An entrepreneur envisions a state-of-the-art solar module factory, its roof gleaming under the tropical sun of an island nation. The business plan is solid, local demand is clear, and financing is in place. Yet, a fundamental challenge remains, one that is often underestimated: the immense geographical distance separating the factory from its essential material suppliers in Asia and Europe.

For an enterprise based in an archipelago, the supply chain isn’t merely a logistical detail—it’s the very pillar on which the entire operation rests. This article outlines the unique supply chain challenges facing island-based solar manufacturers and offers a strategic framework for building a resilient, cost-effective, and predictable materials pipeline. We’ll explore how to manage long lead times, buffer against disruptions, and make informed sourcing decisions for your Bill of Materials (BOM).

Table of Contents

The Unique Logistical Hurdles for Island Nations

Unlike their mainland counterparts, island-based factories cannot afford to overlook the complexities of maritime logistics. Standard supply chain models often fall short in archipelagos, where businesses must contend with a unique set of obstacles.

According to industry logistics analyses, island nations consistently face:

- Higher Shipping Costs: Container freight to remote or less-trafficked ports is significantly more expensive than to major continental hubs.

- Longer Lead Times: A shipment from Asia can take six to ten weeks to reach a Caribbean or Pacific island, compared to three to four weeks to a European port.

- Customs and Port Inefficiencies: Clearing customs in smaller ports can introduce unpredictable delays, adding days or even weeks to the delivery schedule.

- Vulnerability to Disruptions: A single storm, port congestion, or shipping lane disruption can halt the flow of critical materials for extended periods, threatening production continuity.

Operating a solar factory in this environment requires a fundamental shift in planning—from a reactive approach to a highly strategic, proactive one.

