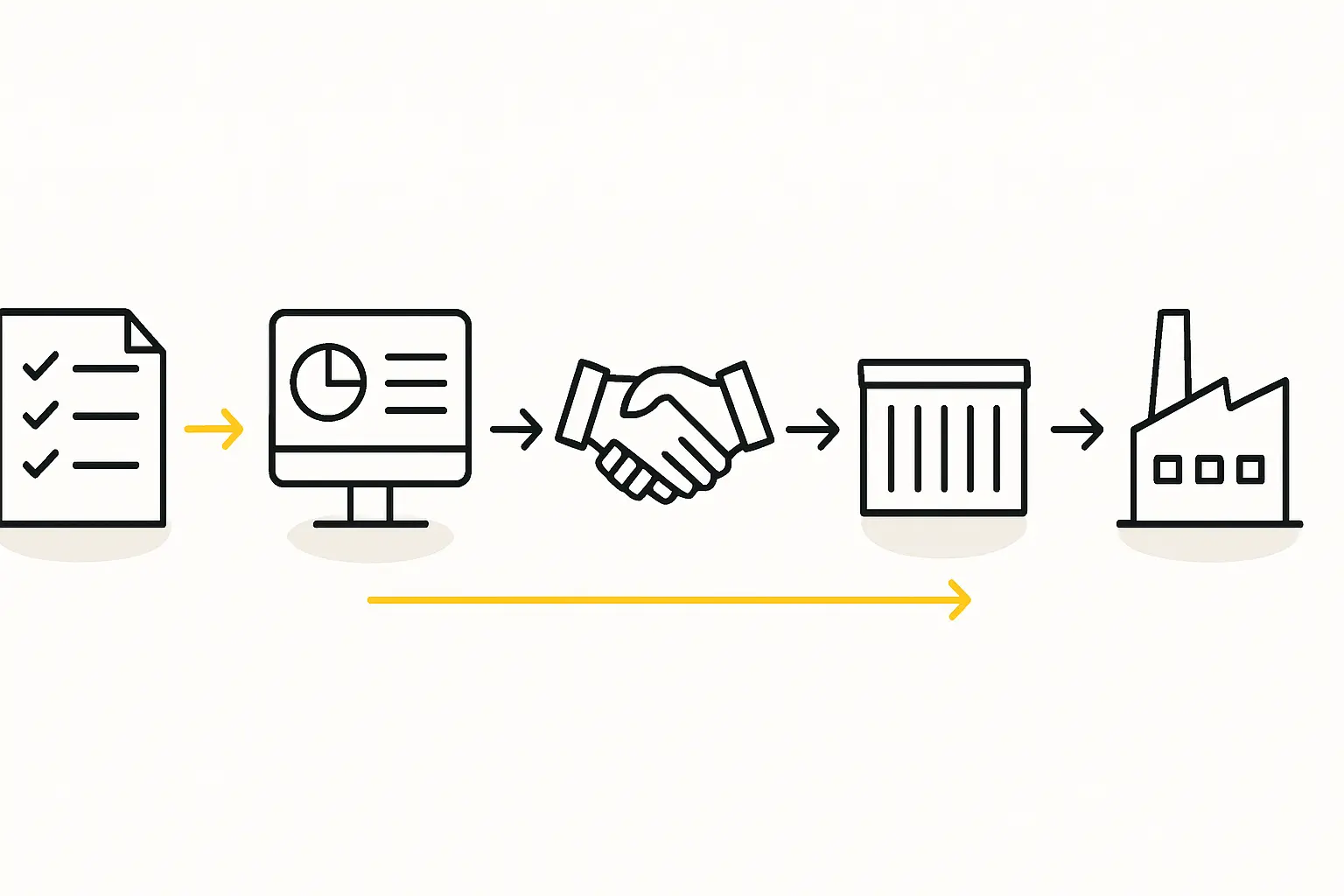

An entrepreneur in Tehran sees a clear opportunity. With abundant sunlight and a growing demand for sustainable energy, establishing a solar module factory seems like a logical and profitable venture. He has secured initial funding and drafted a business plan.

