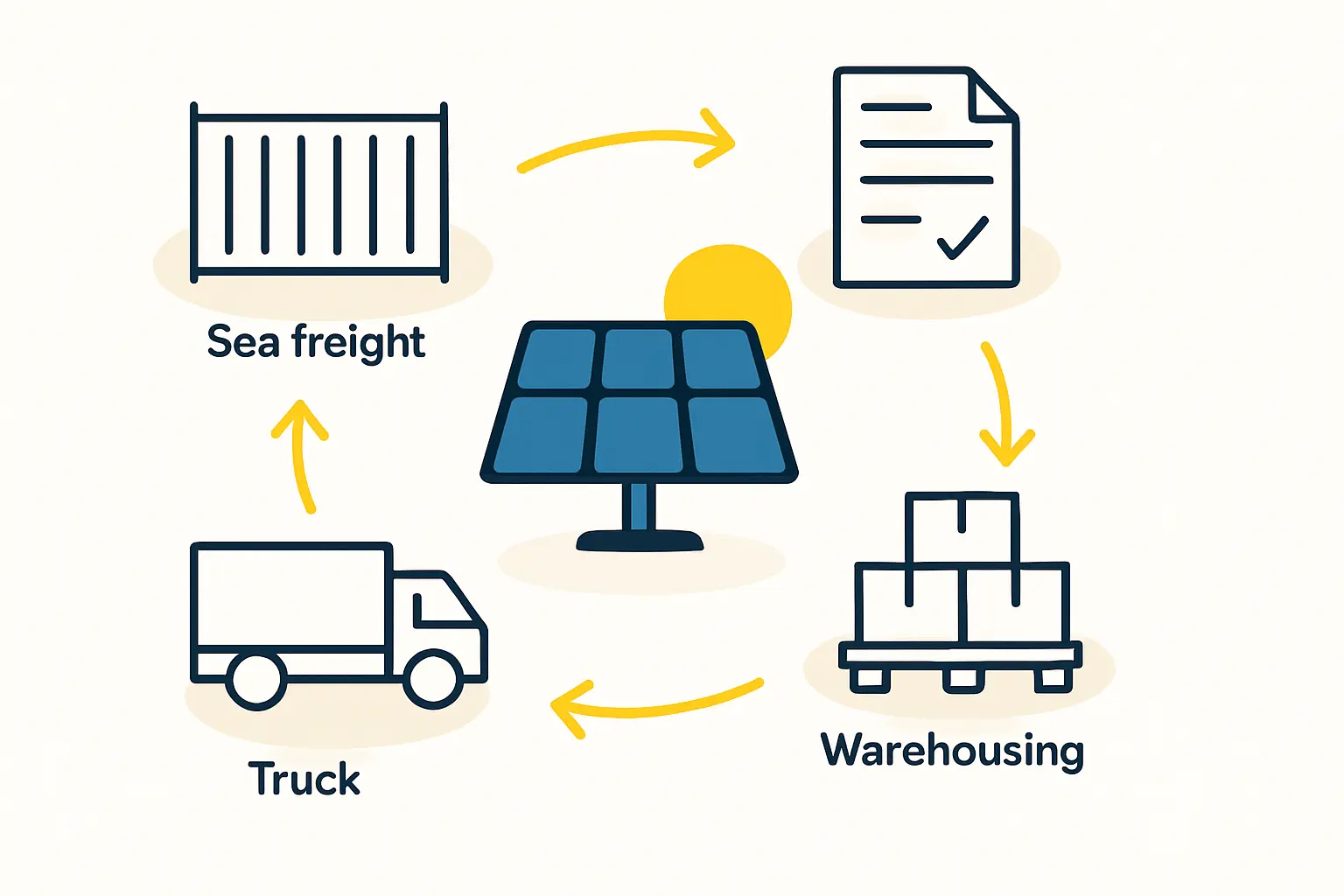

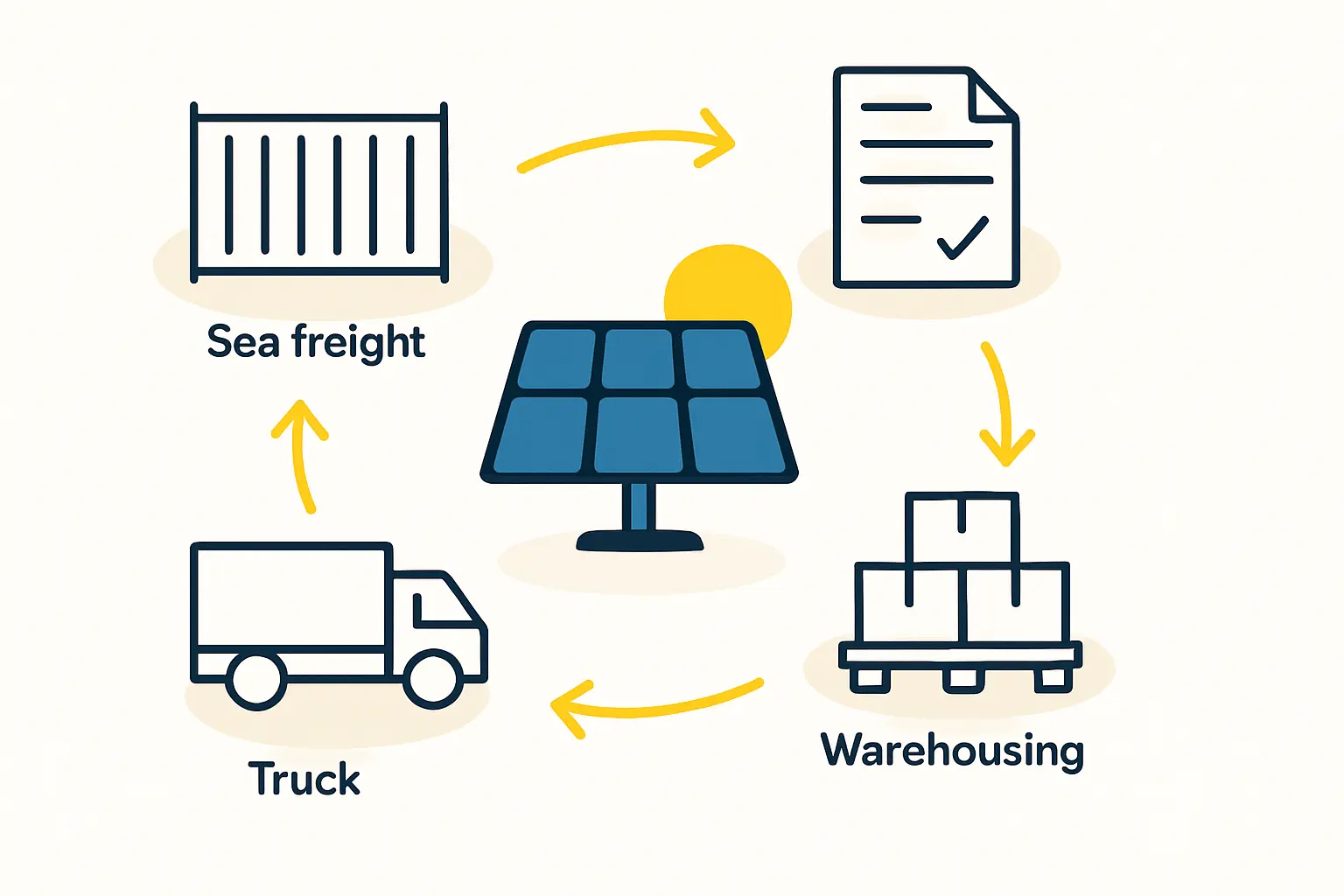

An investor’s focus is often on the factory floor: the advanced machinery, the skilled technicians, and the first solar module coming off the production line. But the success of a solar manufacturing facility in a place like Eritrea hinges just as much on a less visible but critical process: the journey of raw materials from a global supplier to the factory door. That journey almost always begins at a national gateway like the Port of Massawa, and understanding the logistical challenges and opportunities of this specific entry point is essential.

