Any entrepreneur considering a new venture in solar module manufacturing grapples with a critical question: how to manage the substantial initial investment in equipment and facilities to ensure long-term profitability?

In Colombia, the government provides a clear and compelling answer through Law 1715 of 2014, which was significantly enhanced by Law 2099 of 2021. This legislation extends beyond energy producers, creating a powerful financial framework specifically designed to attract and support manufacturers of renewable energy components, including solar modules.

This guide breaks down the specific tax incentives available to new solar module producers under this law and outlines the official process for securing them. Understanding these benefits is a critical first step in evaluating the business case for establishing a solar manufacturing presence in Colombia.

Table of Contents

Understanding Law 1715: A Strategic Advantage for Manufacturers

At its core, Law 1715 is a government initiative to accelerate the adoption of non-conventional renewable energy sources (FNCER). Lawmakers understood that a sustainable energy transition requires more than just installing solar farms—it also demands a robust local manufacturing supply chain.

The law introduces a range of financial incentives aimed directly at reducing the capital expenditure (CapEx) and long-term tax liabilities for businesses investing in the production of renewable energy equipment. For an entrepreneur planning to establish a solar module factory, these incentives can fundamentally alter the financial projections, reducing risk and shortening the path to profitability.

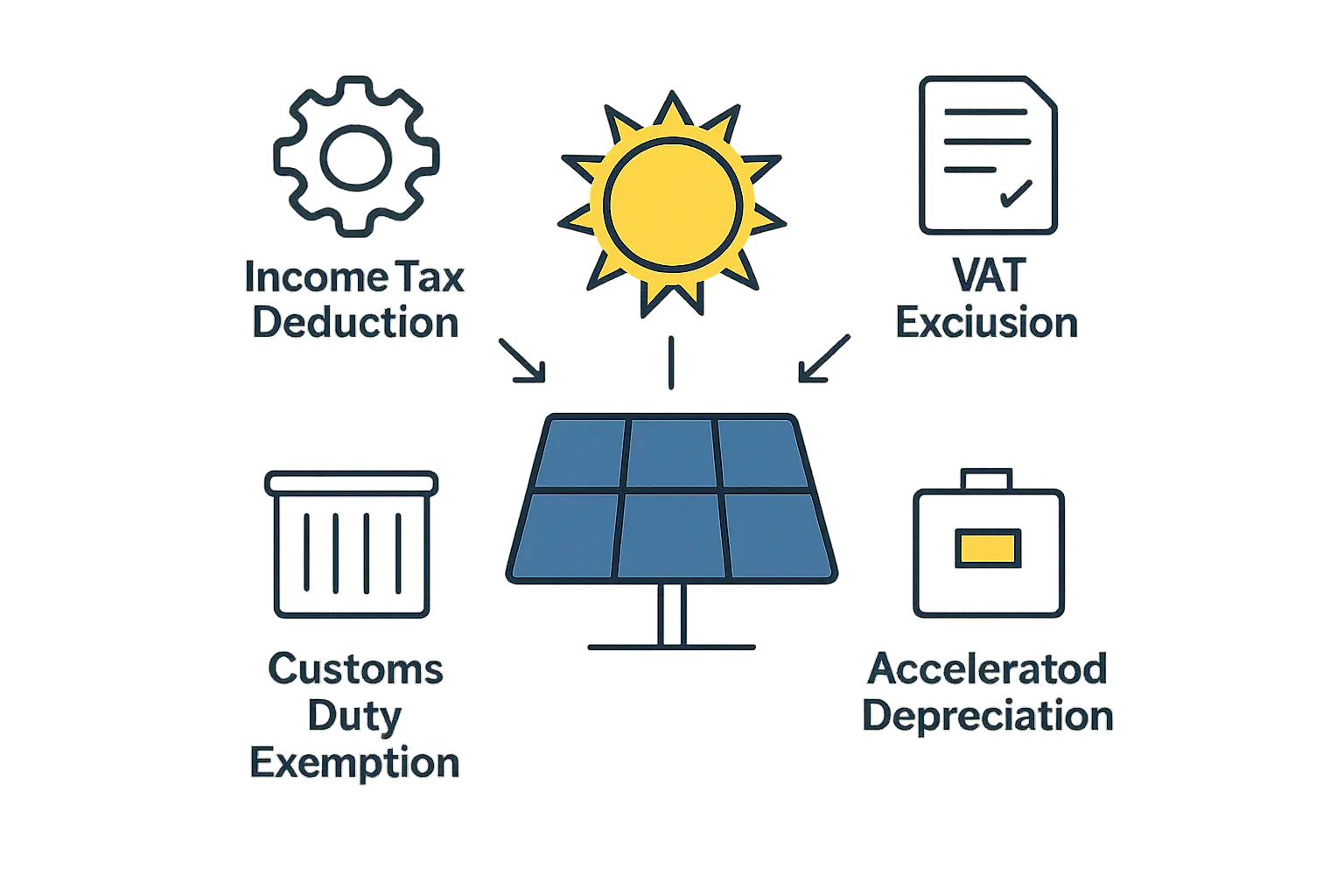

Core Financial Benefits for Solar Module Production

The law offers four primary incentives that directly impact a manufacturer’s bottom line, easing financial pressure from the initial investment stage through to long-term operations.

Income Tax Deduction: Reducing Long-Term Tax Burden

Investors can claim a special income tax deduction of up to 50% of the total value of their investment in the project. This deduction can be applied over the 15 years following the start of the project’s operation.