Yet, when he begins contacting European machinery suppliers, he encounters a series of polite but firm rejections. The equipment he needs isn’t military technology, so why is the process so difficult? His predicament highlights a common and complex challenge: navigating the intricate web of international sanctions.

This article provides an overview of the legal and logistical hurdles involved in sourcing and importing solar manufacturing equipment into Iran. It serves not as legal advice, but as an educational guide to help business leaders understand the landscape, anticipate challenges, and plan accordingly.

Understanding the Core Challenge: It Is Not About the Machines

Many people assume solar manufacturing equipment itself is sanctioned, but in most cases, this is incorrect. Machinery like stringers, laminators, and sun simulators is designed for a specific civilian purpose—producing solar panels—and is not typically classified as dual-use goods with military applications.

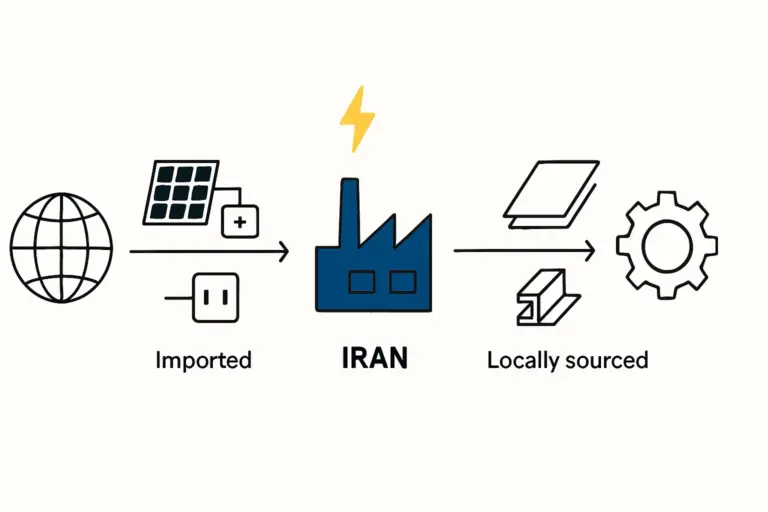

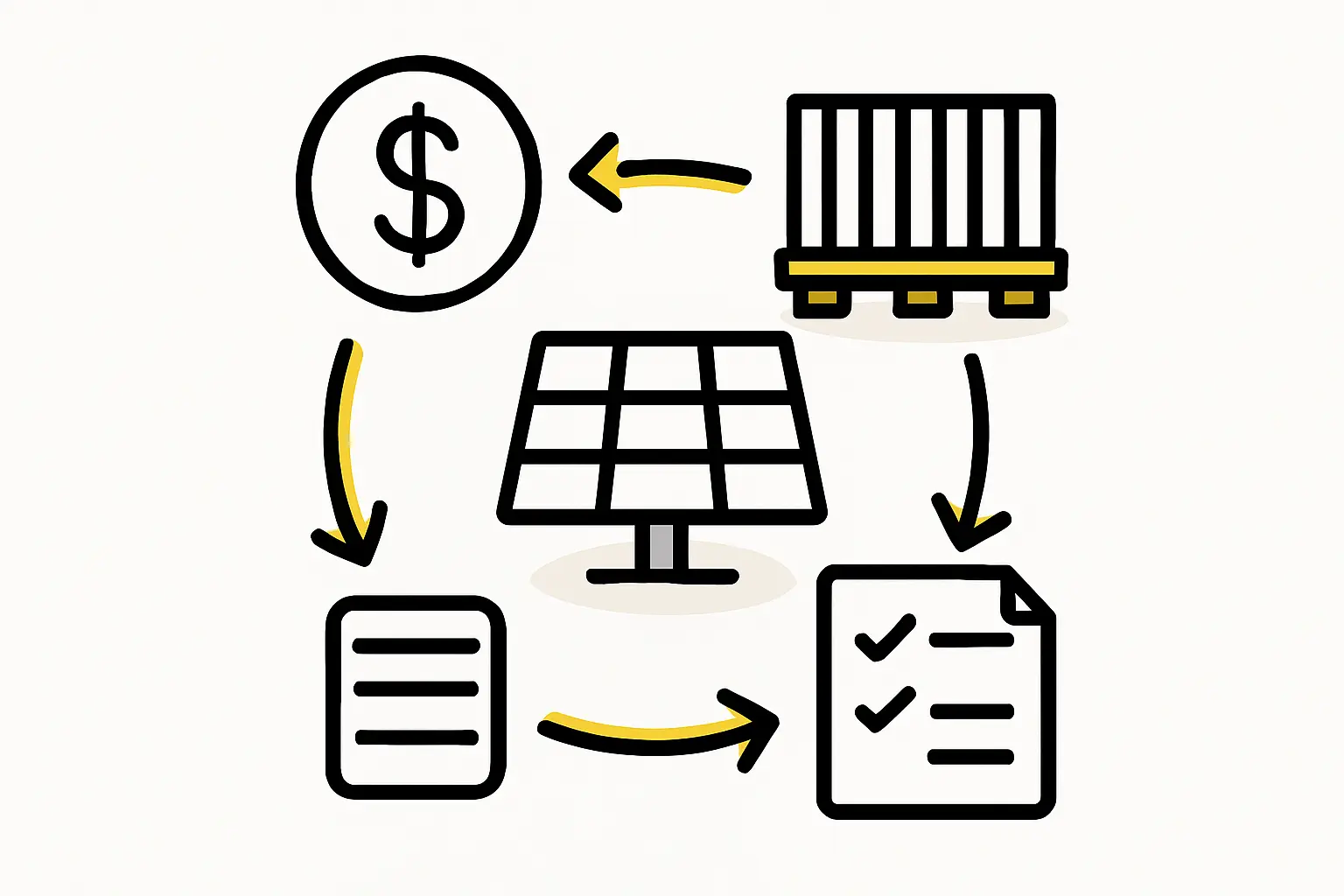

The primary obstacles lie in three interconnected areas:

- Financial Sanctions: Restrictions on banking channels make processing payments nearly impossible.

- US Secondary Sanctions: The risk of non-US companies being penalized for doing business with Iran.

- Logistics and Insurance: The refusal of major shipping and insurance companies to service Iranian routes.

The challenge, therefore, isn’t the legality of the goods, but the immense difficulty of executing the financial and logistical sides of the transaction compliantly. Any project to establish a solar manufacturing equipment factory in Iran must confront these factors from the very beginning.

The European Union’s Regulatory Standpoint

For European suppliers, the primary legal framework is Council Regulation (EU) No 267/2012. This regulation governs economic relations with Iran and outlines specific restrictions.

Dual-Use Goods and “Catch-All” Provisions

The EU strictly controls the export of “dual-use” items—goods that can be used for both civilian and military purposes. Standard solar manufacturing equipment does not fall under this category.

However, a critical “catch-all” provision exists. An export license can be required if the supplier has reason to believe the equipment might be used in connection with Iran’s nuclear or military programs. This requirement places a significant burden of due diligence on the exporter, who must verify the end-user and ensure there are no connections to sanctioned entities, such as the Islamic Revolutionary Guard Corps (IRGC).

Financial Transaction Hurdles

Even if the goods are cleared for export, financial sanctions present a formidable barrier. The EU has designated numerous Iranian banks, and EU financial institutions are prohibited from processing transactions with them. This makes it exceptionally difficult for an Iranian buyer to pay a European seller through standard international banking channels.

The Impact of US Secondary Sanctions

Perhaps the most significant deterrent for many international companies is the United States’ use of “secondary sanctions.” These are measures that target non-US entities for doing business with sanctioned countries like Iran.