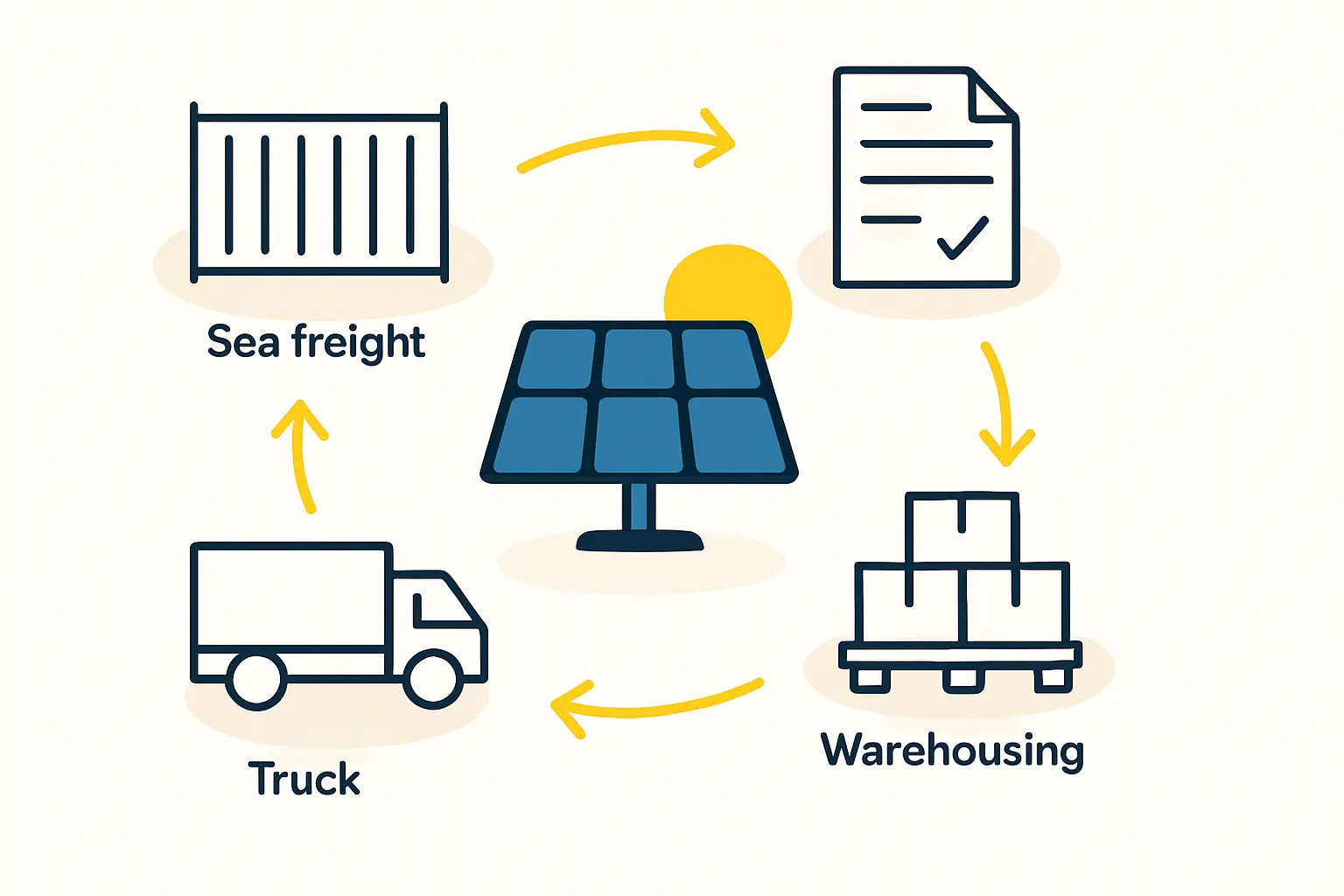

A well-planned supply chain can ensure smooth production; a poorly managed one can grind operations to a halt with costly delays. This guide outlines the key considerations for establishing a reliable logistics strategy for importing solar manufacturing components through Eritrea’s primary seaport.

Understanding the Supply Chain for Solar Module Manufacturing

Before looking at the port itself, it is helpful to understand what is being transported. A typical solar module assembly line requires a steady flow of specific components, most sourced internationally and shipped in standard 20-foot or 40-foot sea containers.

Key imported materials include:

Solar Cells: The most valuable and delicate component.

EVA Encapsulant Film: A polymer sensitive to heat and humidity.

Solar Glass: Heavy, fragile, and requires careful handling.

Backsheets: Polymer-based protective layers.

Aluminum Frames: Pre-cut and ready for assembly.

Each of these items has unique handling and storage requirements that need to be addressed throughout the logistics chain. A deep dive into the bill of materials for a solar module can provide further context on these components.

The Port of Massawa: A Strategic Gateway with Specific Considerations

Located on the Red Sea, the Port of Massawa is Eritrea’s principal maritime hub and a strategic asset for any import-dependent industry. Its container terminal can handle a significant volume of traffic, making it the logical entry point for all sea-bound solar components. But leveraging this gateway effectively means understanding its operational realities.

While the port has the necessary infrastructure, new investors must be prepared for processes that may differ from those in major global hubs like Shanghai or Rotterdam. Anticipating these differences is the mark of a professional operation.

Navigating Customs and Port Formalities

The first major hurdle upon arrival is customs clearance. Bureaucratic processes in many emerging markets can be complex and time-consuming. Minor errors in documentation can lead to significant delays, trapping essential materials at the port and halting factory production.

Essential documents typically include:

- Bill of Lading (B/L): The contract between the shipper and the carrier.

- Commercial Invoice: Details the transaction between the seller and buyer.

- Packing List: An itemized list of the container’s contents.

