For international entrepreneurs, Gabon presents a compelling landscape of opportunity. Driven by a national strategy to diversify its economy beyond traditional sectors, the country is actively courting foreign investment in manufacturing.

Navigating an unfamiliar legal and administrative system, however, can be daunting. An investor might see the potential but question the process: Where to begin? What are the precise legal steps? How can one leverage the government’s incentives effectively?

This guide provides a structured overview of the regulatory framework for establishing a manufacturing company in Gabon. It is designed for business professionals exploring this high-potential market, offering a practical roadmap for turning their vision into a compliant, operational entity.

Understanding Gabon’s Pro-Investment Stance

The Gabonese government has significantly streamlined its processes for foreign investors. The central pillar of this effort is the National Investment Promotion Agency (ANPI-Gabon). This agency acts as a ‘one-stop shop’ (Guichet Unique) and the primary point of contact for investors, guiding them through all administrative, legal, fiscal, and social procedures.

This centralized approach is built on the Investment Code (Law No. 038/2018), which aims to create a transparent and attractive environment. The code provides a range of incentives, including potential tax exemptions and waivers on customs duties for imported equipment. This is a critical consideration when setting up any manufacturing facility, from solar module production to agri-food processing.

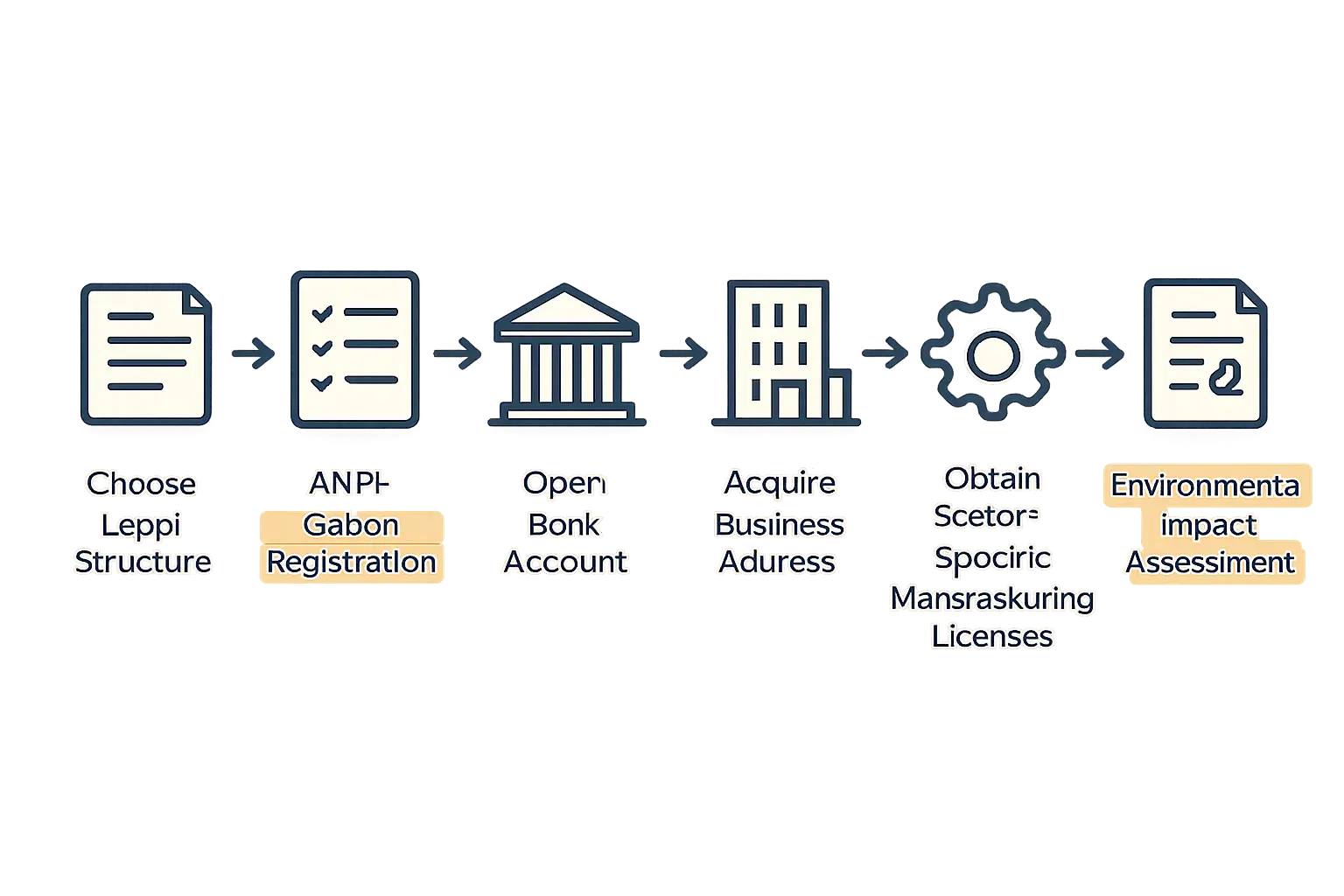

Key Steps in Establishing Your Manufacturing Company

Establishing a business in Gabon is a sequential process. While ANPI-Gabon simplifies these steps, a clear understanding of each stage is essential for effective planning.

