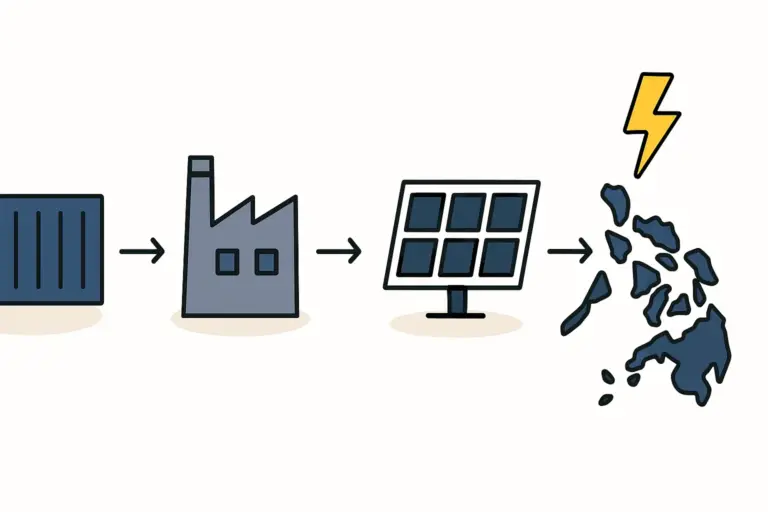

An entrepreneur planning a new 50 MW solar module factory in Indonesia faces several critical decisions. The building is secured, financing is in place, and the production machinery is on order. Yet, one of the most decisive questions remains: how to establish a reliable and cost-effective supply chain for raw materials. The answer determines not only production costs but also the factory’s long-term viability and its ability to compete in a market shaped by national policy.

The choice is not straightforward. It pits the advanced technology and economies of scale offered by the global market, particularly for core components like solar cells, against the Indonesian government’s active encouragement of local sourcing through policies like the Domestic Component Level (Tingkat Komponen Dalam Negeri, or TKDN). This article analyzes these two paths—importing versus local sourcing—to help business professionals build a resilient supply chain for their solar manufacturing venture in Indonesia.

Understanding the Bill of Materials (BOM) for a Solar Module

Before comparing supply strategies, it is essential to understand the primary components of a solar module. The Bill of Materials (BOM) is a detailed list of all raw materials required for production. While it includes many small parts, the cost and strategic focus are concentrated on a few key items:

- Solar Cells: The most critical and expensive component, typically accounting for 50–60% of the total material cost. These semiconductor devices convert sunlight directly into electricity.

- Solar Glass: The front layer of the module, specifically low-iron, tempered glass designed for high light transmission and durability. It is heavy and fragile, making logistics a key consideration.

- Encapsulant (EVA/POE): Polymer sheets that laminate the cells, glass, and backsheet together, protecting the cells from moisture and physical impact.

- Backsheet: The rearmost polymer layer, providing mechanical protection and electrical insulation.

- Aluminum Frame: Provides structural rigidity and a means for mounting the module.

- Junction Box: An enclosure on the back of the module where the cell strings are electrically connected.

An effective sourcing strategy depends on understanding the unique characteristics of each component—its cost, weight, technological complexity, and availability.

The Case for Importing: Access to Global Scale and Technology

For any new solar module factory, importing certain materials is not just an option but a necessity, particularly in the initial phases.

The Dominance of Imported Solar Cells

The global solar cell market is highly concentrated, with production dominated by a few large-scale manufacturers, primarily in China. This concentration offers significant advantages in both technology and cost. Industry analysis shows that Indonesia currently imports over 95% of its solar cells.

For a new manufacturer, attempting to source cells locally is impractical, as Indonesia lacks a commercial-scale cell production industry. Importing offers immediate access to the latest, most efficient cell technologies (like TOPCon or HJT) at globally competitive prices. This allows a new factory to produce high-performance modules from day one, a crucial factor for successful market entry.

Navigating Import Logistics and Costs

While importing cells is necessary, the process comes with its own set of challenges. The true cost goes beyond the purchase price (Free on Board, or FOB). A factory owner must account for the ‘landed cost,’ which includes:

- Ocean Freight: Transporting containers from the port of origin to an Indonesian port like Tanjung Priok in Jakarta.

- Import Duties: Tariffs on solar components can range from 5% to 15%, adding significantly to the material cost.

- Value-Added Tax (VAT): Standard VAT rates apply to all imported goods.

- Port Handling & Customs Clearance: Fees for logistics, documentation, and navigating customs procedures.

- Inland Transportation: Moving materials from the port to the factory site.