Administered by the Office of Foreign Assets Control (OFAC), these sanctions can effectively cut a company off from the US financial system. For a German engineering firm or a European bank, losing access to US dollar transactions or the US market is an unacceptable risk.

This explains why many international banks, even those with no direct US presence, “over-comply” with US sanctions. Their internal risk and compliance departments will often refuse any transaction with an Iranian nexus, regardless of whether it is technically legal under EU law. For the Iranian entrepreneur, this means that even if a supplier in Germany agrees to the sale, finding a bank willing to finance or process the payment is a separate and often insurmountable challenge.

Practical Hurdles in Logistics and Shipping

Even if the legal and financial hurdles could be overcome, the project would still face severe logistical roadblocks.

Shipping Line Withdrawals

Major global shipping carriers, including Maersk, MSC, and CMA CGM, have either completely suspended or heavily restricted services to Iranian ports. They do so to avoid the risk of their vessels or company being targeted by US sanctions. This has several consequences:

- Limited Options: Only a few smaller, regional carriers may service Iranian ports.

- Increased Costs: Less competition and higher risk premiums lead to significantly higher shipping costs.

- Unreliable Schedules: Services are often less frequent and more prone to delays.

Insurance and Risk

Securing marine insurance for shipments to Iran is also extremely difficult. Global insurance and reinsurance markets are highly sensitive to sanctions risk. Without proper insurance, neither the supplier nor the buyer is willing to bear the financial risk of equipment being damaged or lost in transit.

Structuring a Project to Mitigate Risk

Navigating this environment requires meticulous planning and expert guidance. While no simple solution exists, a structured approach can help assess a project’s feasibility.

- Rigorous Due Diligence: The first step for any project is to conduct thorough due diligence on all parties involved. This includes verifying that the end-user, financial intermediaries, and any other partners have no connection to sanctioned entities.

- Transparent Financial Planning: Alternative financial routes may be explored, but these often involve smaller institutions and carry their own complexities and risks. This aspect requires specialized financial and legal consultation and must be a core component of the initial business plan for a solar factory.

- Early Logistical Engagement: Instead of relying on standard freight forwarders, a project requires partners who specialize in complex regions. These logistics experts must be engaged very early in the planning phase to assess feasibility and cost.

Based on experience from past J.v.G. turnkey projects in challenging regulatory environments, these issues can add 12 to 18 months to a project’s timeline compared to one in a non-sanctioned country.

Frequently Asked Questions (FAQ)

Is it illegal for a European company to sell solar equipment to Iran?

Generally, it is not illegal under EU law, provided the end-user is not a sanctioned entity and the transaction does not involve designated banks. However, the immense risk from US secondary sanctions makes it commercially unviable for most European companies.

Why will my bank not process a payment to a German supplier?

Most international banks have internal compliance policies that are stricter than the law requires. To avoid any risk of being penalized under US secondary sanctions, they will proactively block any transaction with a connection to Iran, even for permissible goods.

Can I use cryptocurrency for payment?

While technically possible, using cryptocurrency for multi-million-dollar capital equipment purchases is not a standard business-to-business practice. For a European supplier, such a transaction would raise significant compliance red flags related to anti-money laundering (AML) and sanctions evasion, making it an unacceptable risk.

