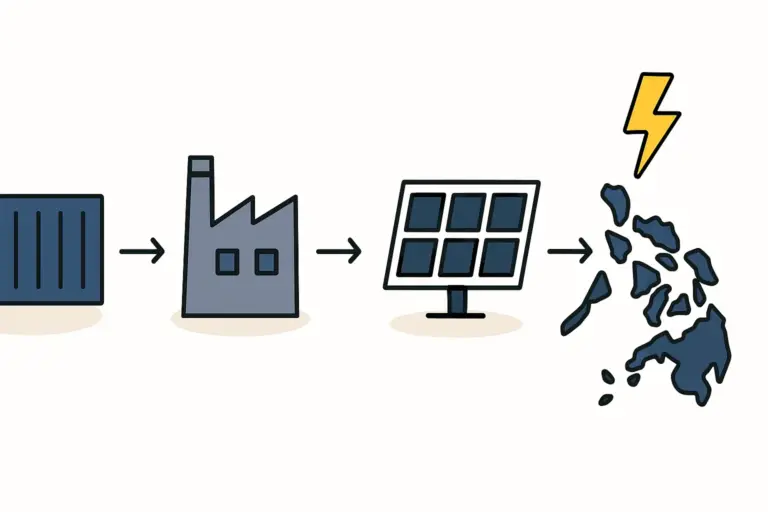

An investor exploring Indonesia for a new solar module factory might logically assume that a designated industrial park is a safe choice. These zones are marketed as having ‘everything included’—reliable power, water, and seamless logistics.

However, the reality on the ground can be starkly different. A recent study by the Indonesian Ministry of Industry reveals a telling statistic: over 60% of businesses within these parks still rely on their own backup diesel generators to maintain operations, citing grid instability as a primary reason.

This discrepancy between marketing promises and operational reality is a critical risk for a capital-intensive venture like solar module manufacturing. This article provides an assessment framework for evaluating industrial parks in Indonesia, focusing on the essential, non-negotiable infrastructure: the electricity grid, water supply, and logistical access to ports. Understanding these factors is the first step toward building a resilient and profitable manufacturing operation.

