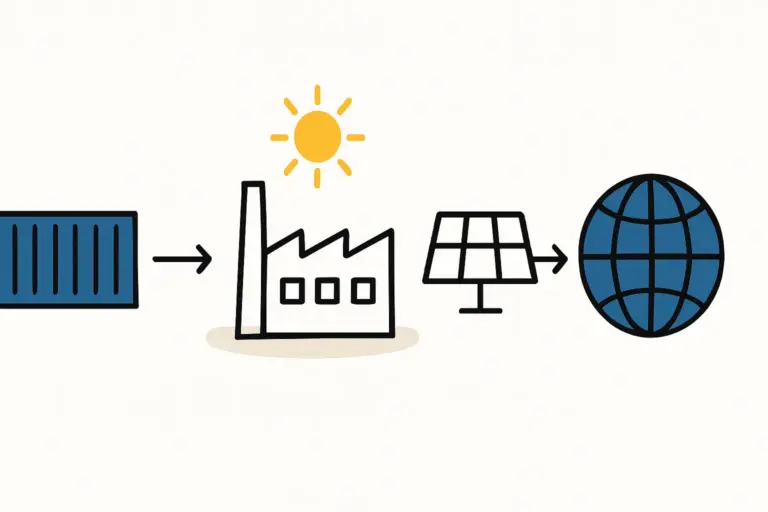

The global shift toward renewable energy is opening up unique opportunities in markets actively seeking to modernize their energy infrastructure. Cuba, with its strategic goal of generating 24% of its electricity from renewable sources by 2030, is a prime example. For international entrepreneurs, however, entering a centrally planned economy can be a complex undertaking.

The key to unlocking this potential lies in understanding a single piece of legislation: Law No. 118, the Foreign Investment Act. This law is not merely a set of rules; it is a formal invitation for foreign investors to participate in the country’s economic development, particularly in high-priority sectors like solar energy. This guide offers a business-focused examination of Law No. 118, outlining its practical implications for establishing a solar manufacturing joint venture in Cuba.

Understanding Law No. 118: The Foundation for Foreign Investment

Enacted in 2014, Law No. 118 was designed to attract foreign capital, technology, and management expertise to stimulate sustainable economic growth and create a more diverse, competitive export market. It replaced previous, more restrictive legislation, establishing a clear framework with protections and incentives designed to build investor confidence.

The law prioritizes investments that align with national objectives, such as generating renewable energy, creating jobs, and developing modern infrastructure. Solar manufacturing proposals are therefore viewed favorably, as they directly support Cuba’s long-term goals for energy independence.

Key Provisions and Incentives for Solar Investors

For professionals considering this market, the most critical elements of Law No. 118 are the concrete protections and financial benefits it offers. These provisions are designed to mitigate risk and improve a project’s financial viability.

Legal Protections for Your Investment

A primary concern for any international investor is the security of their capital. Law No. 118 addresses this directly:

-

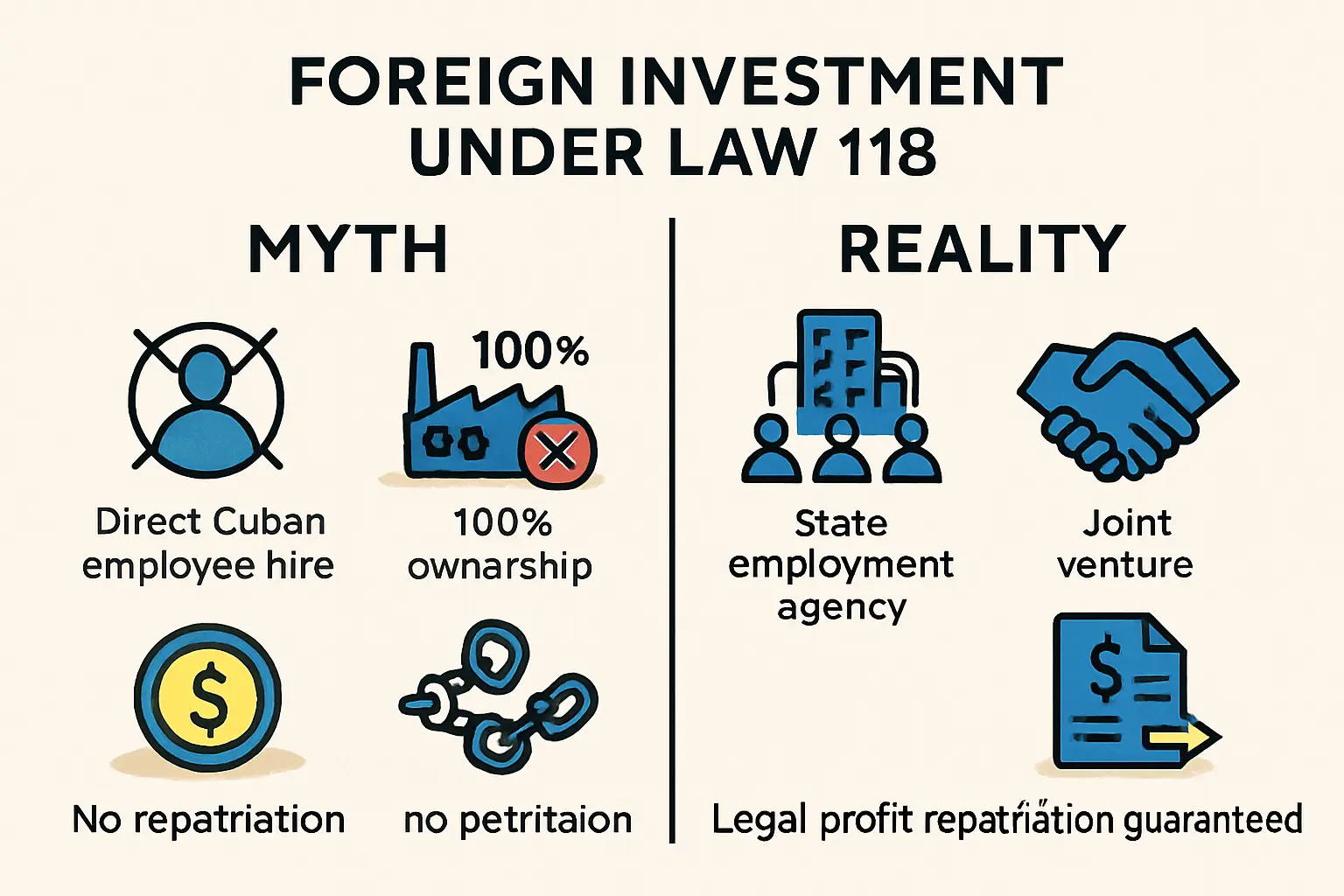

Protection Against Expropriation: The law explicitly guarantees that foreign investments cannot be expropriated, except for reasons of public or social interest as defined by the constitution. In such a rare event, the law mandates fair compensation, determined by mutual agreement and paid in a freely convertible currency.

-

Full Repatriation of Profits: Investors are guaranteed the right to freely transfer abroad—in convertible currency—all net profits or dividends earned from their investment.

Favorable Tax Regime

The financial incentives offered are substantial and designed to facilitate a strong start for new enterprises:

-

Profit Tax Exemption: Approved joint ventures are exempt from paying tax on profits for eight years, a period that can be extended by the Council of Ministers if the project is deemed beneficial to the nation.

-

Reduced Tax Rate: After the exemption period, the tax on profits is set at 15%, a rate significantly lower than in many other jurisdictions.

-

Labor Tax Exemption: Businesses operating under this law are exempt from paying tax on the use of a labor force.

Ownership Structures

Law No. 118 provides three main modalities for foreign investment. For a manufacturing enterprise, the most common and practical is the joint venture.

-

Joint Venture (Empresa Mixta): This involves creating a new Cuban legal entity with its own distinct identity. Shares are held by both the foreign investor and a Cuban state-owned partner. This is the preferred model for establishing a long-term solar manufacturing joint venture, as it integrates foreign capital and technology with local market knowledge and operational oversight.

-

International Economic Association Contract: This model allows for collaboration on a specific project without forming a new legal entity. It is better suited for service agreements, technology licensing, or short-term production initiatives.

-

Wholly Foreign-Owned Company: While permitted by the law, this structure is less common, particularly in strategic sectors like energy. It requires special approval from the Council of Ministers.

