For entrepreneurs aiming to supply the North American solar market, the landscape is a complex mix of tariffs, long supply chains, and intense competition. While many look to traditional manufacturing hubs in Asia, a powerful alternative lies much closer to home. The Dominican Republic, through its well-established Free Trade Zone (FTZ) system—known as Zonas Francas—offers a compelling environment for solar module production, combining significant financial incentives with logistical advantages.

This article explores how establishing a solar manufacturing facility within a Dominican Zona Franca can serve as a strategic gateway to the Americas, detailing the key advantages—from tax exemptions to preferential market access—that investors should consider.

Understanding the ‘Zona Franca’ Model: A Strategic Overview

A Zona Franca is a designated geographical area within a country that operates under special customs and tax regulations designed to promote foreign investment and export-oriented industries. The system in the Dominican Republic is highly developed and managed by the National Council for Export Free Zones (CNZFE). This model creates a business-friendly enclave with simplified rules for international trade.

The core principle is straightforward: companies operating within these zones can import machinery, equipment, and raw materials free of all customs duties and taxes, provided the final products are destined for export. This framework, governed by Law 8-90, has successfully attracted over 780 companies to 84 industrial parks across the country. For any solar manufacturing business plan targeting the US and surrounding markets, a thorough evaluation of this model is a critical first step.

Key Advantages for Solar Module Manufacturers

The benefits of the Zona Franca system extend far beyond basic tax savings. In a capital-intensive industry like solar module manufacturing, these advantages compound to create a highly competitive operational base.

Duty-Free Importation of Machinery and Materials

The most immediate financial benefit is the 100% exemption from all import duties and taxes on equipment and raw materials. A typical solar module production line involves significant capital expenditure on machinery like stringers, laminators, and testers. Eliminating import tariffs on these assets substantially reduces the initial investment.

This exemption also applies to all raw materials needed for production, including:

- Solar cells

- Photovoltaic glass

- Aluminum frames

- EVA (ethylene vinyl acetate) encapsulant

- Backsheets or rear-side glass

- Junction boxes

This continuous duty-free importation lowers the per-unit cost of production, which directly boosts the facility’s long-term profitability and competitiveness.

Favorable Tax Environment and Financial Incentives

Beyond customs duties, companies operating under the Zona Franca regime benefit from a comprehensive set of tax exemptions, typically granted for a renewable 15-year term. As established by Law 8-90, these include a 100% exemption from:

- Corporate Income Tax

- Value-Added Tax (known locally as ITBIS)

- Municipal taxes

- Export taxes and duties

- Taxes on construction and incorporation

This stable, low-tax environment allows a new manufacturing venture to retain a higher percentage of its earnings for reinvestment, expansion, or debt servicing, accelerating its path to profitability.

Proximity and Preferential Access to Major Markets

The Dominican Republic’s geographical location is a major strategic advantage. Situated in the heart of the Caribbean, it offers short shipping times to major ports in North, Central, and South America. This proximity drastically reduces logistics costs and delivery lead times compared to shipping from Asia.

Crucially, the country is a signatory to the Dominican Republic-Central America Free Trade Agreement (DR-CAFTA). This agreement grants goods manufactured in the Dominican Republic duty-free access to the United States market. For a solar module manufacturer, this means products can enter the US without facing many of the tariffs imposed on panels from other global regions, creating a significant price advantage.

Streamlined Logistics and Infrastructure

The Zonas Francas are not just legal frameworks; they are fully developed industrial parks with modern infrastructure. These parks offer reliable electricity, water, telecommunications, and a network of logistics and support services. The presence of nearly 800 companies has created a robust ecosystem that simplifies everything from customs clearance to freight forwarding.

Based on experience from J.v.G. Technology GmbH turnkey projects, the well-developed infrastructure in these zones significantly reduces setup time and mitigates common logistical hurdles an investor might face in other emerging markets. This allows a new enterprise to focus on core production activities rather than solving basic infrastructure problems.

