The Government of Canada has set ambitious targets, aiming for over 9 GW of installed solar capacity by 2030—a goal that creates a significant opportunity for entrepreneurs looking to establish domestic solar module manufacturing.

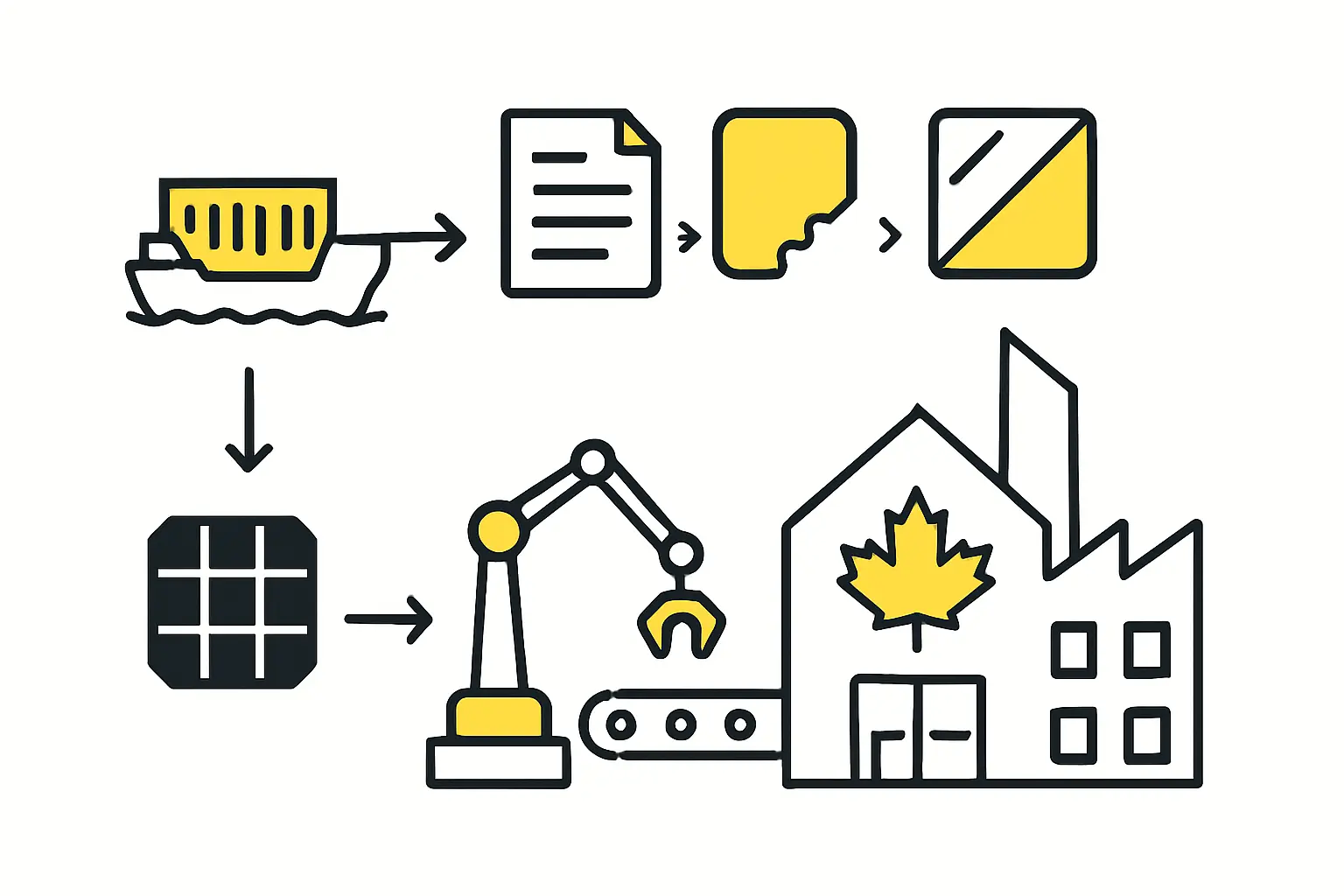

But a successful factory depends on more than just advanced machinery; it requires a robust and predictable supply chain. For new entrants, sourcing raw materials can prove more complex than the production process itself.

