Choosing where to build a new solar module factory is a pivotal decision. While logistics and government incentives are significant, a facility’s long-term operational cost and efficiency ultimately hinge on one critical factor: the local labor market.

It’s a common assumption that selecting the country with the lowest average wage yields the highest profitability. This view, however, overlooks crucial variables such as workforce productivity, technical skill levels, and labor availability—factors that determine the true cost per module produced.

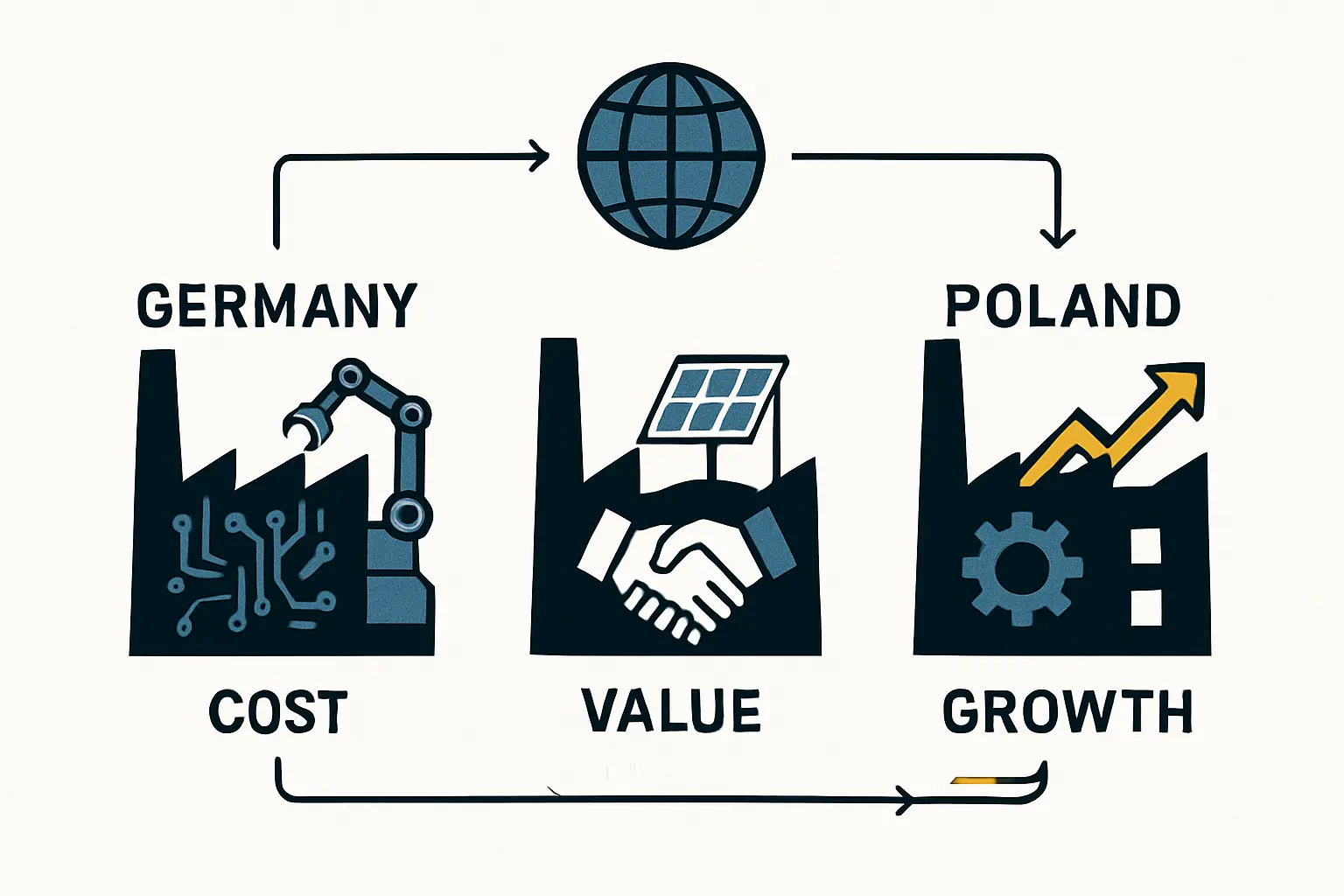

This analysis offers a data-driven comparison of the labor markets in three of Central Europe’s industrial hubs: Germany, Poland, and the Czech Republic. It is designed to help professionals from outside the solar industry grasp the nuances of each market and make a strategic decision based on a more complete view of operational costs.