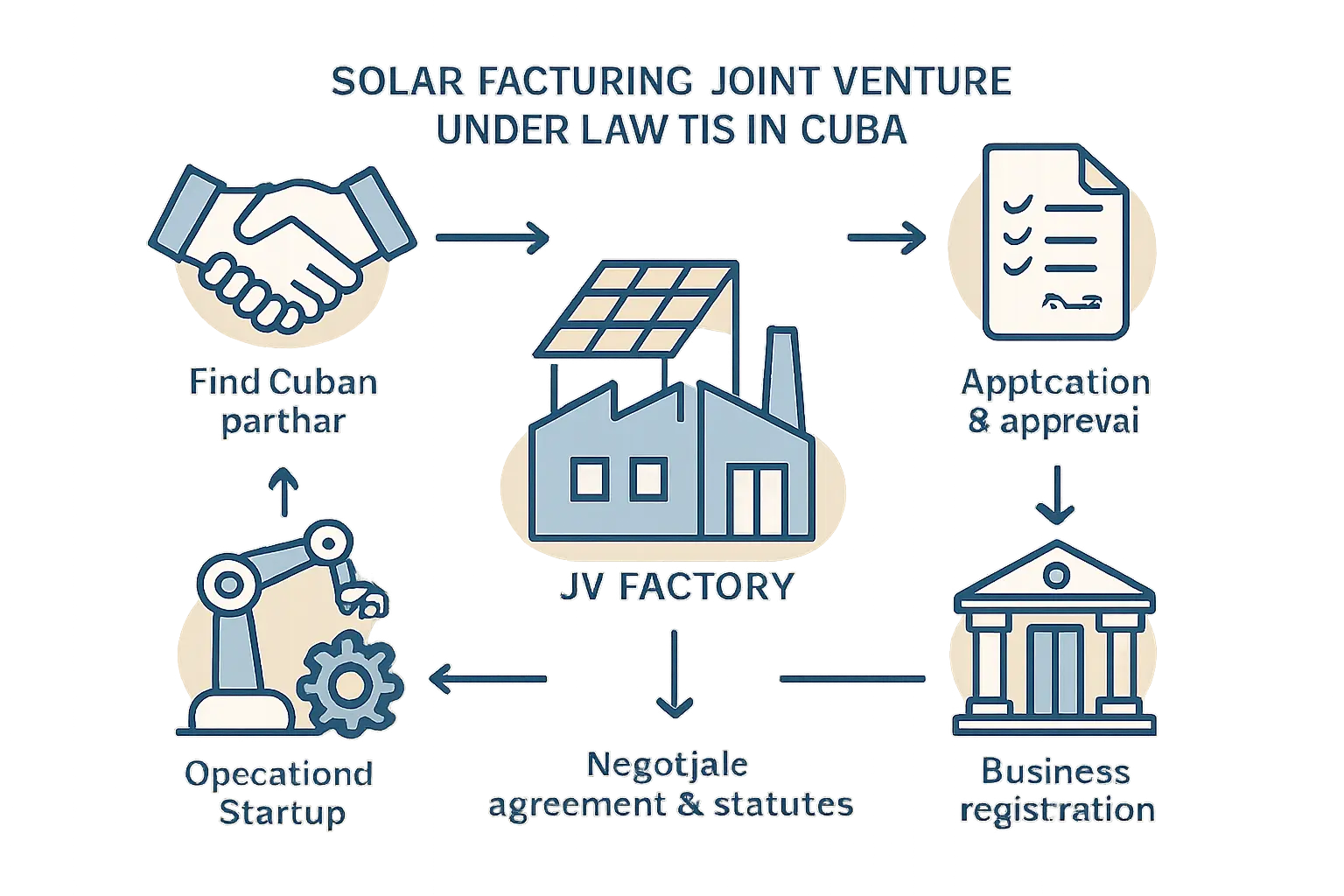

The Process of Establishing a Solar Factory in Cuba

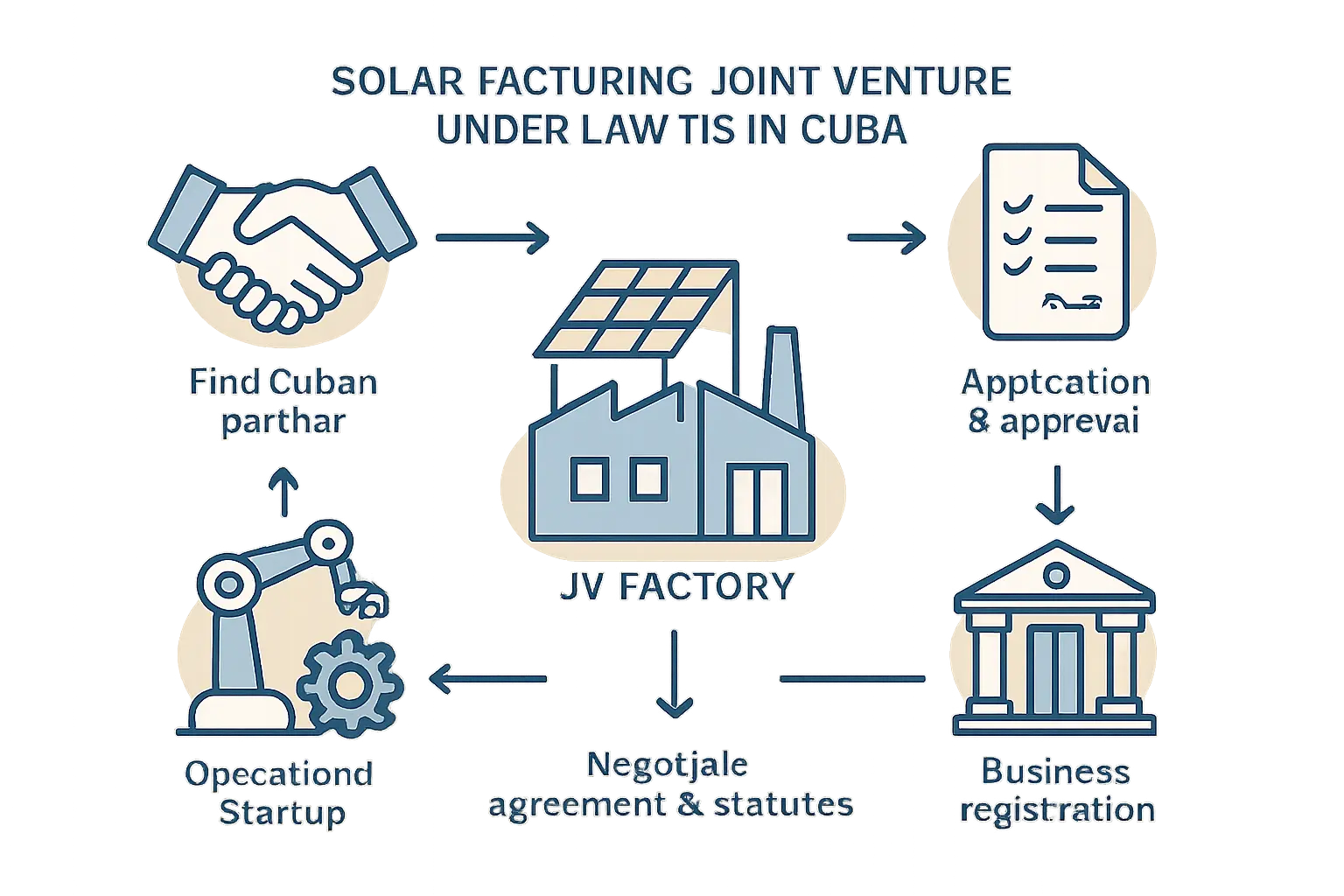

The path from concept to a fully operational facility is a structured, state-managed process. Understanding these steps is essential for realistic planning and timeline development.

Step 1: Identifying a Cuban Partner

For a joint venture, the first step is to engage with a relevant Cuban state-owned enterprise. For a solar module factory, this would likely be an entity within the Ministry of Energy and Mines or the Ministry of Industries.

Step 2: Proposal and Negotiation

Once a partner is identified, the foreign investor must present a detailed proposal, including a comprehensive feasibility study. This critical document outlines the technical, economic, and financial basis of the