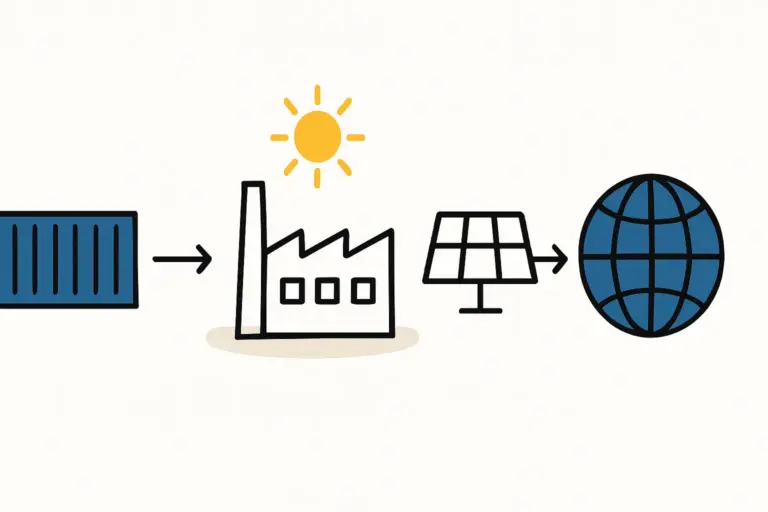

Establishing a solar module factory in Cuba presents entrepreneurs with a unique set of circumstances. The country’s high solar irradiation and clear need for energy independence create a significant business opportunity. However, Cuba also operates under complex international trade restrictions that make sourcing critical components a daunting task.

The core question is not whether a factory can be established, but how to build a resilient and compliant supply chain to sustain it. This article outlines a strategic approach for sourcing essential raw materials—such as silicon cells, EVA, and backsheets—for a solar manufacturing operation in Cuba. It focuses on practical, compliant methods for navigating the international trade landscape and establishing reliable supply routes from the outset.

The Core Components of a Solar Module Supply Chain

Before detailing a sourcing strategy, it’s crucial to understand the key materials that make up a standard photovoltaic (PV) module. A modern solar panel is an assembly of critical components, most of which are produced by a specialized global industry.

The primary inputs include:

-

Silicon Solar Cells: These are the active components that convert sunlight into electricity. They are the single most important and highest-cost item in a module.

-

Encapsulant (EVA): Ethylene Vinyl Acetate is a polymer sheet used to laminate the cells, protecting them from moisture and physical impact.

-

Front Glass and Backsheet: The tempered front glass provides protection from the elements, while the polymer backsheet insulates the rear of the module.

-

Aluminum Frame: This provides structural rigidity and a means for mounting the panel.

-

Junction Box: An enclosure on the back of the module where the cell strings are connected, allowing the panel to be integrated into the system.

A comprehensive understanding of the raw materials for solar panels is the first step in building a robust procurement plan. The vast majority of these components are manufactured in Asia, with a smaller but significant industrial base in Europe.

The Primary Challenge: Understanding International Trade Restrictions

The central obstacle for a Cuban solar enterprise is the U.S. trade embargo. Its implications extend beyond a simple prohibition on direct trade between the United States and Cuba. The restrictions can have an extraterritorial reach, affecting non-U.S. companies and transactions under certain conditions.

For a solar manufacturer, this means any potential supplier must be carefully vetted to ensure its products, technology, and financial transactions are free from U.S. entanglements that could trigger sanctions. This includes:

-

Component Origin: The raw materials themselves must not originate from the U.S.

-

Intellectual Property: The technology used to produce the components should not be subject to U.S. licensing restrictions.

-

Financial Channels: All payments and trade financing must be routed through non-U.S. financial institutions.

The objective is not to find temporary workarounds but to design a supply chain that is inherently compliant and resilient by sourcing from regions and partners without these specific restrictions.

A Three-Pillar Strategy for a Resilient Cuban Supply Chain

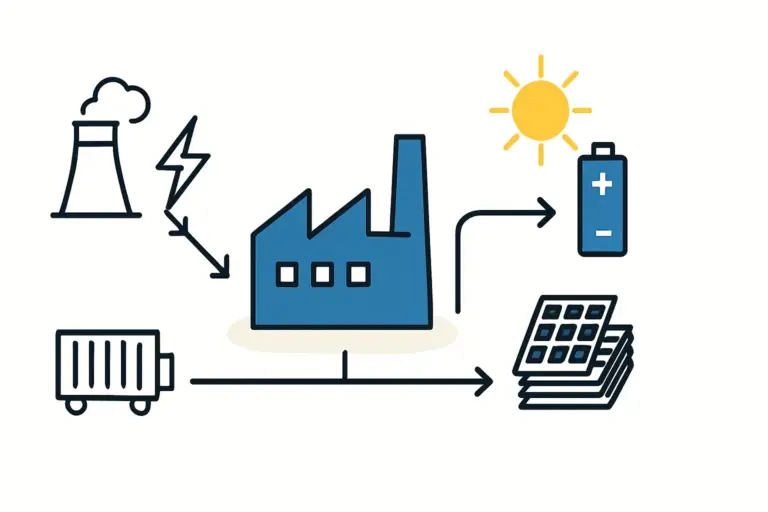

A successful sourcing strategy for a Cuban solar factory rests on three foundational pillars: geographical diversification, rigorous supplier due diligence, and meticulous logistical planning.

