An investor planning a new solar module factory in Guyana faces a pivotal strategic choice. One path leads to the government-led initiative to bring electricity to remote hinterland communities. The other serves a dynamic urban commercial sector rapidly adopting solar to combat high energy costs. While both markets present distinct opportunities, they demand fundamentally different business models, product strategies, and sales approaches.

Understanding the nuances of these pathways is a critical first step for any entrepreneur entering the Guyanese solar manufacturing space. This analysis compares the government-backed rural electrification market with the private commercial and industrial (C&I) sector to clarify the strategic decisions ahead.

The Guyanese Energy Landscape: A Foundation of Opportunity

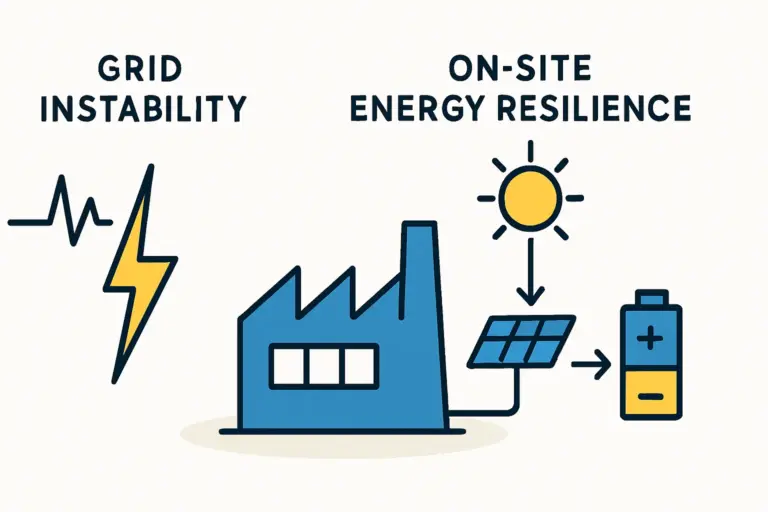

Guyana’s economic growth is set against a backdrop of significant energy challenges. The national grid relies heavily on imported fossil fuels, resulting in some of the highest electricity costs in the region—often between US$0.33 and US$0.40 per kWh. At the same time, grid reliability is a persistent concern for businesses and communities alike.

In response, the Government of Guyana established the Low Carbon Development Strategy 2030 (LCDS 2030), an ambitious plan to transition the country’s energy mix to 70% renewable sources by 2030. This national strategy creates a powerful tailwind for solar energy development and underpins the business case for local manufacturing, putting a domestic producer in a strong position to serve two of the country’s most pressing needs: expanding energy access and providing businesses with a reliable, cost-effective alternative to the grid.

