An investor has a meticulously crafted business plan for a new solar module factory. The projections are sound, market demand is clear, and the technology has been selected. Yet, just six months into operation, the financial controller reports a significant budget overrun.

The cause isn’t a failure in production or sales but a miscalculation of a key operational expenditure: the landed cost of imported raw materials. This scenario, all too common, highlights a critical area of financial planning that entrepreneurs entering the solar industry often underestimate.

For any professional considering a solar module factory in Cambodia, understanding the customs duty and tax framework isn’t a secondary detail—it’s fundamental to the project’s viability. This guide provides a clear overview of the import duties, the Cambodia import VAT rate, and potential exemptions that directly affect the cost of key components like solar cells, glass, and aluminum frames.

Table of Contents

Understanding Cambodia’s Import Tax Framework

When importing raw materials into Cambodia for manufacturing, investors encounter several layers of government levies. The final cost of goods arriving at the factory gate—the “landed cost”—includes the original product price, shipping, and insurance, all compounded by these critical import taxes.

The Royal Government of Cambodia primarily applies three types of tax on imported goods:

- Customs Import Duty: A tariff levied on goods based on their classification under the ASEAN Harmonized Tariff Nomenclature (AHTN). Rates vary significantly by product, ranging from 0% to 35%.

- Special Tax: This tax applies to a specific list of goods, typically items considered luxury products. It is generally not applicable to solar manufacturing components.

- Value Added Tax (VAT): A standard 10% rate is applied to the value of most imported goods. The taxable value is calculated on the CIF (Cost, Insurance, and Freight) price plus the customs import duty.

Accurately forecasting these taxes is essential for any serious financial modeling of a new solar enterprise.