Pillar 1: Diversification of Sourcing Regions

Given the trade restrictions, suppliers must be selected from countries with established manufacturing capabilities and independent trade policies.

Primary Focus on Asia: The majority of solar cell and component manufacturing is concentrated in China, which remains the most viable source for silicon cells, EVA, backsheets, and glass at a competitive scale. Other Southeast Asian countries, such as Vietnam and Malaysia, are also developing their solar manufacturing capacities and can serve as alternative sourcing locations.

Secondary Focus on Europe: While often higher in cost, European suppliers can be an excellent source for specialized components and, crucially, for manufacturing equipment. Engineering firms in Germany, Spain, and Italy have a long history of providing high-quality machinery. Experience from J.v.G. turnkey projects shows that European equipment suppliers are well-versed in global exports and can provide the technology for a complete turnkey solar manufacturing line.

Pillar 2: Thorough Supplier Vetting and Due Diligence

Simply choosing a supplier based in Asia or Europe is not sufficient. A deeper level of due diligence is required to ensure long-term compliance and stability. This process involves verifying that the supplier’s own operations are free from sanctionable U.S. links.

Key steps in the vetting process include:

-

Initial Screening: Confirm the company has no U.S. parent company or majority ownership.

-

Certification of Origin: Require formal documentation for all critical components, attesting that they are not of U.S. origin.

-

Technology Review: Inquire about the origin of the production technology to ensure it is not subject to U.S. licensing.

-

Contractual Safeguards: Include clauses in supply contracts that guarantee compliance with international trade regulations relevant to Cuba.

This due diligence process may add several weeks to the initial supplier qualification phase but is a critical investment in risk mitigation.

Pillar 3: Logistics and Financial Route Planning

The physical and financial pathways for goods and payments must be as carefully planned as the sourcing itself.

Shipping: Using direct shipping routes from ports in Asia or Europe to a major Cuban port like Mariel is essential. Transshipment through ports in countries that enforce the embargo must be strictly avoided to prevent seizure or delays.

Financial Transactions: All payments must be conducted through banking systems that are not tied to the U.S. financial system. European and Asian banks with experience in international trade are typically used for this purpose. Engaging legal and financial advisors with expertise in this specific area is highly recommended.

Case Insight: Lessons from Similar Markets

Lessons from other markets with logistical or political complexities demonstrate that these challenges can be overcome. The key is shifting from a ‘just-in-time’ inventory model to a ‘just-in-case’ approach.

Factories in logistically challenging regions often allocate an additional 10–15% of their initial working capital to secure a larger buffer stock of raw materials. Holding a three-month supply of silicon cells and EVA, for instance, instead of a one-month supply, provides a crucial cushion against potential shipping delays or supplier disruptions. This strategy transforms the supply chain from a potential vulnerability into a source of operational stability.

Frequently Asked Questions (FAQ)

Q1: Are solar components sourced from Asia of sufficient quality?

A1: Yes, provided a robust quality assurance process is implemented. The global solar industry relies heavily on Asian manufacturing. Top-tier suppliers (often referred to as Tier 1) produce components that meet the highest international standards, such as those from TÜV and IEC. The key is to implement a rigorous quality control protocol, including factory audits and incoming material inspections at your own solar factory layout.

Q2: How do shipping times from Asia to Cuba impact production planning?

A2: Sea freight from a major Asian port to Cuba typically takes between 40 and 60 days. This transit time must be factored into the production schedule and inventory management. An effective plan will have new material shipments arriving well before existing stock is depleted.

Q3: Can a Cuban factory source any materials locally?

A3: While core high-tech components like silicon cells and encapsulants must be imported, there may be opportunities to source other materials locally. For example, aluminum for frames, packaging materials like cardboard and plastics, and certain chemicals could be procured within Cuba or the immediate region, reducing import reliance and costs.

Q4: What is the role of a consultant or turnkey partner in this process?

A4: An experienced technical partner or consultant plays a critical role. They can help navigate the complexities of supplier selection by leveraging an existing network of vetted, compliant international suppliers. Additionally, platforms like pvknowhow.com provide structured educational resources to help entrepreneurs understand these planning stages before committing significant capital.

Conclusion: Building a Foundation for Success

Establishing a solar module factory in Cuba is a viable and potentially rewarding venture. The operational challenges, particularly concerning the supply chain, are significant but manageable with a deliberate and well-researched strategy.

Success hinges on moving beyond conventional procurement practices and adopting a framework built on resilience. By focusing on the three pillars—diversified sourcing from compliant regions, exhaustive supplier vetting, and meticulous logistical planning—an entrepreneur can build a robust foundation for a sustainable and impactful manufacturing operation. The journey requires foresight, diligence, and often, the guidance of experienced partners who have navigated these waters before.