Step 1: Choosing the Right Legal Structure

Foreign investors typically choose between two primary corporate structures:

-

Société à Responsabilité Limitée (SARL): Equivalent to a Limited Liability Company (LLC), this is a popular choice for small to medium-sized enterprises. It can be established by a single shareholder with a minimum share capital of 100,000 XAF (approx. €150).

-

Société Anonyme (SA): This structure is comparable to a corporation and is suitable for larger operations. It requires at least one shareholder and a minimum share capital of 10,000,000 XAF (approx. €15,200). An SA must also appoint a board of directors.

The choice between an SARL and an SA depends on the investment’s scale, the number of stakeholders, and long-term growth ambitions.

Step 2: The Company Registration Process via ANPI-Gabon

Once the legal structure is determined, the registration process begins at the ANPI-Gabon one-stop shop. The goal is to obtain a tax identification number (Numéro d’Identification Fiscale, NIF) and formal registration with the Commercial Register (Registre du Commerce et du Crédit Mobilier, RCCM).

Key documents typically required include:

- Completed company registration forms.

- The company’s notarized articles of association.

- Proof of share capital deposit in a local bank account.

- Valid identification for all company directors and shareholders.

- A legally secured address for the company’s headquarters in Gabon.

ANPI-Gabon consolidates the procedures for multiple agencies, significantly reducing the time and complexity compared to registering with each entity separately.

Step 3: Securing Necessary Licenses and Permits

After the company is registered, investors must obtain a general business license. Depending on the nature of the manufacturing activity, additional industry-specific permits may be required. For a technical facility, this could involve approvals for factory specifications, safety standards, and the importation of specialized equipment. A thorough business plan that anticipates these needs is crucial for avoiding delays.

Leveraging Gabon’s Special Economic Zones (SEZs)

One of the most powerful tools for foreign manufacturers in Gabon is the Special Economic Zone (SEZ). The Nkok SEZ, located near the capital city of Libreville, is a prime example and a high-priority area for industrial development.

Establishing a manufacturing entity within an SEZ like Nkok offers substantial advantages that directly affect a venture’s investment requirements and long-term profitability:

-

Tax Incentives: Companies often benefit from a 10-year exemption on corporate income tax, followed by a reduced preferential rate. They are also typically exempt from Value Added Tax (VAT) on goods and services produced within the zone.

-

Customs Duty Waivers: All machinery, equipment, and raw materials needed for production can be imported duty-free.

-

100% Foreign Ownership: SEZs permit full foreign ownership of the established entity, providing complete control over the operation.

-

Simplified Procedures: Administrative processes for licensing and permits within the SEZ are further streamlined, with a dedicated authority managing all investor needs.

For entrepreneurs considering turnkey factory solutions or other large-scale projects, locating within an SEZ can fundamentally improve the business case.

Navigating Environmental and Labor Regulations

Establishing a facility also requires careful attention to environmental and labor laws.

Environmental Compliance: The ESIA Process

Gabonese law mandates an Environmental and Social Impact Assessment (ESIA) for any industrial project to analyze its potential environmental and social effects. The completed ESIA report is submitted to the Ministry of Environment for review. Approval results in an environmental compliance certificate, a prerequisite for starting construction and operations. Careful factory layout planning can help mitigate potential environmental concerns from the outset.

Labor Law Essentials

The Gabonese Labor Code governs employment contracts, working conditions, and dismissals. While the law prioritizes hiring Gabonese nationals, it allows for the employment of expatriate staff, provided the necessary work permits and visas are obtained. ANPI-Gabon can typically help coordinate this process.

Frequently Asked Questions (FAQ)

What is the minimum investment required to start a company in Gabon?

The legal minimum is the share capital—as low as 100,000 XAF (approx. €150) for an SARL. The practical investment for a manufacturing facility, however, will be substantially higher and depends on the project’s scale.

How long does the company registration process take?

Through the ANPI-Gabon one-stop shop, the formal registration process can often be completed within a few weeks, provided all documentation is in order.

Can a foreign national be the sole owner of a company in Gabon?

Yes, both SARL and SA structures allow for a single shareholder, and within an SEZ, 100% foreign ownership is explicitly guaranteed.

Are there any restrictions on repatriating profits?

Gabon is a member of the Central African Economic and Monetary Community (CEMAC), whose regulations generally permit the repatriation of profits and dividends, subject to proper declaration and tax settlement.

Is knowledge of French necessary for conducting business?

French is the official language of Gabon. While senior government officials and business leaders may speak English, all official documents and administrative procedures are in French. Engaging local legal and business consultants is highly recommended.

Conclusion: Your Next Steps in Gabon

Gabon offers a structured and increasingly investor-friendly environment for establishing a manufacturing entity. The government’s clear strategy, embodied by ANPI-Gabon and the attractive incentives of Special Economic Zones like Nkok, provides a solid foundation for foreign entrepreneurs.

Success, however, hinges on diligent preparation. A thorough understanding of legal structures, registration procedures, and compliance requirements is not just an administrative task—it is the cornerstone of a sound business strategy. By methodically addressing each regulatory step, you can confidently build a lasting and profitable presence in this promising Central African market.