Entrepreneurs planning a solar module factory in Kazakhstan often focus on major capital expenditures like machinery and buildings. But a significant, recurring operational cost is often overlooked in early financial models: the landed cost of critical imported raw materials.

A seemingly small difference between a 0% and a 6.5% import tariff on a core component can fundamentally change the profitability and long-term viability of the entire enterprise. This guide outlines the customs duties and logistical pathways for sourcing two essential components—solar cells and EVA (Ethylene Vinyl Acetate) film—into Kazakhstan.

For any serious investor looking to capitalize on the country’s growing renewable energy sector, understanding these factors is crucial. For those exploring how to start a solar module manufacturing business, this analysis forms a critical piece of the financial puzzle.

The Strategic Context: Kazakhstan’s Renewable Energy Landscape

With ambitious targets for renewable sources to make up 15% of all electricity generation by 2030 and 50% by 2050, the Kazakhstani government’s initiative has positioned the nation as one of the top 10 most attractive developing countries for renewable energy investment.

A key policy encouraging this growth is the promotion of local content. While this creates a favorable environment for domestic manufacturing, it also presents a challenge: certain high-technology components, such as photovoltaic cells, are not yet produced at scale within the country. This means aspiring module manufacturers must establish robust international supply chains. The success of that strategy hinges on a precise understanding of the import framework governed by Kazakhstan’s membership in the Eurasian Economic Union (EAEU).

Understanding the Eurasian Economic Union (EAEU) Customs Framework

Kazakhstan is a member of the Eurasian Economic Union, alongside Armenia, Belarus, Kyrgyzstan, and Russia. This means goods imported from outside the EAEU are subject to a Common External Tariff (CET). This unified tariff standardizes duties across all member states, creating a single economic territory.

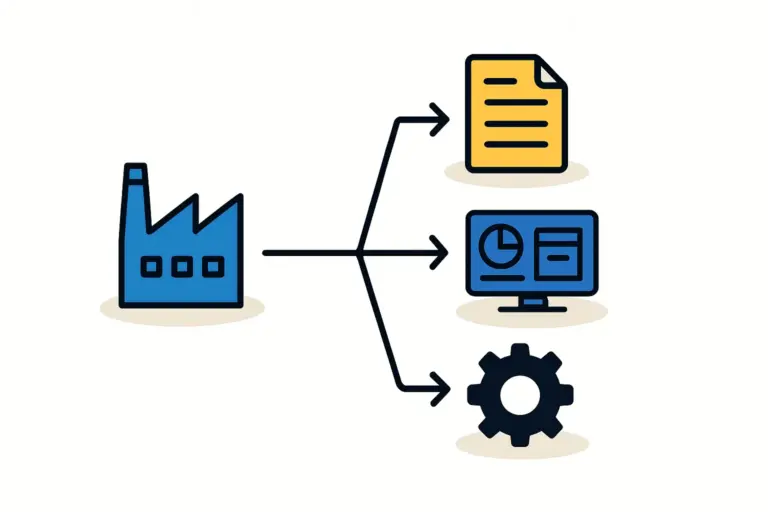

For a solar module manufacturer, this simplifies the tariff structure but also makes it rigid. The duty applied to a specific component is determined by its Harmonized System (HS) code and is consistent across the EAEU. Navigating this framework correctly is essential for accurate cost forecasting and for avoiding costly delays at the border.

Critical Component Tariffs: Solar Cells vs. EVA Film

While both solar cells and EVA film are fundamental to the complete solar panel manufacturing process, they are treated very differently under the EAEU’s tariff schedule. This distinction has profound implications for a factory’s operational budget.

Solar Cells (HS Code 8541.40.9000): A Favourable 0% Tariff

Photovoltaic cells, whether or not assembled in modules or made up into panels, fall under HS Code 8541.40.9000. Under the current EAEU Common External Tariff, these goods are subject to a 0% import duty.

This 0% tariff is a significant advantage for investors in Kazakhstan. The absence of a duty on the single most expensive component of a solar module directly reduces the cost of goods sold (COGS) and strengthens the business case for local assembly. This allows manufacturers to source high-efficiency cells from leading global suppliers without incurring additional tax burdens at the border.

EVA Film (HS Code 3920.10.2500): Factoring in the 6.5% Duty

EVA film, the encapsulant material that bonds the solar cells to the glass and backsheet, is classified under HS Code 3920.10.2500. For this specific category of material, the EAEU’s CET imposes a 6.5% import duty.

While not as costly as solar cells, EVA film represents a substantial, recurring material expense. This 6.5% tariff must be meticulously factored into financial projections. Overlooking it can lead to an underestimation of production costs by several percentage points, eroding margins and impacting competitiveness. Experience from J.v.G. turnkey projects shows that attention to such details is precisely what separates a well-prepared business plan from an unfeasible one.