Experience from J.v.G. turnkey projects in similar markets shows that engaging a reputable, licensed local customs broker is not just advisable—it’s essential for navigating regulations and ensuring compliance.

Inland Transportation: The Journey from Port to Factory

Once cleared, containers must be transported from Massawa to the factory’s location, which may be in Asmara or another industrial zone. This inland leg of the journey has its own challenges that demand careful planning.

Road Infrastructure and Vehicle Suitability

A primary concern is the condition of the road network. The route from Massawa inland involves significant changes in elevation and can include mountainous terrain. The quality of the roads dictates the speed of transit, the type of trucks that can be used, and the level of risk to the cargo.

Fragile materials like pallets of solar glass or boxes of delicate solar cells are particularly vulnerable to damage from vibrations and shocks on poorly maintained roads. Selecting a freight transport partner with well-maintained vehicles and experienced drivers is critical.

Security and Risk Management

High-value cargo such as solar cells means that a single container holds a significant concentration of capital. Securing this cargo during transit is a vital part of managing risk.

Prudent measures include:

- Ensuring the transport company has adequate Goods-in-Transit insurance.

- Using vehicles equipped with GPS tracking for real-time monitoring.

- Planning routes and travel times to minimize risk where applicable.

These logistical risks should be factored into the overall project timeline, a key component of a comprehensive solar manufacturing business plan.

Warehousing and Inventory Management: Securing Your Raw Materials

The final step in the import process is the safe storage of raw materials. A dedicated, properly designed warehouse is not a luxury but a necessity for maintaining the quality and integrity of components before they enter the production line.

This is especially true for materials like EVA encapsulant, which can be damaged by prolonged exposure to high temperatures and humidity—conditions common in the region. Storing such materials in a non-climate-controlled environment can render them unusable and lead to direct financial loss.

Key Requirements for a Solar Materials Warehouse

An effective warehouse for solar components should feature:

- Climate Control: Air conditioning and dehumidifiers to protect sensitive polymers.

- Organized Storage: Proper shelving and pallet systems to prevent glass breakage and cell damage.

- Security: Measures to prevent theft of high-value items.

- Inventory System: A clear process for tracking stock levels to inform reordering schedules.

The specifications for your factory building must account for adequate on-site or nearby storage that meets these criteria.

Developing a Resilient Logistics Strategy

A resilient supply chain is built on foresight and planning. For an investor establishing a solar factory in Eritrea, a sound strategy will center on mitigating the specific risks of the Port of Massawa and the country’s inland infrastructure.

Key action points include:

- Engage Local Experts: Partner with an experienced local customs broker and a freight forwarding company with a proven track record.

- Conduct Due Diligence: Before committing, investigate transport routes, vehicle quality, and warehousing options firsthand.

- Plan for Contingencies: Build buffer time and safety stock into your production schedule to absorb potential delays in shipping or customs.

- Optimize Shipments: Work with suppliers to plan container loads efficiently, ensuring a balanced flow of all necessary materials.

A turnkey solutions provider often incorporates this detailed logistics planning into the overall project setup, managing these variables on behalf of the investor.

Frequently Asked Questions (FAQ)

How long does customs clearance typically take in Massawa?

This can vary significantly based on shipment volume and the accuracy of your documentation. A prudent business plan should budget for anywhere from several business days to over a week, and any documentation errors will extend this period.

What is the most fragile material to transport inland?

Solar glass is the heaviest and one of the most fragile core components. It is shipped on specialized pallets and requires extremely careful handling during loading, transit, and unloading to prevent costly breakage.

Should a new factory buy or lease a warehouse for raw materials?

For a startup operation, leasing a suitable facility can offer greater financial flexibility. As the operation scales, constructing a purpose-built warehouse adjacent to the factory may become a more cost-effective, long-term solution that provides greater control.

How far in advance should raw materials be ordered?

A typical sea freight journey from major suppliers in Asia can take 45–60 days. Adding time for customs clearance and inland transport, a new order should be placed at least three to four months before the materials are needed on the production line. Maintaining a buffer stock is essential.

Conclusion: Your Next Steps in Supply Chain Planning

Logistics is not an afterthought; it is a core pillar of a successful manufacturing operation. For entrepreneurs and investors looking to enter the solar industry in Eritrea, mastering the supply chain from the Port of Massawa inward is as important as mastering the technology on the assembly line.

While the challenges are tangible, they are entirely manageable with diligent research, strategic partnerships, and meticulous planning. By addressing these factors proactively, an investor can build a resilient and reliable operation capable of capitalizing on the region’s immense solar potential. For a more structured approach to this and other planning stages, the educational materials at pvknowhow.com offer a comprehensive foundation.