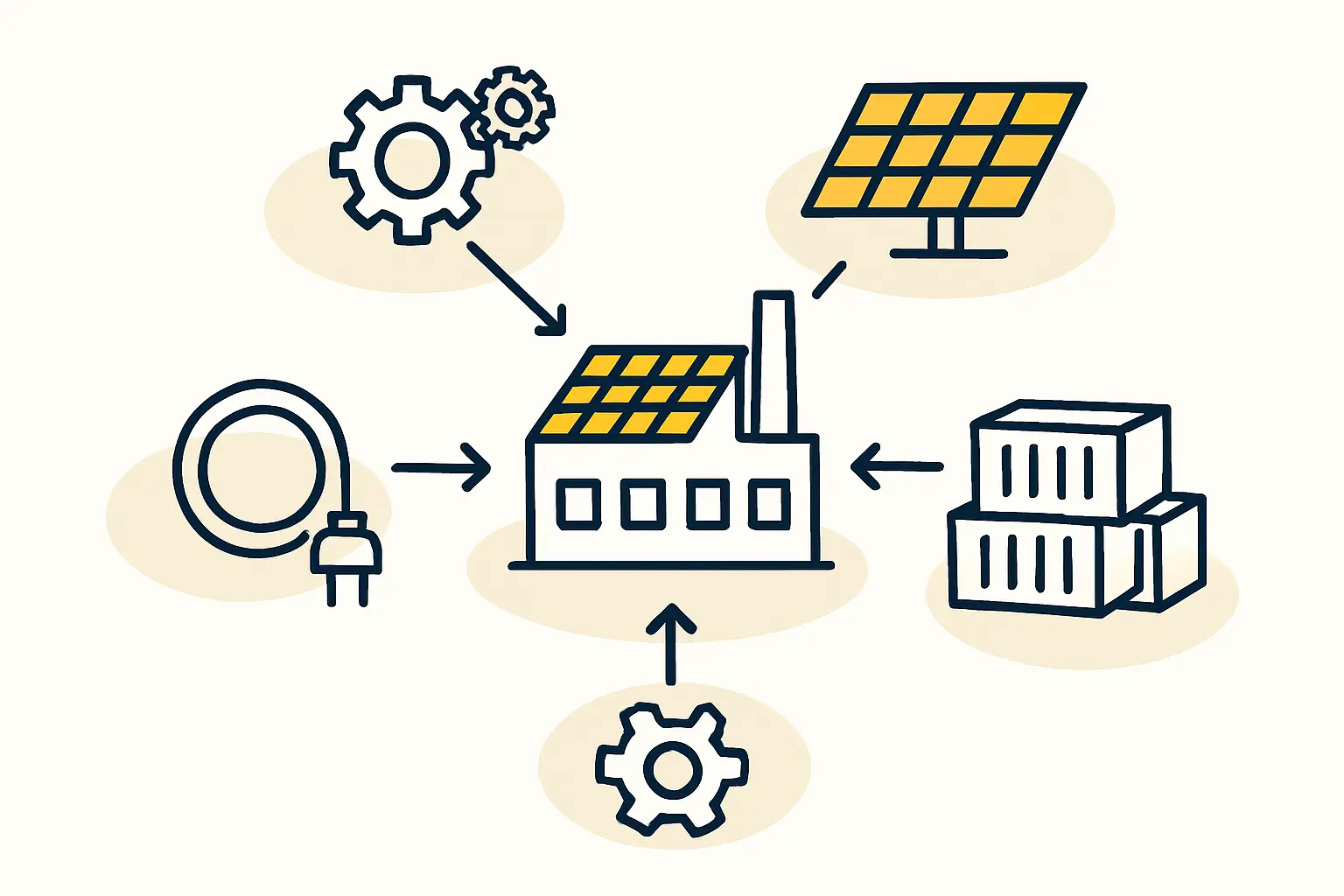

Strategic Sourcing: Balancing Cost, Quality, and Risk

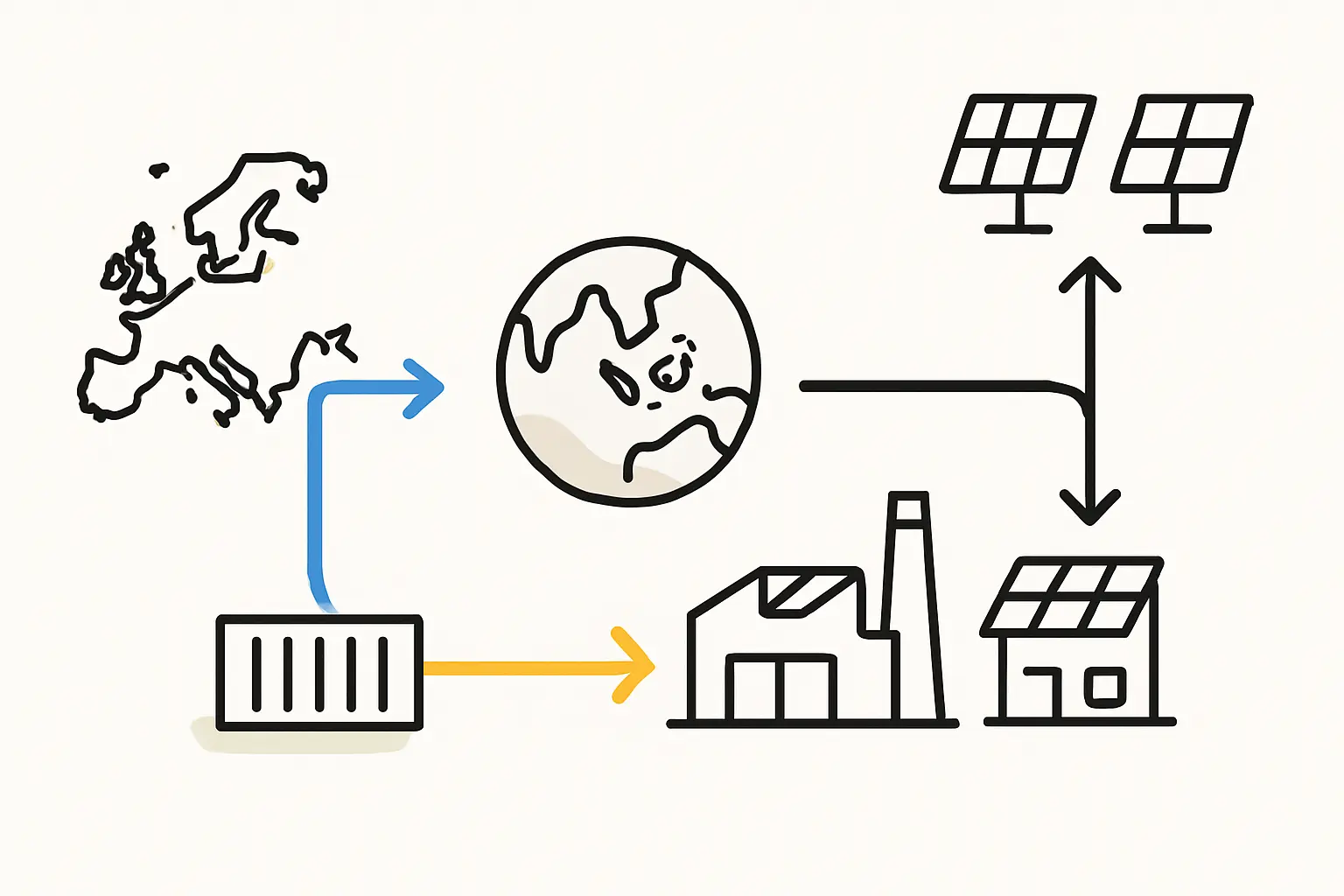

A successful supply chain begins with intelligent sourcing. The global solar manufacturing landscape is highly concentrated; the International Energy Agency (IEA) reported in 2022 that over 80% of all key manufacturing stages for solar panels are dominated by China. While this concentration offers cost advantages, it also carries a significant risk.