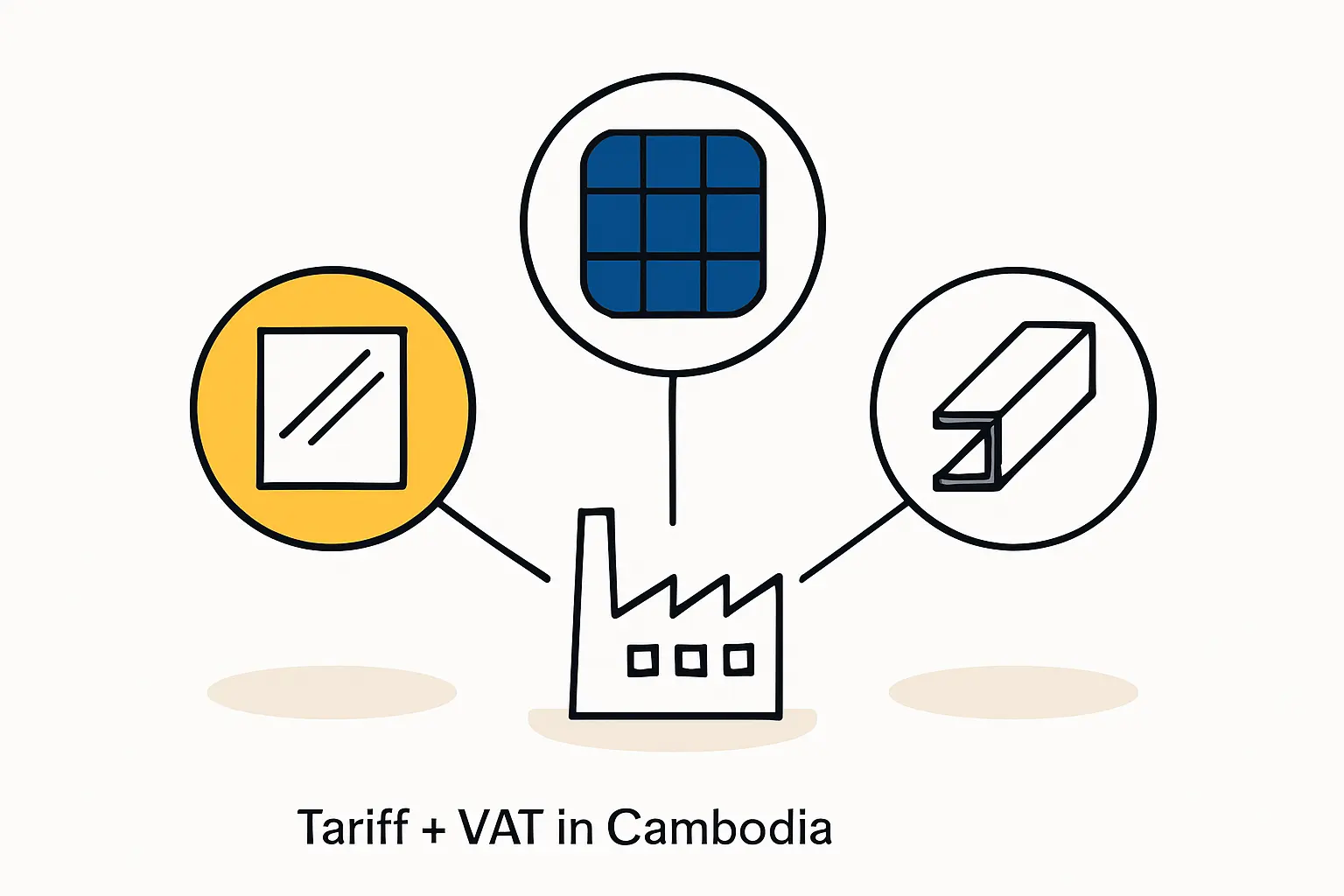

Tariff Classifications for Key Solar Components

The customs duty for each component depends on its specific Harmonized System (HS) Code. While these codes can be subject to change and interpretation by the General Department of Customs and Excise (GDCE), what follows is a general guideline for standard tariff rates on materials used in solar module assembly.

Solar Cells (Photovoltaic Cells):

- Typical HS Code: 8541.42 or 8541.43

- Standard Duty Rate: Often falls within the 0% to 7% range.

Solar Glass (Tempered, Low-Iron):

- Typical HS Code: 7007.19

- Standard Duty Rate: Can range from 7% to 15%.

Aluminum Frames:

- Typical HS Code: 7604.21

- Standard Duty Rate: Typically around 7%.

EVA (Ethylene Vinyl Acetate) Encapsulant Film:

- Typical HS Code: 3920.10

- Standard Duty Rate: Approximately 7%.

Backsheet (e.g., PVF, PET film):

- Typical HS Code: 3920.62 or 3920.99

- Standard Duty Rate: Often around 7%.

Junction Boxes:

- Typical HS Code: 8536.90

- Standard Duty Rate: Can be 7% or higher.

Without any exemptions, these duties add a substantial cost that must be factored into the product’s final price per watt. No comprehensive analysis of the solar material supply chain is complete without this localized cost data.

The Critical Advantage: Qualified Investment Project (QIP) Status

For any serious investor, the pivotal consideration is Cambodia’s Law on Investment. This framework is designed to attract foreign capital into key sectors, including manufacturing. By registering a solar factory project with the Council for the Development of Cambodia (CDC), an enterprise can obtain the status of a “Qualified Investment Project” (QIP).

This status is the single most effective tool for mitigating import tax burdens.

Key Benefits of QIP Status

A QIP is entitled to a comprehensive customs duty exemption on the import of production equipment, construction materials, and—most importantly—raw materials and production inputs.

This means that for a QIP-certified solar factory, the standard customs duties of 7% or 15% on components like solar cells and glass are reduced to 0%. This incentive fundamentally changes the financial viability of setting up a solar module factory in the country, making it competitive with other regional manufacturing hubs.

Experience from J.v.G. Technology GmbH turnkey projects, shows that securing QIP status is a foundational step in a project’s legal and financial setup. The process requires a detailed application and a clear business plan, but the long-term benefits are immense.