The Critical Role of Infrastructure Due Diligence

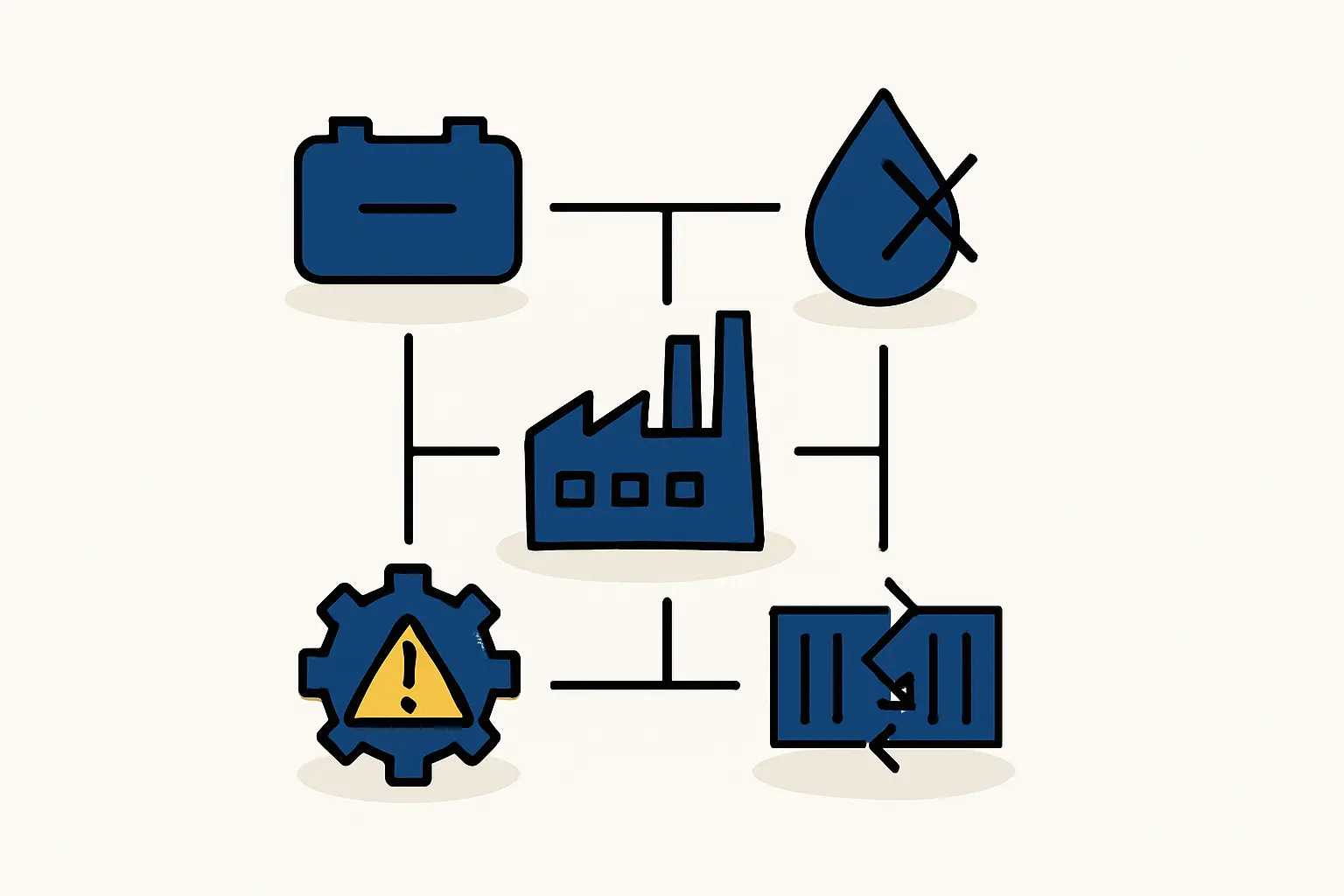

A solar module factory is not a simple assembly workshop; it is a precision manufacturing facility. The machinery involved, from automated cell stringers to multi-stage laminators, is highly sensitive to interruptions. A one-hour power outage does not simply mean one hour of lost production. It can necessitate hours of recalibration, lead to material wastage, and in some cases, cause damage to sensitive electronic components.

Similarly, delays in the supply chain can halt the entire production line. A prospective investor must therefore look beyond a park’s advertised features and conduct thorough due diligence on the fundamental infrastructure that will underpin their daily operations.

Assessing Electrical Grid Stability and Reliability

For any solar factory, the quality and consistency of the electrical supply are paramount—and in Indonesia, this factor warrants critical analysis.

Beyond the ‘Available Power’ Promise

Industrial park management will typically confirm the availability of sufficient power capacity (e.g., 2 megawatts). While this is an important first check, the more crucial metrics are reliability and stability. Data from PLN, Indonesia’s national grid operator, provides crucial context. In 2022, the national average for power interruptions was 9.25 hours per customer for the year (SAIDI), with an average frequency of 7 interruptions (SAIFI). For comparison, Germany’s average annual downtime is typically under 15 minutes.

This national average highlights a systemic challenge. An investor must investigate the specific performance of the local grid feeding the industrial park, as performance varies significantly by region.

Key Questions for Park Management

To gain a clear picture of electrical reliability, an investor should ask targeted questions:

-

What are the historical SAIDI and SAIFI figures for this specific industrial park or its feeder line? The park’s management or the local PLN office should be able to provide this data.

-

Is the park supplied by a dedicated industrial feeder line? A dedicated line is less susceptible to fluctuations caused by residential or commercial load changes.

