Entrepreneurs eyeing the Dominican Republic’s thriving solar market often notice the significant government support and assume it applies exclusively to large-scale energy generation projects. This is a common and costly misunderstanding.

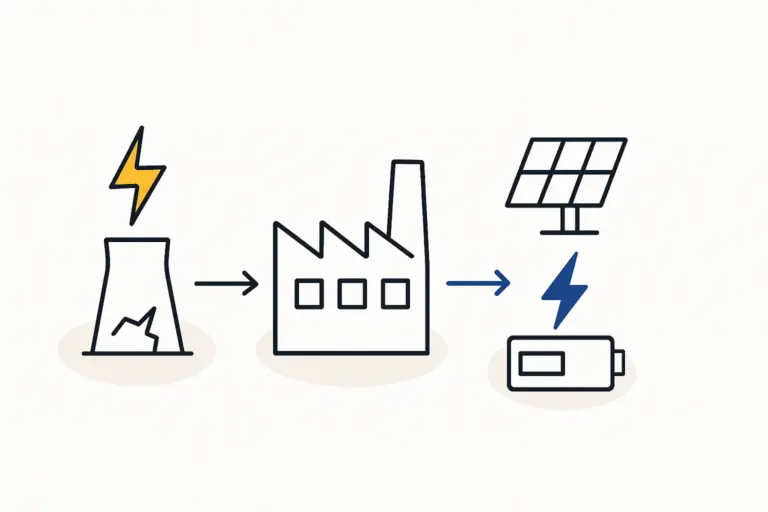

While incentives for solar farms are well-known, a powerful, distinct set of benefits is available specifically for manufacturers of solar equipment, including modules. Law 57-07 on Renewable Energy Incentives was designed not only to encourage clean energy production but also to foster a local manufacturing base, a key piece of recent Dominican Republic renewable energy news.

For business professionals considering entry into this sector, understanding these manufacturing-specific incentives is the first step toward building a robust and highly competitive business case. This guide breaks down the fiscal advantages available to solar module manufacturers under this landmark legislation.

Understanding Law 57-07: A Dual Focus

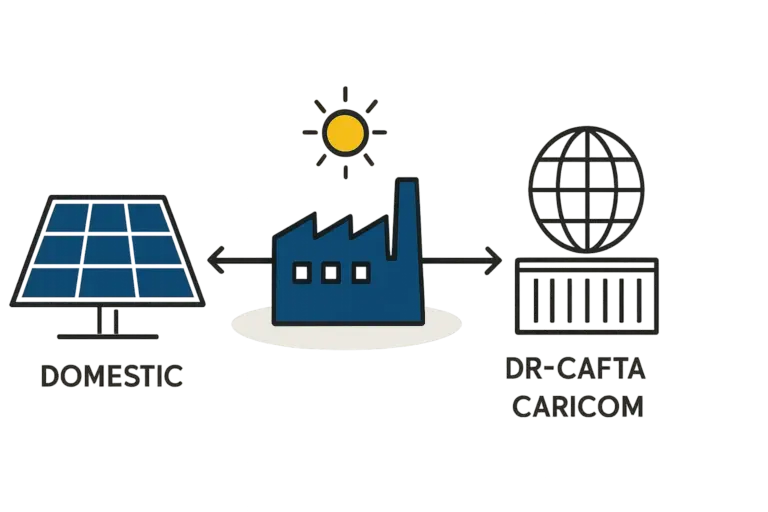

At its core, Law 57-07 has two primary objectives: increasing the share of renewables in the nation’s energy mix and stimulating local economic development. To achieve this, the law offers two separate but complementary sets of incentives:

-

For Energy Generation: These benefits target companies that install and operate renewable energy systems (like solar or wind farms) to sell power to the grid. They typically include income tax exemptions and preferential financing.

-

For Equipment Manufacturing: These benefits are for companies that produce the components and equipment needed for renewable energy projects within the Dominican Republic.