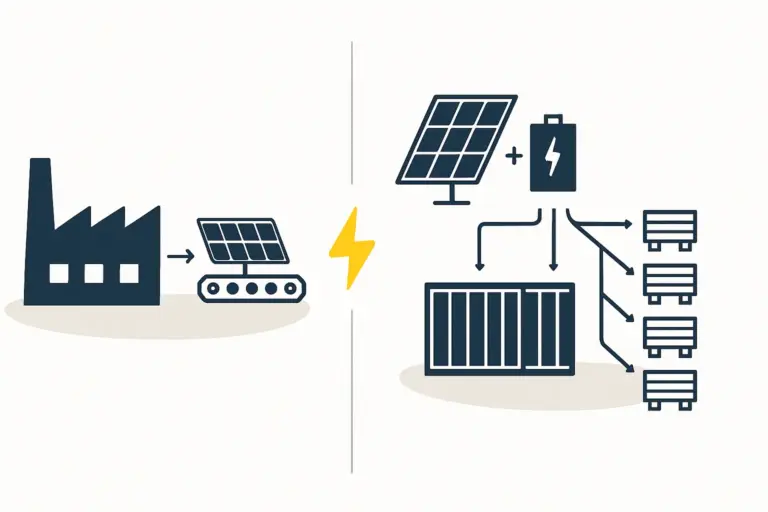

Navigating Logistics: From Supplier to Your Factory Floor

Beyond tariffs, the physical movement of goods presents its own challenges and opportunities. The choice of transportation route directly impacts lead times, costs, and supply chain resilience.

The Middle Corridor: A Modern Transit Route

Given its geographical position, Kazakhstan is a natural logistics hub. The Trans-Caspian International Transport Route (TITR), also known as the “Middle Corridor,” has emerged as a strategic alternative to traditional transport routes. This multimodal corridor connects China and Southeast Asia to Europe via Kazakhstan, the Caspian Sea, Azerbaijan, and Georgia.

For a solar factory sourcing components from Asia, the Middle Corridor offers a reliable and increasingly efficient option, reducing dependency on any single transit route and potentially shortening delivery times.

Customs Clearance Best Practices

A 0% tariff on solar cells is an advantage only if the goods clear customs without incident. Delays can halt production and lead to significant demurrage charges, making a smooth process critical. This requires having all documentation in perfect order, including a commercial contract outlining the terms of sale, a commercial invoice detailing the goods, a packing list correlating with the invoice, a certificate of origin to verify the country of manufacture, and the official bill of lading or air waybill. Working with an experienced customs broker who understands the specific requirements for importing parts for solar module manufacturing equipment is a critical investment.

Integrating Tariffs and Logistics into Your Business Plan

Tariffs and logistics are not mere trivia; they are essential inputs for any credible financial model. When building a solar panel factory, these figures directly influence capital requirements, the cost of goods sold (COGS), your pricing strategy, and ultimately, your profitability margins. Accurate cost forecasting is the foundation of sustainable profits.

A business plan that reflects a clear understanding of these nuanced, country-specific costs demonstrates greater diligence and is more likely to secure financing and stakeholder confidence.

Frequently Asked Questions

Why can’t solar cells and EVA film be sourced locally in Kazakhstan?

While Kazakhstan is rapidly developing its industrial base, the manufacturing of high-purity, high-efficiency photovoltaic cells is a capital-intensive process concentrated in just a few regions globally. High-quality EVA film production also requires specialized chemical engineering capabilities that are not yet established locally.

What is an HS Code?

The Harmonized System (HS) is the international standard for classifying traded products. Customs authorities worldwide use HS codes to identify products and apply the correct duties and taxes. Using the correct code is mandatory for international trade compliance.

Does the 0% tariff on solar cells apply regardless of the country of origin?

Yes, the Common External Tariff (CET) of the EAEU applies to goods based on their classification (HS code), not their country of origin. The 0% rate for HS Code 8541.40.9000 applies to imports from any non-EAEU country.

How do exchange rate fluctuations affect import costs?

Import duties are typically calculated based on the “customs value” of the goods, which is the invoice value converted to the local currency (Kazakhstani Tenge) at the prevailing exchange rate. Because of this, significant fluctuations in the KZT against the US Dollar or Euro can change the final landed cost of materials.

From Planning to Production

Successfully navigating the import landscape is a foundational step in establishing a solar module factory in Kazakhstan. The favorable 0% tariff on solar cells offers a distinct advantage, while the 6.5% duty on EVA film demands careful financial planning. Paired with a robust logistics strategy that uses modern transit corridors, these elements form the backbone of a resilient and cost-effective supply chain.

For entrepreneurs and investors, moving from an initial idea to a fully operational facility requires a structured approach. Understanding these granular details of the supply chain is an indispensable part of that journey.