For international investors eyeing the North American solar market, the United States often seems like the primary and most logical location. Its substantial, incentive-driven demand makes it an attractive target.

But this direct approach overlooks a more nuanced and potentially advantageous strategy: establishing a manufacturing base in Canada to serve the US market.

This strategy leverages the Canada-United States-Mexico Agreement (CUSMA), known in the US as the USMCA, to create a unique opportunity for export-oriented production. It allows manufacturers to navigate complex US trade policies while benefiting from Canada’s distinct operational advantages.

Table of Contents

Understanding the Complex US Solar Trade Landscape

The US solar market combines strong growth with significant protectionist trade measures. A firm grasp of these policies is critical for any business planning to import or manufacture solar modules for this market.

Several key regulations shape the current environment:

- Section 201 & 301 Tariffs: Implemented to protect domestic manufacturers from unfair foreign competition, these tariffs primarily target solar cells and modules from China. They add a substantial cost layer to imported products.

- Anti-Dumping/Countervailing Duties (AD/CVD): These are long-standing measures against specific countries found to be selling solar products in the US below fair market value. Ongoing investigations can create market uncertainty.

- Uyghur Forced Labor Prevention Act (UFLPA): This act places stringent restrictions on goods produced in China’s Xinjiang region, a major source of the world’s polysilicon. It requires importers to provide extensive documentation proving their supply chains are free of forced labor, often leading to shipment delays and seizures.

These policies collectively create high barriers to entry for modules imported directly from many parts of Asia, opening an opportunity for production within North America.

The CUSMA Framework: A Gateway to the US Market

CUSMA provides a modernized framework for trade between Canada, the US, and Mexico, effectively creating one of the world’s largest free-trade zones. For a solar module manufacturer, its most important provision is the potential for tariff-free access to the vast US market.

This access is not automatic. To qualify for duty-free treatment, a product must meet the agreement’s “Rules of Origin.” In simple terms, this means the product must undergo a “substantial transformation” within the CUSMA region.

For a solar module, this typically involves assembling various components—solar cells, glass, backsheet, and aluminum frames—into a finished product in a Canadian factory.

What Constitutes “Substantial Transformation”?

The core principle behind the Rules of Origin is to prevent products from simply passing through one country to avoid tariffs in another. The manufacturing process must add significant value and fundamentally change the nature of the components.

For a solar panel, assembling imported solar cells into a complete, certified module in a Canadian facility is generally sufficient to establish Canadian origin. This allows the finished product to be exported to the US free from the Section 201 or 301 tariffs that would apply if the same module were shipped directly from Asia.

The Canadian Advantage: Navigating US Trade Barriers

By establishing production in Canada, a business can strategically position itself to overcome the primary hurdles of the US market. A Canadian-made module that qualifies under CUSMA can enter the US on a more competitive footing.

A Canadian operation also offers a compelling solution to the supply chain challenges posed by the UFLPA. By carefully sourcing raw materials like polysilicon, wafers, and cells from regions unaffected by the act (such as Europe, South Korea, or other parts of Southeast Asia), a manufacturer can build a transparent and compliant supply chain.

This “clean” bill of materials significantly reduces the risk of customs delays and rejections at the US border—a critical factor for ensuring reliable delivery to customers. As experience from J.v.G. turnkey projects shows, establishing a robust supplier vetting process is a foundational step in de-risking the entire operation.

A Balanced View: Competing with US-Based Production

The most significant recent development in the US solar industry is the Inflation Reduction Act (IRA). This legislation introduces powerful tax credits, such as the 45X Advanced Manufacturing Production Credit, for components produced within the United States, directly incentivizing manufacturing south of the border.

Still, a Canadian manufacturing strategy offers several counterbalancing advantages:

- Operational Costs: Depending on the province, Canada can offer more competitive electricity rates and a lower overall cost structure for skilled labor compared to many US states.

- Logistical Strengths: With major ports on both the Atlantic and Pacific coasts and an extensive rail network integrated with the US system, Canada provides efficient pathways for both importing raw materials and exporting finished goods.

- Stable Environment: Canada is known for its stable political climate, skilled workforce, and well-established legal and regulatory frameworks, all of which create a predictable environment for long-term capital investment.

The decision is not whether Canada is definitively “better” than the US, but whether it presents the right strategic fit for an investor’s goals. Starting a solar module factory requires a detailed analysis of these trade-offs.

Solar panel manufacturing line”/>

Solar panel manufacturing line”/>Key Considerations for Establishing a Canadian Solar Factory