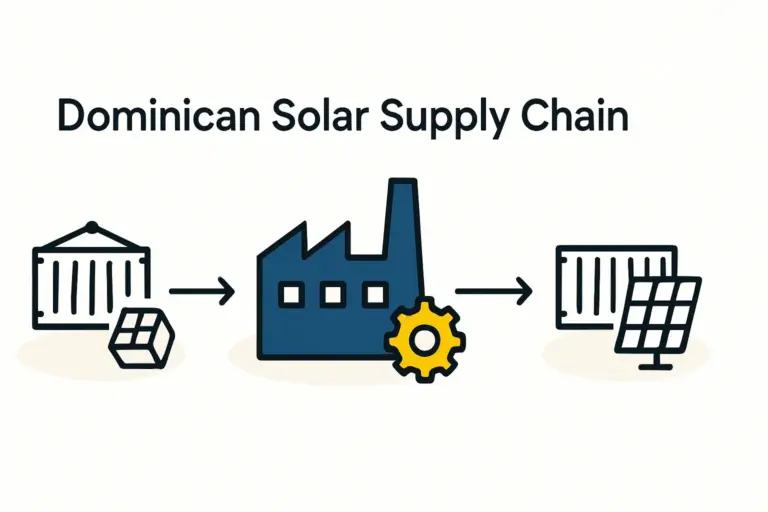

This distinction is critical. Any investor focused on starting a solar module factory must evaluate their project based on these specific manufacturing incentives, which are substantial and directly address the primary costs of setting up a production line.

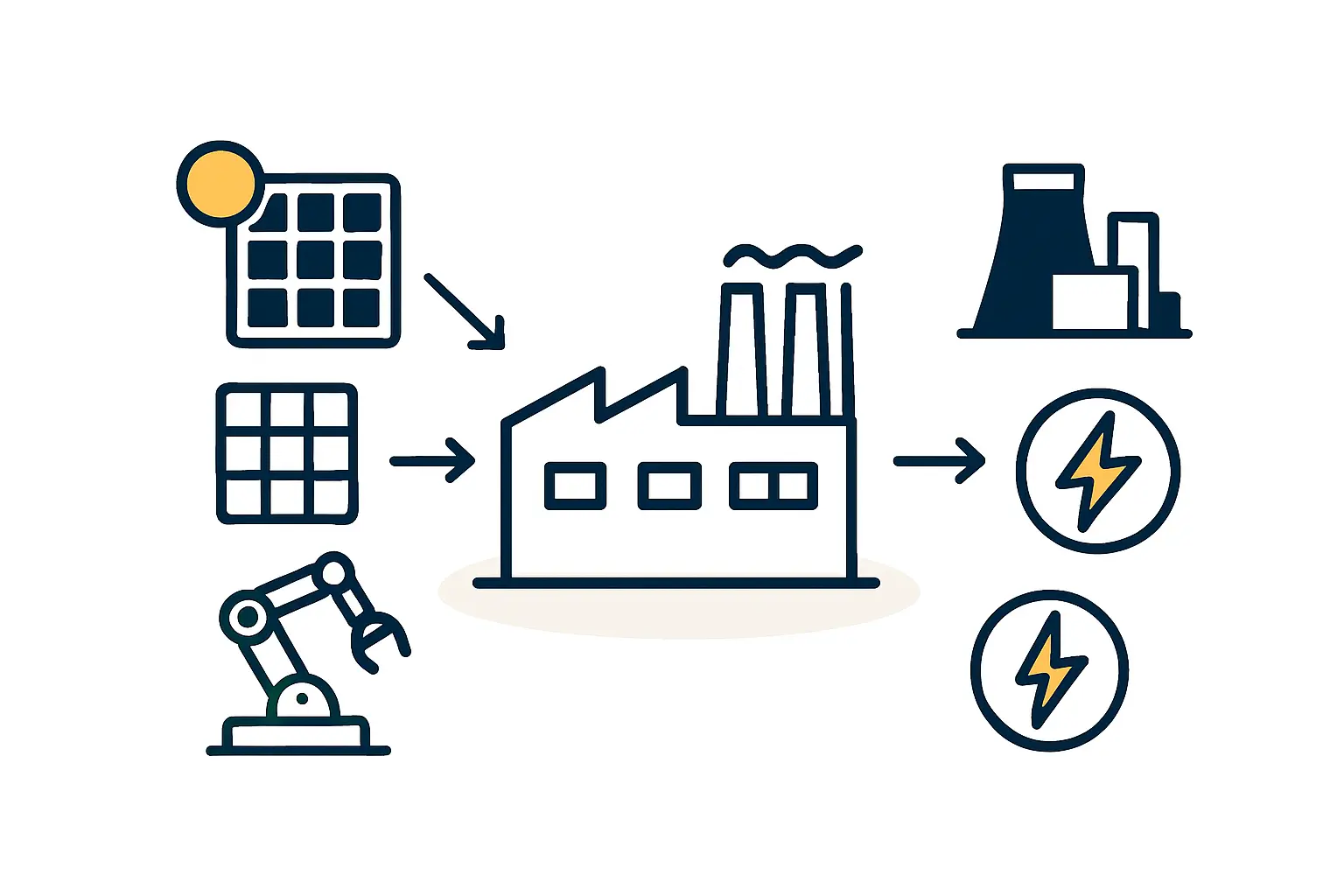

Core Fiscal Benefits for Solar Equipment Manufacturers

The law provides three foundational fiscal incentives designed to reduce both initial capital expenditure (CapEx) and long-term tax liabilities. To access these benefits, a company must be formally registered with the National Energy Commission (CNE), the government body that oversees the law’s implementation.

