When entrepreneurs consider entering the solar manufacturing sector, their initial analysis often focuses on technology, machinery, and market demand. However, the regulatory and fiscal environment of a chosen location can be just as critical to the long-term viability and profitability of the investment. A complex bureaucracy or an unfavorable tax regime can undermine even the most robust business plan.

This is where Special Economic Zones (SEZs) offer a compelling alternative. Gabon’s Special Economic Zone (GSEZ) at Nkok, in particular, provides a structured ecosystem designed to attract and support industrial investment. This article explores how its unique incentives can significantly de-risk and accelerate the establishment of a solar module manufacturing facility.

What is the Gabon Special Economic Zone (GSEZ)?

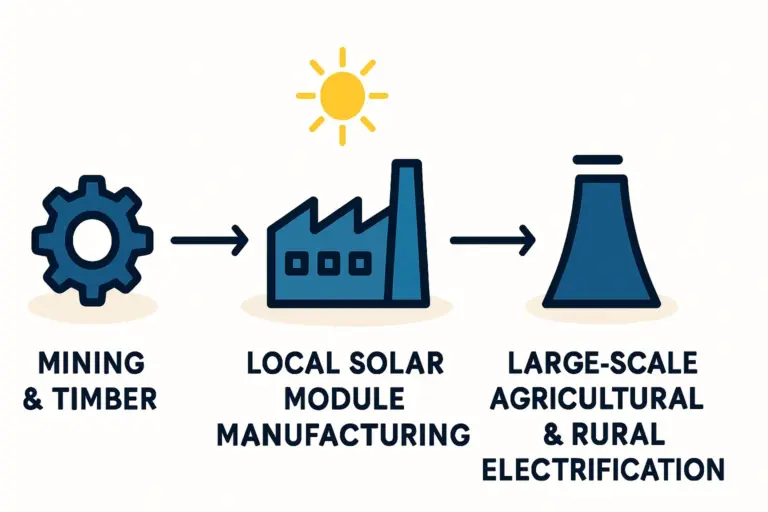

Established in 2010, the GSEZ at Nkok is a public-private partnership between the Republic of Gabon and Olam International, a leading global agribusiness and food company. This partnership model has been key to creating a world-class industrial park recognized as one of Africa’s most successful SEZs.

Located just 27 kilometers from the capital city, Libreville, and near the Owendo international port, the zone provides critical logistical advantages. Initially focused on transforming Gabon’s timber industry, the GSEZ has successfully diversified to attract investment across various sectors, including photovoltaic manufacturing.

It provides reliable infrastructure—stable power, treated water, and a fiber optic network—amenities that are crucial for high-tech manufacturing but not always guaranteed in emerging markets.

Core Fiscal Incentives for Solar Manufacturing Investors

The financial advantages offered within the GSEZ are substantial, designed to lower the initial capital burden and enhance profitability during the critical early years of operation. For an investor calculating the cost to start a solar panel manufacturing plant, these incentives fundamentally alter the financial projections.

The key fiscal benefits include:

-

Corporate Income Tax Exemption: Businesses in the GSEZ are exempt from corporate income tax for the first 10 years. From the 11th to the 15th year, they pay a significantly reduced rate of 10%. The standard national rate only applies from the 16th year onwards. This extended tax holiday allows for rapid capital recovery and reinvestment.

-

Exemption from Customs and Import Duties: This is one of the most significant incentives for a solar module manufacturer. All machinery, equipment, spare parts, and raw materials needed for the production line can be imported completely free of customs duties. This directly reduces the initial setup cost, a major component of which is the investment in the list of machines for solar panel manufacturing.

-

Value Added Tax (VAT) Exemption: Companies within the zone are exempt from VAT on goods and services, which simplifies accounting and improves cash flow.

-

100% Repatriation of Profits: Investors can repatriate 100% of their profits and capital without restrictions, providing financial security and flexibility.

These incentives create a highly competitive financial environment. Based on experience from J.v.G. turnkey projects, such fiscal benefits can shorten the return-on-investment period by several years compared to operating in a standard customs territory.

Streamlining Operations: The Advantage of a Single-Window System

Beyond financial benefits, the GSEZ addresses a common challenge for foreign investors in new markets: bureaucratic complexity. The zone operates a ‘Guichet Unique,’ or single-window clearance system.

This centralized authority handles all necessary administrative procedures, including:

- Company registration

- Building permits

- Operating licenses

- Environmental clearances

- Visas and work permits for expatriate staff

By consolidating these functions, the single-window system drastically reduces the time and effort required to become operational. It gives investors a single point of contact, ensuring clarity, transparency, and efficiency. This administrative support is invaluable for entrepreneurs unfamiliar with local regulations and is a key factor when planning how to start a solar panel business in a new country.

Strategic Considerations Beyond Financial Incentives

While the fiscal and administrative advantages are compelling, the GSEZ offers other strategic benefits that align with the goals of a solar module manufacturer targeting regional markets.

-

Market Access: Gabon is a member of the Economic and Monetary Community of Central Africa (CEMAC), providing duty-free access to a regional market of over 50 million people. Locating a factory in the GSEZ positions it as an ideal export hub for Central Africa.

-

Government Alignment: The Gabonese government is actively pursuing economic diversification away from its dependence on oil exports. Investment in renewable energy manufacturing aligns perfectly with this national strategy, suggesting strong long-term government support.

-

Workforce Availability: The zone facilitates access to a pool of local skilled and semi-skilled labor, and the streamlined visa process simplifies hiring specialized international experts when needed.

-

Stable Operating Environment: Reliable utilities and logistics within a secured industrial park minimize operational disruptions, allowing management to focus on production and quality control.

Frequently Asked Questions (FAQ)

Is the GSEZ suitable for small to medium-sized enterprises (SMEs)?

Yes. While the zone hosts large multinational corporations, its framework is also designed to support SME investment. The streamlined setup process and reduced initial capital outlay from customs exemptions make it particularly attractive for new entrants to the manufacturing sector.

What are the primary challenges to consider, even with these incentives?

While the GSEZ mitigates many risks, investors must still conduct thorough due diligence. Key considerations include sourcing specific raw materials that aren’t imported, developing local labor training programs, and understanding the logistics of exporting to target countries within the CEMAC region.

How does the GSEZ’s incentive package compare to others in Africa?

The GSEZ at Nkok is widely regarded as a benchmark SEZ on the continent. Its combination of a long-term tax holiday, full customs exemption, and a highly effective single-window system makes its incentive package one of the most competitive and comprehensive available.

What is the process for applying to set up a facility in the GSEZ?

The process begins with an application submitted through the single-window authority. The application typically requires a detailed business plan, proof of funding, and technical specifications of the proposed project. The GSEZ authority guides investors through each step of the approval and implementation process.

A Framework for De-risking Your Solar Investment

Choosing a location for a solar module factory is a foundational decision that influences every subsequent aspect of the business. The Gabon Special Economic Zone at Nkok presents more than just a list of incentives; it offers a comprehensive, de-risked framework for industrial investment.

By combining significant long-term fiscal advantages with a streamlined, supportive administrative environment and strategic market access, the GSEZ allows entrepreneurs to focus on their core business: producing high-quality solar modules. For investors looking to establish a manufacturing foothold in Central Africa, it represents a compelling strategic opportunity that deserves serious consideration during initial planning and feasibility assessment.