Guyana’s economy is undergoing a significant transformation, driven by newfound oil wealth and a strategic government focus on sustainable development. For international investors and entrepreneurs, this has created a unique landscape of opportunity, particularly in the renewable energy sector.

The country’s ambitious Low Carbon Development Strategy (LCDS 2030) is not just a policy document; it’s an open invitation for investment in green technologies. For an entrepreneur considering a solar module manufacturing plant, the critical question is not if an opportunity exists, but how to navigate the administrative landscape to capitalize on it.

This guide explores the Guyana Office for Investment (GO-Invest) and the specific incentives available to new solar manufacturing enterprises, outlining the application process, eligibility criteria, and potential benefits. It offers a clear roadmap for investors aiming to establish a presence in one of the world’s fastest-growing economies.

Understanding Guyana’s Strategic Vision for Renewable Energy

Effectively engaging with GO-Invest begins with understanding the national context. The government’s LCDS 2030 framework aims to use revenue from the petroleum sector to finance the country’s transition to a low-carbon, sustainable economy. A central pillar of this strategy is expanding renewable energy generation to achieve greater energy independence and reduce reliance on imported fossil fuels.

This national priority fosters a favorable environment for investments in solar technology. The government actively seeks to build local capacity, moving beyond simply importing finished solar panels to manufacturing them domestically. A local solar module factory aligns perfectly with these objectives by:

- Creating skilled manufacturing jobs.

- Reducing foreign exchange expenditure on imported panels.

- Improving energy security and supply chain resilience.

- Positioning Guyana as a potential export hub for solar technology within the CARICOM region.

An application to GO-Invest that demonstrates a clear understanding of these national goals is far more likely to receive favorable consideration.

The Role of GO-Invest: Your Primary Partner

The Guyana Office for Investment (GO-Invest) is the primary agency for guiding new investors. It functions as a facilitator, designed to steer businesses through the necessary regulatory, administrative, and legal processes. It is crucial to view GO-Invest not as a bureaucratic hurdle, but as a strategic partner.

Their mandate includes:

- Providing information on investment opportunities.

- Assisting with applications for fiscal incentives.

- Connecting investors with relevant government ministries and agencies.

- Facilitating the acquisition of necessary permits and licenses.

Contacting GO-Invest early in the planning phase is a crucial first step. Their guidance can help shape an investment proposal that meets all governmental requirements from the outset.