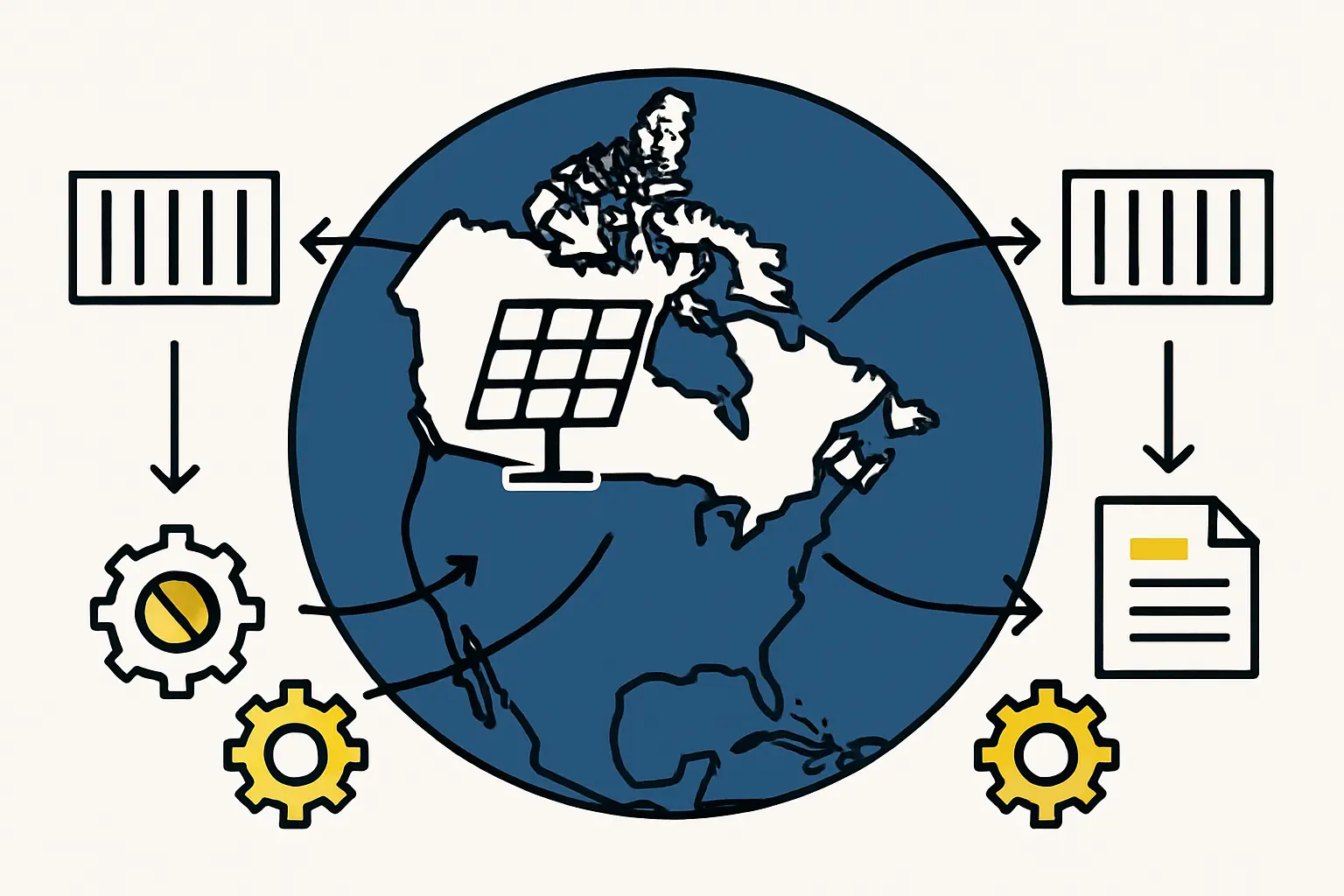

This guide breaks down the practical steps and strategic considerations for building a successful supply chain for a Canadian solar module facility. It covers the realities of global sourcing, the intricacies of trade agreements like the Canada-United States-Mexico Agreement (CUSMA), and the strategic potential of developing a local component ecosystem.

Table of Contents

The Core Components: Understanding Your Solar Module Bill of Materials

Before developing a logistics strategy, it’s essential to understand the primary materials required for module assembly. While a complete bill of materials is extensive, the five major components that drive sourcing decisions are:

- Solar Cells: The most critical and highest-value component. These silicon wafers convert sunlight into electricity.

- Solar Glass: Specially tempered, low-iron glass used for the front surface of the module.

- Encapsulant (EVA/POE): Polymer sheets that laminate the cells, protecting them from moisture and impact while ensuring light transmission.

- Backsheet: A durable, multi-layered polymer film that provides mechanical protection and electrical insulation for the rear of the module.

- Aluminum Frame: Provides structural integrity and a means for mounting the finished module.

A firm grasp of these items is fundamental, as the sourcing strategy for these materials will largely define a factory’s operational plan and cost structure. For a detailed technical breakdown, investors should familiarize themselves with the core components of a modern solar module.

Global Sourcing vs. Local Potential: A Strategic Decision

A new Canadian manufacturer faces an immediate strategic choice: rely on established global supply chains or pursue emerging local options. In practice, a hybrid approach is often the most viable path.

