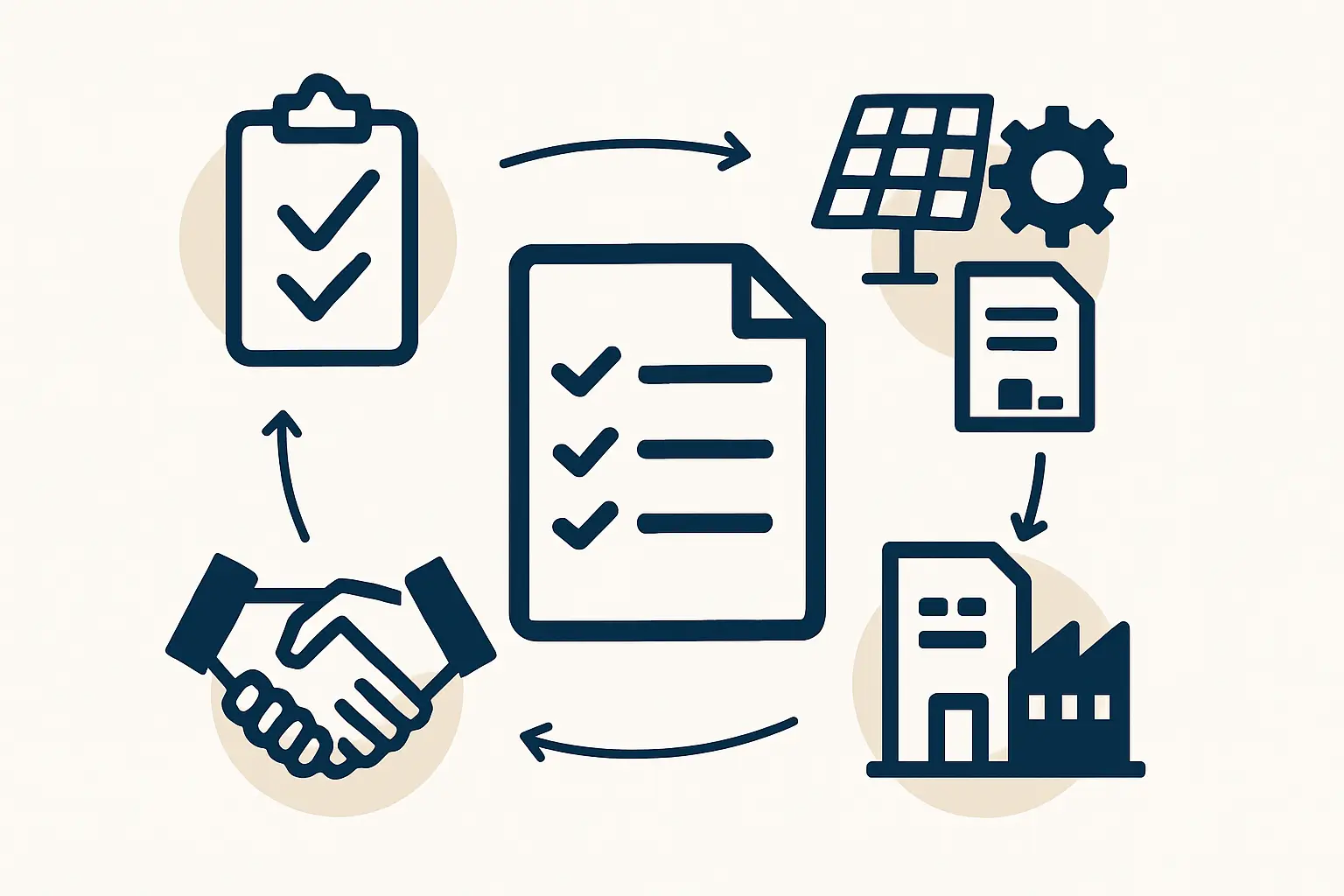

Securing these benefits requires a formal application process through the Investment Promotion Agency (API), a crucial step that ensures a proposed project aligns with Burundi’s national development goals and streamlines the company registration in Burundi.

Step 1: Prepare and Submit an Application File

The investor must submit a comprehensive file to the API, which typically includes:

-

The official application form for the Certificate of Eligibility.

-

A detailed business plan for the solar factory, outlining production capacity, technology, market analysis, and financial projections.

-

The legal statutes and registration documents of the company.

-

Proof of sufficient financing for the project.

-

An environmental impact assessment demonstrating compliance with national regulations.

Step 2: Review and Issuance of the Certificate of Eligibility

The API reviews the application to ensure it is complete and compliant with the Investment Code. The agency assesses the project’s viability and its potential contribution to the economy, particularly in terms of job creation, technology transfer, and export potential.

If the project is approved, the API issues a “Certificate of Eligibility for the Advantages of the Investment Code.” This document formally grants access to all the outlined incentives.

Step 3: Fulfilling Investor Obligations

Obtaining the certificate also comes with key responsibilities. The investor must commit to the project as outlined in the business plan. Key obligations under the code include:

-

Commencing project activities within the agreed timeline.

-

Maintaining proper accounting standards.

-

Adhering to labor and environmental laws.

-

Submitting periodic progress reports to the API.

Failure to meet these obligations can result in the suspension or withdrawal of benefits, making realistic planning and professional execution of the factory setup and commissioning process all the more important.

Frequently Asked Questions (FAQ) for Investors in Burundi

What is the role of the Investment Promotion Agency (API)?

The API is the government body responsible for facilitating investment. It acts as a “one-stop shop” to guide investors through the application process, provide information, and help coordinate with other government departments.

Is there a minimum investment amount to qualify?

While the code does not specify a rigid minimum for all sectors, a project must be of a commercially viable and impactful scale. An investment in a solar factory would naturally be substantial and easily meet the implicit requirements.

How does the law protect my investment from political risk?

The code provides explicit protection against nationalization and expropriation without fair and prior compensation. Additionally, Burundi is a member of international bodies like the Multilateral Investment Guarantee Agency (MIGA), which offers political risk insurance.

Can I employ foreign technical staff?

Yes, the code allows for the employment of foreign personnel for positions where qualified local candidates are not available. However, the company is expected to implement a plan for training and gradually transitioning these roles to Burundian nationals.

What are the ongoing reporting requirements?

Investors are typically required to submit annual reports to the API detailing their operational progress, employment figures, financial performance, and compliance with their investment agreement.

Conclusion: A Strategic Framework for Your Investment

Burundi’s Investment Code is more than a set of rules; it is a strategic framework designed to attract serious, long-term investors in priority sectors like renewable energy manufacturing. By offering substantial exemptions on customs duties, taxes, and VAT, the government directly lowers the primary barrier to entry: high initial capital expenditure.

For an entrepreneur or company looking to enter the African solar market, a thorough understanding of this code and a professional approach to navigating it are essential. The code provides a clear, predictable path to establishing a cost-competitive manufacturing operation that also benefits from legal protections that safeguard the investment. Ultimately, the incentives offered can make the difference between a marginal project and a highly profitable one, creating a solid foundation for sustainable growth in the heart of the Great Lakes region.