project, including the full investment requirements. The proposal is submitted to the Ministry of Foreign Trade and Investment (MINCEX), which serves as the central coordinating body.

Step 3: Formal Approval

MINCEX evaluates the proposal and, if it aligns with national development goals, presents it to the Council of Ministers for final approval. This stage involves thorough due diligence by the Cuban government.

Step 4: Implementation

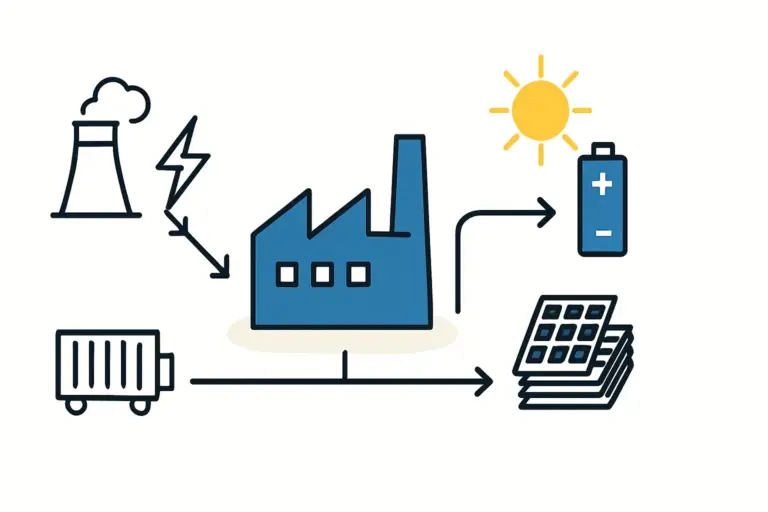

Following approval, the joint venture can be legally constituted. The next phase involves the practical setup of the turnkey solar factory. This includes securing the location, constructing or retrofitting the building, and installing the solar panel production line. Law 118 facilitates the import of necessary machinery, often with customs duty exemptions.

