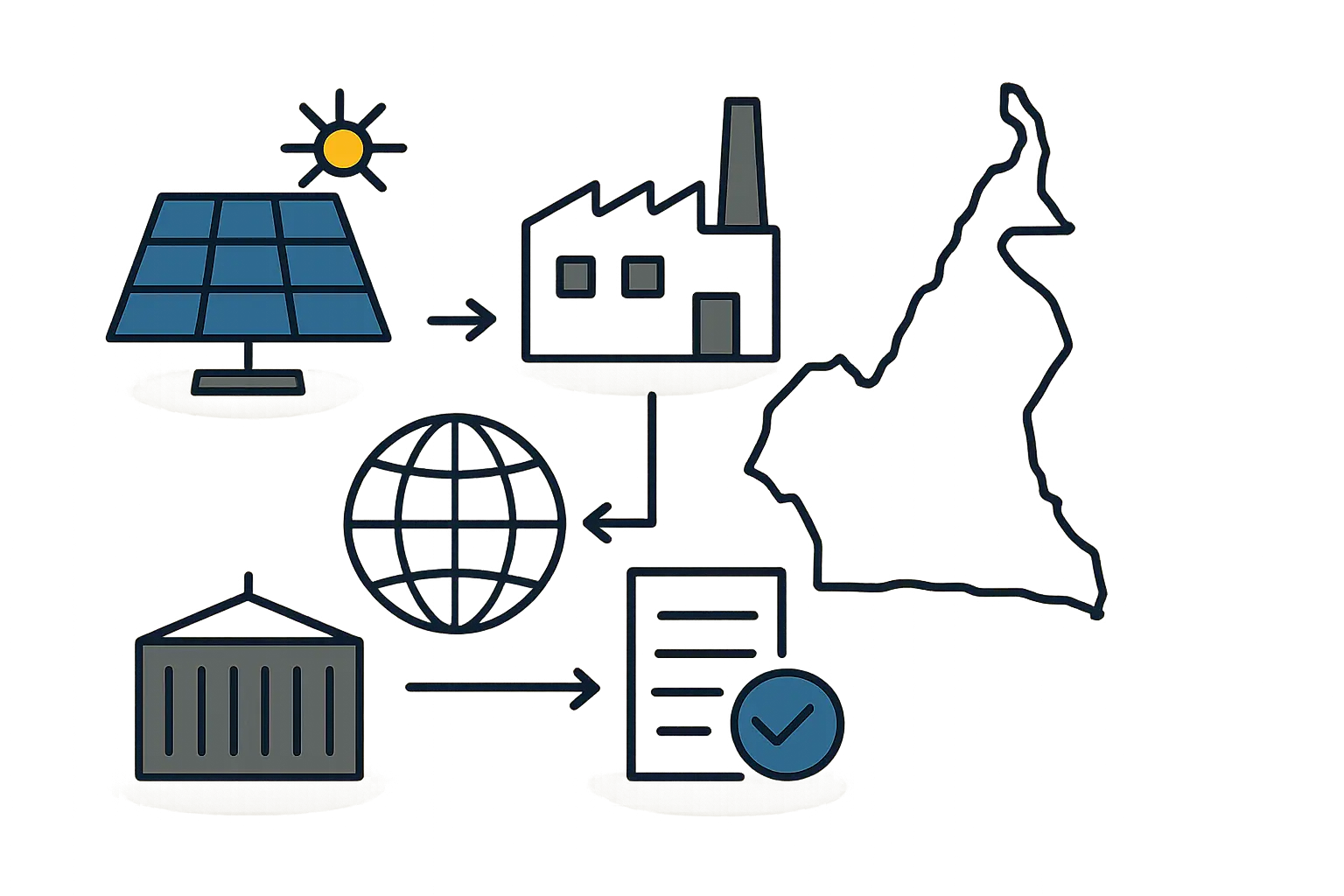

An investor has secured financing for a new solar module factory in Cameroon. The business plan is robust, the location has been selected, and a German supplier has the production line ready for shipment. But a critical question remains—how do you navigate the complex process of transporting multi-ton, high-value industrial machinery from a European port, through Cameroonian customs, and onto the factory floor?