For example, a solar cell with an FOB price of $0.10 per watt can easily reach a landed cost of $0.115 per watt or more after all duties and logistics are factored in. Careful planning and experienced logistics partners are vital to managing these costs and avoiding delays.

The Strategic Advantage of Local Sourcing

While importing is essential for high-tech components, a purely import-based strategy overlooks significant advantages and may hinder access to a large segment of the Indonesian market.

Aligning with National Policy: The TKDN Imperative

The Indonesian government uses the Domestic Component Level (TKDN) policy to stimulate local industry. For many government-funded or state-owned enterprise (SOE) utility-scale solar projects, a minimum TKDN of 40% is mandatory. A module factory that relies solely on imported materials will be ineligible to bid on these lucrative projects.

Developing a local supply chain, therefore, is not just a cost-saving exercise—it is a strategic business decision that unlocks market access. Achieving a high TKDN score makes a module manufacturer a preferred supplier for national projects and provides a substantial competitive advantage. Factoring this into a comprehensive business plan is essential.

Identifying Prime Candidates for Localization

The key to a successful hybrid strategy is identifying which components offer the best return on localization efforts. The focus should be on materials that are either bulky and expensive to ship or readily available from existing domestic industries.

- Aluminum Frames: Indonesia has a robust aluminum extrusion industry. Sourcing frames locally is often cheaper than importing them once shipping and duties are considered, and it provides a straightforward, significant boost to the TKDN percentage.

- Solar Glass: This presents a more complex trade-off. While specialized, low-iron tempered solar glass production is limited, some local suppliers like Asahimas Flat Glass exist. Local glass may have a higher unit cost, but it drastically reduces shipping expenses, eliminates the risk of breakage during long-distance transit, and shortens lead times.

- Junction Boxes and Packaging: Components like junction boxes, cables, and all packaging materials (cardboard boxes, corner protectors) are excellent candidates for local sourcing to further increase the TKDN value.

The Business Case: Beyond Unit Cost

The benefits of local sourcing extend beyond policy compliance. A local supply chain offers:

- Reduced Lead Times: Eliminating weeks or months of transit time allows for more agile production planning.

- Lower Inventory Levels: Shorter supply chains mean less capital is tied up in inventory sitting in warehouses or on ships.

- Mitigated Logistical Risks: Sourcing locally reduces exposure to international shipping disruptions, port congestion, and customs delays.

- Currency Stability: Sourcing in Indonesian Rupiah (IDR) reduces exposure to US Dollar (USD) fluctuations.