Exemption from Import Duties and Tariffs

Acquiring specialized machinery—most of which is imported—represents one of the most significant upfront costs in establishing a solar module factory. Law 57-07 grants a 100% exemption from all import duties and customs tariffs on the equipment required for production.

This includes, but is not limited to:

- Cell stringers and bussing machines

- Laminators and framing machines

- Solar simulators and EL testers

- Raw materials not available locally

This provision alone can substantially reduce the initial investment cost, freeing up capital for other critical areas like operations and workforce training.

100% Exemption from ITBIS (VAT)

In addition to import duties, the law provides a full exemption from the Tax on the Transfer of Industrialized Goods and Services (ITBIS), the Dominican Republic’s value-added tax (VAT). This exemption applies to:

- The importation of manufacturing equipment and materials.

- The local purchase of materials and services required for the manufacturing process.

This benefit further reduces the capital needed for setup and lowers the ongoing cost of raw materials, directly improving the factory’s operational cost structure and price competitiveness.

The 40% Investment Tax Credit: A Key Differentiator

Arguably the most powerful incentive for manufacturers under Law 57-07 is the tax credit on equipment investment. An eligible manufacturer is entitled to a tax credit of 40% of the total cost of machinery and equipment purchased for the factory.

For example, if a company invests USD $2,000,000 in its production line equipment, it receives a tax credit of USD $800,000 to offset future income tax liabilities. This is not a simple deduction but a direct, dollar-for-dollar credit that dramatically accelerates the project’s return on investment (ROI). Accurately calculating this credit’s impact is essential for creating a comprehensive business plan and securing financing.

