An investor looking at Kazakhstan’s solar market might see two vastly different images. One is a massive, grid-connected solar farm stretching across the steppe, a symbol of national energy strategy. The other is a small, standalone set of panels powering a remote agricultural business, a testament to individual energy independence.

Both are driven by solar power, yet they represent distinct markets with fundamentally different customers, supply chains, and opportunities. For an entrepreneur considering entry into solar module manufacturing, understanding this duality is not just an academic exercise—it is the foundation of a successful business strategy.

Choosing whether to supply large, government-backed projects or serve the distributed, off-grid sector will define the factory’s scale, technology, and business model. This article breaks down the domestic demand landscape in Kazakhstan, contrasting the unique requirements of these two primary markets.

The Government-Driven Engine: Kazakhstan’s Utility-Scale Solar Market

The most visible segment of Kazakhstan’s solar industry is driven by a clear national vision. The government has set ambitious targets: achieving 15% of energy from renewable sources by 2030 and 50% by 2050. This top-down commitment creates a predictable and sizable market for utility-scale solar developers.

To facilitate this growth, the country introduced an auction system in 2018. This mechanism provides project developers with fixed, 15-year tariffs for the energy they produce, indexed to inflation. This long-term revenue certainty is highly attractive to large-scale investors, significantly de-risking the substantial capital outlay required for solar farms. Consequently, over 90% of the nation’s renewable energy capacity stems from these auction-supported projects.

For a solar module manufacturer, targeting this segment means:

- High-Volume Orders: Projects are often in the multi-megawatt range, requiring thousands of identical panels.

- Standardized Products: Buyers prioritize cost-efficiency and proven performance, leading to demand for standard module specifications.

- Key Relationships: Business development focuses on a small number of customers, such as large engineering, procurement, and construction (EPC) companies and state-affiliated energy firms.

However, this market presents its own significant challenges. The existing grid infrastructure can be a bottleneck, limiting the size and location of new solar farms. Government tenders may also include local content requirements, which can influence sourcing and operational decisions for a new manufacturing plant.

The Untapped Frontier: The Case for Off-Grid Solar

Beyond the central grid lies a different but equally compelling opportunity. Kazakhstan is a vast country where an estimated 1.3 million people across nearly 6,000 settlements live in remote areas without reliable access to centralized electricity. This includes a significant portion of the country’s agricultural sector, with over 122,000 livestock farms, many of which operate off-grid.

For these individuals and businesses, energy is not about national targets; it is about operational necessity. They need reliable power for lighting, water pumps, refrigeration, and communications. Solar energy offers a practical and increasingly cost-effective solution.

Supplying the off-grid market presents a different set of characteristics:

- Fragmented Demand: The customer base is large but distributed, consisting of individual farmers, small communities, and rural enterprises.

- Customized Solutions: Demand is often for smaller, complete kits that may include batteries and inverters, rather than just modules.

- Durability and Robustness: Modules must withstand Kazakhstan’s harsh climate, where extreme temperature fluctuations make long-term durability more important than peak efficiency.

This market requires a strong distribution network to reach end-users across the country. While individual order sizes are small, the collective potential is substantial and growing as the costs of solar technology decline.

A Tale of Two Supply Chains: Key Differences for a Manufacturer

The decision to target utility-scale or off-grid customers directly impacts the entire manufacturing operation. A business cannot easily serve both without a deliberate and well-structured strategy, as their operational and logistical requirements are fundamentally different.

Supplying Utility-Scale Projects

The focus here is on economies of scale. A manufacturer needs a highly automated solar panel production line capable of producing a large volume of standardized panels at the lowest possible cost per watt. The sales cycle is long, involving tenders and extensive negotiations with a few large clients. Logistics are planned around bulk freight shipments to specific project sites.

Supplying Off-Grid Markets

This model prioritizes flexibility and distribution. The production line may need to handle smaller batches or different product variations. The business must build a network of regional dealers or partners to sell, install, and service systems in remote areas. The sales model is closer to traditional distribution, with a focus on marketing, channel management, and inventory.