Understanding the Total Cost of Labor: Beyond the Hourly Wage

An employee’s hourly wage is only the starting point. The total cost of employment is a more accurate metric for financial planning, as it includes mandatory social security contributions, health insurance, pension funds, and other employer-paid taxes. These additional costs can increase an employee’s base salary by 20–40%, depending on the country.

Beyond the raw numbers, three qualitative factors are critical in a solar manufacturing context:

-

Productivity: An experienced, better-trained workforce can produce more modules per hour with fewer defects, directly offsetting higher wages and lowering the cost per unit.

-

Skill Level: Advanced solar manufacturing lines rely on automation. The availability of technicians skilled in robotics, PLC programming, and quality control is essential for minimizing downtime and ensuring a smooth production ramp-up.

-

Labor Availability: A low national unemployment rate might signal a healthy economy, but for a new factory, it can mean intense competition for qualified candidates, leading to longer hiring times and upward wage pressure.

A successful business plan must balance these quantitative and qualitative elements to accurately project the true operational costs.

A Comparative Overview: Key Labor Market Metrics

Germany, Poland, and the Czech Republic form a powerful industrial triangle in the heart of Europe. Each nation presents a distinct profile for investors in the solar manufacturing sector.

Key Metrics (2023 Estimates)

Germany

Average Gross Monthly Wage (Manufacturing): ~€4,100

Total Employer Cost (Approx. % of Gross Wage): ~21%

Unemployment Rate: ~5.7%

Industrial Tradition: High-end machinery, automotive, automation

Poland

Average Gross Monthly Wage (Manufacturing): ~€1,750

Total Employer Cost (Approx. % of Gross Wage): ~20%

Unemployment Rate: ~5.0%

Industrial Tradition: Heavy industry, manufacturing, electronics

Czech Republic

Average Gross Monthly Wage (Manufacturing): ~€1,800

Total Employer Cost (Approx. % of Gross Wage): ~34%

Unemployment Rate: ~2.7%

Industrial Tradition: Automotive, advanced engineering

Note: Figures are estimates and can vary by region and specific industry. Sources include Eurostat and national statistics offices.

This data frames the key strategic choice: Do the cost savings in Poland outweigh the potential productivity gains from Germany’s highly trained workforce, or does the Czech Republic’s stable, specialized environment offer the best balance?

In-Depth Country Analysis for Solar Manufacturing

Making an informed decision requires a deeper look into each country’s industrial culture and labor dynamics.

Germany: The High-Skill, High-Cost Benchmark

Germany is synonymous with engineering excellence and quality manufacturing. Its “dual education” system, which combines classroom instruction with paid apprenticeships, produces a workforce with exceptional technical proficiency.

Wages and Costs: Germany has the highest labor costs of the three countries. However, this investment often translates into tangible benefits on the factory floor. German technicians are typically skilled in operating and maintaining complex automated equipment, which can lead to higher machine uptime and a faster production ramp-up.

Skills and Productivity: For a highly automated solar factory, the availability of skilled mechatronics engineers and automation specialists is a decisive advantage. This expertise can lead to lower defect rates and consistently high product quality, strengthening a brand’s reputation.

Availability: While unemployment is relatively low, Germany’s large population and participation in the EU’s free movement of labor ensure a deep talent pool. However, competition for top-tier engineers is fierce, particularly in established industrial regions like Bavaria and Baden-Württemberg.

Choosing Germany reflects a strategy focused on technical leadership and premium product quality, justifying higher labor costs with superior operational efficiency. This approach significantly impacts the overall Investment Requirements for a Solar Factory, as the business model must support a higher operational budget.

Poland: The Rising Industrial Powerhouse

Over the past two decades, Poland has transformed into a dynamic manufacturing hub, attracting significant foreign investment. Its combination of a large, motivated workforce and competitive cost structures makes it a compelling option.

Wages and Costs: Poland offers the most competitive labor costs in this comparison. Both gross wages and employer contributions are substantially lower than in Germany, providing a clear advantage for operational budgets.

Skills and Productivity: The country has a strong network of technical universities and vocational schools that produce a growing number of well-educated engineers and technicians. While deep experience in automation may not be as widespread as in Germany, productivity levels in modern Polish factories are high and continuously improving. Many professionals, especially in the younger generation, are fluent in English.