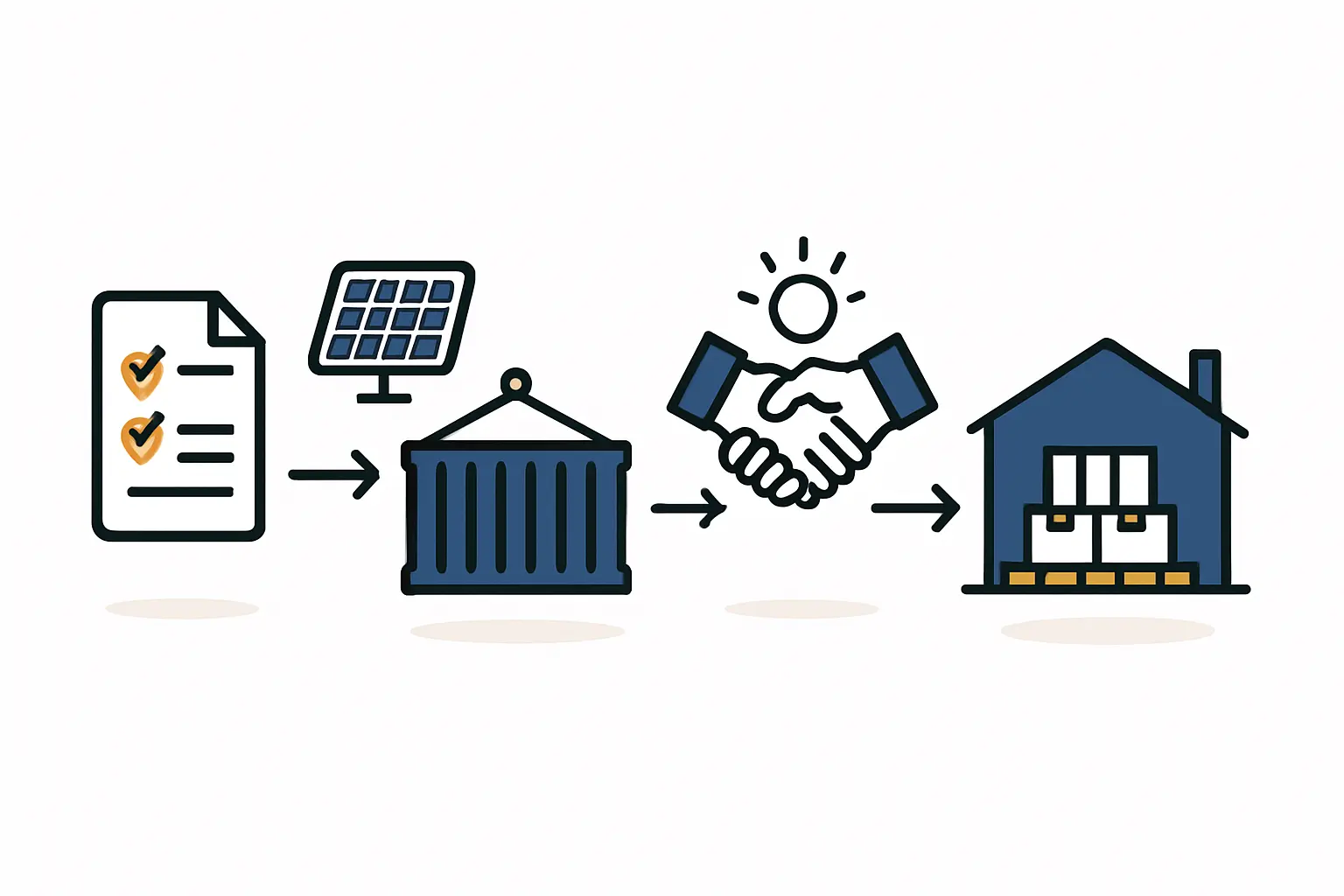

The Administrative Process: Registering with the CNE

Gaining access to these incentives is not automatic. A prospective manufacturer must prepare a detailed project proposal and submit it to the National Energy Commission (CNE) for approval and registration. This process requires thorough documentation, including technical specifications, financial projections, and a clear business plan demonstrating the project’s viability.

Successfully navigating this regulatory step is a critical milestone. J.v.G. Technology GmbH’s experience establishing turnkey factories worldwide shows that engaging local legal and administrative experts early in the planning phase is essential for a smooth and successful application.

Why These Incentives Matter for Your Business Case

Combined, these fiscal benefits create a uniquely favorable environment for solar module manufacturing in the Dominican Republic. The impact on a new venture is profound:

- Reduced Barrier to Entry: Lowering upfront equipment costs through tax and duty exemptions makes launching a factory more accessible.

- Accelerated Profitability: The 40% tax credit significantly shortens the payback period and improves the overall financial performance of the investment.

- Enhanced Local Competitiveness: Local manufacturing becomes highly competitive against importing finished solar modules, which are subject to standard taxes and duties.

- Alignment with National Strategy: Establishing a factory contributes directly to the Dominican Republic’s goals for energy independence and industrial development, creating a strong foundation for long-term partnerships with public and private sector stakeholders.

Frequently Asked Questions (FAQ)

Do these benefits apply only to fully integrated manufacturing?

The incentives apply to the manufacturing and assembly of equipment for renewable energy sources. This means a facility focused on the final assembly of solar modules using imported cells and other materials is generally eligible.

How long have these incentives been in place?

Law 57-07 was enacted in 2007, providing a stable and long-standing legal framework. This history gives investors confidence in the government’s commitment to the renewable energy sector. However, verifying the current status of all regulations during the project planning stage is always a prudent step.

Is there a minimum investment required to qualify for Law 57-07 benefits?

The law itself does not specify a minimum investment threshold. Eligibility is determined by the CNE based on the technical and financial merits of the proposed project, making the framework potentially accessible for small to medium-sized manufacturing operations as well as larger ones.

How do these incentives compare to operating in a Free Trade Zone (Zona Franca)?

While Free Trade Zones offer their own set of broad tax and customs benefits, Law 57-07 is specifically tailored to the renewable energy sector. Its benefits, such as the 40% investment tax credit, are designed to support the unique business model of an energy equipment manufacturer. A key advantage is that a factory under Law 57-07 can be located anywhere in the national territory, not just within a designated zone.

Conclusion and Next Steps

For entrepreneurs and investors, Law 57-07 represents more than just a tax break; it is a clear signal from the Dominican government of its active support for a local solar manufacturing industry. The combination of import duty exemptions, VAT relief, and a substantial investment tax credit creates one of the most attractive environments in the region for this type of venture.

Understanding these provisions is the essential first step. The next is to integrate them into a detailed financial model and operational plan. By leveraging these powerful incentives, starting a solar module factory in the Dominican Republic becomes a financially sound and strategically advantageous enterprise.