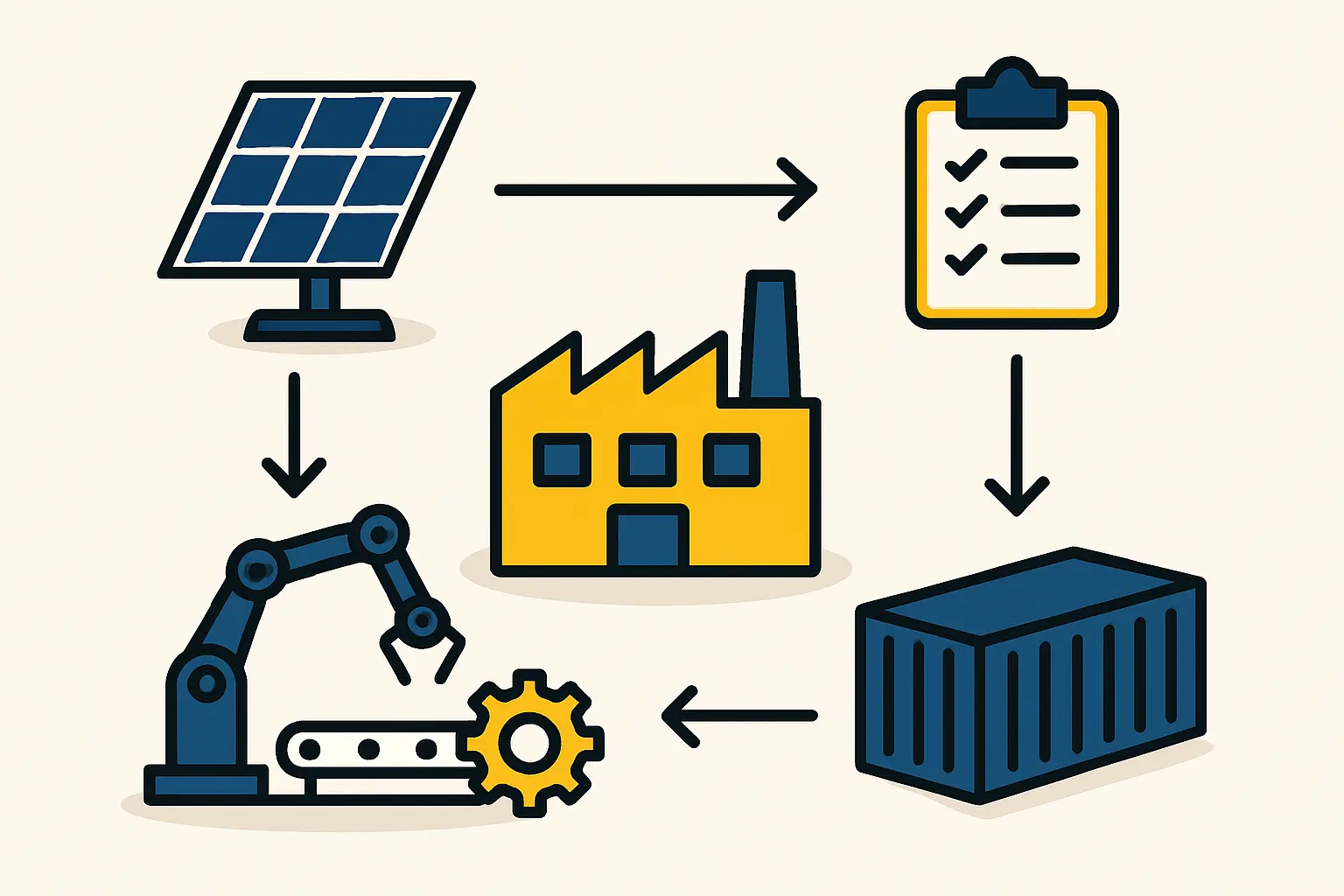

Setting Up Your Operation: Practical Considerations

The CNZFE regulates and facilitates the process of establishing a company within a Zona Franca. An investor must submit a detailed proposal outlining the project’s scope, investment, job creation potential, and production processes. Once approved, the company can select a location within an industrial park and begin setting up its facility.

The Dominican Republic also offers a large and competitive labor force. While technical training for specialized roles is necessary, the ready availability of personnel for assembly, logistics, and administrative functions is a significant operational advantage. Investing in a turnkey solar production line can further streamline this process, as it often includes initial staff training and process optimization.

Frequently Asked Questions (FAQ)