This logistical challenge is often underestimated by new entrants in the manufacturing sector. The journey from port to factory floor involves a series of procedures, documents, and costs that can significantly impact a project’s timeline and budget.

This guide breaks down the process for business professionals importing solar production machinery into Cameroon, covering customs clearance, applicable tariffs, and strategies for managing logistical hurdles.

Table of Contents

Understanding the Regulatory Framework: CEMAC and National Policies

Cameroon is a member of the Economic and Monetary Community of Central Africa (CEMAC), which establishes a common customs union for its member states. This means imports are subject to a Common External Tariff (CET) that creates a standardized tariff structure across the region.

For an investor, two key governmental bodies are central to the import process:

- GUCE (Guichet Unique des Opérations du Commerce Extérieur): This body serves as the single window for foreign trade operations. All customs declarations and related procedures are processed through its electronic platform, designed to centralize and streamline the flow of information between importers, customs brokers, and government agencies.

- Investment Promotion Agency (API): The API is responsible for implementing the government’s private investment charter. It offers a range of incentives to attract foreign and domestic investment, including significant tax and customs exemptions for projects aligned with national development goals like Cameroon’s “Vision 2035.”

The government’s strategic focus on renewable energy creates a highly favorable environment. Projects in the solar sector are often treated as priority investments, making them eligible for benefits under the investment charter.

The Customs Clearance Process: A Step-by-Step Overview

Navigating Cameroonian customs demands precision and strict adherence to protocol. The law prohibits investors from managing this process directly; all commercial import and export operations must be conducted by a licensed customs broker, known locally as a transitaire agréé. Selecting a reputable and experienced broker is one of the most critical decisions in the entire logistics chain.

The clearance process typically follows these steps:

- Pre-Arrival Documentation: Before the shipment arrives, the importer and their customs broker must gather all necessary documents. Inaccurate or missing information is a primary cause of costly delays.

- Declaration Submission: The customs broker submits a detailed import declaration through the GUCE portal. This includes classifying each piece of equipment with the correct Harmonized System (HS) code.

- Inspection and Valuation: Customs authorities may conduct a physical inspection of the cargo to verify that its contents match the declaration. They will also assess the customs value of the goods, which is typically based on the CIF (Cost, Insurance, and Freight) value.

- Duty and Tax Assessment: Based on the valuation and HS code classification, the system calculates all applicable duties and taxes.

- Payment and Release: Once all duties and taxes are paid, customs issues a release order (bon à enlever), authorizing the cargo to be moved from the port.

Essential documents for importing machinery into Cameroon include:

- Commercial Invoice

- Bill of Lading (B/L) for sea freight or Air Waybill (AWB) for air freight

- Packing List

- Certificate of Origin

- Electronic Cargo Tracking Note (ECTN/BESC), which is mandatory and must be arranged at the port of origin

- Insurance Certificate

- Inspection Certificate (if required)

Tariffs and Taxes: The Financial Implications of Importing

A clear understanding of potential costs is essential for financial planning. The primary import costs break down into customs duties, Value Added Tax (VAT), and other smaller levies.

- CEMAC Common External Tariff (CET): This tariff is structured in four categories. Industrial machinery for a solar module manufacturing line generally falls into Category II (10%) or Category III (20%), depending on the specific equipment.

- Value Added Tax (VAT): The standard VAT rate in Cameroon is 19.25%, applied to the CIF value plus the customs duty.

- Other Levies: Additional small taxes include the Community Integration Tax (TCI) and computer levies for processing the declaration.