Navigating Potential Challenges

While Law No. 118 provides a robust framework, prospective investors must be aware of the unique operating environment. A clear understanding of these challenges is fundamental to executing a successful project.

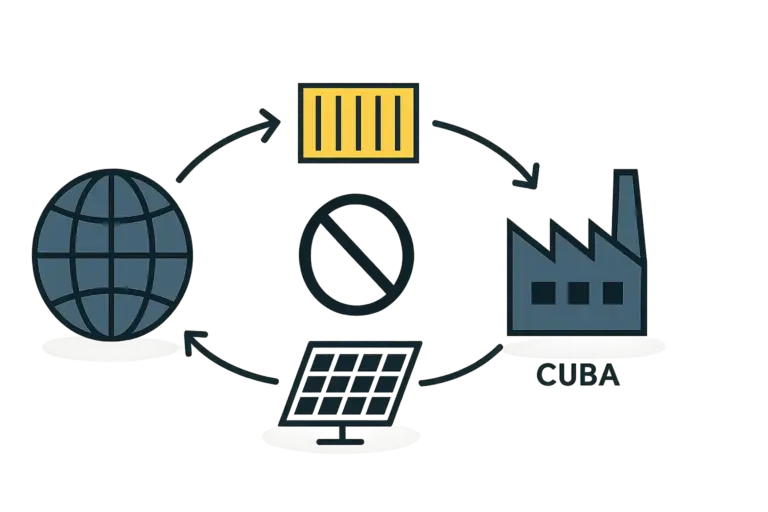

The U.S. Embargo

The long-standing U.S. embargo, particularly the Helms-Burton Act (Title III), poses a significant risk for investors with ties to the United States or who use the U.S. financial system. This requires careful legal and financial planning to ensure compliance and avoid potential sanctions.

Bureaucratic Processes

As in many countries, navigating the administrative and approval processes can be time-consuming. Success requires patience, meticulous documentation, and often the support of experienced local advisors who understand the system.

The Labor Market

Foreign joint ventures do not hire Cuban employees directly. Instead, they contract with a state-run employment agency. The joint venture pays the agency in convertible currency for labor, and the agency then pays the workers in local currency according to the national salary scale. This is a critical structural difference from market-based economies.

Frequently Asked Questions (FAQ) for Prospective Investors

What is the typical ownership split in a joint venture?

While Cuban law previously favored a 51% Cuban majority, Law No. 118 is more flexible. The ownership split is now negotiable and can reflect the capital, technology, and market contributions of each partner. For high-priority projects, a foreign majority stake is possible.

How long does the approval process take?

Timelines can vary significantly depending on a project’s complexity and strategic importance. A realistic estimate, from the initial proposal to final approval, is between 6 and 12 months, though it can sometimes take longer.

Can I import specialized equipment for my factory?

Yes. The law allows for the import of technology, machinery, and equipment necessary for the investment. Approved projects often benefit from exemptions from customs duties on these imports during the investment phase.

Which Cuban entities are potential partners for solar manufacturing?

Likely partners would be state-owned enterprises in the energy or electronics sectors, such as the Unión Eléctrica (UNE) or entities under the Grupo de la Electrónica (GELECT).

How does the regulatory landscape in Cuba compare to other emerging markets?

The regulatory landscape in Cuba is unique. It offers stronger legal guarantees and more generous tax incentives than many other markets. However, this is balanced by a state-controlled economy, a distinct labor system, and external geopolitical challenges.

Conclusion: A Strategic Opportunity with Unique Parameters

Cuba’s Foreign Investment Law No. 118 presents a clear, structured, and surprisingly favorable framework for investors in the solar energy sector. The combination of extensive tax holidays, legal protections against expropriation, and the right to repatriate profits makes it an attractive proposition on paper.

Success, however, depends not just on understanding the law, but on navigating its application within Cuba’s specific economic and political context. For the well-prepared entrepreneur, the opportunity to establish a manufacturing foothold in a nation committed to a renewable energy future is substantial. This endeavor requires diligent research, expert guidance, and a long-term strategic vision.