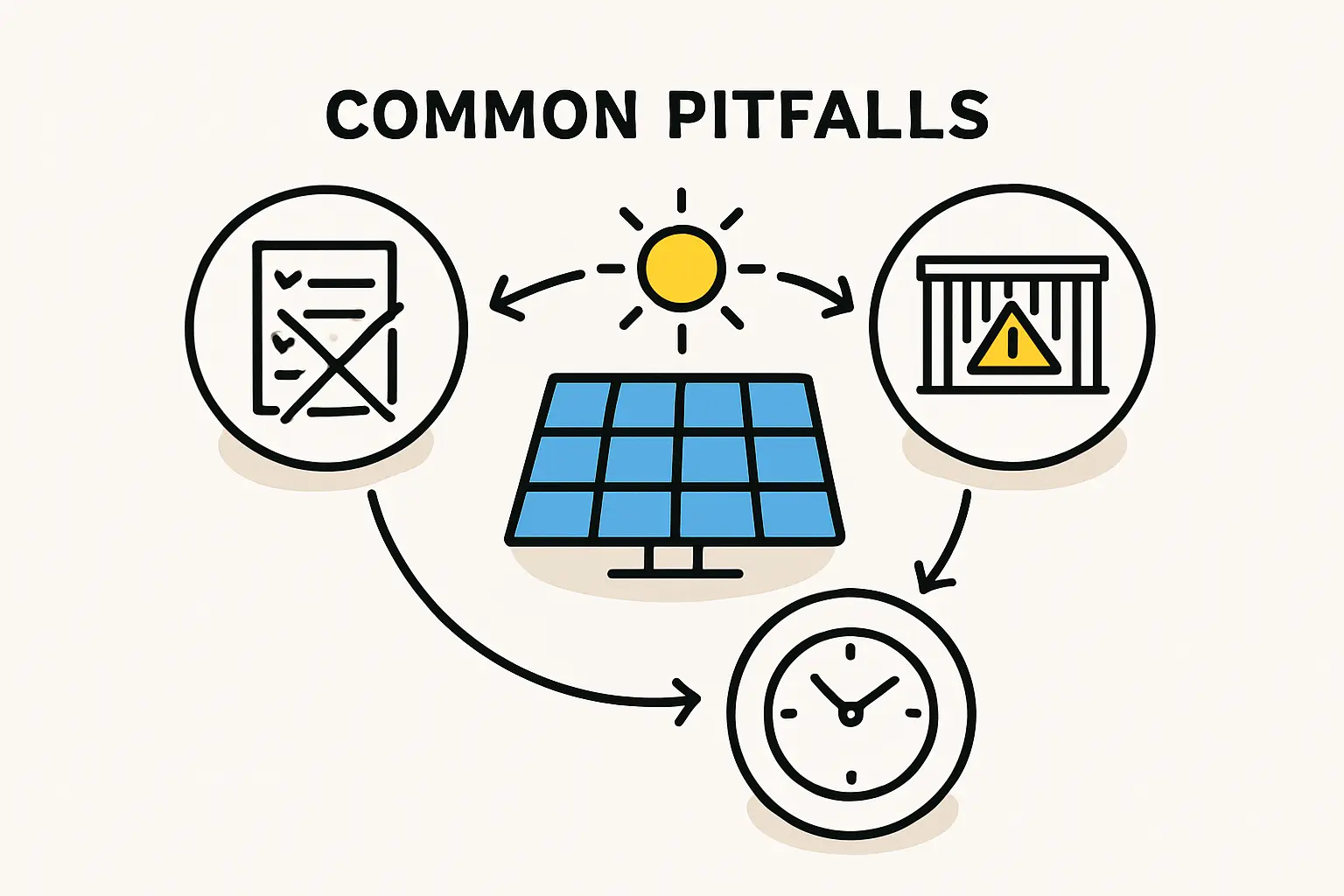

What is the typical timeline to get a factory operational in a Zona Franca?

With proper planning and a clear business proposal, the CNZFE approval process can be completed in a few months. The full timeline from application to the start of production is typically less than a year, depending on equipment lead times and facility construction or retrofitting.

Are the tax benefits permanent?

The tax incentives are granted for an initial period, typically 15 years for standard locations, and are renewable upon application. This provides a long-term, stable financial planning horizon for investors.

What are the primary obligations of a company in a Zona Franca?

The main obligation is to export the vast majority of its production. Companies are also expected to comply with national labor and environmental laws. The system is designed to create local employment and generate foreign currency through exports.

How does this strategy fit with global supply chain diversification?

Establishing a manufacturing base in the Dominican Republic is an excellent ‘nearshoring’ strategy. It helps de-risk a supply chain that may be overly dependent on a single geographic region, such as East Asia, while providing more stable and predictable access to the key North American market.

Conclusion: A Strategic Gateway to the American Solar Market

The Dominican Republic’s Zona Franca system offers a powerful and often underestimated platform for solar module manufacturing. The combination of comprehensive tax exemptions, duty-free imports, and preferential entry into the US market presents a compelling business case. For any entrepreneur or established company looking to efficiently serve the Americas, this is a location worth serious consideration.

To turn these insights into a workable strategy, a deep understanding of industry fundamentals is essential. Take the next step by exploring the free solar manufacturing course on pvknowhow.com, which provides a comprehensive foundation for planning your venture.