How it works: If a new solar module factory requires an initial investment of $10 million, the business can deduct up to $5 million from its taxable income over the subsequent 15-year period.

Business Impact: This significantly lowers the company’s long-term tax obligations, freeing up capital for reinvestment, expansion, or operational improvements. The deduction is capped annually, meaning it cannot exceed 50% of the company’s net liquid income for that year.

VAT Exclusion: Lowering Initial Capital Expenditure

The law offers a full exclusion from the Value Added Tax (VAT) on the purchase of equipment, machinery, materials, and services required during the pre-investment and investment stages. In Colombia, the standard VAT rate is 19%.

How it works: When purchasing or importing essential manufacturing equipment—such as stringers, laminators, and cell testers—the 19% VAT is not applied. This benefit extends to services directly related to the project’s construction and setup.

Business Impact: This translates to an immediate and direct reduction in setup costs. For a factory investment of several million dollars, this incentive alone can save hundreds of thousands, or even millions, of dollars, significantly lowering the capital needed to launch the business.

Customs Duty Exemption: Streamlining Equipment Imports

A significant portion of specialized solar module manufacturing equipment is imported from global leaders in Europe and Asia. To support this, Law 1715 provides a full exemption from customs duties on the importation of machinery, equipment, materials, and supplies intended for the project.

How it works: All certified equipment imported for the factory is exempt from import tariffs at customs.

Business Impact: Importing a full production line involves significant logistical costs. Eliminating customs duties removes a major expense and simplifies the importation process, reducing administrative delays.

Accelerated Depreciation: Improving Early-Stage Cash Flow

The legislation allows for an accelerated depreciation rate for assets acquired for the project. The annual depreciation rate can be up to 33.33%—a significant increase from standard fiscal depreciation rates.

How it works: Depreciation is an accounting method that spreads the cost of an asset over its useful life. By allowing a faster rate, the law enables the business to report lower taxable profits in the crucial first few years of operation.

Business Impact: This improves cash flow during the critical start-up phase when revenue is beginning to scale. By reducing the tax burden early on, the company gains more financial flexibility to manage operations and growth.

The Application Process: Securing Certification from UPME

Access to these powerful incentives is not automatic. It requires a formal application and certification process managed by the Mining and Energy Planning Unit (UPME), a technical body under the Ministry of Mines and Energy. The UPME evaluates projects through a structured process, requiring detailed documentation to ensure they align with the objectives of Law 1715.

Step 1: Project Registration

The first step is to register the company and the project details on the UPME’s online platform, known as SITEE (Information System for Tax Incentives).

Step 2: Document Preparation

Applicants must prepare a comprehensive file that includes a detailed technical description of the manufacturing project, a complete investment plan outlining all costs, and a specific list of all goods, services, and equipment for which the tax benefits are being requested.

Step 3: Submission and Evaluation

Once submitted via the SITEE platform, the complete application is reviewed by the UPME’s technical team to verify its eligibility and compliance with the law’s requirements.

Step 4: Certification Issuance

If the project is approved, the UPME issues an official certificate, or “Aval,” which formally endorses the project’s eligibility for the tax benefits.

Step 5: Presenting to DIAN

This UPME certificate is the key document that must be presented to the National Tax and Customs Directorate (DIAN) to formally apply the VAT and customs duty exemptions and register the income tax deduction.

Why These Incentives Matter for a New Solar Business in Colombia

For any entrepreneur or company considering entry into the Colombian market, these incentives create a highly favorable investment climate.

De-risking the Investment

The combination of lower initial costs and reduced long-term tax liabilities significantly lowers the overall financial risk. Law 1715 makes the substantial investment required for a solar module factory far more attainable.

Enhancing Competitiveness

By reducing the cost base, a new local manufacturer can compete more effectively against imported solar modules, both on price and its ability to serve the local market quickly.

Aligning with National Goals

Investing in local solar manufacturing aligns the business with Colombia’s national energy transition strategy. This creates a positive relationship with government bodies and positions the company as a key contributor to the country’s economic and environmental goals. Starting a production line thus becomes part of a larger, nationally supported vision.

Frequently Asked Questions (FAQ)

Q: What types of equipment qualify for the benefits?

A: Generally, any machinery, equipment, and materials directly involved in the manufacturing process of solar modules qualify. This includes cell stringers, laminators, framing machines, and testing equipment. The UPME requires a detailed list for approval.

Q: How long does the UPME certification process typically take?

A: The timeline can vary depending on the project’s complexity and the completeness of the application. Applicants should plan for a process that may take several months. Thorough and professional preparation of the required technical and financial documentation is critical for avoiding delays.

Q: Are these benefits available for expanding an existing factory?

A: Yes, the benefits apply to “new investments.” This can include the construction of a new facility or the installation of a new, separate production line within an existing plant.

Q: Is it necessary to have a local partner in Colombia to apply?

A: While not a strict legal requirement, engaging with local legal and technical advisors is highly recommended. Navigating the UPME and DIAN procedures requires familiarity with Colombian administrative processes.

Conclusion

Colombia’s Law 1715 represents one of the most robust incentive packages for renewable energy manufacturing in Latin America. For investors with a clear business plan, it provides a structured pathway to lower costs, reduce risk, and build a competitive and profitable solar module production business. While the application process demands diligence, the financial rewards are designed to ensure the long-term success of those who invest in Colombia’s clean energy future.