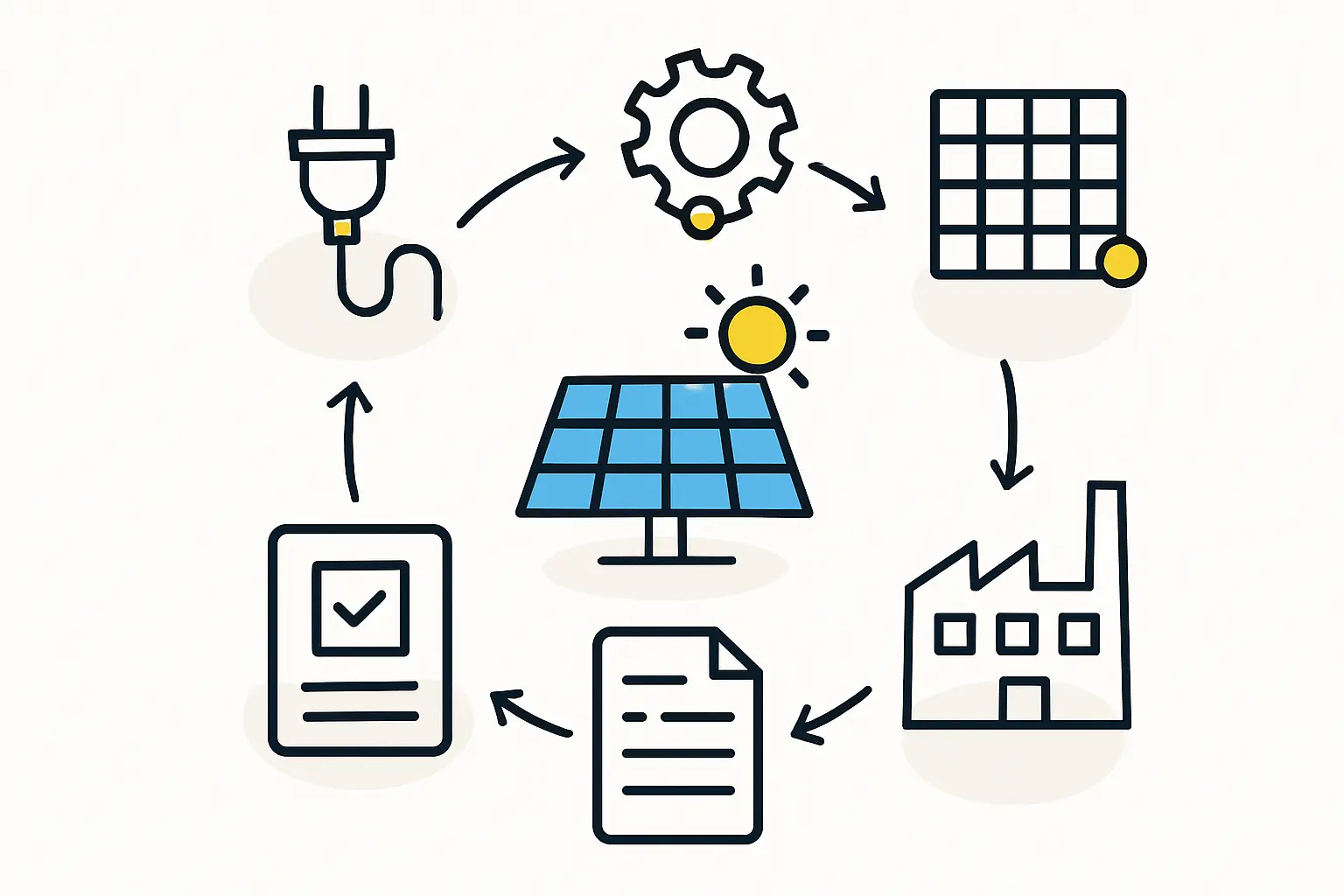

An entrepreneur pursuing this strategy must address several core operational areas:

- Supply Chain Design: The entire business case rests on sourcing CUSMA-compliant raw materials, which requires building relationships with suppliers in regions unaffected by US trade enforcement.

- Technology and Equipment: To compete on quality and cost, the factory must be equipped with modern, efficient solar panel manufacturing machines. The choice of technology will directly impact the module’s performance and bankability.

- Investment and Financial Planning: The initial investment must account for land, building, equipment, and working capital. A detailed business plan is essential to secure financing and guide the project through to profitability.

- Certification: To be sold in the US market, modules must be certified to recognized standards (such as UL). This certification process should be factored into the project timeline from the very beginning.

Frequently Asked Questions (FAQ)

Q: What are the “Rules of Origin” for solar modules under CUSMA?

A: In essence, the rule requires that the key components of the module undergo a significant manufacturing process within Canada. The assembly of foreign-made solar cells, glass, frames, and other materials into a finished, functional solar module is typically considered a “substantial transformation,” allowing the final product to qualify as Canadian.

Q: Can a Canadian factory use parts from Asia?

A: Yes, and this is central to the strategy. A Canadian factory can import components like solar cells, glass, and junction boxes from Asia or other regions. The key is that the assembly process in Canada must be significant enough to confer Canadian origin on the finished module, thereby qualifying it for duty-free export to the US.

Q: How does the US IRA affect a Canadian manufacturing strategy?

A: The IRA’s manufacturing credits make US-based production very attractive and create direct competition. A Canadian producer’s key advantage, however, remains tariff-free access to the US market, which IRA-supported domestic factories do not need. A Canadian factory can also serve the growing Canadian domestic market. The strategy is viable but requires a sharp focus on cost efficiency and supply chain security to remain competitive.

Q: What is the typical timeline for setting up a factory in Canada?

A: From initial planning to full production, a typical timeline for a small-to-mid-size (e.g., 50-200 MW) solar module factory is approximately 12 to 18 months. This includes site selection, equipment procurement, installation, commissioning, and staff training.

Conclusion: A Strategic North American Play

While the US market presents an immense opportunity, a direct entry strategy is complicated by a web of tariffs and trade regulations. For the discerning global entrepreneur, Canada offers a sophisticated alternative: a stable, cost-effective manufacturing platform with privileged, tariff-free access to the US market through CUSMA.

This approach transforms complex trade barriers into a potential competitive advantage. It requires diligent planning, a secure supply chain, and expert guidance, but for the right business model, it represents a powerful strategy for capturing long-term growth in the North American solar industry.