Entering the solar module manufacturing industry offers a significant opportunity, especially in sun-rich regions with a growing demand for renewable energy. For investors considering a market like Cabo Verde—a nation boasting one of the highest solar irradiation levels in the world—the potential is particularly compelling. However, turning that potential into a profitable enterprise requires a rigorous and realistic financial plan.

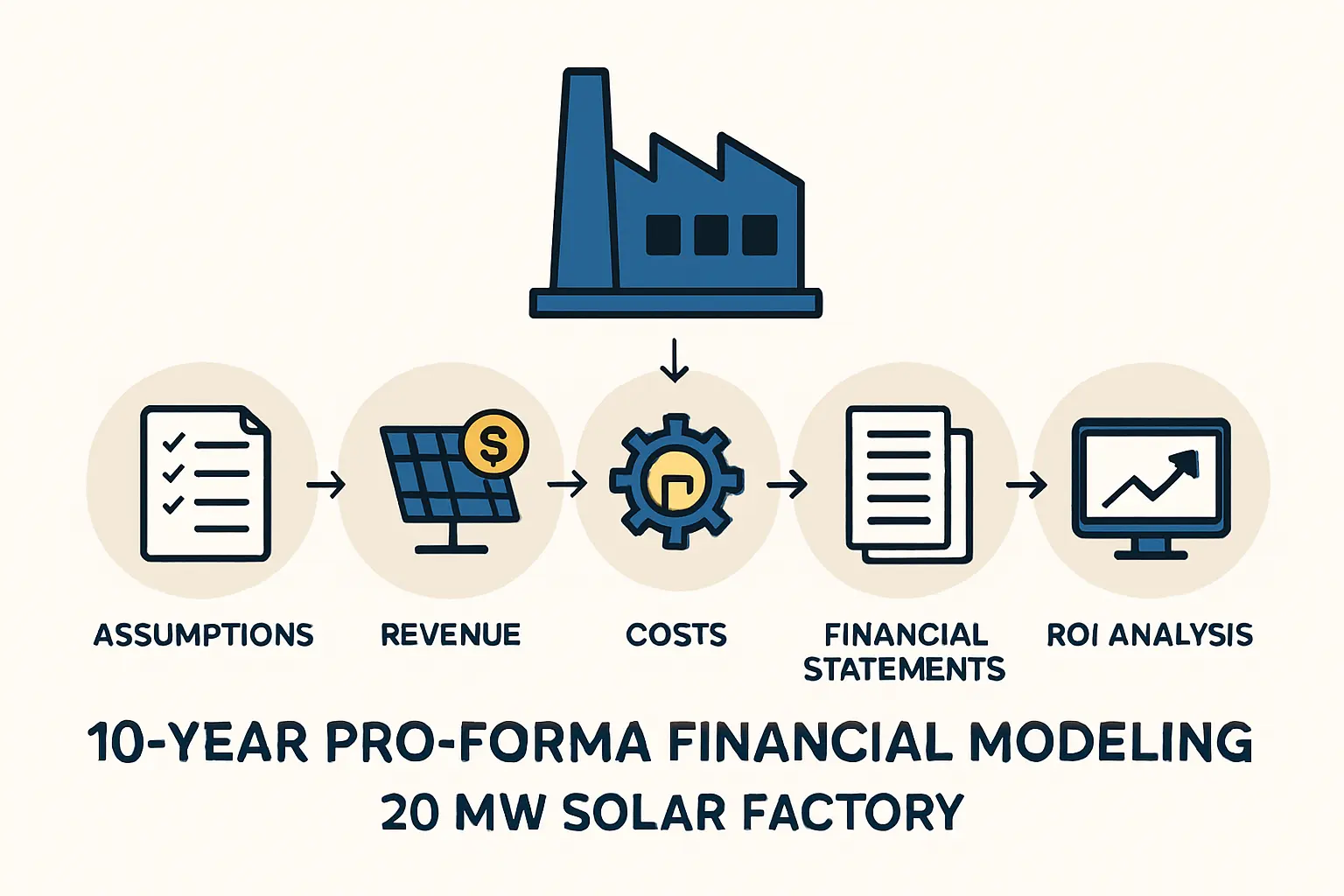

This article breaks down a pro-forma analysis for establishing a 20 MW solar module assembly line in Cabo Verde. Serving as a foundational guide for entrepreneurs and business leaders, it outlines the critical financial components—from initial investment to ongoing operational costs—in this specific market. The goal is to move beyond abstract concepts and provide tangible figures to inform a preliminary investment evaluation.

Table of Contents

Understanding the Core Financial Components

A pro-forma financial model is a forward-looking projection of a business’s future financial performance. For a new manufacturing venture, it serves as the essential blueprint for estimating startup costs, predicting operating expenses, and forecasting revenue. This model is built on two primary pillars: Capital Expenditures (CAPEX) and Operational Expenditures (OPEX).

Capital Expenditures (CAPEX)

The one-time, upfront costs of establishing the factory, including the purchase of machinery, facility preparation, and other initial investments needed to begin production.

Operational Expenditures (OPEX)

The recurring costs of running the factory and producing solar modules day-to-day. This category encompasses raw materials, labor, utilities, and administrative overhead.

Understanding both is fundamental to accurately assessing the project’s financial viability.

A Sample CAPEX Projection for a 20 MW Line

The initial investment for a 20 MW solar module factory is substantial, with the majority allocated to production equipment. Based on experience from numerous J.v.G. Technology turnkey projects, the total CAPEX for a semi-automated 20 MW line generally falls between €1.2 million and €2.0 million, depending on the level of automation and specific equipment choices.