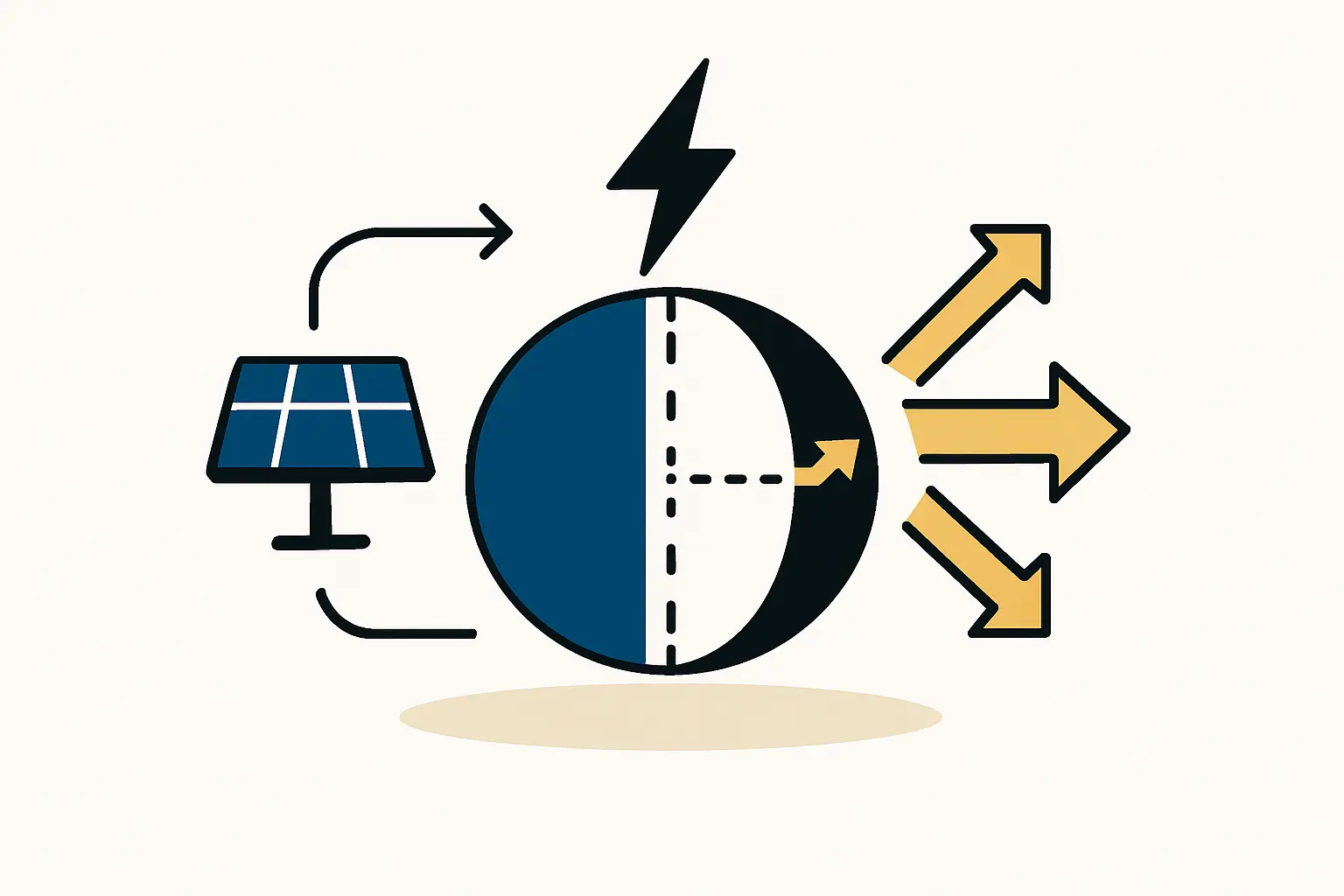

Navigating the Value Added Tax (VAT) System

While QIP status provides a full exemption from customs duties, it does not eliminate the Value Added Tax. The standard Cambodia VAT rate of 10% for 2025 is still levied on the CIF value of imported raw materials.

However, for a manufacturer that exports its finished solar modules or sells them domestically, the VAT paid on imports isn’t a final cost. Cambodia’s VAT system allows registered taxpayers to claim credits for the VAT paid on their inputs against the VAT they collect on their sales.

- For Exporters: If the final solar modules are exported, the sale is zero-rated for VAT. The company can then apply for a refund of the VAT it paid on its imported raw materials.

- For Domestic Sales: If the modules are sold within Cambodia, the company charges 10% VAT to its customers. The VAT paid on imported materials can then be used to offset the VAT owed to the government.

While recoverable, this initial VAT payment significantly impacts cash flow. A business must have sufficient working capital to finance these VAT payments while awaiting refunds or offsetting them against future sales revenue.

Frequently Asked Questions (FAQ)

Q: What is an HS Code and why is it important for my business?

A: The Harmonized System (HS) Code is an internationally standardized system of names and numbers for classifying traded products. Customs authorities worldwide use HS Codes to identify products and apply the correct duties and taxes. Using the correct code for your solar cells, glass, and other materials is essential for calculating costs accurately and avoiding delays or penalties during customs clearance.

Q: Is it possible to get a VAT exemption on raw materials as a QIP?

A: Generally, the Cambodia import VAT rate of 10% still applies even for QIPs in 2025. The primary relief mechanism is the credit and refund system, not an upfront exemption on raw material imports. This distinguishes it from the customs duty, which receives a full exemption.

Q: How long does the QIP application process typically take?

A: The timeline can vary, but an investor should generally budget several months for preparing the application, submitting it to the CDC, and receiving the Final Registration Certificate. Starting this process early is critical to the project timeline.

Q: Are there other taxes to consider besides import duties and VAT?

A: Yes, businesses in Cambodia are also subject to Tax on Profit (corporate income tax), Prepayment of Tax on Profit, and Withholding Tax, among others. However, QIPs are also eligible for a Tax on Profit exemption for up to nine years, further enhancing the project’s financial appeal.

Next Steps for a Prudent Investor

Understanding Cambodia’s tax and duty framework is a non-negotiable step for anyone looking to enter its growing solar manufacturing sector. While standard tariffs exist, the government’s investment incentives—particularly QIP status—offer a powerful pathway to establishing a cost-competitive operation.

Ultimately, financial success depends not only on production efficiency but also on skillfully navigating the local regulatory and fiscal environment. Accurately projecting landed costs, managing VAT-related cash flow, and securing QIP status early are decisive factors that separate successful ventures from those that falter.