Availability: With a population of nearly 38 million, Poland has the largest labor pool of the three nations. Industrial zones, particularly in regions like Silesia and near major cities, offer access to a significant number of skilled and semi-skilled workers. The labor market is also bolstered by experienced workers from neighboring countries.

Poland is a strong choice for investors aiming for large-scale production with a focus on cost control, without making significant compromises on workforce quality.

Czech Republic: The Stable and Specialized Hub

The Czech Republic has a long and proud heritage in precision engineering, particularly in the automotive sector. This tradition has created a highly industrialized economy and a workforce with a strong technical mindset.

Wages and Costs: Czech labor costs are positioned between Poland’s and Germany’s. While no longer a “low-cost” country, it remains competitive, especially considering its high level of industrialization. Notably, employer social security contributions are the highest of the three, adding approximately 34% to the gross wage.

Skills and Productivity: The workforce is known for its technical aptitude and problem-solving skills, honed by the demanding standards of the automotive supply chain. This experience is highly transferable to the disciplined processes required in solar module manufacturing.

Availability: This, however, is the primary challenge in the Czech market. The country consistently has one of the lowest unemployment rates in the EU, often below 3%. This dynamic creates a highly competitive environment for employers, making recruitment for the necessary Labor Requirements for a Solar Panel Production Line a strategic priority.

The Czech Republic is an excellent option for a factory that requires a stable, highly skilled technical workforce and prioritizes long-term operational consistency over the lowest possible wage cost.

Synthesizing the Data: A Decision Framework for Investors

The optimal location depends directly on the factory’s production strategy and business model. There is no single “best” country—only the best fit for a specific plan.

-

For a “Quality & Automation-First” Strategy: Germany is the logical choice. The investment in a highly skilled workforce pays off in efficiency, low error rates, and the ability to manage sophisticated, next-generation production lines.

-

For a “Scale & Cost-Leadership” Strategy: Poland offers the most compelling financial case. Its large, qualified, and cost-effective labor pool allows for large-scale production with favorable operational margins, a crucial aspect of How to Start a Solar Panel Manufacturing Business.

-

For a “Balanced & Stable” Strategy: The Czech Republic provides a middle ground. It combines a highly capable workforce and excellent infrastructure with costs that are still well below German levels, making it ideal for investors who value stability and proven industrial performance.

Experience from J.v.G. Technology GmbH’s turnkey projects confirms that successful location analysis always involves a detailed feasibility study that models these labor costs against projected output and quality targets.

Frequently Asked Questions (FAQ)

What are the typical employer social security contributions in these countries?

As a general rule, employers should budget an additional 20-22% on top of the gross wage in Germany and Poland. In the Czech Republic, this figure is significantly higher at around 34%, which must be factored into any financial projections.

How does labor union influence differ across these markets?

Germany has a well-established system of co-determination and strong trade unions, particularly in traditional industries. In Poland and the Czech Republic, union influence is generally less pronounced, though it can be strong in specific sectors like mining and heavy industry. All three countries have robust labor laws protecting employee rights.

Is English widely spoken in the industrial sector of these countries?

In all three countries, English proficiency is common among engineers, managers, and younger technical staff. For roles on the factory floor, however, communication in the local language (German, Polish, or Czech) is often necessary. Planning for translators or bilingual shift leaders is a practical step.

What are the notice periods and termination laws an employer should be aware of?

All three countries have statutory notice periods based on an employee’s length of service. Germany has some of the strongest employee protection laws in Europe, making terminations more complex and costly than in Poland or the Czech Republic. Seeking local legal counsel to fully understand these obligations is essential.

Conclusion: Making an Informed Location Decision

Deciding where to build a new solar manufacturing plant in Central Europe is a complex balancing act between cost, skill, and strategic priorities. Germany offers unparalleled technical expertise at a premium price. Poland provides an outstanding blend of scale, skill, and cost-effectiveness. The Czech Republic presents a stable, high-quality industrial environment but with a very tight labor market.

While this analysis of labor costs is a critical first step, a comprehensive decision requires a deeper investigation. Factors like energy costs, logistics, raw material availability, and regional incentives are equally important. Understanding how these elements interconnect is the foundation for building a successful and profitable solar manufacturing venture.