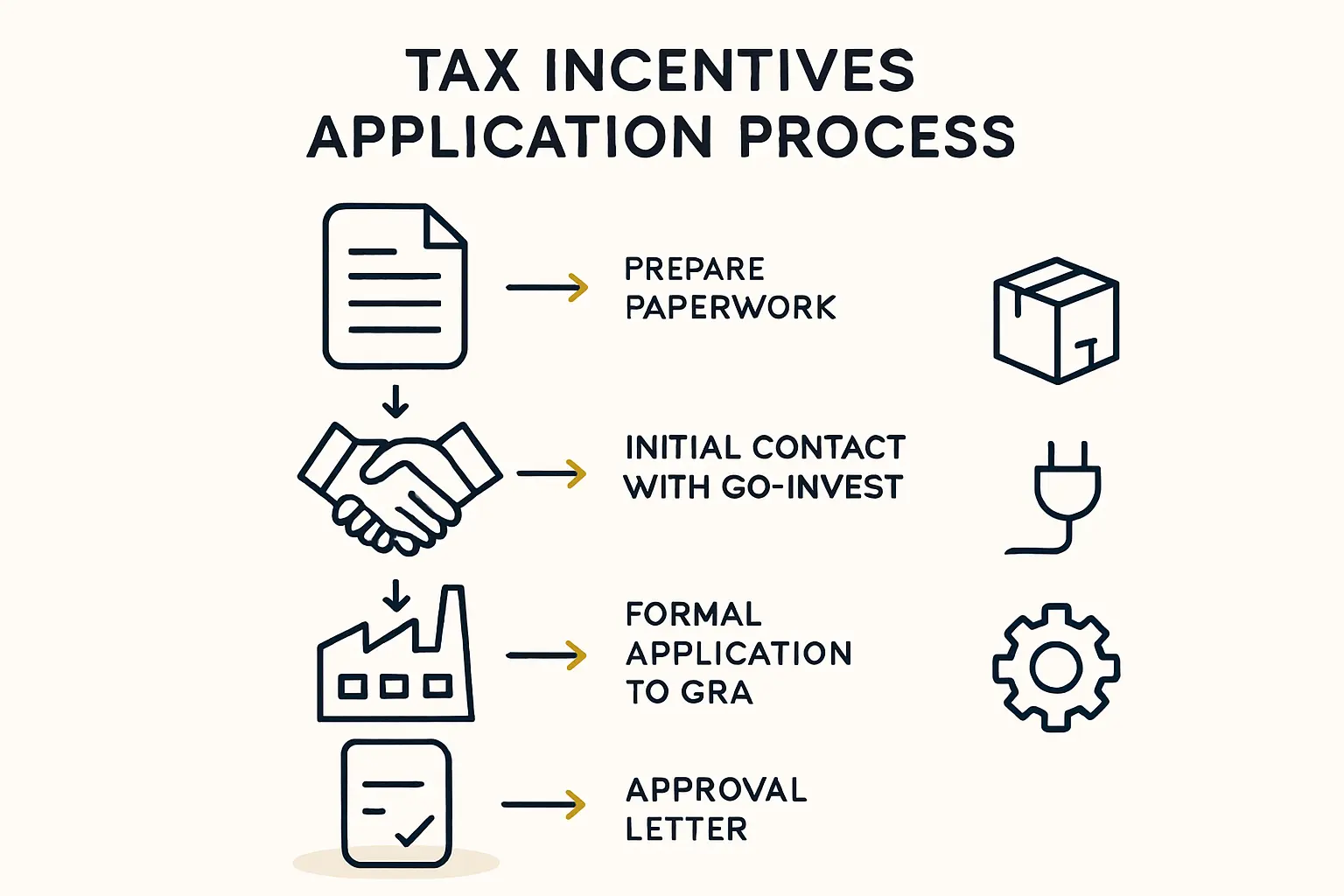

The GO-Invest Application Process: A Step-by-Step Guide

Securing government support is a structured process that requires meticulous preparation. It generally follows two main stages: securing an Investment Agreement and then applying for specific fiscal incentives.

Stage 1: The Investment Agreement Application

The Investment Agreement is the foundational document formalizing the relationship between your enterprise and the Government of Guyana. The application requires a comprehensive package of documents, the most critical of which is the business plan.

A generic business plan will not suffice. The submission must detail every aspect of the proposed solar manufacturing facility. For guidance on structuring this crucial document, investors often reference established frameworks on how to create a bankable solar business plan. Key components that GO-Invest will scrutinize include:

- Company Registration: Proof of legal incorporation in Guyana.

- Financial Projections: Detailed cash flow, profit and loss statements, and balance sheet forecasts for at least five years.

- Proof of Financing: Evidence of sufficient capital to fund the project.

- Technical Plan: A description of the manufacturing process, machinery, and technology to be used.

- Market Analysis: An assessment of domestic and potential export markets for the solar modules.

- Employment Plan: Projections for job creation, including roles, skill levels, and training programs.

Stage 2: Applying for Fiscal Incentives

Once the Investment Agreement is approved in principle, the investor can formally apply for the package of fiscal incentives. This application builds on the business plan, justifying why the requested tax concessions are vital for the project’s viability and how they contribute to the country’s economic goals.

Eligibility Criteria: What GO-Invest Looks For in a Solar Project

GO-Invest evaluates projects against criteria designed to maximize the economic benefit to Guyana. A successful application for a solar manufacturing plant must demonstrate strong alignment with the following:

- Capital Investment: While the official minimum for new investment is relatively low, a credible solar manufacturing project requires a significant capital outlay. A typical investment for a 50 MW factory provides a realistic benchmark for the scale of project needed to attract serious government interest.