Market Profile 1: Powering the Hinterland through Government Programs

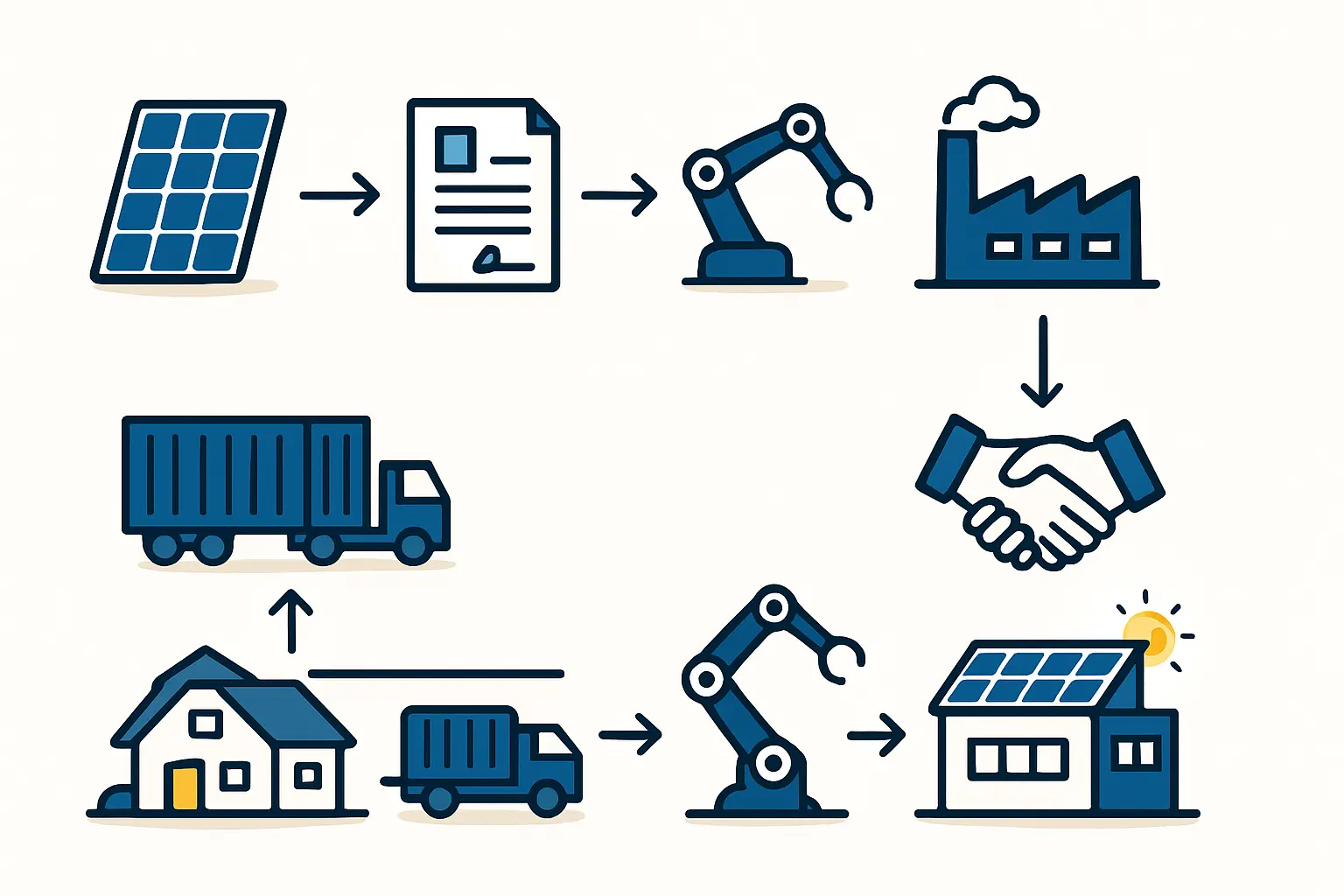

Electrifying Guyana’s remote hinterland regions is a primary objective of the LCDS 2030. The government has initiated large-scale programs to deploy approximately 30,000 Solar Home Systems (SHS) and develop solar mini-grids for around 200 communities. For a local solar module manufacturer, this represents a significant and well-defined market.

Business Dynamics and Sales Cycle

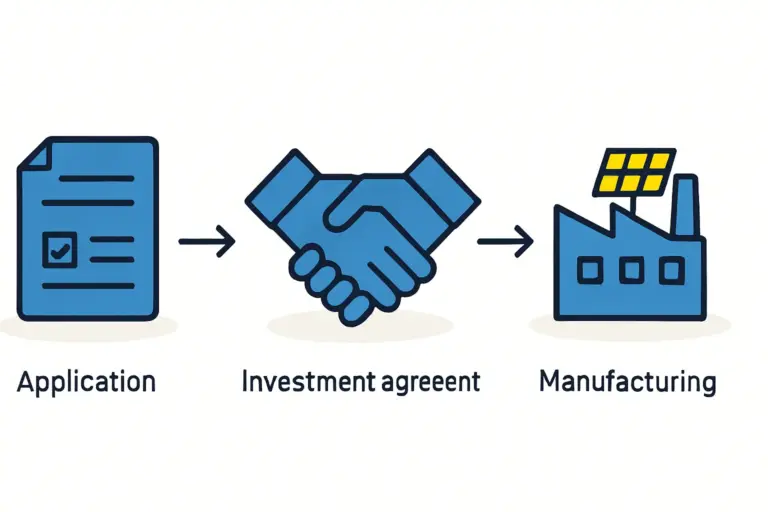

Engaging with this market means participating in public procurement, where the primary customer is the government or its designated agencies.

- Sales Process: The sales cycle is driven by public tenders. This involves preparing detailed bids, meeting stringent compliance requirements, and navigating the formal processes of government contracting.

- Order Structure: Contracts are typically large in volume but infrequent. A single successful tender could secure a production pipeline for several months.

- Financials: While securing contracts can be a lengthy process, government backing provides a high degree of payment assurance. However, payment schedules can be slower than in the private sector.

- Key Drivers: Decision-making is guided by national policy, social development goals, and energy access targets, rather than a purely commercial return on investment.

Product Requirements

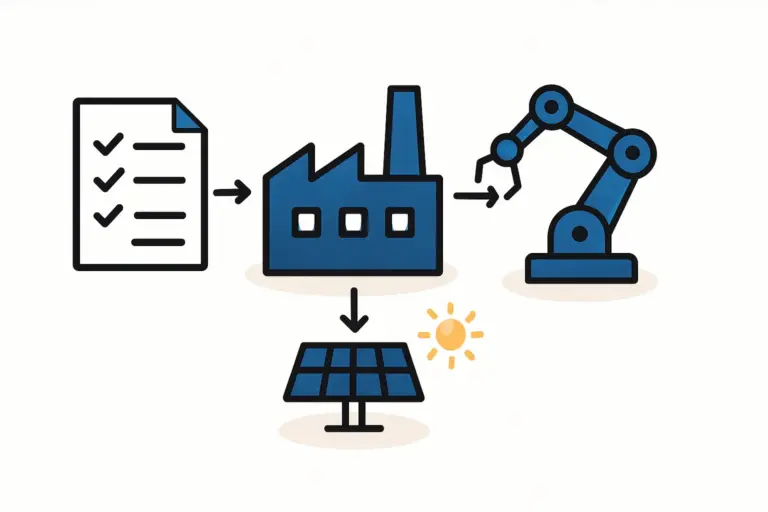

Modules for hinterland communities must meet specific criteria, and the solar panel manufacturing process must be adapted to produce panels that are:

- Durable and Robust: The modules must withstand challenging transport over rough terrain and perform reliably in isolated environments with limited technical support.