The Reality of Global Imports

The global photovoltaic (PV) supply chain is highly concentrated, with over 80% of the world’s solar wafers and cells manufactured in a single region. Consequently, any new facility in Canada, particularly in its initial phase, will likely need to import high-efficiency solar cells.

This reliance on imports introduces several logistical factors:

- Lead Times: Ocean freight, from order placement to delivery at a Canadian port, can take 8 to 16 weeks. This requires careful inventory and production planning.

- Supplier Vetting: Due diligence is critical to ensure cell quality, efficiency, and consistency from international suppliers.

- Currency Fluctuation: Transactions are typically conducted in USD, introducing financial risk that must be managed.

Experience from J.v.G. turnkey projects shows that establishing strong relationships with two to three vetted international cell suppliers is a key strategy for de-risking the first years of operation.

The Emerging Canadian Supply Chain

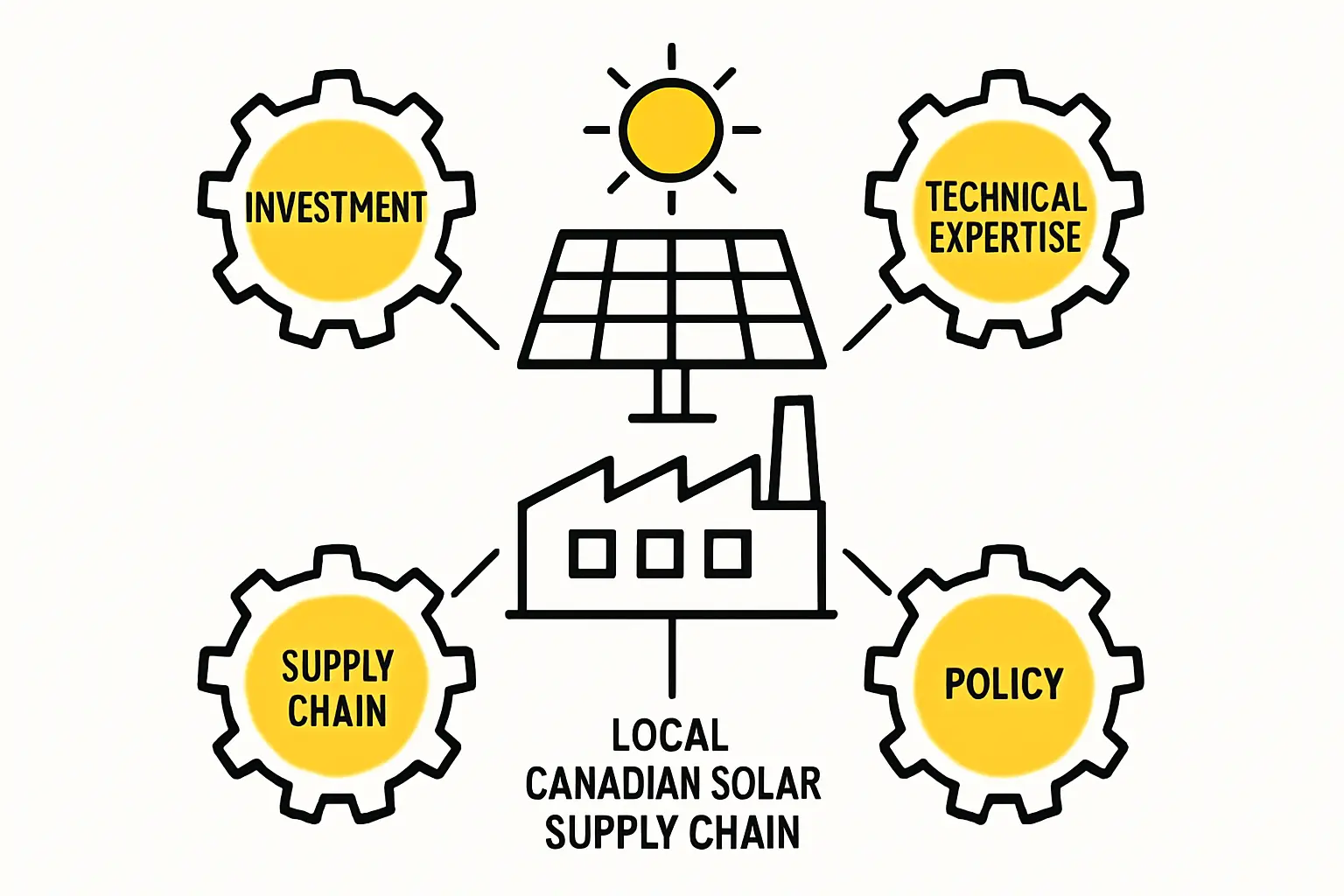

While cell importation is a near-term necessity, Canada has significant potential to localize other parts of the supply chain. The nation already produces raw materials like polysilicon (the precursor to solar cells), high-quality glass, and aluminum.