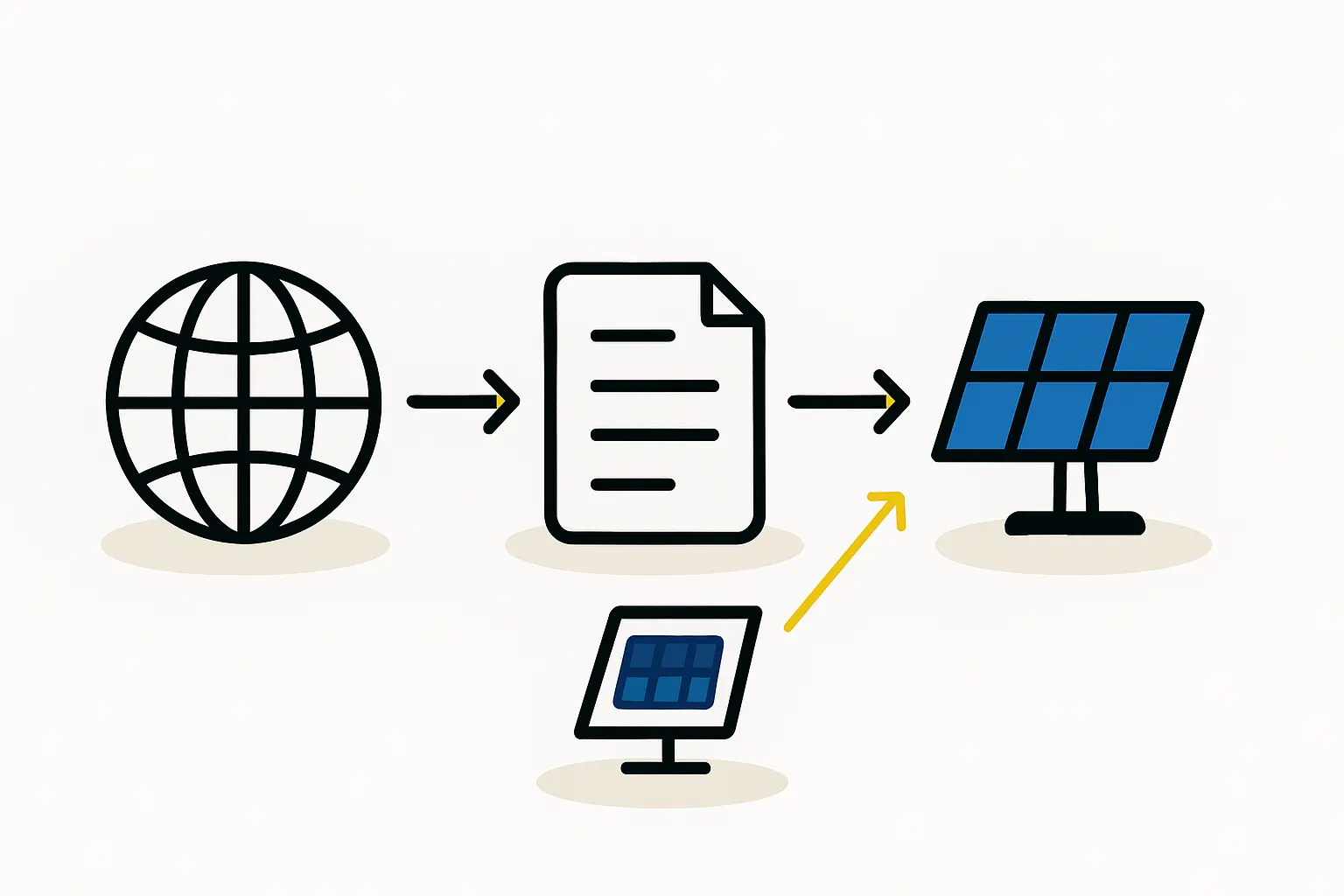

Does the origin of the equipment (e.g., German vs. Chinese) make a difference?

Yes, the supplier’s country of origin is highly relevant. European suppliers are directly exposed to the pressures of EU regulations and US secondary sanctions. Suppliers from other jurisdictions may operate under different rules, but any transaction processed in US dollars or Euros will still be subject to scrutiny by the global banking system.

The Path Forward: Planning and Expertise

Starting a solar factory in Iran is a venture that requires more than technical and commercial vision; the primary challenges are geopolitical and regulatory. Successfully launching a turnkey solar production line in such an environment hinges on a deep understanding of these non-technical risks.

Any serious project must begin with a realistic assessment of the sanctions landscape and incorporate specialized legal, financial, and logistical expertise from day one. The path is complex, but a clear understanding of the obstacles is the first step to navigating them.