- Job Creation: The project must create meaningful, long-term employment for Guyanese citizens. Business plans should clearly quantify the number of direct jobs (e.g., technicians, engineers, administrative staff) and, if possible, estimate indirect job creation within the supply chain. A 20-50 MW facility can typically create 30-50 direct jobs.

- Export Potential: Projects that can generate foreign currency through exports are highly valued. A solar module manufacturer should present a clear strategy for exporting to CARICOM nations or other regional markets.

- Use of Local Resources: While most manufacturing equipment will be imported, the plan should prioritize the use of local services, labor, and any available raw materials.

- Alignment with National Strategy: The proposal must explicitly connect the project to the goals of the LCDS 2030, emphasizing its contribution to Guyana’s green transition.

Unpacking the Incentives: A Closer Look at the Financial Benefits

The incentives offered through GO-Invest can dramatically improve the financial viability of a new solar manufacturing venture. The primary benefits include:

Tax Holidays

Eligible new manufacturing enterprises can be granted a ‘tax holiday’—a complete waiver of Corporation Tax for up to ten years. This allows the business to reinvest profits during its critical initial growth phase, accelerating its path to stability and expansion.

Customs Duty & VAT Exemptions

This is arguably the most significant incentive for a capital-intensive project like a solar factory. Approved investors are exempt from customs duties and Value-Added Tax (VAT) on all plant machinery, equipment, spare parts, and raw materials. For an investor setting up a turnkey solar module manufacturing line, this concession can reduce initial capital expenditure by a substantial margin, directly improving the project’s return on investment.

Export Allowances

For manufacturing businesses that export a percentage of their products, the government offers export allowances. This allows a company to deduct a portion of its export-derived income from its taxable income, providing a powerful, ongoing incentive to compete in international markets.

Practical Considerations and Common Pitfalls

While the opportunity in Guyana is clear, success requires a realistic approach. Based on experience from J.v.G. turnkey projects in emerging markets, detailed technical and financial projections are the single most important factor in securing government support.

- The Power of a Professional Business Plan: The business plan is the cornerstone of the entire application. It is not a mere formality but the primary tool for negotiation and evaluation.

- Patience and Persistence: Government administrative processes can take time. Investors should budget for a timeline of 6-12 months from initial application to final approval and be prepared for requests for additional information.

- Local Expertise: Engaging reputable local legal and financial advisors is not a cost—it is an investment. They bring invaluable knowledge of the local system and can help avoid common administrative errors that cause delays.

Frequently Asked Questions (FAQ)

How long does the GO-Invest application process typically take?

While timelines can vary, a realistic estimate from initial submission to the finalization of an Investment Agreement and incentive package is between 6 and 12 months. Thorough and complete documentation is the best way to expedite the process.

Is a local partner in Guyana required to invest?

No, a foreign investor is not legally required to have a local partner. However, partnering with a reputable local business or individual can be highly beneficial for navigating the business environment, establishing local supply chains, and understanding cultural nuances.

What are the biggest non-financial challenges for new investors?

Beyond navigating the administrative process, new investors often cite logistics and infrastructure as key challenges. While Guyana is investing heavily in improving its ports, roads, and power grid, careful planning is required for supply chain management and ensuring reliable factory operations.

Can investment incentives be revoked?

Yes. The Investment Agreement is a contract with binding commitments on both sides. If an investor fails to meet key obligations outlined in their business plan—such as promised investment levels, timelines, or job creation targets—the government reserves the right to review and potentially revoke the granted incentives.

Conclusion and Next Steps

Guyana’s strategic commitment to renewable energy, backed by substantial government incentives, presents a compelling case for investment in solar module manufacturing. GO-Invest provides a structured pathway for entrepreneurs to access these benefits.

Success, however, is not automatic. It depends on meticulous preparation, a professional approach, and a deep understanding of the country’s economic and strategic priorities. Understanding these governmental frameworks is the first step. The next is to develop a comprehensive technical and financial plan that aligns with these requirements and demonstrates a clear path to a successful manufacturing operation. For guidance in this critical planning phase, resources like a structured e-course from pvknowhow.com can provide a valuable framework.