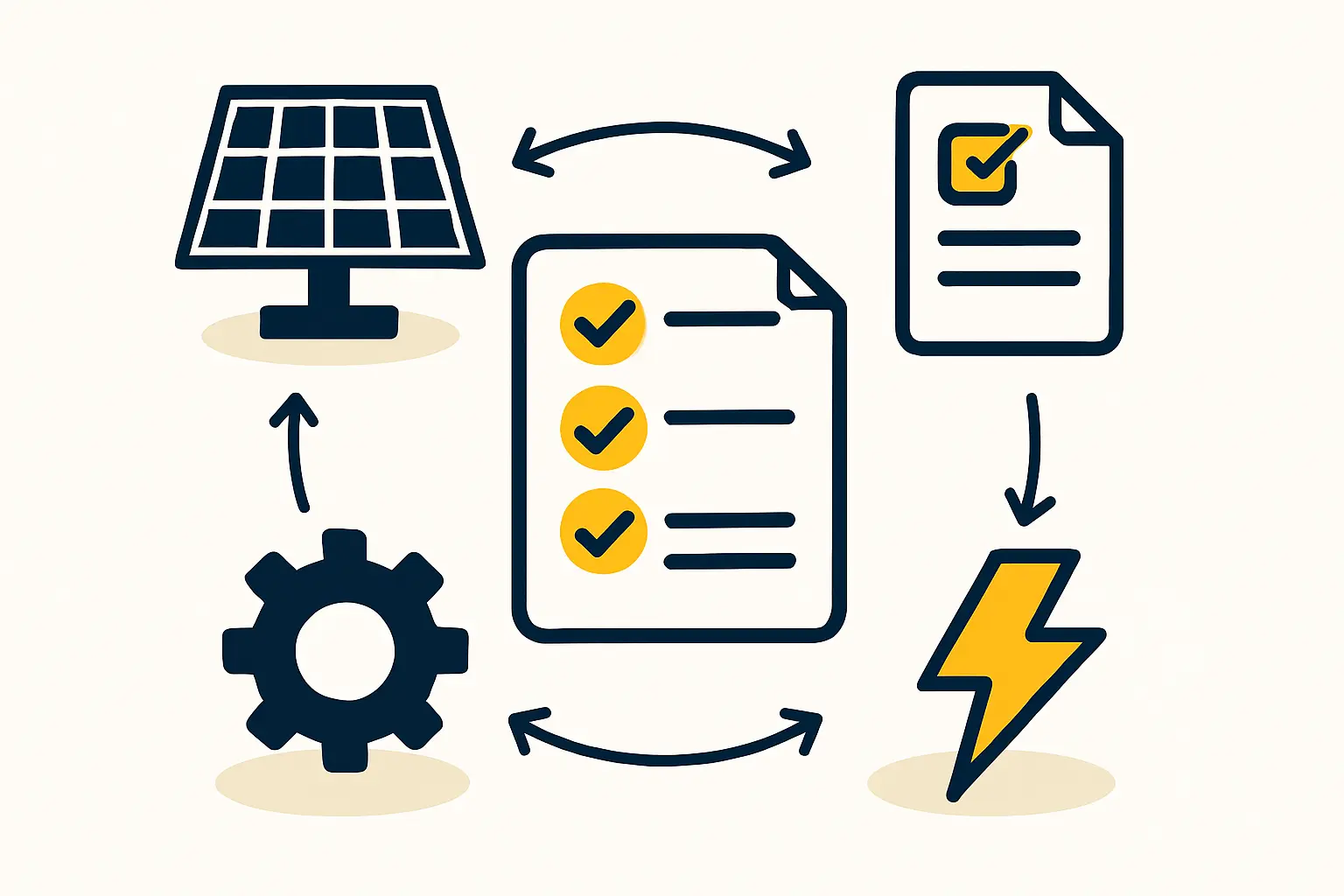

The Critical Exemption for Renewable Energy Equipment

This is where a significant opportunity arises for investors in the solar sector. Cameroon’s Finance Laws, in line with its economic development strategy, provide substantial incentives for investments in renewable energy.

Machinery, materials, and equipment intended for the production of renewable energy may be eligible for a full exemption from all customs duties and VAT.