-

What grid redundancy or backup systems does the park itself provide? Some premium parks may have their own gas-fired power plants or large-scale battery storage.

-

What are the experiences of existing tenants? Speaking directly with other factory managers in the park provides invaluable, real-world insight into the frequency and duration of power issues.

The widespread reliance of tenants on their own generators is a strong indicator that prudent financial planning should include the capital and operational costs of a robust backup power system.

Analysing Logistics and Supply Chain Access

A solar factory is fundamentally a conversion business; it imports components and converts them into a higher-value final product. Efficient and predictable logistics are therefore not a convenience but a core business requirement.

The Port Proximity Equation

Indonesia is an archipelago, and sea freight is the primary method for importing key raw materials such as solar glass, EVA encapsulant, and aluminium frames. When evaluating a site, measuring the distance to the nearest port is not enough.

According to a World Bank report on Indonesian logistics, the average ‘dwell time’—the time a container spends at the port after being unloaded—at major ports like Tanjung Priok in Jakarta can be 3 to 4 days. This contrasts sharply with the sub-24-hour times seen at world-class ports like Singapore.

This delay must be factored into inventory management and working capital calculations. An investor must also assess road quality, potential traffic congestion, and seasonal disruptions (e.g., flooding) on the route between the port and the proposed factory site.

Planning for Raw Material Imports

A successful logistics strategy involves more than just transport. It requires considering:

-

Customs and Clearance: Is there an efficient customs office at the port? Are there experienced freight forwarding agents who specialize in industrial components?

-

Warehousing: Does the industrial park offer bonded warehouse facilities? This can help manage cash flow related to import duties.

-

Accessibility: Can 40-foot container trucks easily access the factory site year-round?

A delay of one week in a critical shipment can bring a multi-million dollar production line to a complete standstill.

Essential Utilities: The Importance of Water

While power is the most obvious utility, a consistent supply of clean water is also crucial. Water is used extensively in the glass washing stage—a critical step for ensuring module quality and longevity—as well as for cooling certain types of machinery.

The Indonesian Ministry of Public Works and Housing reports that even in prioritized industrial estates, up to 30% of businesses in some regions can experience intermittent water supply or pressure fluctuations. This can disrupt production schedules and, if untreated, introduce contaminants that affect the final product. It is therefore essential to verify the park’s water source, treatment facilities, and on-site storage capacity.

The Broader Context: Integrating Your Factory

The selection of an industrial park has cascading effects on the entire project. The stability of the ground, for instance, has a direct impact on factory building requirements and foundation costs. The local infrastructure will also influence the installation and commissioning of a turnkey production line.

Based on experience from J.v.G. Technology GmbH turnkey projects across various emerging markets, conducting a comprehensive, on-the-ground site survey is a non-negotiable step before any significant capital is committed. This survey validates the claims of the park’s management and uncovers potential risks that are not apparent from a distance.

Frequently Asked Questions (FAQ)

What is the first step in choosing an industrial park in Indonesia?

The first step is desk research to create a shortlist based on proximity to ports and major economic centres. This must be immediately followed by on-site visits and direct interviews with park management and existing tenants to verify the actual quality of infrastructure.

Is it better to be located closer to a major port or a major city?

This depends on the business model. A location near a major port like Jakarta or Surabaya simplifies raw material logistics. A location closer to a secondary city may offer lower land costs and easier access to labor. The optimal choice requires a careful trade-off analysis.

Can I rely solely on the industrial park’s power supply?

Based on current data and the common practice of existing tenants, it is highly prudent to include a dedicated backup power generation system in the initial business plan and budget. Relying solely on the grid without a backup presents a significant operational risk.

How does poor infrastructure impact the final cost per solar module?

Poor infrastructure increases the cost per module in several ways: production downtime lowers output, power surges can damage expensive equipment and require repairs, and supply chain delays necessitate holding larger, more expensive inventories of raw materials. All these factors reduce a factory’s overall efficiency and profitability.