- Sized for Application: The demand is primarily for smaller panels, typically in the 50Wp to 200Wp range, suitable for individual Solar Home Systems.

Market Profile 2: The Urban Commercial & Industrial (C&I) Sector

In parallel with the government’s efforts, Guyana’s private sector is also embracing solar energy. Businesses in manufacturing, agriculture, and services are turning to solar to reduce high electricity costs and ensure operational continuity during grid outages. This market operates on a direct business-to-business sales model.

Business Dynamics and Sales Cycle

Serving the C&I market requires a different operational approach focused on direct engagement with private companies.

- Sales Process: The sales cycle is much shorter and relies on building relationships with business owners, facility managers, and solar installers. It requires a dedicated sales team capable of explaining the financial benefits of solar.

- Order Structure: Orders are smaller than government tenders but are far more frequent, creating a more consistent flow of demand.

- Financials: Transactions are direct with private entities, requiring a robust system for customer credit assessment. Payment cycles are generally faster, positively impacting cash flow.

- Key Drivers: The purchasing decision is almost exclusively driven by financial metrics: return on investment (ROI), payback period, and immediate savings on electricity bills.

Product Requirements

The C&I sector demands products that maximize energy output and financial returns.

- High Efficiency: Customers prioritize high-performance modules, often 400Wp and larger, to maximize power generation from limited rooftop or ground space.

- Bankability and Certification: Products must meet international quality standards, assuring business owners and their financiers of the long-term performance of their investment.

Strategic Comparison: Hinterland vs. C&I Markets

| Feature | Hinterland (Government Tenders) | Urban Commercial & Industrial (C&I) |

|---|---|---|

| Primary Customer | Government agencies | Private businesses, solar installers |

| Key Driver | Social policy, energy access | Return on Investment (ROI), cost savings |

| Sales Cycle | Long, formal, tender-based | Short, relationship-based, direct sales |

| Order Size | Large, but infrequent | Smaller, but frequent and recurring |

| Product Focus | Durability, smaller sizes (50-200Wp) | High efficiency, larger sizes (400Wp+) |

| Financial Aspect | High payment security, slower cycles | Faster payment, requires credit management |

| Required Team | Tender/bidding specialists | Direct sales force, technical support |

The ‘Made in Guyana’ Advantage in Both Markets

A local manufacturing facility holds inherent advantages over foreign competitors. In government projects, the ‘Made in Guyana’ label aligns with national development goals and can be a significant factor in tender evaluations. For C&I clients, a domestic factory offers faster delivery, simpler logistics, and accessible after-sales support—all valuable differentiators.

Choosing which market to prioritize is a foundational decision. A business could focus exclusively on one or develop a phased strategy to serve both. This choice will directly influence the selection of key machinery for a solar module factory, the hiring of personnel, and overall financial projections.

Frequently Asked Questions (FAQ)

1. Can a single solar factory in Guyana serve both the hinterland and C&I markets?

Yes, but it requires careful production planning. A factory would need production lines capable of efficiently switching between smaller, robust modules for home systems and larger, high-efficiency modules for commercial projects. This flexibility must be designed into the factory layout and equipment selection from the start.

2. How complex is the government tender process for a new company?

Participating in public tenders requires specialized knowledge. The process involves navigating detailed administrative procedures, meeting pre-qualification criteria, and often providing performance bonds. New entrants should consider partnering with established firms or hiring personnel with direct experience in Guyanese public procurement.

3. What is the typical ROI that drives a C&I customer’s purchasing decision?

Given Guyana’s high grid electricity costs (above US$0.30/kWh), commercial solar installations can offer very attractive payback periods, often just 3 to 6 years. This compelling financial case is the primary driver for the C&I market’s growth.

4. Does a local factory have a cost advantage over imported modules from China?

While Chinese manufacturers benefit from massive economies of scale, a Guyanese factory can compete by eliminating international shipping costs, import tariffs, and long-lead-time inventory. The primary advantages, however, are often in service, speed, and local alignment rather than unit price alone.

Ultimately, a thorough understanding of these distinct market dynamics is the foundation for building a successful solar module production business in a promising market like Guyana. Each path offers a route to success, but they are not interchangeable.