Disclaimer: This case study represents a composite example derived from real-world

consulting work by J.v.G. Technology GmbH in solar module production and factory optimization. All data points are realistic but simplified for clarity and educational purposes.

The Gulf Cooperation Council (GCC) region is undergoing an unprecedented energy transformation, with solar power at its core. Projections estimate the regional solar market will reach USD 20 billion by 2030, driven by ambitious national goals like Saudi Arabia’s Vision 2030 and the UAE’s Energy Strategy 2050.

For an entrepreneur looking to enter this market, the key question isn’t about demand, but about strategic positioning. How can a new manufacturer effectively supply this booming region while competing with established global players?

The answer may not lie within the GCC itself, but just across its border. This article outlines a complete investment blueprint for establishing a 50 MW turnkey solar module factory in Jordan’s Al-Hassan Industrial Estate—a strategic venture designed for export to Saudi Arabia, the UAE, and Kuwait. The plan leverages unique geopolitical and economic advantages to create a competitive edge.

The Strategic Advantage: Why Jordan?

While many investors first look to manufacture within their target market, Jordan offers a unique combination of logistical, economic, and political benefits. For a solar module exporter, the country is a powerful and stable manufacturing hub with privileged access to its neighbors.

A Logistical Bridge to the GCC

Jordan’s geographic location is a significant advantage for serving the GCC. Shipping routes from Al-Hassan Industrial Estate to major project sites in Saudi Arabia or the UAE are measured in days, not weeks. This proximity drastically reduces logistics costs and lead times compared to importing modules from East Asia. For large-scale projects where timing is critical, this local presence creates a more responsive and reliable supply chain.

The Power of Trade Agreements

Jordan has cultivated strong economic ties within the region, underpinned by trade agreements that facilitate tariff-free exports to most GCC nations. This eliminates a significant cost barrier, allowing products manufactured in Jordan to be priced competitively against international imports.

Furthermore, the Al-Hassan Industrial Estate is a designated Qualified Industrial Zone (QIZ). This designation also grants duty-free access to the United States market, opening a valuable channel for future market diversification.

Access to a Skilled Workforce

Jordan has a well-educated and cost-effective technical workforce. Access to skilled engineers and technicians is critical for maintaining high production standards and operational efficiency—a key factor in the long-term success of any manufacturing facility.

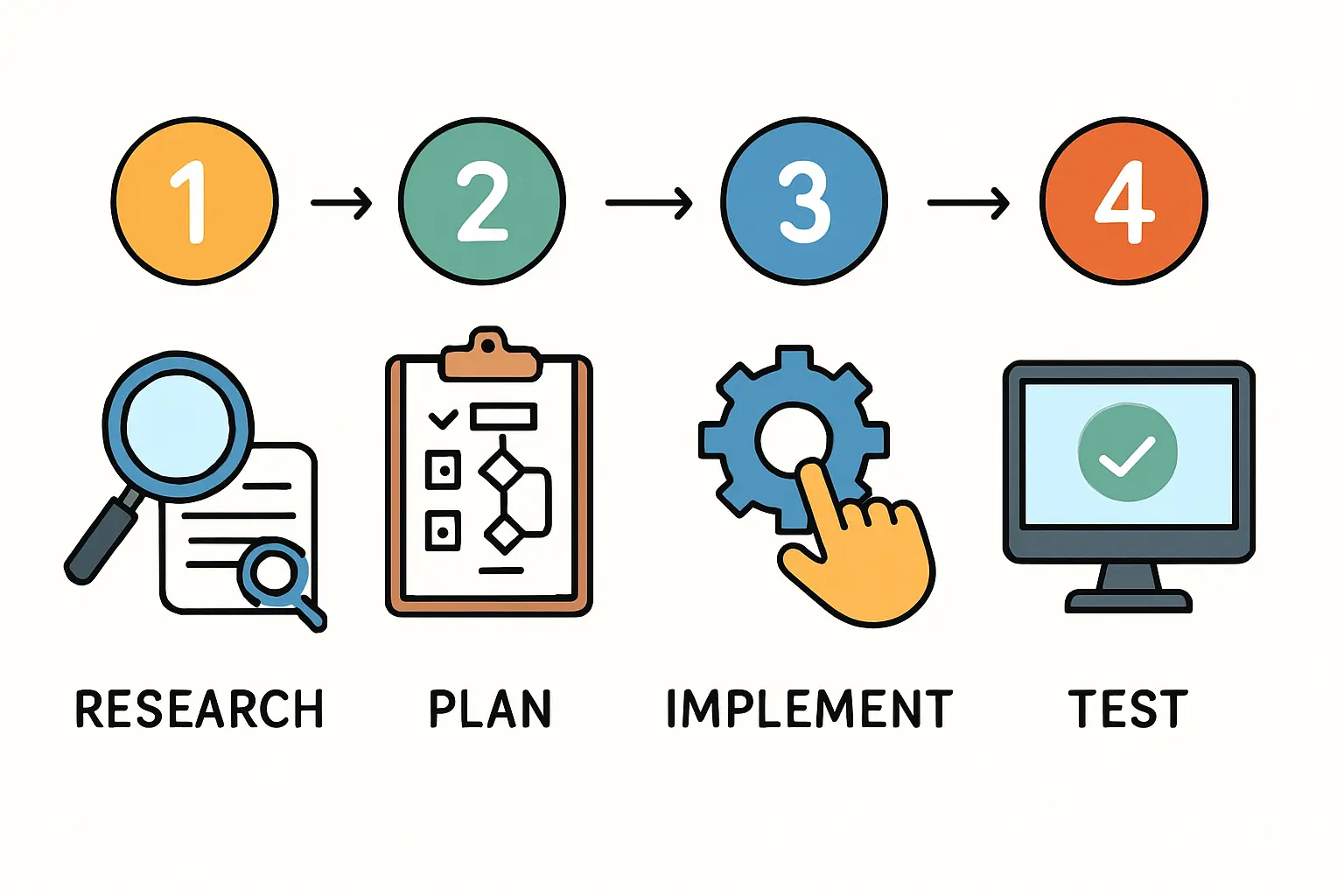

The Operational Blueprint: An EU-Based Photovoltaic Manufacturing Solutions Partner Turnkey Solution