The Canadian government’s goal to expand domestic manufacturing capacity—potentially reaching 6 GW annually by 2030—is expected to stimulate investment in these upstream industries.

For an entrepreneur, this presents a long-term opportunity. Cultivating relationships with potential Canadian suppliers of glass, frames, and junction boxes can:

- Reduce transportation costs and lead times.

- Increase supply chain resilience against global disruptions.

- Allow for “Made in Canada” branding, which can be a powerful market differentiator.

Navigating Trade Agreements and Tariffs: The CUSMA Factor

For many investors, the primary market for Canadian-made solar modules is not just Canada itself, but the entire North American continent. This makes the Canada-United States-Mexico Agreement (CUSMA), also known as USMCA, a critical component of the business plan.

CUSMA allows for duty-free access to the U.S. market, provided the products meet specific “rules of origin.” This typically means a certain percentage of the product’s value must be derived from North American content. Manufacturers planning to export to the United States must design their factory’s supply chain and bill of materials to comply with these rules. Sourcing components like glass and aluminum frames from Canada or the U.S. can help meet these thresholds.

Global trade policies, such as the U.S. Section 301 tariffs on Chinese solar products and Canada’s own review of its trade defense measures, also directly influence sourcing decisions. Relying on suppliers from countries with stable trade relations can prevent unexpected cost increases from tariffs.

Practical Logistics: From Port to Production Line

An effective supply chain isn’t just about sourcing; it’s about the physical movement and management of materials.

Importation and Customs

Materials arriving from overseas will enter Canada through major ports like Vancouver, Montreal, or Halifax. The process requires meticulous documentation, including bills of lading, commercial invoices, and customs declarations.

Engaging a reliable customs broker is non-negotiable. This partner navigates the clearance process, ensuring compliance with Canada Border Services Agency (CBSA) regulations and minimizing delays that could otherwise halt production.

Inventory Management and Warehousing

Once cleared, materials must be transported to the factory and stored. A key challenge in new ventures is underestimating the space required for raw material inventory. A typical 50-100 MW factory requires a significant warehouse area to hold several weeks’ worth of components.

This buffer is essential for keeping production running smoothly despite potential shipping delays, and the necessary space must be factored into the initial building design and layout. Furthermore, a well-planned supply chain management system is crucial for tracking inventory levels, managing reorder points, and ensuring the smooth flow of materials to the assembly line.

Building a Resilient and Future-Proof Supply Chain

The landscape for solar manufacturing is dynamic. Trade policies shift, new technologies emerge, and logistical challenges arise. A resilient supply chain strategy is one that anticipates this constant change.

Key principles include:

- Supplier Diversification: Avoid reliance on a single supplier for any critical component, especially solar cells.

- Local Partnerships: Actively engage with emerging Canadian and North American suppliers to build a more localized network over time.

- Continuous Monitoring: Stay informed about international trade policies, shipping costs, and raw material price trends.

A structured approach to planning is essential. Comprehensive educational resources can provide a framework for developing a business plan that addresses these complex supply chain variables from day one.

Frequently Asked Questions (FAQ)

Q: What are the most difficult components to source for a new Canadian factory?

A: High-efficiency solar cells remain the most challenging component to source outside of Asia. Building strong relationships with established global cell manufacturers is a top priority for any new module assembly operation.

Q: How does CUSMA/USMCA benefit a Canadian solar manufacturer?

A: The primary benefit is the potential for duty-free access to the large U.S. solar market. To qualify, the finished modules must meet the agreement’s “rules of origin,” which encourages sourcing components and labor from within North America.

Q: Is it possible to source all necessary solar module components within Canada?

A: Currently, it is not possible to source all components, particularly high-performance solar cells, from within Canada. However, the domestic supply base for glass, aluminum frames, and other balance-of-materials is growing. Partnering with a reliable canadian solar parts supplier for these items is a key strategic opportunity.

Q: What is a realistic lead time for imported solar cells?

A: A new manufacturer should plan for a total lead time of 8 to 16 weeks from placing an order with an Asian supplier to having the cells available at their Canadian factory. This includes production time, ocean freight, and customs clearance.

Conclusion: Your Next Steps in Planning

Establishing a solar module factory in Canada is a venture with immense potential, but its success hinges on a well-executed supply chain strategy. The modern manufacturer must be both a global sourcer and a local partner, balancing the realities of international markets with the strategic advantages of a domestic supply base.

The key is diligent, forward-looking planning. By understanding the bill of materials, navigating trade agreements thoughtfully, and building a resilient logistics network, an entrepreneur can lay the foundation for a competitive and sustainable manufacturing operation in Canada’s growing solar industry.