Production Machinery

This is the heart of the operation and represents the largest single investment. A complete solar panel production line involves several key machines working in sequence, from a cell stringer and lay-up station to a laminator, framing machine, and a final performance tester (Sun Simulator). The choice of this equipment directly impacts production efficiency, module quality, and labor requirements.

Building & Infrastructure

The facility itself requires careful planning. A 20 MW line typically needs a factory building for solar panel manufacturing of approximately 1,500 to 2,500 square meters to accommodate the production line, raw material storage, finished goods warehousing, and administrative offices. Costs will vary depending on whether the building is leased or constructed, and the budget must account for industrial modifications such as reinforced flooring, climate control, and a stable power supply.

Ancillary Equipment & Initial Setup

Beyond the main production line, the factory requires supporting equipment. This includes:

- Material handling equipment (forklifts, pallet jacks)

- An air compressor system

- IT infrastructure (servers, computers, networking)

- Office furniture and supplies

- Initial stock of spare parts for machinery

Soft Costs & Contingencies

These non-physical assets are crucial for a smooth launch. They include:

- Company registration and business licensing fees

- Permits and regulatory compliance costs

- Initial employee training and skill development

- Consultancy fees for project planning and implementation

- A contingency fund (typically 10-15% of total CAPEX) to cover unforeseen expenses

Estimating Annual OPEX in the Cabo Verde Context

Once the factory is operational, ongoing expenses determine its profitability. For a 20 MW facility operating at a reasonable capacity, annual OPEX is a significant figure, driven primarily by the cost of materials.

Raw Materials (Bill of Materials – BOM)

The cost of solar panel raw materials typically accounts for 70-80% of a finished module’s total cost. The primary components include solar cells, tempered glass, EVA film, backsheet, and aluminum frames. For an island nation like Cabo Verde, logistics are a critical consideration. All raw materials must be imported, making supply chain management, shipping costs, and import duties a major factor in the final cost structure. Building strong relationships with international suppliers is paramount.

Labor

A semi-automated 20 MW line typically requires a workforce of 25 to 35 employees. This includes skilled machine operators and technicians, quality control inspectors, maintenance staff, and administrative personnel. While local labor costs in Cabo Verde may be competitive, investing in a comprehensive training program is essential to ensure high production quality and operational efficiency.

Utilities

Manufacturing is an energy-intensive process. The laminator, in particular, requires a significant and stable supply of electricity. In a region where electricity costs can be high, this becomes a major operational expense. However, this also presents a unique opportunity: a solar module factory can install its own rooftop solar array to offset a portion of its electricity consumption, providing a natural hedge against rising energy prices.

Maintenance, Sales & Administration

This category includes a wide range of overheads:

- Scheduled maintenance and spare parts for machinery

- Sales and marketing expenses to secure local or regional customers

- Salaries for administrative and management staff

- Insurance, rent (if applicable), and other general business expenses

Revenue Projections & ROI Analysis

With a clear picture of costs, the next step is to project revenue and assess the potential return on investment.

Calculating Potential Revenue

A 20 MW factory has the theoretical capacity to produce 20,000,000 watts of solar modules per year. Assuming an average module power of 550 watts, this translates to approximately 36,000 modules annually.

Annual Revenue = (Annual Capacity in Watts) x (Price per Watt)

Market conditions ultimately determine the selling price per watt. In Cabo Verde, a locally produced module will compete against imported panels. A successful strategy often involves focusing on factors beyond price, such as shorter delivery times, local technical support, and customization for specific projects. For this model, assuming a competitive market price of €0.25 per watt, the potential annual revenue would be:

20,000,000 W x €0.25/W = €5,000,000

The Path to Profitability

Profitability depends on managing OPEX relative to revenue. The Gross Margin is a key indicator, calculated as (Revenue – Cost of Goods Sold) / Revenue. The primary challenge for any new manufacturer is to scale production efficiently to cover fixed costs and achieve a healthy margin. A well-managed 20 MW facility can often achieve profitability within its first 18-24 months of operation.

Return on Investment (ROI)

The payback period for the initial capital investment depends heavily on net profit margins and operational efficiency. Based on industry benchmarks for well-executed turnkey projects in emerging markets, a payback period of 3 to 5 years is a realistic target under favorable market conditions.

Frequently Asked Questions (FAQ)

Q: How accurate is this pro-forma model?

A: This model provides a high-level estimate to illustrate the key financial dynamics. A detailed feasibility study and comprehensive business plan are necessary to develop precise figures based on specific supplier quotes, local labor laws, and current market prices. The pvknowhow.com platform provides structured guidance for creating such a detailed plan.

Q: What is the typical timeline to set up a 20 MW factory?

A: From placing machinery orders to producing the first certified module, a typical project timeline is between 9 and 12 months. This includes factory preparation, equipment shipping and installation, and staff training.

Q: Can a factory be profitable with only a 20 MW capacity?

A: Yes. While larger giga-factories benefit from economies of scale, a 20 MW facility can be highly profitable by targeting a specific niche, such as serving the local market, offering faster fulfillment than international competitors, and providing modules for government or utility-scale projects within the region.

Q: What are the biggest financial risks?

A: The primary financial risks include volatility in raw material prices (especially solar cells), disruptions to international shipping and logistics, unexpected changes in government trade or energy policies, and challenges in securing a consistent volume of orders to maintain high capacity utilization.

Next Steps in Your Investment Journey

This pro-forma analysis shows that establishing a 20 MW solar module factory in a high-potential market like Cabo Verde can be a financially viable venture. Success, however, requires a significant initial investment and meticulous management of ongoing operational costs, particularly those related to imported raw materials.

The success of such a project hinges on diligent planning long before the first machine is purchased. Your next step should not be a purchase order, but a deeper dive into the specifics of your business case. Developing a detailed business plan, securing financing, and conducting a thorough feasibility study are the foundational steps that transform an idea into a successful enterprise.