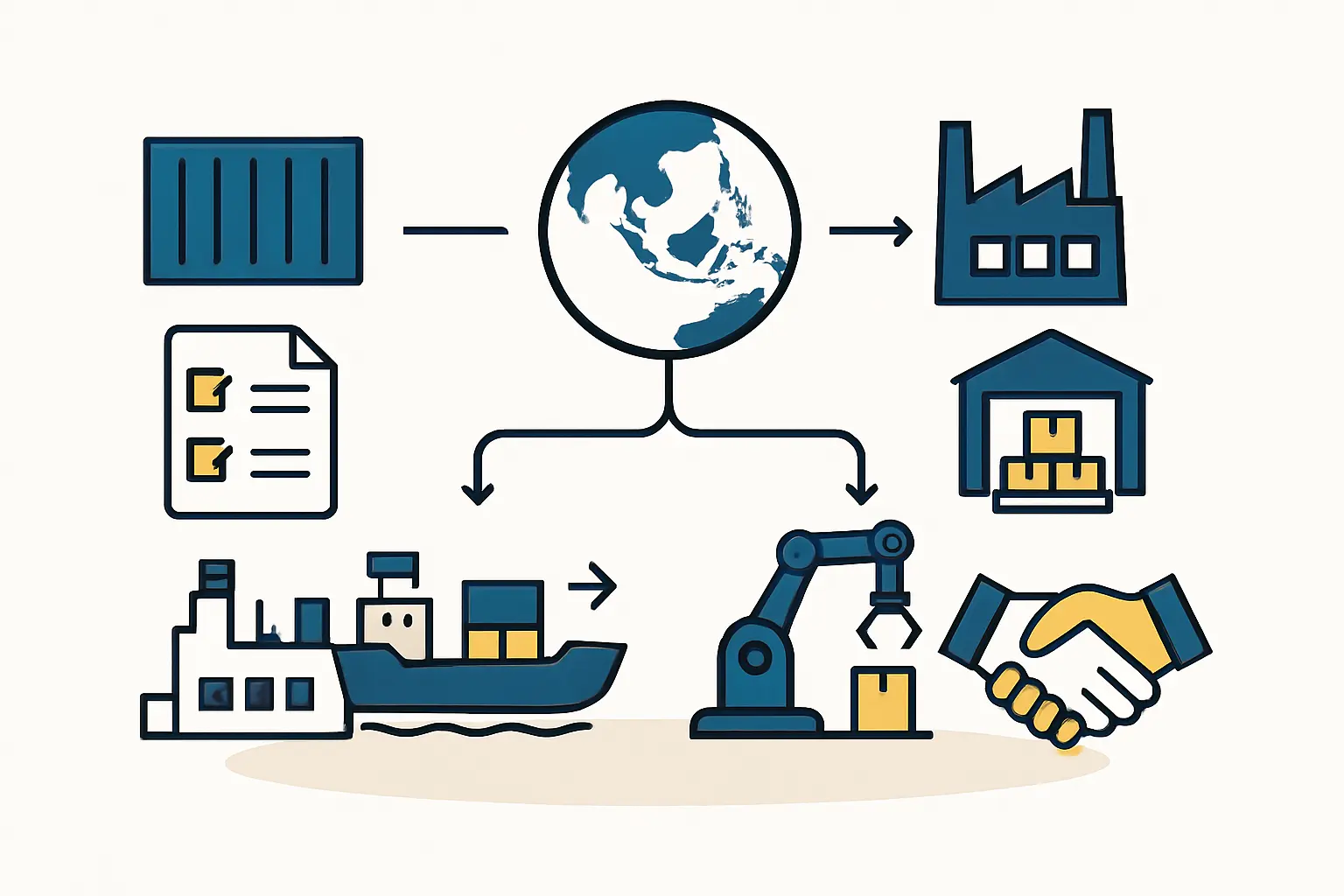

A Hybrid Strategy: The Most Practical Approach for New Entrants

For a new solar module manufacturer in Indonesia, the optimal path is a balanced, hybrid supply chain strategy that evolves over time.

- Phase 1 (Year 1–2): Begin by importing technologically complex, high-value components like solar cells and perhaps specialized backsheets or encapsulants. Simultaneously, establish strong partnerships with local suppliers for aluminum frames, packaging, and potentially junction boxes. This approach enables quick market entry with a competitive product while immediately building a base TKDN score. The choice of materials also influences the selection of machinery, particularly the solar panel lamination machine.

- Phase 2 (Year 3+): As production volume increases, explore deeper localization. This could involve co-developing specifications with a local glass manufacturer or encouraging a junction box supplier to expand its product line. This phased approach, based on experience from J.v.G. turnkey projects in emerging markets, balances initial cost-effectiveness with long-term strategic positioning.

This strategy enables a business to start efficiently while progressively strengthening its local footprint, supply chain resilience, and eligibility for key domestic projects.

Frequently Asked Questions (FAQ)

What is TKDN and why is it critical in Indonesia?

TKDN, or Domestic Component Level, is a government regulation that measures the percentage of domestic components used in a product. For solar projects procured by the government or state-owned enterprises, a minimum TKDN level (often 40% or higher) is mandatory, making it a critical factor for market access.

Can a new factory source solar cells locally in Indonesia?

Currently, there is no large-scale commercial manufacturing of solar cells in Indonesia. New module assembly plants will therefore need to import virtually 100% of their solar cells, predominantly from established global suppliers.

How much do import duties add to the cost of raw materials?

Import duties vary by component but typically range from 5% to 15%. This, combined with shipping, insurance, and handling fees, can increase the final landed cost of imported components by 10–20% over their initial FOB price.

Is it more difficult to manage quality control with local suppliers?

Managing quality requires a robust qualification process, regardless of a supplier’s location. For local suppliers, this may involve providing technical support and establishing clear quality assurance protocols. However, proximity can make factory audits, inspections, and collaborative problem-solving easier and faster than with overseas suppliers.

How does the choice of materials affect the required solar panel manufacturing equipment?

Material choices directly impact equipment selection and process parameters. For instance, using thinner glass or different types of encapsulants may require adjustments to the lamination recipe. To ensure module quality and reliability, the specifications of the solar panel manufacturing equipment must align with the BOM.

Conclusion: Building a Resilient and Compliant Supply Chain

The decision between importing and local sourcing is not a binary choice but a complex strategic exercise. For entrepreneurs entering the Indonesian solar manufacturing sector, a hybrid approach is the most logical and effective path forward.

By importing technologically advanced components like solar cells while strategically localizing bulky materials like aluminum frames and glass, a new factory can simultaneously achieve three critical goals: produce a high-quality, cost-competitive product; build a resilient, agile supply chain; and meet the national TKDN requirements essential for long-term success in the Indonesian market. This balanced strategy transforms the supply chain from a mere operational function into a powerful competitive advantage.