Establishing a factory from the ground up requires a proven framework. Drawing on more than 30 years of experience in the solar industry, a seasoned turnkey delivery partner has developed a turnkey blueprint that covers the key technical, financial, and operational requirements.

Key Investment and Operational Metrics

Understanding the core figures is essential for anyone planning such a venture.

- Initial Investment: The required capital for a 50 MW turnkey solar module production line is approximately USD 6–8 million. This covers machinery, installation, and initial training.

- Project Timeline: From signing the contract to producing the first certified solar module, the typical timeline is 9–12 months.

- Facility Requirements: A suitable building for this capacity requires a floor space of around 3,000 square meters.

- Labor Force: The factory would operate with a team of approximately 60 to 80 employees, including operators, technicians, and administrative staff.

The DESERT+ Production Line: Engineered for the Climate

Standard solar modules can suffer from significant efficiency losses in the extreme heat and arid conditions common in the GCC. The turnkey blueprint from a specialized EU engineering partner addresses this head-on by incorporating the DESERT+ production line.

This technology is specifically engineered to produce modules optimized for hot climates. Key features include:

- Enhanced heat dissipation to maintain performance at high ambient temperatures.

- Durable materials that resist degradation from sand abrasion and high UV exposure.

- Advanced cell connection technology to minimize power loss.

By producing modules designed for the region’s environment, the factory can offer a technologically superior product with a clear performance advantage.

Securing Financing and Strategic Oversight

Navigating the financial landscape is often one of the most challenging aspects of new industrial projects. Through its established network, an experienced European turnkey partner can connect investors with German and European development banks, such as DEG and KfW. These institutions often provide favorable loan conditions for well-structured projects in emerging markets.

To ensure the project adheres to the highest standards of German engineering and project management, the entire process is overseen. With over three decades of experience setting up solar factories worldwide, their strategic guidance de-risks the investment and ensures the facility is built for long-term, profitable operation.

Go-to-Market Strategy: Targeting Key Growth Centers

With a state-of-the-art facility in a strategic location, the final piece of the puzzle is a focused go-to-market strategy. The primary targets are the largest and most active solar markets in the region.

Saudi Arabia: The Epicenter of Demand

The Kingdom’s Vision 2030 and giga-projects like NEOM are creating unprecedented demand for solar modules. A Jordanian manufacturing base is ideally positioned to supply these massive developments, offering logistical simplicity and a high-quality, climate-appropriate product.

United Arab Emirates (UAE): A Mature and Growing Market

As the UAE pushes towards its 2050 renewable energy targets, its mature market and established quality standards create strong demand for high-performance, durable modules. A ‘Made in Jordan’ product built with German technology can effectively compete on both quality and value.

Kuwait: An Emerging Opportunity

With its goal of achieving 15% of its energy from renewables by 2030, Kuwait represents a growing and underserved market. A regional supplier based in Jordan can build early relationships and establish itself as a trusted partner as the market expands.

Frequently Asked Questions (FAQ)

Q1: What makes Jordan a better manufacturing location than the UAE or Saudi Arabia?

While manufacturing within the target market has its benefits, Jordan offers a unique combination of lower operational costs, established trade agreements for tariff-free export across the GCC, and QIZ status for duty-free access to the US market. This blend of cost-efficiency and market access is difficult to match.

Q2: What is the total capital required to start this 50 MW factory?

The core investment for the 50 MW solar panel production line is between USD 6 million and USD 8 million. Additional capital will be needed for the building, operational expenses, and initial raw materials.

Q3: How does the DESERT+ module technology provide a competitive advantage?

Standard solar modules lose efficiency as temperatures rise. DESERT+ modules are specifically designed to perform better in the high-temperature, high-irradiation conditions of the GCC. This translates to a higher energy yield and a better return on investment for the customer, creating a clear product differentiator.

Q4: What is the role of an established European industrial solutions provider?

A specialized EU engineering partner provides the turnkey production line, the engineering know-how, and helps facilitate financing. The experienced European turnkey engineering team provides the hands-on strategic oversight and project management, drawing on over 30 years of global experience to ensure the project’s successful implementation. This level of support is crucial for investors without a deep technical background in solar manufacturing.

Q5: How long does it take to become operational?

With a clear plan and decisive action, the factory can be fully operational and producing its first modules within 9 to 12 months from signing the initial agreements.

This blueprint demonstrates that with the right strategy, location, and technology, a new entrant can do more than enter the competitive GCC solar market—it can thrive. By leveraging Jordan’s unique advantages and partnering with experienced engineering leadership, an investor can build a robust manufacturing business poised for success in one of the world’s fastest-growing energy sectors.

Download the 50 MW Jordan Solar Factory Case Study (PDF)

Author: This case study was prepared by the

turnkey solar module production specialists at J.V.G. Technology GmbH

It is based on real data and consulting experience from J.v.G. projects

worldwide, including installations ranging from 20 MW to 500 MW capacity.