A prudent strategy involves diversifying suppliers across different geographic regions to build a more resilient and flexible supply chain.

Dual-Sourcing: A Practical Approach

A balanced approach often involves a dual-sourcing strategy, where high-volume, standardized components are sourced from established Asian markets while specialized or high-performance materials are procured from European suppliers.

- From Asia: The bulk of the bill of materials for a solar panel, particularly solar cells which make up 50-60% of a module’s cost, is typically sourced from leading manufacturers in Asia to achieve competitive pricing.

- From Europe: Specialized components, such as advanced polymer backsheets, high-performance encapsulants, or specific types of junction boxes, are often sourced from Germany, Switzerland, or other European countries. These suppliers frequently offer superior quality, innovation, and long-term reliability.

This hybrid model mitigates geopolitical risk, reduces dependency on a single region, and allows a manufacturer to optimize for both cost and quality across the entire BOM.

Inventory Management: From ‘Just-in-Time’ to ‘Just-in-Case’

The pre-pandemic era favored a ‘just-in-time’ (JIT) inventory model, where materials arrived just as they were needed for production, minimizing warehousing costs. However, as a 2022 McKinsey report highlighted, global supply chain disruptions have forced a widespread shift to a ‘just-in-case’ (JIC) strategy. For an island-based factory, this approach is not just a trend—it’s a necessity.

A JIC strategy involves maintaining a strategic buffer of critical inventory to ensure production can continue even if a shipment is delayed.

Prioritizing Your Strategic Stock

Stockpiling every component is financially impractical. Instead, focus on the materials most critical to the solar panel manufacturing process and those with the longest lead times.

Based on a typical BOM cost breakdown, prioritize:

- Solar Cells (50-60% of module cost): The most expensive and critical component.

- Glass (10-15%): Heavy and bulky, requiring specialized shipping.

- Encapsulant (EVA/POE): Essential for module lamination and durability.

A case study from a J.v.G. turnkey project in the Caribbean illustrates this principle. The client successfully mitigated disruption risks by maintaining a rolling three-month supply of solar cells and EVA film at a nearby regional logistics hub, ensuring production continuity during hurricane season and unforeseen shipping delays.

Managing Landed Costs, Not Just Purchase Price

A common mistake in international procurement is focusing solely on the unit price of a component. A more accurate measure is the total landed cost, which reflects the true cost of getting a product from the supplier to the factory floor.

Total Landed Cost = Supplier’s Unit Price + Shipping & Freight + Insurance + Tariffs & Duties + Customs Clearance Fees

A Comparative Cost Analysis

When evaluating suppliers, calculating the landed cost for each option is essential. A component from a European supplier may have a higher unit price than one from an Asian supplier, but lower shipping costs or more favorable trade agreements could make it the more economical choice overall. Detailed analysis like this is crucial for making sound financial decisions.

Future-Proofing: Building Local and Regional Resilience

A long-term strategy for enhancing supply chain resilience involves exploring opportunities for nearshoring or localizing the sourcing of certain materials. While high-tech components like solar cells are unlikely to be produced locally in the short term, other bulky and less complex materials could be viable.

Items such as aluminum frames and, in some cases, solar glass could potentially be sourced from regional industrial hubs or even manufactured locally if the capacity exists or can be developed. This not only reduces lead times and shipping costs but also supports the local economy—a critical factor for many entrepreneurs launching a solar panel manufacturing business in an emerging market.