Strategic Considerations for Market Entry

An entrepreneur must decide which market to pursue before calculating the solar panel manufacturing plant cost; it’s a strategic choice that influences every subsequent decision.

- Product and Technology: The factory must choose between high-efficiency monocrystalline PERC modules, favored in large-scale farms, and exceptionally durable modules designed for decades of service in harsh remote conditions. This choice will tailor the entire solar module manufacturing process.

- Business Model: The core business model depends on the target customer. Is it a government procurement officer managing a 100 MW tender or a network of a hundred local installers serving the agricultural sector? The answer dictates the entire sales, marketing, and operational structure of your solar panel manufacturing business.

- Capital Investment: A factory designed for the utility-scale market requires a significant upfront investment to achieve the necessary scale and automation. In contrast, an operation focused on the off-grid market may begin with a more modest setup, offering a different risk and capital profile.

Based on experience from J.v.G. turnkey projects in emerging markets, aligning the production setup with the target market from day one is a critical success factor. A misaligned strategy—such as trying to sell small quantities of high-cost, specialized modules to a utility-scale developer—is unlikely to succeed.

Frequently Asked Questions (FAQ)

What are the main drivers of solar energy growth in Kazakhstan?

Growth is driven by two key factors: strong government support through renewable energy targets and the auction system for utility-scale projects, and the practical need for energy independence in vast rural and agricultural areas not served by the central grid.

Is it better for a new manufacturer to focus on utility-scale or off-grid markets?

This depends entirely on the investor’s capital resources, risk appetite, and long-term business strategy. The utility-scale market offers the potential for large, predictable orders but has high barriers to entry and formidable competition. The off-grid market is more fragmented and requires building a distribution network, but it may be more accessible for a new entrant with a focused product strategy.

What technical challenges are unique to Kazakhstan?

The extreme continental climate, with temperatures ranging from below -40°C in winter to over +40°C in summer, places significant stress on solar modules and equipment. The country’s vast distances also create logistical challenges for both project construction and off-grid distribution, while limitations in the national grid infrastructure can constrain the development of new large-scale projects.

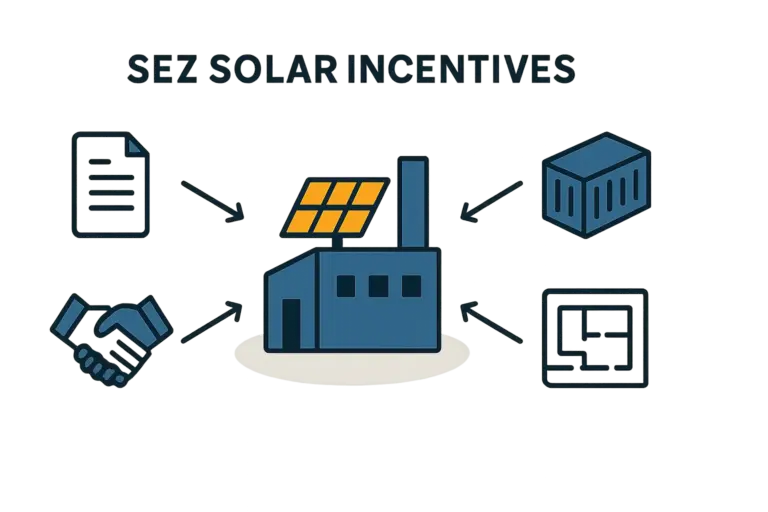

Are there local content requirements I need to be aware of?

Yes, for government-supported projects, there may be requirements or incentives related to using locally manufactured components. Investors should thoroughly investigate the current regulations, as this can provide a significant advantage for a domestic manufacturer competing against importers in public tenders.

A Foundation for Your Business Plan

Kazakhstan’s solar market is not a single entity but a dynamic landscape with two distinct and promising paths. One is paved by government policy and large-scale infrastructure investment, while the other is being forged by the practical needs of individuals and businesses seeking energy self-sufficiency.

Choosing the right path requires more than just technical knowledge; it demands a clear-eyed analysis of the market and a business strategy that is purpose-built for its intended customer. Understanding this foundational dynamic is the essential first step for any entrepreneur looking to build a lasting and successful solar manufacturing enterprise in the region.