Securing this exemption is not automatic and requires a formal application, typically facilitated through the Investment Promotion Agency (API). The investor must provide a detailed list of all imported equipment, correctly classified with HS codes. The authorities then validate that the equipment is exclusively for the stated purpose. Meticulous preparation as part of a comprehensive business plan is invaluable, providing the foundation for the application.

Navigating Logistics: From Port to Factory

The physical movement of the machinery presents its own unique challenges that demand careful planning.

Port Selection

Cameroon has two primary international ports:

- Port of Douala: As the country’s main port, it handles the vast majority of cargo traffic. While well-established, it is also known for significant congestion that can lead to delays and potential demurrage charges.

- Port of Kribi: A modern, deep-sea port south of Douala, Kribi was built to alleviate congestion and handle larger vessels. It offers greater efficiency and faster turnaround times, making it an increasingly attractive option, depending on the factory’s final destination.

Inland Transportation

Once cleared, the machinery must be transported inland. The quality of road infrastructure can vary, and moving the heavy or oversized components of a production line requires specialized logistics providers. A full production line can comprise dozens of crates shipped in multiple 40-foot containers, requiring a coordinated convoy of trucks. Planning the route, securing permits for oversized loads, and ensuring the equipment’s safety are all critical final-stage tasks.

Common Challenges and Strategic Solutions

Experience from turnkey projects in emerging markets highlights a few recurring challenges. Proactive planning is the key to mitigating them.

Challenge: Bureaucratic Delays

Strategic Solution: Engage a reputable, licensed customs broker early. Ensure all documentation is complete and accurate before the shipment departs its country of origin.

Challenge: Incorrect HS Code Classification

Strategic Solution: Work closely with both the machinery supplier and the local customs broker to assign the correct Harmonized System (HS) codes. This is essential for qualifying for tax exemptions.

Challenge: Port Congestion & Demurrage

Strategic Solution: Factor potential delays and storage fees (demurrage) into the project budget. If the factory location allows, consider using the more efficient Port of Kribi to minimize this risk.

Challenge: Managing Multiple Suppliers

Strategic Solution: A turnkey factory setup from a single partner consolidates all equipment into a coordinated shipment, simplifying documentation and customs clearance for complex production lines.

Frequently Asked Questions (FAQ)

Q: How long does customs clearance typically take in Cameroon?

A: The timeline can vary significantly, from one week to over a month. With perfect documentation and a smooth process, 10-15 working days is achievable. However, it is prudent to budget for three to four weeks to account for potential delays.

Q: What is an ECTN/BESC and is it mandatory?

A: Yes. The Electronic Cargo Tracking Note (Bordereau Electronique de Suivi des Cargaisons) is a mandatory document for all sea freight shipments to Cameroon. It must be issued and validated at the port of loading before the vessel departs. Failure to comply results in significant penalties.

Q: Can I handle the customs process myself to save costs?

A: No. Under Cameroonian law, all commercial imports must be processed by a customs broker holding a valid license (transitaire agréé en douane). Attempting to bypass this requirement is not possible.

Q: How can I confirm if my specific machinery qualifies for tax exemptions?

A: Confirmation requires a formal application. This generally involves registering the investment project with the Investment Promotion Agency (API) and submitting a detailed file with the equipment list, its intended use, and its value. The API, in coordination with the Ministry of Finance, then grants an approval that is presented to customs to claim the exemption.

Conclusion: The Path to a Successful Importation

Importing a solar module production line into Cameroon is a complex but entirely manageable undertaking. Success hinges on meticulous documentation, a highly competent local logistics partner, and an equipment supplier who understands the nuances of exporting industrial machinery to the region.

The Cameroonian government’s strategic support for renewable energy provides a powerful financial incentive through customs and VAT exemptions. By leveraging these provisions and approaching the logistics with diligent planning, an investor can navigate the process efficiently, ensuring that high-value equipment arrives safely and on schedule, ready to begin production. This initial logistical phase is the first practical step in turning a business plan into an operational reality.