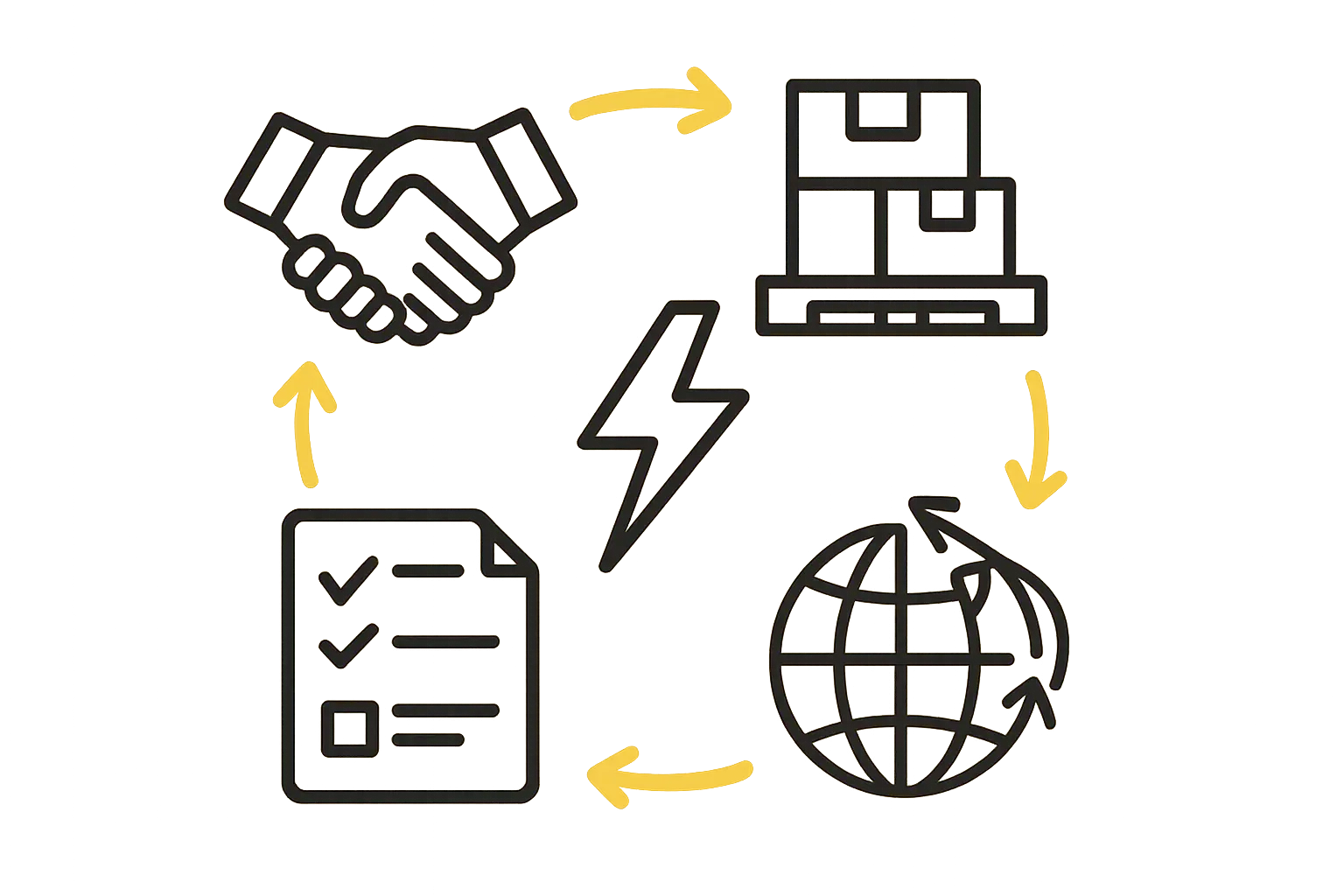

Navigating the Process with Expertise

Structuring a global supply chain is a complex undertaking that requires specialized knowledge in procurement, logistics, and international trade. The selection of the right solar panel manufacturing equipment is only one part of the equation.

Experience from dozens of J.v.G. turnkey projects shows that establishing strong relationships with reliable freight forwarders and customs brokers is as critical as selecting material suppliers. These partners become an extension of your team, navigating the complexities of global trade on your behalf.

Frequently Asked Questions (FAQ)

Q: What is a typical lead time for components from Asia to a Caribbean island?

A: A typical lead time, including production, sea freight, and customs clearance, ranges from 6 to 10 weeks. This can vary based on the port of origin, shipping line availability, and the efficiency of the destination port.

Q: How much extra inventory should an island factory hold?

A: This depends on the specific component and its lead time. As a general guideline, maintaining a buffer stock of 2 to 3 months for critical, long-lead-time components like solar cells and encapsulant is a prudent starting point for ensuring uninterrupted production.

Q: Can I source all components from a single country?

A: While technically possible, sourcing all components from a single country is not recommended. This practice, known as single-sourcing, exposes a business to significant geopolitical, economic, and logistical risks. Supplier diversification is a core principle of a resilient supply chain.

Q: Are European components always more expensive?

A: The initial purchase price of European components may be higher. However, their total landed cost can sometimes be competitive, especially for factories in Africa or the Middle East that may have shorter shipping routes from Europe than from Asia. Furthermore, higher quality can lead to lower defect rates and better long-term module performance, improving the overall cost of ownership.